|

Goldstein For Congress - Please Subscribe and also visit us at www.goldsteinforcongress.com

Proposed Single-Payer Health Care in Connecticut

Why New York Walked Away — and Why Connecticut Cannot Ignore the Warning

As the Connecticut General Assembly convenes for its regular February session, one proposal is almost certain to reappear: “HUSKY for All,” a single-payer, state-run universal health-care system.

This proposal has failed repeatedly in prior years. But following poor local election turnout and low-engagement special elections, the Democratic super-majority appears newly emboldened. Under the banner of “affordability,” single-payer health care is likely to return—without incorporating the hard fiscal lessons learned by states that studied it and ultimately rejected it, most notably New York.

That is not reform.

That is willful disregard of evidence.

Insanity as a Policy Method - The Connecticut Way

Connecticut has developed a pattern of watching progressive policy experiments fail elsewhere—particularly in New York and California—and then attempting to replicate them anyway, often without modification.

Single-payer health care is the latest and most dangerous example.

Despite years of economic modeling and clear warnings, Connecticut lawmakers continue to flirt with state takeover of the entire health-care system, as though the risks are hypothetical.

They are not.

What Single-Payer (“HUSKY for All”) Actually Does

Under the proposal:

The State of Connecticut becomes the sole health insurer

Medicare and Medicaid recipients are folded into a single state plan

Deductibles and copays are eliminated

Health-care costs become a direct obligation of the state budget

This creates unlimited demand with finite and inadequate revenue, while placing cost control in the hands of politicians and bureaucrats facing constant pressure from special interests.

The Core Economic Failure: Demand Without Discipline

When care becomes “free,” utilization rises sharply. That is not ideology—it is economics.

Without firm guardrails:

Costs escalate rapidly

Provider reimbursements are squeezed

Doctors and specialists leave the state

Hospital finances deteriorate

Wait times increase

Quality declines

The result is not universal care—it is rationed care.

Federal Waivers: Necessary, Risky, and Insufficient

To implement single-payer, Connecticut would require federal waivers allowing Medicare and Medicaid dollars to flow to the state.

Even if granted, those funds would fall dramatically short of covering total costs.

The gap must be filled by:

