Email

Wednesday Watchlist – Lithium & Silver

| From | TA Insider <[email protected]> |

| Subject | Wednesday Watchlist – Lithium & Silver |

| Date | January 14, 2026 4:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

2 actionable trade ideas

Click here to unsubscribe.

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

Welcome back to the Wednesday Watchlist.

The mining and metals sector remains hot.

One of our picks from a couple weeks ago – Lithium Argentina (LAR) – is up 35%.

One of last week’s picks – Peabody Energy Corporation (BTU) – has posted gains.

The other one – Cleveland-Cliffs Inc. (CLF) – didn’t hit our $14 buy trigger

(go ahead and cancel that Buy Limit order if you’ve placed it)…

So even though it dropped significantly last week, there’s no loss for us.

With that said, let’s get right into today’s two actionable trade ideas.

Trade Idea #1 – Lithium Americas Corp. (LAC)

Lithium Americas Corp. (LAC) has had quite a ride recently.

It first exploded in late September after President Trump announced that the

government would be taking a stake in this firm.

The stock nearly tripled in just a few weeks, in a pattern reminiscent of many

meme stocks.

And predictably, it pulled back sharply again after.

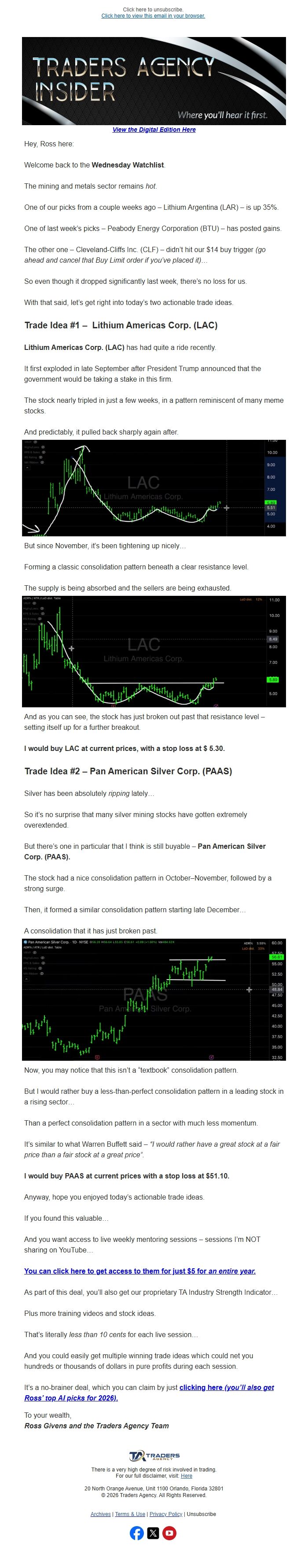

But since November, it’s been tightening up nicely…

Forming a classic consolidation pattern beneath a clear resistance level.

The supply is being absorbed and the sellers are being exhausted.

And as you can see, the stock has just broken out past that resistance level –

setting itself up for a further breakout.

I would buy LAC at current prices, with a stop loss at $ 5.30.

Trade Idea #2 – Pan American Silver Corp. (PAAS)

Silver has been absolutely ripping lately…

So it’s no surprise that many silver mining stocks have gotten extremely

overextended.

But there’s one in particular that I think is still buyable – Pan American

Silver Corp. (PAAS).

The stock had a nice consolidation pattern in October–November, followed by a

strong surge.

Then, it formed a similar consolidation pattern starting late December…

A consolidation that it has just broken past.

Now, you may notice that this isn’t a “textbook” consolidation pattern.

But I would rather buy a less-than-perfect consolidation pattern in a leading

stock in a rising sector…

Than a perfect consolidation pattern in a sector with much less momentum.

It’s similar to what Warren Buffett said – “I would rather have a great stock

at a fair price than a fair stock at a great price”.

I would buy PAAS at current prices with a stop loss at $51.10.

Anyway, hope you enjoyed today’s actionable trade ideas.

If you found this valuable…

And you want access to live weekly mentoring sessions – sessions I’m NOT

sharing on YouTube…

You can click here to get access to them for just $5 for an entire year.

<[link removed]>

As part of this deal, you’ll also get our proprietary TA Industry Strength

Indicator…

Plus more training videos and stock ideas.

That’s literally less than 10 cents for each live session…

And you could easily get multiple winning trade ideas which could net you

hundreds or thousands of dollars in pure profits during each session.

It’s a no-brainer deal, which you can claim by just clicking here (you’ll

also get Ross’ top AI picks for 2026).

<[link removed]>

To your wealth,

Ross Givens and the Traders Agency Team

There is a very high degree of risk involved in trading.

For our full disclaimer, visit: Here

<[link removed]>

20 North Orange Avenue, Unit 1100 Orlando, Florida 32801

© 2026 Traders Agency. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

<[link removed]> <[link removed]>

<[link removed]>

Click here to unsubscribe.

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

Welcome back to the Wednesday Watchlist.

The mining and metals sector remains hot.

One of our picks from a couple weeks ago – Lithium Argentina (LAR) – is up 35%.

One of last week’s picks – Peabody Energy Corporation (BTU) – has posted gains.

The other one – Cleveland-Cliffs Inc. (CLF) – didn’t hit our $14 buy trigger

(go ahead and cancel that Buy Limit order if you’ve placed it)…

So even though it dropped significantly last week, there’s no loss for us.

With that said, let’s get right into today’s two actionable trade ideas.

Trade Idea #1 – Lithium Americas Corp. (LAC)

Lithium Americas Corp. (LAC) has had quite a ride recently.

It first exploded in late September after President Trump announced that the

government would be taking a stake in this firm.

The stock nearly tripled in just a few weeks, in a pattern reminiscent of many

meme stocks.

And predictably, it pulled back sharply again after.

But since November, it’s been tightening up nicely…

Forming a classic consolidation pattern beneath a clear resistance level.

The supply is being absorbed and the sellers are being exhausted.

And as you can see, the stock has just broken out past that resistance level –

setting itself up for a further breakout.

I would buy LAC at current prices, with a stop loss at $ 5.30.

Trade Idea #2 – Pan American Silver Corp. (PAAS)

Silver has been absolutely ripping lately…

So it’s no surprise that many silver mining stocks have gotten extremely

overextended.

But there’s one in particular that I think is still buyable – Pan American

Silver Corp. (PAAS).

The stock had a nice consolidation pattern in October–November, followed by a

strong surge.

Then, it formed a similar consolidation pattern starting late December…

A consolidation that it has just broken past.

Now, you may notice that this isn’t a “textbook” consolidation pattern.

But I would rather buy a less-than-perfect consolidation pattern in a leading

stock in a rising sector…

Than a perfect consolidation pattern in a sector with much less momentum.

It’s similar to what Warren Buffett said – “I would rather have a great stock

at a fair price than a fair stock at a great price”.

I would buy PAAS at current prices with a stop loss at $51.10.

Anyway, hope you enjoyed today’s actionable trade ideas.

If you found this valuable…

And you want access to live weekly mentoring sessions – sessions I’m NOT

sharing on YouTube…

You can click here to get access to them for just $5 for an entire year.

<[link removed]>

As part of this deal, you’ll also get our proprietary TA Industry Strength

Indicator…

Plus more training videos and stock ideas.

That’s literally less than 10 cents for each live session…

And you could easily get multiple winning trade ideas which could net you

hundreds or thousands of dollars in pure profits during each session.

It’s a no-brainer deal, which you can claim by just clicking here (you’ll

also get Ross’ top AI picks for 2026).

<[link removed]>

To your wealth,

Ross Givens and the Traders Agency Team

There is a very high degree of risk involved in trading.

For our full disclaimer, visit: Here

<[link removed]>

20 North Orange Avenue, Unit 1100 Orlando, Florida 32801

© 2026 Traders Agency. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

<[link removed]> <[link removed]>

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost