|

|

Most Billionaires Are Already Finished Paying into Social Security for 2026 |

|

By the end of the first week of January, Americans who earn more than $10,000,000 a year will be finished paying Social Security taxes for 2026. This year the cap on earnings subject to Social Security tax is $184,500.

New research from the Economic Policy Institute suggests that scrapping the Social Security tax cap would actually benefit many wealthy Americans in the long run. EPI estimates that 70 percent of workers between the ages of 32 and 66 who earned more than the taxable amount in 2024 would lose more from future benefit cuts than they would pay in additional taxes if lawmakers eliminated the cap.

|

|

Reminder: Alliance National Membership Meeting is this April |

|

The Alliance looks forward to seeing you at our National Membership Meeting in April at the recently renovated Sahara hotel in Las Vegas, Nevada.

Come celebrate the Alliance’s 25th anniversary and chart our path forward in fighting for retirement security and older Americans! |

|

|

The event will kick off with a late afternoon welcome reception on Monday, April 27 and will continue through Thursday, April 30. Attendees will elect the Alliance’s officers, participate in special workshops, learn about emerging issues and what’s at stake in the 2026 elections, and how to grow our retiree activism.

More information, including registration details, will be announced in early January. In the meantime, please contact Joni Jones at [email protected] or call 888-373-6497 with any questions.

Click here to sign up for updates as more information becomes available. |

|

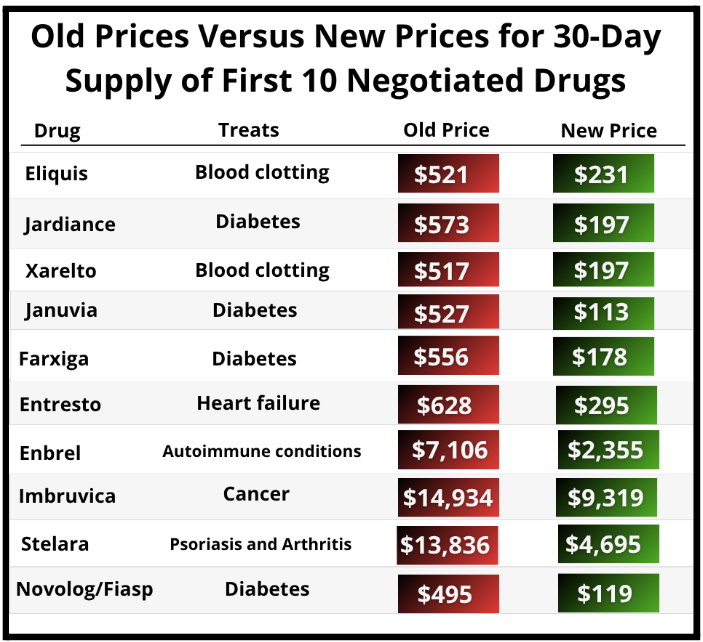

Medicare Negotiated Prices for Ten Expensive Drugs Kick In This Year |

|

Seniors will pay dramatically less at the pharmacy counter for 10 high-priced prescription drugs this year, thanks to the Inflation Reduction Act (IRA) signed into law by President Joe Biden in 2022. |

|

|

The drugs – part of the first round selected for Medicare price negotiation – treat common health conditions, including but not limited to heart failure and diabetes. The Centers for Medicare and Medicaid Services (CMS) estimates that Medicare beneficiaries will save $1.5 billion in out-of-pocket costs this year thanks to the negotiated prices. |

|

Last year, Medicare selected fifteen additional drugs for negotiation. Negotiated prices for those will take effect in 2027.

As of January 1, the annual out of pocket cap for prescription drugs increased to $2,100 for people with Medicare Part D. Once a beneficiary's prescription drug spending reaches that limit, the rest of their eligible costs will be covered.

Older Americans will continue to receive other benefits from the IRA this year, including:

“Since its inception, the Inflation Reduction Act has delivered savings and peace of mind for millions of older Americans struggling to pay for their prescription drugs, and this year will be no different,” said Richard Fiesta, Executive Director of the Alliance. “We urge the Trump Administration to build upon the law’s legacy and work to make health care more affordable for seniors.” |

|

KFF Health News: Wheelchair? Hearing Aids? Yes. ‘Disabled’? No Way. |

|

In her house in Ypsilanti, Michigan, Barbara Meade said, “there are walkers and wheelchairs and oxygen and cannulas all over the place.”

Barbara, 82, has chronic obstructive pulmonary disease, so a portable oxygen tank accompanies her everywhere. Spinal stenosis limits her mobility, necessitating the walkers and wheelchairs and considerable help from her husband, Dennis, who serves as her primary caregiver.

“I know I need hearing aids,” Barbara added. “My hearing is horrible.” She acquired a pair a few years ago but rarely uses them. Dennis Meade, 86, is more mobile, despite arthritis pain in one knee, but contends with his own hearing problems. Similarly dissatisfied with the hearing aids he once bought, he said, “I just got to the point where I say, ‘Talk louder.’”

But if you ask either of them a question included on a recent University of Michigan survey — “Do you identify as having a disability?” — the Meades answer promptly: No, they don’t.

Disability “means you can’t do things,” Dennis said. “As long as you can work with it and it’s not affecting your life that much, you don’t consider yourself disabled.”

Their daughter Michelle Meade, a rehabilitation psychologist and the director of the Center for Disability Health and Wellness at the university, accompanies her parents to medical appointments and tends to roll her eyes at their reluctance to acknowledge needing support.

Working with other researchers on the recent national poll has shown her how often older adults feel that they are not disabled despite ample evidence to the contrary.

|

|

Thanks for reading. Every day, we're fighting to lower prescription drug prices and protect retirees' earned benefits and health care. But we can't do it without your help. Please support our work by donating below. |

|

|

|

|

Alliance for Retired Americans | 815 16th Street, NW | Washington, DC 20006 | www.retiredamericans.org