Massive payroll taxes

Major increases in state income taxes

Or both

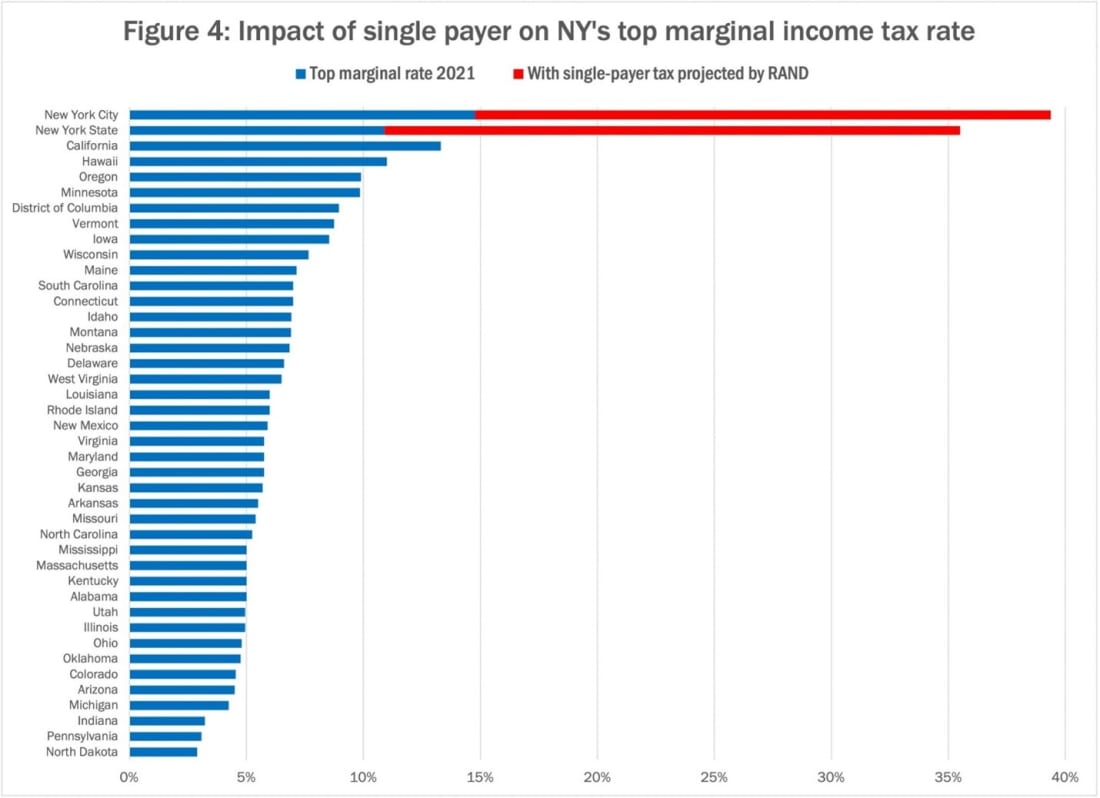

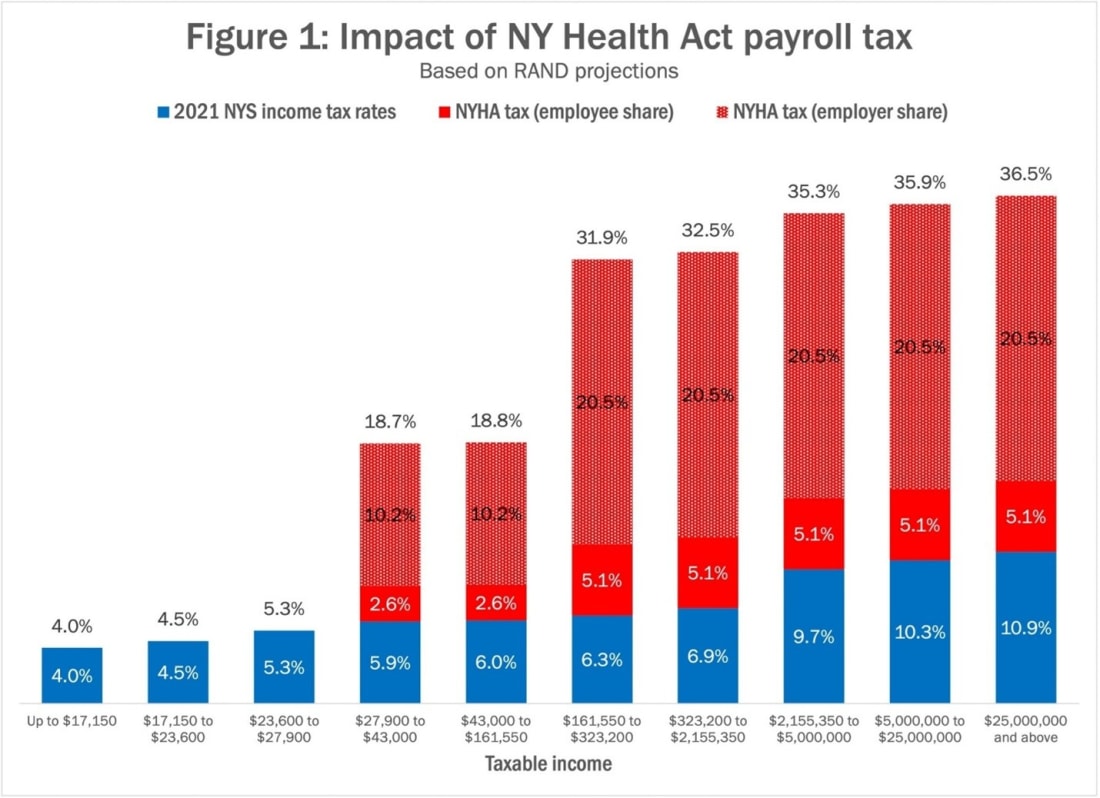

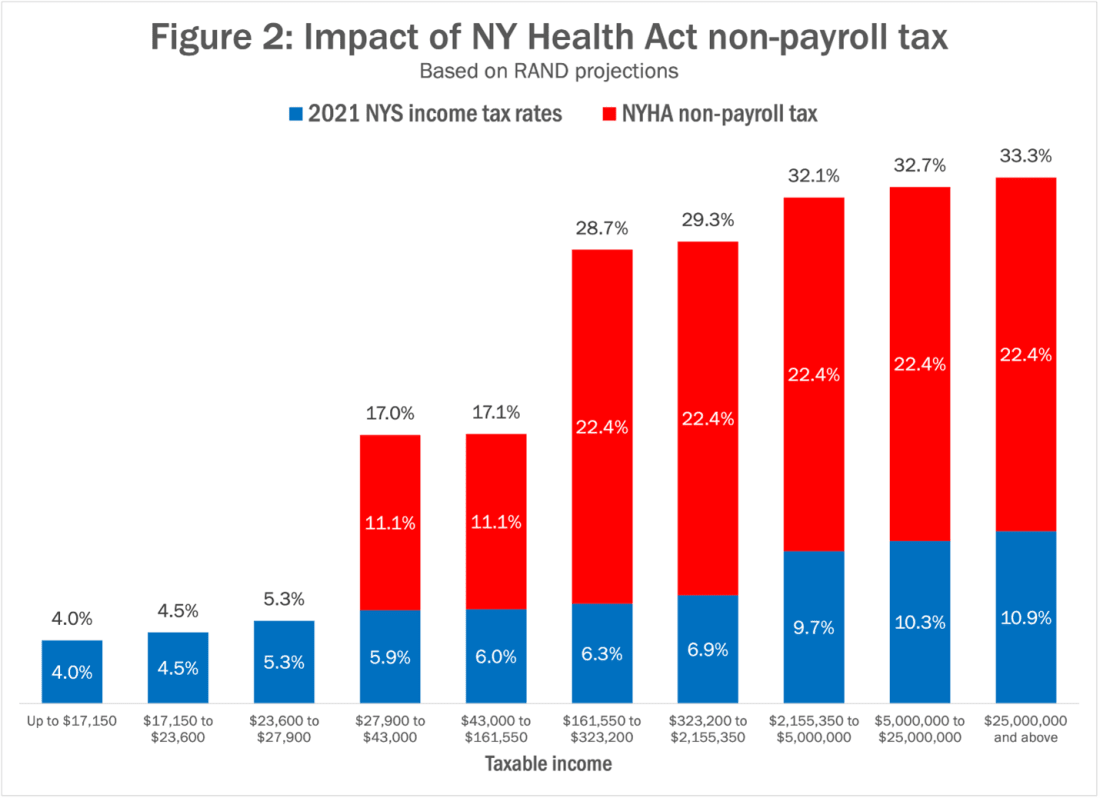

What New York Learned (RAND Corporation Study)

New York commissioned the RAND Corporation to evaluate the New York Health Act—a proposal nearly identical to Connecticut’s.

RAND’s findings were decisive:

156% increase in total state tax revenue required

New payroll and income taxes imposed across nearly all income brackets

Effective state income-tax rates for high earners approaching or exceeding 30%, before federal taxes

RAND further warned that if even 0.5% of top earners left the state, the plan would collapse financially.

New York listened—and walked away.

Why Connecticut Is Even More Vulnerable Than New York

Connecticut’s problem is not just high taxes.

It is tax concentration.

Unlike New York, Connecticut relies on a small number of towns and taxpayers to fund state government. Any policy that materially increases the tax burden on these communities threatens the entire revenue system.

