Prefer to view this content on our website? Click here.

These Options-Based ETFs Pay Respectable Yields

One of the simplest ways to build passive income is by owning dividend-paying ETFs. But in recent years, a fast-growing category has taken the income conversation in a new direction: options-based income ETFs.

Instead of relying primarily on stock dividends, these funds seek to generate cash flow from option premiums - most commonly through covered calls, call spreads, or other systematic options strategies. The appeal is obvious: option premium can be harvested in many market environments, and some ETFs are structured to distribute that premium to shareholders on a frequent schedule.

The trade-offs are just as important as the yield. Options-based income strategies can cap upside during sharp rallies, and distributions often include significant return of capital (ROC), which can reduce NAV over time. In other words, these funds can be excellent income tools when used appropriately, but they are not “free yield.”

With that context, here are two options-based ETFs that stand out for frequency of distributions and income orientation heading into 2026.

Med-x Inc

Med-X is preparing for a potential NASDAQ listing (ticker: MXRX) — but the real opportunity is right now, before global validation reshapes the valuation.

In independent lab studies, Med-X’s all-natural pesticide Nature-Cide has outperformed chemical competitors in key use cases — delivering powerful results without toxic tradeoffs.

Now comes a potential industry-defining catalyst:

Med-X is pursuing World Health Organization pre-qualification, aiming to become the first botanical pesticide recognized at a global public-health level.

With the global biopesticide market projected to grow nearly 3× by 2030 — from $5.8B to $17.6B — WHO validation could unlock access to governments, agriculture, and mosquito-control programs worldwide.

Already sold through Amazon, Walmart, and Kroger, and expanding across 41 international markets, Med-X is positioning itself for its next major chapter.

Simpler. Safer. More Effective Pesticides.

👉 Become a Med-X shareholder at $4 per share before NASDAQ plans unfold

ETF: Defiance Nasdaq 100 LightningSpread Income ETF (SYM: QLDY)

QLDY is designed for investors who want frequent income tied to the Nasdaq-100 without necessarily owning the underlying Nasdaq-100 stocks directly.

According to Defiance, QLDY is an actively managed ETF seeking current income (primary objective) and capital appreciation (secondary objective). It is built around a proprietary “LightningSpread” approach that combines:

Importantly, the fund explicitly notes that investors do not have rights to dividends from Nasdaq-100 constituents because the exposure is obtained through options rather than directly holding the stocks.

What makes QLDY different: twice-weekly distributions

Defiance describes QLDY as the first ETF designed to make distributions twice weekly, aiming to deliver more frequent income than traditional monthly or quarterly income funds.

The fund’s posted distribution schedule shows frequent declaration and payable dates consistent with that high-frequency intent. For example, recent payouts listed on the sponsor page include:

Costs, price, and “headline yield” considerations

Defiance lists QLDY’s expense ratio at 1.04%, with a fund inception date of 09/17/2025.

As of 01/16/2026, Defiance reported a NAV of $46.58 and a closing price of $46.50.

The sponsor page also shows a distribution rate of 40.00% (as displayed on the fund page as of mid-January 2026).

However, it is essential to interpret that number correctly: distribution rates in options-income ETFs can be heavily influenced by recent payouts, volatility, and NAV movement—so they can change materially over time.

The critical detail most investors miss: ROC risk

Defiance also includes an explicit warning that QLDY distributions can vary significantly and are not guaranteed. Even more important, the sponsor page notes that QLDY’s distributions (for the referenced 19a-1 notice) were shown as 100% return of capital, and it cautions that ROC reduces NAV and trading price over time and “can result in losses on an investment.”

Bottom line on QLDY: If you want very frequent cash flow tied to Nasdaq-100-style exposure, QLDY is purpose-built for that. But you should go in with eyes open—this is an options strategy with meaningful complexity, capped upside potential, and a strong likelihood of ROC-heavy distributions.

TradeSmith

Here’s The Best Day to Buy Stocks

Did you know the S&P 500 has a 100% history of soaring, beginning on one particular

date every year?

We call this “The Green Day Phenomenon.” It works on 5,000 stocks.

For example, Nvidia has a 93% history of soaring beginning every January 26. This has held true for 15 years, through bull and bear markets.

Click here to see the green days for 5 major stocks today.

Clicking the link above will opt you into communication from TradeSmith, including the TradeSmith Daily daily E-Letter.

ETF: YieldMax Target 12 Big 50 Option Income ETF (SYM: BIGY)

BIGY takes a different approach. Instead of synthetic index exposure and 0DTE put spreads, BIGY targets income by holding a diversified portfolio of the largest U.S. companies and generating premium through a systematic call option / call spread overlay.

YieldMax describes BIGY as an actively managed ETF that seeks a target annualized distribution of 12% and capital appreciation via direct investments in a portfolio of 50 of the largest publicly traded U.S. companies by market cap, selected with attention to liquidity and volatility.

The fund seeks to generate income primarily by selling call options and call spreads on its portfolio holdings, while also pursuing capital appreciation via equity exposure.

Structure and fund details

On the sponsor site, BIGY lists:

-

Fund inception: 11/20/2024

-

Gross expense ratio: 1.09%

-

Distribution rate: 12.00% (as of 12/30/2025 on the sponsor page)

-

The fund “intends to pay out dividends and interest income, if any, monthly.”

As of January 20, 2026, BIGY was trading around $51.31.

Recent distributions (monthly)

YieldMax provides a distribution table on the BIGY page. Recent entries include:

-

$0.5325 declared 12/30/2025, payable 01/02/2026

-

$0.5331 declared 12/02/2025, payable 12/04/2025

The BIGY trade-off: upside cap and ROC

YieldMax is very direct about the risk profile: because BIGY sells options, its exposure to gains is capped, while it remains exposed to declines in the underlying holdings (which may not be fully offset by option income).

Also, like many options-income ETFs, BIGY’s distribution composition can include substantial return of capital. The sponsor page notes that the most recent distribution (12/30/2025) contained 86.47% return of capital and 13.53% income, and it cautions that ROC can decrease NAV and trading price over time.

Why BIGY can work in 2026

BIGY’s holdings are oriented toward the largest, most liquid U.S. companies—many of which are tied to the AI and data-center capex cycle. While you do not need an AI thesis to own BIGY, the macro tailwind helps explain why large-cap growth leadership (and options premiums on those names) remains a central income theme.

On the broader AI backdrop, Grand View Research estimates the global AI market was $390.91B in 2025 and projects it could reach $3,497.26B by 2033.

Bottom line on BIGY: BIGY is designed as a monthly high-income vehicle built on a diversified portfolio of mega-cap U.S. stocks plus a call-selling overlay. It can be a practical “income sleeve,” but investors should understand the upside cap and ROC-heavy distribution dynamics.

Weiss Ratings

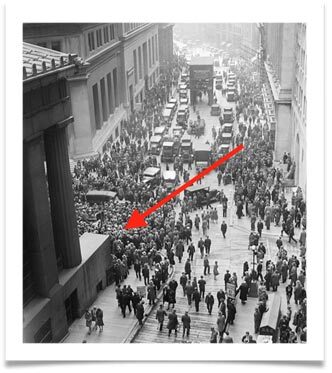

Strange picture signals market shift in 2026?

Take a look at this picture:

It's the New York Stock Exchange right after the 1229 crash.

But did you know …

A strange investment secret — discovered just a few short weeks before this image was taken — correctly predicted the crash?

Even crazier, this secret accurately called every major financial event in recent history …

Now, this secret is signaling something very scary is about to hit the stock market in 2026 …

Click here to find out more.

Are there any other income-focused ETFs you swear by? What other sectors of the market are you currently interested in? Hit "reply" to this email and let us know your thoughts!