|

|

Trump just turned the screw tighter on Powell

Rate slash demand comes hard on the heels of cooling inflation numbers

Hello Capitalists,

Here is everything you should be following today:

Trump unloads on Powell to cut rates further

Inflation growth slows again

Microsoft pledges to be a good neighbor with AI datacenter buildout

JP Morgan beats expectations even as profits dip

California “Wealth Tax” proposal gets major heat from an unexpected source

Today’s markets + assets:

🔴 DOW: 49213.01 (⬆️ .076%)

🔴 S&P: 6960.55 (⬆️ 023%)

🔴 NASDAQ: 23704.20 (⬆️ 0.13%)

⚠️✅CBOE VIX Volatility Index: 15.83 (⬆️ 4.70%)

🔴 Gold: $4601.40 (⬆️ 0.29%)

✅ Silver: $86.86 (⬆️ 2.08%)

✅ Bitcoin: $93,591 (⬆️ 2.36%)

The Capitalist is a reader-supported publication Reject Corporate Left-Wing Journalism

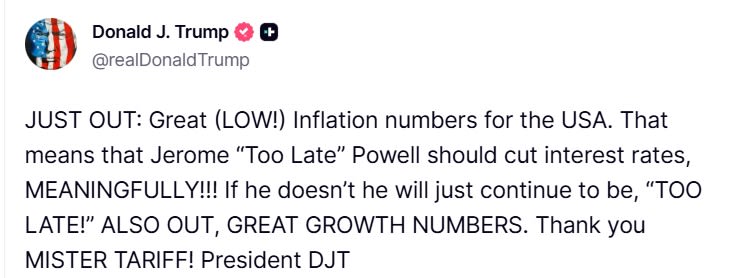

Trump blasts Powell demands massive rate slash

President Donald Trump seized on Tuesday’s consumer price data showing steady inflation to renew his aggressive push for Federal Reserve Chair Jerome Powell to cut interest rates “meaningfully,” labeling him “Jerome ‘Too Late’ Powell” and warning further delays would prove costly amid ongoing economic tensions.

Inflation numbers stable: December CPI held firm, with core inflation unchanged at 2.6% annually and 0.2% monthly, slightly below economist forecasts and reversing prior distortions from government shutdown effects.

Trump celebrates growth: President Trump hailed accompanying “GREAT GROWTH NUMBERS” and credited his tariff policies as “MISTER TARIFF” for driving positive economic momentum.

Fed faces unchanged outlook: Data reinforced market expectations that the Federal Reserve would hold interest rates steady at its upcoming meeting, despite recent cuts in the prior year.

Pressure intensifies on Powell: Trump’s Truth Social post escalated his long-standing criticism, insisting low inflation proves the need for deeper, immediate rate reductions to avoid being “TOO LATE.”

Together with Nutrition and Healing

What Neil Armstrong REALLY saw on the moon, NASA did their best to keep it secret…

You won’t see THIS in any history book…But after becoming the first man to set foot on the moon…Neil Armstrong reported a strange encounter he had in space during a post-mission debrief. And he wasn’t the only astronaut to experience it.

NASA did their best to keep it secret…But now, unearthed NASA audio is blowing the lid off of everything. This official Apollo recording is only seconds long, but it will chill you to the bone.

P.S. Of all the moon landing conspiracies, THIS could be the most incredible. Get the full truth HERE now while it’s still publicly available.

Inflation cools further, Core measure hits slowest pace since 2021

US inflation eased in December 2025 as core consumer prices — excluding volatile food and energy — rose at their slowest annual pace since March 2021, climbing just 2.6% year-over-year while headline CPI held steady at 2.7%, matching expectations and reinforcing a downward trend amid moderating underlying pressures.

Food Prices Surge Notably: Food index jumped 0.7% monthly outpacing overall inflation with five of six major grocery categories rising despite a 0.2% drop in meat prices.

Used Vehicles Drag Core Lower: Used cars and trucks plunged 1.7% in December helping temper core CPI gains alongside declines in airline fares and transportation services.

Core Inflation Moderates Genuinely: Annual core rate held at 2.6% equaling November’s level with economists noting true easing in underlying pressures despite some prior data volatility.

Fed Rate Cut Odds Fade: Markets priced in 95% chance of unchanged rates at the January 2026 meeting as inflation drifts lower but stays above the 2% target less pressing than labor risks.

Microsoft vows no electricity hikes from AI data centers

Microsoft pledged Tuesday that local consumers won’t face higher electricity bills when it builds massive AI-powered data centers nearby, committing to pay elevated utility rates and fund infrastructure expansions amid surging U.S. power costs driven by the tech industry’s AI boom.

Pays premium utility rates Microsoft will negotiate higher electricity rates with utilities to fully cover its data center power needs and prevent cost pass-through to residents.

Funds grid infrastructure The company plans advanced deals with utilities to invest in adding electricity supply, addressing shortages from explosive AI demand.

Replenishes water excess Beyond energy, Microsoft commits to restoring more water than its facilities consume and boosting local tax revenues without seeking property tax breaks.

Doubles data center scale With plans to nearly double its footprint in the next two years and $35 billion in recent AI infrastructure spending, the pledges aim to ease community opposition and speed deployments.

JPMorgan smashes expectations despite profit dip

JPMorgan Chase beat Wall Street estimates with adjusted earnings of $5.23 per share and revenue of $46.77 billion in the fourth quarter of 2025, fueled by surging trading gains in equities and fixed income. A $2.2 billion reserve charge tied to absorbing the Apple Card portfolio from Goldman Sachs drove reported profit down 7% to $13.03 billion, pressuring shares lower in early trading.

Trading Surge Powers Gains Robust equities trading jumped 40% to $2.9 billion, outpacing expectations by $350 million, while fixed income rose 7% to $5.4 billion amid favorable market conditions.

Investment Banking Lags Fees declined 5% to $2.3 billion, falling about $210 million short of forecasts and highlighting softer deal-making momentum.

2026 Outlook Issued The bank guided to roughly $103 billion in full-year net interest income and $105 billion in adjusted expenses, both dependent on market developments.

Dimon Sees Resilient Economy CEO Jamie Dimon noted softening but stable labor markets, sustained consumer spending, and potential boosts from deregulation and fiscal stimulus, while warning of geopolitical and inflation risks.

The California wealth tax is so bad that Newsom comes out against it

California Gov. Gavin Newsom condemned a proposed 5% one-time wealth tax on billionaires as “really damaging” to the state Monday, warning that its mere introduction is already prompting the ultra-wealthy—including tech titans like Larry Page and Sergey Brin—to shift money and businesses elsewhere amid fears of the looming 2026 ballot measure.

Wealth tax targets billionaires with over $1 billion in assets, imposing a one-time 5% levy due in 2027, potentially payable over five years with interest, and applying retroactively to California residents as of January 1, 2026.

Newsom vows opposition declaring the proposal “makes no sense” and “bad economics,” predicting its defeat due to widespread resistance and emphasizing his pragmatic agenda against such measures in his final year.

Billionaires relocating assets including Google co-founder Larry Page moving business entities and buying Miami properties, Oracle’s Larry Ellison selling his San Francisco home, and others like Sergey Brin and Peter Thiel shifting operations out of state.

Economic fallout feared with Newsom citing real impacts on revenue, startups, long-term investments, and heightened uncertainty, as the tax risks driving away innovation and commitments crucial to California’s economy.

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.