Top 10 Towns by Total State Income Taxes Paid

Greenwich: $916,372,895

Stamford: $406,126,633

Darien: $285,743,758

Westport: $264,713,486

Fairfield: $255,469,783

New Canaan: $230,056,400

West Hartford: $224,039,635

Norwalk: $180,453,967

Glastonbury: $153,488,988

Ridgefield: $130,184,495

Top 10 Towns by Income Tax Paid Per Capita

Greenwich: $14,431

Darien: $13,274

New Canaan: $11,165

Lyme: $10,108

Westport: $9,758

Weston: $6,285

Wilton: $6,251

Avon: $5,501

Woodbridge: $5,254

Ridgefield: $5,206

Top 10 Towns by Average Tax Paid Per Return

Greenwich: $34,971

Darien: $34,728

New Canaan: $28,880

Lyme: $25,536

Westport: $23,327

Weston: $16,854

Wilton: $15,722

Ridgefield: $12,731

Avon: $12,056

Woodbridge: $12,008

These towns represent the financial backbone of Connecticut state government

What Single-Payer Does to This Tax Base

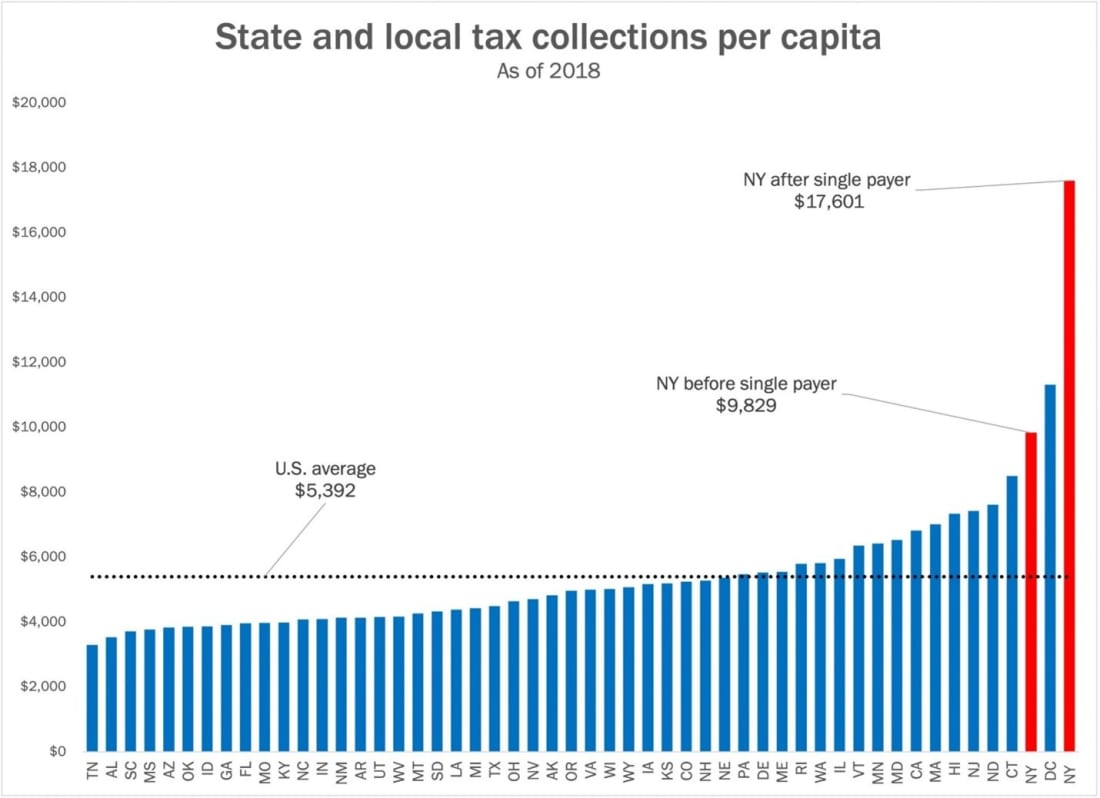

Applying RAND’s New York modeling to Connecticut produces a stark conclusion:

Effective state income-tax rates would double or triple for top earners

New payroll taxes would be layered on top

Per-capita state taxes in the highest-contributing towns would rise from $10,000–$15,000 to $30,000–$40,000

Dual-income households would face $100,000–$120,000+ annually in state taxes alone

These figures exclude federal taxes.

That level of taxation is not sustainable.

The Inevitable Outcome: Tax Flight and Revenue Collapse

Connecticut does not have a broad tax base to absorb this shock.

If even a small percentage of high-income households leave:

Income-tax receipts fall sharply

Remaining taxpayers face higher rates

More households leave

Property values decline

Municipal budgets deteriorate

The cycle accelerates

This is the same revenue death spiral RAND identified for New York—but faster and more severe due to Connecticut’s smaller, more concentrated base

Who Actually Benefits?

Retirees on Medicare with limited taxable income

Pensioners with low state-tax exposure

Who Are the Losers?

Middle-class and upper-middle-class workers—the backbone of Connecticut’s economy—pay more, often substantially more.

Other Fundamental Issues

Connecticut residents who work in New York and other states would not be subject to a Connecticut Payroll Tax.

Will out of state residents who work in Connecticut be covered?

People who now have employer funded health insurance would lose that benefit and have to pay higher taxes to pay for their health insurance and may not get a corresponding offset in their compensation

Will Connecticut become a healthcare Sanctuary State with all of the uninsured flocking here?

Would Other States Accept Husky for All when CT Residents travel or become snowbirds?

Conclusion: Math Wins. Always.

Single-payer health care is not merely expensive.

It is structurally incompatible with Connecticut’s tax reality.

A system that depends on tripling taxes on the very towns that fund the state is not compassionate.

It is reckless.

New York studied the numbers and walked away.

Connecticut should learn from that wisdom—before it is too late.

The Goldstein Substack is free today. But if you enjoyed this post, you can tell The Goldstein Substack that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments.