Email

$38 trillion in debt (here's what happens next)

| From | Parler Sponsor <[email protected]> |

| Subject | $38 trillion in debt (here's what happens next) |

| Date | January 13, 2026 3:54 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed]

View in browser

A Special Message from our SponsorPlease note that views expressed in this message do not necessarily reflect those of Parler and do not constitute an endorsement or recommendation by Parler.

DM Intelligence

‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌

Dear Reader,

The U.S. national debt just crossed $38 trillion... and a couple months ago it was $37 trillion.

That's right - the US added a TRILLION dollars in a matter of weeks.

That's the fastest rate of debt growth outside the pandemic.

[link removed]

No war... no crisis... just spending.

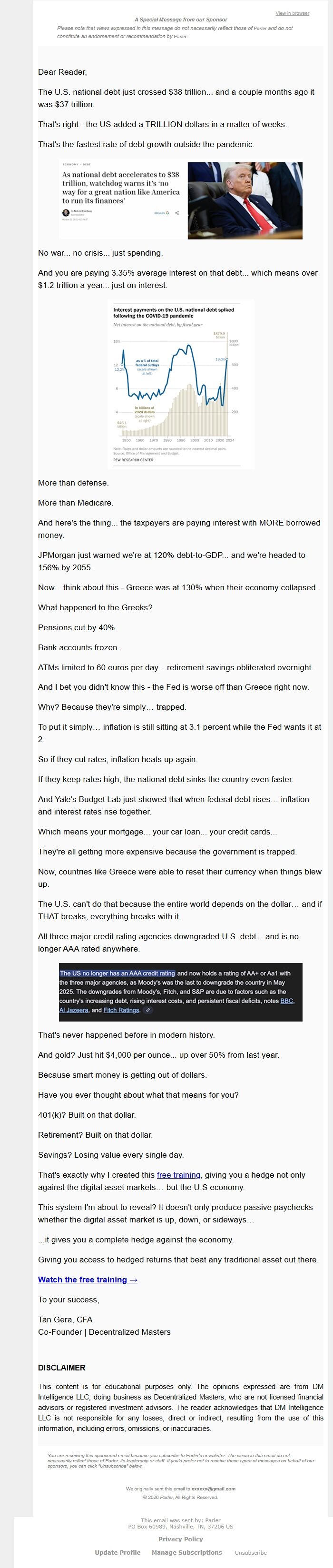

And you are paying 3.35% average interest on that debt... which means over $1.2 trillion a year... just on interest.

[link removed]

More than defense.

More than Medicare.

And here's the thing... the taxpayers are paying interest with MORE borrowed money.

JPMorgan just warned we're at 120% debt-to-GDP... and we're headed to 156% by 2055.

Now... think about this - Greece was at 130% when their economy collapsed.

What happened to the Greeks?

Pensions cut by 40%.

Bank accounts frozen.

ATMs limited to 60 euros per day... retirement savings obliterated overnight.

And I bet you didn't know this - the Fed is worse off than Greece right now.

Why? Because they're simply… trapped.

To put it simply… inflation is still sitting at 3.1 percent while the Fed wants it at 2.

So if they cut rates, inflation heats up again.

If they keep rates high, the national debt sinks the country even faster.

And Yale's Budget Lab just showed that when federal debt rises… inflation and interest rates rise together.

Which means your mortgage... your car loan... your credit cards...

They're all getting more expensive because the government is trapped.

Now, countries like Greece were able to reset their currency when things blew up.

The U.S. can't do that because the entire world depends on the dollar… and if THAT breaks, everything breaks with it.

All three major credit rating agencies downgraded U.S. debt... and is no longer AAA rated anywhere.

[link removed]

That's never happened before in modern history.

And gold? Just hit $4,000 per ounce... up over 50% from last year.

Because smart money is getting out of dollars.

Have you ever thought about what that means for you?

401(k)? Built on that dollar.

Retirement? Built on that dollar.

Savings? Losing value every single day.

That's exactly why I created this

[link removed]

free training , giving you a hedge not only against the digital asset markets… but the U.S economy.

This system I'm about to reveal? It doesn't only produce passive paychecks whether the digital asset market is up, down, or sideways…

...it gives you a complete hedge against the economy.

Giving you access to hedged returns that beat any traditional asset out there.

[link removed]

Watch the free training →

To your success,

Tan Gera, CFA

Co-Founder | Decentralized Masters

DISCLAIMER

This content is for educational purposes only. The opinions expressed are from DM Intelligence LLC, doing business as Decentralized Masters, who are not licensed financial advisors or registered investment advisors. The reader acknowledges that DM Intelligence LLC is not responsible for any losses, direct or indirect, resulting from the use of this information, including errors, omissions, or inaccuracies.

You are receiving this sponsored email because you subscribe to Parler's newsletter. The views in this email do not necessarily reflect those of Parler, its leadership or staff. If you'd prefer not to receive these types of messages on behalf of our sponsors, you can click "Unsubscribe" below.

We originally sent this email to [email protected]

(c) 2026 Parler, All Rights Reserved.

----------------------------------------

This email was sent by: Parler

PO Box 60989,

Nashville, TN, 37206 US

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

View in browser

A Special Message from our SponsorPlease note that views expressed in this message do not necessarily reflect those of Parler and do not constitute an endorsement or recommendation by Parler.

DM Intelligence

‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌ ‌

Dear Reader,

The U.S. national debt just crossed $38 trillion... and a couple months ago it was $37 trillion.

That's right - the US added a TRILLION dollars in a matter of weeks.

That's the fastest rate of debt growth outside the pandemic.

[link removed]

No war... no crisis... just spending.

And you are paying 3.35% average interest on that debt... which means over $1.2 trillion a year... just on interest.

[link removed]

More than defense.

More than Medicare.

And here's the thing... the taxpayers are paying interest with MORE borrowed money.

JPMorgan just warned we're at 120% debt-to-GDP... and we're headed to 156% by 2055.

Now... think about this - Greece was at 130% when their economy collapsed.

What happened to the Greeks?

Pensions cut by 40%.

Bank accounts frozen.

ATMs limited to 60 euros per day... retirement savings obliterated overnight.

And I bet you didn't know this - the Fed is worse off than Greece right now.

Why? Because they're simply… trapped.

To put it simply… inflation is still sitting at 3.1 percent while the Fed wants it at 2.

So if they cut rates, inflation heats up again.

If they keep rates high, the national debt sinks the country even faster.

And Yale's Budget Lab just showed that when federal debt rises… inflation and interest rates rise together.

Which means your mortgage... your car loan... your credit cards...

They're all getting more expensive because the government is trapped.

Now, countries like Greece were able to reset their currency when things blew up.

The U.S. can't do that because the entire world depends on the dollar… and if THAT breaks, everything breaks with it.

All three major credit rating agencies downgraded U.S. debt... and is no longer AAA rated anywhere.

[link removed]

That's never happened before in modern history.

And gold? Just hit $4,000 per ounce... up over 50% from last year.

Because smart money is getting out of dollars.

Have you ever thought about what that means for you?

401(k)? Built on that dollar.

Retirement? Built on that dollar.

Savings? Losing value every single day.

That's exactly why I created this

[link removed]

free training , giving you a hedge not only against the digital asset markets… but the U.S economy.

This system I'm about to reveal? It doesn't only produce passive paychecks whether the digital asset market is up, down, or sideways…

...it gives you a complete hedge against the economy.

Giving you access to hedged returns that beat any traditional asset out there.

[link removed]

Watch the free training →

To your success,

Tan Gera, CFA

Co-Founder | Decentralized Masters

DISCLAIMER

This content is for educational purposes only. The opinions expressed are from DM Intelligence LLC, doing business as Decentralized Masters, who are not licensed financial advisors or registered investment advisors. The reader acknowledges that DM Intelligence LLC is not responsible for any losses, direct or indirect, resulting from the use of this information, including errors, omissions, or inaccuracies.

You are receiving this sponsored email because you subscribe to Parler's newsletter. The views in this email do not necessarily reflect those of Parler, its leadership or staff. If you'd prefer not to receive these types of messages on behalf of our sponsors, you can click "Unsubscribe" below.

We originally sent this email to [email protected]

(c) 2026 Parler, All Rights Reserved.

----------------------------------------

This email was sent by: Parler

PO Box 60989,

Nashville, TN, 37206 US

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Salesforce Email Studio (ExactTarget)