|

|

BlackRock is the problem Larry Fink warns about

BlackRock continues to promote foreign influence on American companies.

The Capitalist is a reader-supported publication

Reject Corporate Left Wing Journalism

BlackRock Is the Problem Larry Fink Warns About

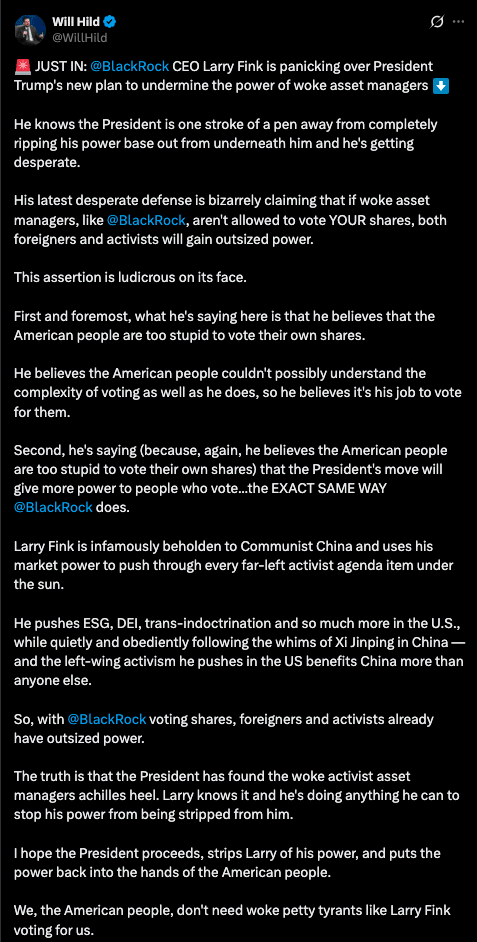

By Will Hild

BlackRock CEO Larry Fink recently argued that an Executive Order to curb the influence of large proxy advisers and index funds would empower “foreigners” and “activists.” We do need to stop foreign investors and political operatives from interfering with American companies, but the record shows that BlackRock has a long history of empowering such interests, and it remains a major part of the problem. Especially with the order now signed by President Trump, Mr. Fink should put his words into action and actually stop conduct that he now admits is harmful to American interests.

Over 40% of BlackRock’s assets are foreign-owned. According to a Congressional investigation, Norway and Japan‘s government pension funds pressured BlackRock into changing its shareholder votes and joining Climate Action 100+. Afterwards, BlackRock’s votes for environmental proposals increased tenfold (from 6% to 64%), and its votes against directors on climate-related issues increased fivefold (from 55 to 255).

Similarly, BlackRock became one of the first global asset managers to have a wholly owned onshore mutual fund business in China. Even George Soros opined that this move “will damage the national security interests of the U.S.” BlackRock has repeatedly voted for traditional energy companies to adopt emissions targets and advocacy approaches that force a transition to wind and solar, such as at Chevron, ConocoPhillips, and Berkshire Hathaway. Since wind and solar supply chains are 80-90% dominated by China, BlackRock’s actions not only harm these American companies but also align with the strategic goals of the United States’ greatest adversary. This is not a hypothetical problem—it was recently reported that rogue communication devices were found in Chinese solar power inverters.

BlackRock continues to promote foreign influence on American companies. While SEC Chairman Paul Atkins has threatened to require foreign companies to abandon foreign accounting standards because of their focus on immaterial sustainability requirements, BlackRock imposes these same foreign requirements, which the International Sustainability Standards Board marketed as “ushering in a new era of sustainability-related disclosures,” on American firms.

BlackRock also maintains membership in the United Nations Principles for Responsible Investment, whose members promise to “be active owners and incorporate ESG issues into our ownership policies and practices.” In addition, BlackRock’s Vice Chairman helps lead the UN-initiated Glasgow Financial Alliance for Net Zero, which organizes asset managers to “accelerate the transition to a net-zero global economy.”

BlackRock continues to use its proxy voting to support environmental activists like the Accountability Board, an organization led by the individual who invented the “holocaust on a plate” ad campaign for PETA. The Accountability Board recently pressured restaurants to cut emissions in line with net-zero targets. Reaching net zero in agriculture requires cutting U.S. beef consumption in half. That goal makes no financial sense for a restaurant that sells beef or hamburgers. Nevertheless, since last year, BlackRock has voted in favor of the Accountability Board’s proposals regarding emissions reduction at Jack in the Box, Wingstop, Denny’s, and Cracker Barrel. Because BlackRock owns a large share of these companies (almost 15% in the case of Cracker Barrel), its activism has often been decisive.

These recent votes follow a long history of BlackRock supporting environmental activists. For example, BlackRock voted against the reelection of the chair of Transdigm for “failure “to adopt quantitative greenhouse gas emissions goals.” BlackRock also famously supported the 2021 vote to install directors chosen by climate activists onto Exxon’s Board.

BlackRock has been equally activist on DEI. Mr. Fink previously stated his philosophy that companies need to “force behaviors“ to increase diversity. BlackRock bragged in 2021 that its top reason for voting against directors was that the Board failed to meet diversity quotas. That year, BlackRock voted against 648 directors based on diversity, compared to only 246 based on the second-most-frequent reason (compensation). That philosophy remains. BlackRock’s current proxy voting guidelines state that it will vote against board members “to the extent an S&P 500 company board is an outlier” on diversity.

For all these reasons, the Executive Order signed last month is a good start. Given conflicts of interest between large foreign asset owners and American retail investors, preventing BlackRock from voting or engaging with companies is a reasonable solution. BlackRock’s potential conflicts are likely to worsen, as the firm could use its low-fee public equity votes to boost the value of its higher-fee private equity offerings.

Mr. Fink correctly recognizes that foreign influence and politically motivated wreckers skew proxy voting from its only legitimate purpose—maximizing risk-adjusted returns for investors. His mistake is ignoring, or failing to stop, BlackRock’s substantial role in that problem.

Will Hild is Executive Director of Consumers’ Research.

Will Hild is Executive Director of Consumers’ Research.

Hild has been a longtime opponent of the ESG movement and specifically of Larry Fink's role in advancing progressive political objectives through "corporate engagement" with the shares he holds as a fiduciary. Will and Consumers' Research has mobilized numerous efforts to expose, halt, and roll-back ESG policies pushed by BlackRock and similar firms, often with considerable success.

The Capitalist is a reader-supported publication

Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.