Email

Is Rising Volatility Tarnishing Gold's Appeal? | Dealers' Silver Inventories Decimated

| From | Money Metals Exchange <[email protected]> |

| Subject | Is Rising Volatility Tarnishing Gold's Appeal? | Dealers' Silver Inventories Decimated |

| Date | January 5, 2026 3:50 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

January 5, 2026 Money Metals' well-stocked silver inventory situation is attracting attention at a time when intense retail demand has wiped out most other dealers' inventories.

To be sure, volume has been very high over the past several weeks, coinciding with wild silver price moves and a global supply crunch.

Silver rallied $4 higher again since last night, and continues to trade at a premium in London and especially Asia, with China (the second largest producer of silver) restricting exports of the "poor man's gold" as of January 1.

The steep silver premiums in Asia have the effect of drawing in physical silver from other parts of the world like a magnet, fueling overall price gains.

Given Money Metals strong capitalization and robust inventory management system, virtually all products remain in stock at Money Metals. Our primary challenge has been keeping up with the overwhelming call volume and order fulfillment throughput.

[link removed]

Meanwhile, the best value in silver right now is pre-1965 silver dimes and quarters [link removed] , available at Money Metals for $1 BELOW SPOT. Check it out!

Phone lines are open at Money Metals, but there are often wait times given the incredible demand coming in. Remember that you can always order online [link removed] at MoneyMetals.com [link removed] !

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$4,345 (-2.3%) [link removed]

$4,449 (+2.2%) [link removed]

Silver [link removed]

$73.53 (-8.0%) [link removed]

$77.45 (+5.3%) [link removed]

Platinum [link removed]

$2,154 (-13.2%) [link removed]

$2,303 (+6.9%) [link removed]

Palladium [link removed]

$1,657 (-16.1%) [link removed]

$1,742 (+5.1%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 59.1 to 1

Is Rising Volatility Tarnishing Gold's Appeal?

Share this Article: [link removed] [link removed] [link removed]

We???ve seen some sharp price swings in the gold market over the last couple of months. Should this diminish gold???s investment appeal?

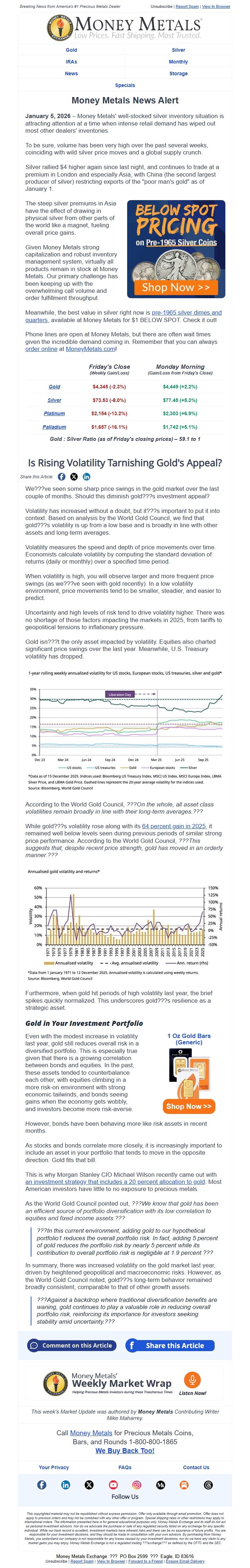

Volatility has increased without a doubt, but it???s important to put it into context. Based on analysis by the World Gold Council, we find that gold???s volatility is up from a low base and is broadly in line with other assets and long-term averages.

Volatility measures the speed and depth of price movements over time. Economists calculate volatility by computing the standard deviation of returns (daily or monthly) over a specified time period.

When volatility is high, you will observe larger and more frequent price swings (as we???ve seen with gold recently). In a low volatility environment, price movements tend to be smaller, steadier, and easier to predict.

Uncertainty and high levels of risk tend to drive volatility higher. There was no shortage of those factors impacting the markets in 2025, from tariffs to geopolitical tensions to inflationary pressure.

Gold isn???t the only asset impacted by volatility. Equities also charted significant price swings over the last year. Meanwhile, U.S. Treasury volatility has dropped.

According to the World Gold Council, ???On the whole, all asset class volatilities remain broadly in line with their long-term averages.???

While gold???s volatility rose along with its 64 percent gain in 2025 [link removed] , it remained well below levels seen during previous periods of similar strong price performance. According to the World Gold Council, ???This suggests that, despite recent price strength, gold has moved in an orderly manner.???

Furthermore, when gold hit periods of high volatility last year, the brief spikes quickly normalized. This underscores gold???s resilience as a strategic asset.

Gold in Your Investment Portfolio

Even with the modest increase in volatility last year, gold still reduces overall risk in a diversified portfolio. This is especially true given that there is a growing correlation between bonds and equities. In the past, these assets tended to counterbalance each other, with equities climbing in a more risk-on environment with strong economic tailwinds, and bonds seeing gains when the economy gets wobbly, and investors become more risk-averse.

1 Oz Gold Bars (Generic) [link removed] [link removed]

Shop Now >> [link removed]

However, bonds have been behaving more like risk assets in recent months.

As stocks and bonds correlate more closely, it is increasingly important to include an asset in your portfolio that tends to move in the opposite direction. Gold fits that bill.

This is why Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold [link removed] . Most American investors have little to no exposure to precious metals.

As the World Gold Council pointed out, ???We know that gold has been an efficient source of portfolio diversification with its low correlation to equities and fixed income assets.???

???In this current environment, adding gold to our hypothetical portfolio1 reduces the overall portfolio risk. In fact, adding 5 percent of gold reduces the portfolio risk by nearly 5 percent while its contribution to overall portfolio risk is negligible at 1.9 percent.???

In summary, there was increased volatility on the gold market last year, driven by heightened geopolitical and macroeconomic risks. However, as the World Gold Council noted, gold???s long-term behavior remained broadly consistent, comparable to that of other growth assets.

???Against a backdrop where traditional diversification benefits are waning, gold continues to play a valuable role in reducing overall portfolio risk, reinforcing its importance for investors seeking stability amid uncertainty.???

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Mike Maharrey.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

January 5, 2026 Money Metals' well-stocked silver inventory situation is attracting attention at a time when intense retail demand has wiped out most other dealers' inventories.

To be sure, volume has been very high over the past several weeks, coinciding with wild silver price moves and a global supply crunch.

Silver rallied $4 higher again since last night, and continues to trade at a premium in London and especially Asia, with China (the second largest producer of silver) restricting exports of the "poor man's gold" as of January 1.

The steep silver premiums in Asia have the effect of drawing in physical silver from other parts of the world like a magnet, fueling overall price gains.

Given Money Metals strong capitalization and robust inventory management system, virtually all products remain in stock at Money Metals. Our primary challenge has been keeping up with the overwhelming call volume and order fulfillment throughput.

[link removed]

Meanwhile, the best value in silver right now is pre-1965 silver dimes and quarters [link removed] , available at Money Metals for $1 BELOW SPOT. Check it out!

Phone lines are open at Money Metals, but there are often wait times given the incredible demand coming in. Remember that you can always order online [link removed] at MoneyMetals.com [link removed] !

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$4,345 (-2.3%) [link removed]

$4,449 (+2.2%) [link removed]

Silver [link removed]

$73.53 (-8.0%) [link removed]

$77.45 (+5.3%) [link removed]

Platinum [link removed]

$2,154 (-13.2%) [link removed]

$2,303 (+6.9%) [link removed]

Palladium [link removed]

$1,657 (-16.1%) [link removed]

$1,742 (+5.1%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 59.1 to 1

Is Rising Volatility Tarnishing Gold's Appeal?

Share this Article: [link removed] [link removed] [link removed]

We???ve seen some sharp price swings in the gold market over the last couple of months. Should this diminish gold???s investment appeal?

Volatility has increased without a doubt, but it???s important to put it into context. Based on analysis by the World Gold Council, we find that gold???s volatility is up from a low base and is broadly in line with other assets and long-term averages.

Volatility measures the speed and depth of price movements over time. Economists calculate volatility by computing the standard deviation of returns (daily or monthly) over a specified time period.

When volatility is high, you will observe larger and more frequent price swings (as we???ve seen with gold recently). In a low volatility environment, price movements tend to be smaller, steadier, and easier to predict.

Uncertainty and high levels of risk tend to drive volatility higher. There was no shortage of those factors impacting the markets in 2025, from tariffs to geopolitical tensions to inflationary pressure.

Gold isn???t the only asset impacted by volatility. Equities also charted significant price swings over the last year. Meanwhile, U.S. Treasury volatility has dropped.

According to the World Gold Council, ???On the whole, all asset class volatilities remain broadly in line with their long-term averages.???

While gold???s volatility rose along with its 64 percent gain in 2025 [link removed] , it remained well below levels seen during previous periods of similar strong price performance. According to the World Gold Council, ???This suggests that, despite recent price strength, gold has moved in an orderly manner.???

Furthermore, when gold hit periods of high volatility last year, the brief spikes quickly normalized. This underscores gold???s resilience as a strategic asset.

Gold in Your Investment Portfolio

Even with the modest increase in volatility last year, gold still reduces overall risk in a diversified portfolio. This is especially true given that there is a growing correlation between bonds and equities. In the past, these assets tended to counterbalance each other, with equities climbing in a more risk-on environment with strong economic tailwinds, and bonds seeing gains when the economy gets wobbly, and investors become more risk-averse.

1 Oz Gold Bars (Generic) [link removed] [link removed]

Shop Now >> [link removed]

However, bonds have been behaving more like risk assets in recent months.

As stocks and bonds correlate more closely, it is increasingly important to include an asset in your portfolio that tends to move in the opposite direction. Gold fits that bill.

This is why Morgan Stanley CIO Michael Wilson recently came out with an investment strategy that includes a 20 percent allocation to gold [link removed] . Most American investors have little to no exposure to precious metals.

As the World Gold Council pointed out, ???We know that gold has been an efficient source of portfolio diversification with its low correlation to equities and fixed income assets.???

???In this current environment, adding gold to our hypothetical portfolio1 reduces the overall portfolio risk. In fact, adding 5 percent of gold reduces the portfolio risk by nearly 5 percent while its contribution to overall portfolio risk is negligible at 1.9 percent.???

In summary, there was increased volatility on the gold market last year, driven by heightened geopolitical and macroeconomic risks. However, as the World Gold Council noted, gold???s long-term behavior remained broadly consistent, comparable to that of other growth assets.

???Against a backdrop where traditional diversification benefits are waning, gold continues to play a valuable role in reducing overall portfolio risk, reinforcing its importance for investors seeking stability amid uncertainty.???

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Mike Maharrey.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a