Email

Choppy Waters Ahead?

| From | Ross Givens <[email protected]> |

| Subject | Choppy Waters Ahead? |

| Date | January 21, 2026 2:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Wednesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Volatility is back with a vengeance.

What with all the talk about potentially acquiring Greenland “no matter what”,

additional tariffs, and now threats from Europe about dumping U.S. Treasuries.

So it’s no surprise that many people are seeing choppy waters ahead.

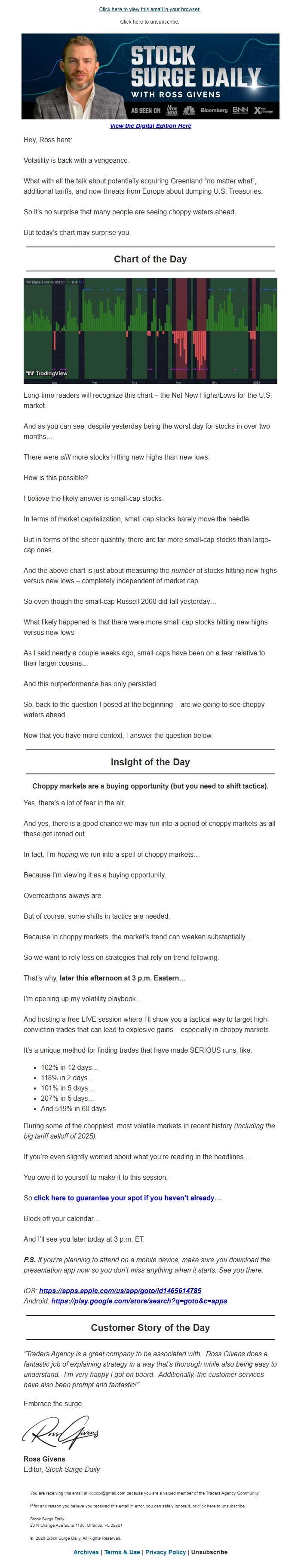

But today’s chart may surprise you.

Chart of the Day

Long-time readers will recognize this chart – the Net New Highs/Lows for the

U.S. market.

And as you can see, despite yesterday being the worst day for stocks in over

two months…

There were still more stocks hitting new highs than new lows.

How is this possible?

I believe the likely answer is small-cap stocks.

In terms of market capitalization, small-cap stocks barely move the needle.

But in terms of the sheer quantity, there are far more small-cap stocks than

large-cap ones.

And the above chart is just about measuring the number of stocks hitting new

highs versus new lows – completely independent of market cap.

So even though the small-cap Russell 2000 did fall yesterday…

What likely happened is that there were more small-cap stocks hitting new

highs versus new lows.

As I said nearly a couple weeks ago, small-caps have been on a tear relative

to their larger cousins…

And this outperformance has only persisted.

So, back to the question I posed at the beginning – are we going to see choppy

waters ahead.

Now that you have more context, I answer the question below.

Insight of the Day

Choppy markets are a buying opportunity (but you need to shift tactics).

Yes, there’s a lot of fear in the air.

And yes, there is a good chance we may run into a period of choppy markets as

all these get ironed out.

In fact, I’m hoping we run into a spell of choppy markets…

Because I’m viewing it as a buying opportunity.

Overreactions always are.

But of course, some shifts in tactics are needed.

Because in choppy markets, the market’s trend can weaken substantially…

So we want to rely less on strategies that rely on trend following.

That’s why, later this afternoon at 3 p.m. Eastern…

I’m opening up my volatility playbook…

And hosting a free LIVE session where I’ll show you a tactical way to target

high-conviction trades that can lead to explosive gains – especially in choppy

markets.

It’s a unique method for finding trades that have made SERIOUS runs, like:

* 102% in 12 days…

* 118% in 2 days…

* 101% in 5 days…

* 207% in 5 days…

* And 519% in 60 days

During some of the choppiest, most volatile markets in recent history

(including the big tariff selloff of 2025).

If you’re even slightly worried about what you’re reading in the headlines…

You owe it to yourself to make it to this session.

So click here to guarantee your spot if you haven’t already…

<[link removed]>

Block off your calendar…

And I’ll see you later today at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Traders Agency is a great company to be associated with. Ross Givens does a

fantastic job of explaining strategy in a way that’s thorough while also being

easy to understand. I’m very happy I got on board. Additionally, the customer

services have also been prompt and fantastic!"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Volatility is back with a vengeance.

What with all the talk about potentially acquiring Greenland “no matter what”,

additional tariffs, and now threats from Europe about dumping U.S. Treasuries.

So it’s no surprise that many people are seeing choppy waters ahead.

But today’s chart may surprise you.

Chart of the Day

Long-time readers will recognize this chart – the Net New Highs/Lows for the

U.S. market.

And as you can see, despite yesterday being the worst day for stocks in over

two months…

There were still more stocks hitting new highs than new lows.

How is this possible?

I believe the likely answer is small-cap stocks.

In terms of market capitalization, small-cap stocks barely move the needle.

But in terms of the sheer quantity, there are far more small-cap stocks than

large-cap ones.

And the above chart is just about measuring the number of stocks hitting new

highs versus new lows – completely independent of market cap.

So even though the small-cap Russell 2000 did fall yesterday…

What likely happened is that there were more small-cap stocks hitting new

highs versus new lows.

As I said nearly a couple weeks ago, small-caps have been on a tear relative

to their larger cousins…

And this outperformance has only persisted.

So, back to the question I posed at the beginning – are we going to see choppy

waters ahead.

Now that you have more context, I answer the question below.

Insight of the Day

Choppy markets are a buying opportunity (but you need to shift tactics).

Yes, there’s a lot of fear in the air.

And yes, there is a good chance we may run into a period of choppy markets as

all these get ironed out.

In fact, I’m hoping we run into a spell of choppy markets…

Because I’m viewing it as a buying opportunity.

Overreactions always are.

But of course, some shifts in tactics are needed.

Because in choppy markets, the market’s trend can weaken substantially…

So we want to rely less on strategies that rely on trend following.

That’s why, later this afternoon at 3 p.m. Eastern…

I’m opening up my volatility playbook…

And hosting a free LIVE session where I’ll show you a tactical way to target

high-conviction trades that can lead to explosive gains – especially in choppy

markets.

It’s a unique method for finding trades that have made SERIOUS runs, like:

* 102% in 12 days…

* 118% in 2 days…

* 101% in 5 days…

* 207% in 5 days…

* And 519% in 60 days

During some of the choppiest, most volatile markets in recent history

(including the big tariff selloff of 2025).

If you’re even slightly worried about what you’re reading in the headlines…

You owe it to yourself to make it to this session.

So click here to guarantee your spot if you haven’t already…

<[link removed]>

Block off your calendar…

And I’ll see you later today at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Traders Agency is a great company to be associated with. Ross Givens does a

fantastic job of explaining strategy in a way that’s thorough while also being

easy to understand. I’m very happy I got on board. Additionally, the customer

services have also been prompt and fantastic!"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2026 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost