Email

They Can’t Get Enough of America

| From | Ross Givens <[email protected]> |

| Subject | They Can’t Get Enough of America |

| Date | January 28, 2026 2:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Wednesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

The Fed is almost certainly going to hold rates steady today.

If they cut again, it would be a massive (though positive) shock for stocks.

Even with them likely holding rates flat though, Powell flapping his lips at

the afternoon press conference will still most likely send ripples through the

market.

But for this morning, let’s look at how – despite all the rhetoric around the

“overvalued” U.S. market…

The money keeps flowing in.

Chart of the Day

Yes, the dollar just fell to multi-year lows – while gold has printed new

fresh highs.

Yes, compared to other countries’ stock markets, the U.S. has relatively

underperformed.

And yes, there are real and legitimate concerns about whether the valuations

of some of these tech companies have run too far ahead of fundamentals.

But as you can see from the chart above…

Despite all of that – the money still keeps pouring in.

Investors – both domestic and global – can’t get enough of the American stock

market.

And it’s not showing signs of slowing down either.

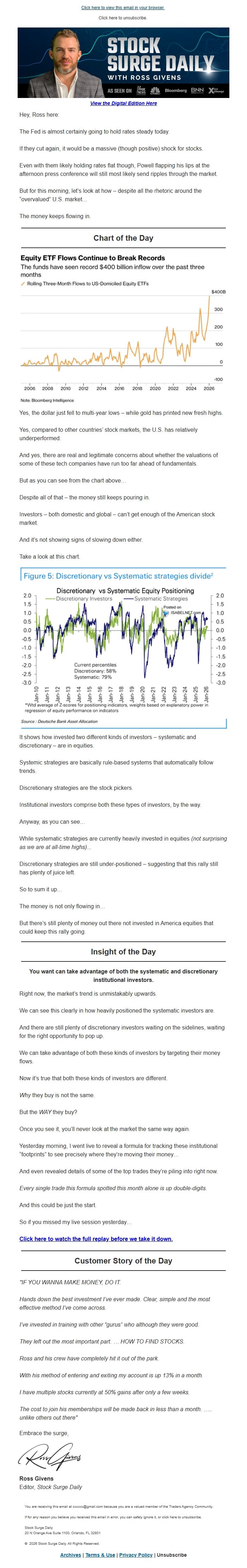

Take a look at this chart.

It shows how invested two different kinds of investors – systematic and

discretionary – are in equities.

Systemic strategies are basically rule-based systems that automatically follow

trends.

Discretionary strategies are the stock pickers.

Institutional investors comprise both these types of investors, by the way.

Anyway, as you can see…

While systematic strategies are currently heavily invested in equities (not

surprising as we are at all-time highs)...

Discretionary strategies are still under-positioned – suggesting that this

rally still has plenty of juice left.

So to sum it up…

The money is not only flowing in…

But there’s still plenty of money out there not invested in America equities

that could keep this rally going.

Insight of the Day

You want can take advantage of both the systematic and discretionary

institutional investors.

Right now, the market’s trend is unmistakably upwards.

We can see this clearly in how heavily positioned the systematic investors are.

And there are still plenty of discretionary investors waiting on the

sidelines, waiting for the right opportunity to pop up.

We can take advantage of both these kinds of investors by targeting their

money flows.

Now it’s true that both these kinds of investors are different.

Why they buy is not the same.

But the WAY they buy?

Once you see it, you’ll never look at the market the same way again.

Yesterday morning, I went live to reveal a formula for tracking these

institutional “footprints” to see precisely where they’re moving their money…

And even revealed details of some of the top trades they’re piling into right

now.

Every single trade this formula spotted this month alone is up double-digits.

And this could be just the start.

So if you missed my live session yesterday…

Click here to watch the full replay before we take it down.

<[link removed]>

Customer Story of the Day

"IF YOU WANNA MAKE MONEY, DO IT.

Hands down the best investment I’ve ever made. Clear, simple and the most

effective method I’ve come across.

I’ve invested in training with other “gurus” who although they were good.

They left out the most important part. … HOW TO FIND STOCKS.

Ross and his crew have completely hit it out of the park.

With his method of entering and exiting my account is up 13% in a month.

I have multiple stocks currently at 50% gains after only a few weeks.

The cost to join his memberships will be made back in less than a month. …..

unlike others out there"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

The Fed is almost certainly going to hold rates steady today.

If they cut again, it would be a massive (though positive) shock for stocks.

Even with them likely holding rates flat though, Powell flapping his lips at

the afternoon press conference will still most likely send ripples through the

market.

But for this morning, let’s look at how – despite all the rhetoric around the

“overvalued” U.S. market…

The money keeps flowing in.

Chart of the Day

Yes, the dollar just fell to multi-year lows – while gold has printed new

fresh highs.

Yes, compared to other countries’ stock markets, the U.S. has relatively

underperformed.

And yes, there are real and legitimate concerns about whether the valuations

of some of these tech companies have run too far ahead of fundamentals.

But as you can see from the chart above…

Despite all of that – the money still keeps pouring in.

Investors – both domestic and global – can’t get enough of the American stock

market.

And it’s not showing signs of slowing down either.

Take a look at this chart.

It shows how invested two different kinds of investors – systematic and

discretionary – are in equities.

Systemic strategies are basically rule-based systems that automatically follow

trends.

Discretionary strategies are the stock pickers.

Institutional investors comprise both these types of investors, by the way.

Anyway, as you can see…

While systematic strategies are currently heavily invested in equities (not

surprising as we are at all-time highs)...

Discretionary strategies are still under-positioned – suggesting that this

rally still has plenty of juice left.

So to sum it up…

The money is not only flowing in…

But there’s still plenty of money out there not invested in America equities

that could keep this rally going.

Insight of the Day

You want can take advantage of both the systematic and discretionary

institutional investors.

Right now, the market’s trend is unmistakably upwards.

We can see this clearly in how heavily positioned the systematic investors are.

And there are still plenty of discretionary investors waiting on the

sidelines, waiting for the right opportunity to pop up.

We can take advantage of both these kinds of investors by targeting their

money flows.

Now it’s true that both these kinds of investors are different.

Why they buy is not the same.

But the WAY they buy?

Once you see it, you’ll never look at the market the same way again.

Yesterday morning, I went live to reveal a formula for tracking these

institutional “footprints” to see precisely where they’re moving their money…

And even revealed details of some of the top trades they’re piling into right

now.

Every single trade this formula spotted this month alone is up double-digits.

And this could be just the start.

So if you missed my live session yesterday…

Click here to watch the full replay before we take it down.

<[link removed]>

Customer Story of the Day

"IF YOU WANNA MAKE MONEY, DO IT.

Hands down the best investment I’ve ever made. Clear, simple and the most

effective method I’ve come across.

I’ve invested in training with other “gurus” who although they were good.

They left out the most important part. … HOW TO FIND STOCKS.

Ross and his crew have completely hit it out of the park.

With his method of entering and exiting my account is up 13% in a month.

I have multiple stocks currently at 50% gains after only a few weeks.

The cost to join his memberships will be made back in less than a month. …..

unlike others out there"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost