Email

All Precious Metals Zooming Sharply Higher... What the Heck is Happening?

| From | Money Metals Exchange <[email protected]> |

| Subject | All Precious Metals Zooming Sharply Higher... What the Heck is Happening? |

| Date | December 22, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

December 22, 2025 Gold, silver, platinum, and palladium are buidling upon last week's gains and rallying again this morning -- in a big way.

Traders are paying particularly close attention to gold -- with the yellow metal now poking above its all-time high reached back in October. Gold has traded sideways for two months while silver and the platinum group metals took the lead.

A new breakout in gold would make major headlines and lead to a new surge in retail interest in all precious metals as well as mining stocks. Interestingly, the stocks have barely outperformed the metals themselves this year.

At Money Metals, we're seeing rising levels of first-time purchaser inflows -- and only modest selling from long-time holders despite the significant capital gains they now enjoy.

[link removed]

In reality, though, very few Americans own a single ounce of gold or silver bullion -- having been failed by their financial advisors who were taught to belittle gold and those who own it. Other parts of the world, particularly Asia, are having most of the fun.

A quick reminder -- Money Metals' free silver bonus is still valid through Wednesday. Purchase $750 or more in silver and we'll throw in a quarter ounce buffalo silver round with our thanks.

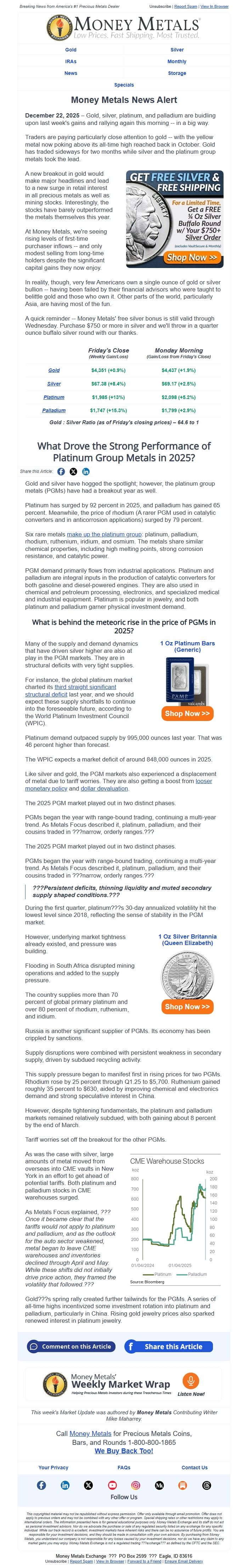

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$4,351 (+0.9%) [link removed]

$4,437 (+1.9%) [link removed]

Silver [link removed]

$67.38 (+8.4%) [link removed]

$69.17 (+2.5%) [link removed]

Platinum [link removed]

$1,985 (+13%) [link removed]

$2,098 (+5.2%) [link removed]

Palladium [link removed]

$1,747 (+15.3%) [link removed]

$1,799 (+2.9%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 64.6 to 1

What Drove the Strong Performance of Platinum Group Metals in 2025?

Share this Article: [link removed] [link removed] [link removed]

Gold and silver have hogged the spotlight; however, the platinum group metals (PGMs) have had a breakout year as well.

Platinum has surged by 92 percent in 2025, and palladium has gained 65 percent. Meanwhile, the price of rhodium (A rarer PGM used in catalytic converters and in anticorrosion applications) surged by 79 percent.

Six rare metals make up the platinum group [link removed] : platinum, palladium, rhodium, ruthenium, iridium, and osmium. The metals share similar chemical properties, including high melting points, strong corrosion resistance, and catalytic power.

PGM demand primarily flows from industrial applications. Platinum and palladium are integral inputs in the production of catalytic converters for both gasoline and diesel-powered engines. They are also used in chemical and petroleum processing, electronics, and specialized medical and industrial equipment. Platinum is popular in jewelry, and both platinum and palladium garner physical investment demand.

What is behind the meteoric rise in the price of PGMs in 2025?

Many of the supply and demand dynamics that have driven silver higher are also at play in the PGM markets. They are in structural deficits with very tight supplies.

For instance, the global platinum market charted its third straight significant structural deficit [link removed] last year, and we should expect these supply shortfalls to continue into the foreseeable future, according to the World Platinum Investment Council (WPIC).

1 Oz Platinum Bars (Generic) [link removed] [link removed]

Shop Now >> [link removed]

Platinum demand outpaced supply by 995,000 ounces last year. That was 46 percent higher than forecast.

The WPIC expects a market deficit of around 848,000 ounces in 2025.

Like silver and gold, the PGM markets also experienced a displacement of metal due to tariff worries. They are also getting a boost from looser monetary policy [link removed] and dollar devaluation [link removed] .

The 2025 PGM market played out in two distinct phases.

PGMs began the year with range-bound trading, continuing a multi-year trend. As Metals Focus described it, platinum, palladium, and their cousins traded in ???narrow, orderly ranges.???

The 2025 PGM market played out in two distinct phases.

PGMs began the year with range-bound trading, continuing a multi-year trend. As Metals Focus described it, platinum, palladium, and their cousins traded in ???narrow, orderly ranges.???

???Persistent deficits, thinning liquidity and muted secondary supply shaped conditions.???

During the first quarter, platinum???s 30-day annualized volatility hit the lowest level since 2018, reflecting the sense of stability in the PGM market.

However, underlying market tightness already existed, and pressure was building.

Flooding in South Africa disrupted mining operations and added to the supply pressure.

The country supplies more than 70 percent of global primary platinum and over 80 percent of rhodium, ruthenium, and iridium.

1 Oz Silver Britannia (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

Russia is another significant supplier of PGMs. Its economy has been crippled by sanctions.

Supply disruptions were combined with persistent weakness in secondary supply, driven by subdued recycling activity.

This supply pressure began to manifest first in rising prices for two PGMs. Rhodium rose by 25 percent through Q1.25 to $5,700. Ruthenium gained roughly 35 percent to $630, aided by improving chemical and electronics demand and strong speculative interest in China.

However, despite tightening fundamentals, the platinum and palladium markets remained relatively subdued, with both gaining about 8 percent by the end of March.

Tariff worries set off the breakout for the other PGMs.

As was the case with silver, large amounts of metal moved from overseas into CME vaults in New York in an effort to get ahead of potential tariffs. Both platinum and palladium stocks in CME warehouses surged.

As Metals Focus explained, ???Once it became clear that the tariffs would not apply to platinum and palladium, and as the outlook for the auto sector weakened, metal began to leave CME warehouses and inventories declined through April and May. While these shifts did not initially drive price action, they framed the volatility that followed.???

Gold???s spring rally created further tailwinds for the PGMs. A series of all-time highs incentivized some investment rotation into platinum and palladium, particularly in China. Rising gold jewelry prices also sparked renewed interest in platinum jewelry.

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Mike Maharrey.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

December 22, 2025 Gold, silver, platinum, and palladium are buidling upon last week's gains and rallying again this morning -- in a big way.

Traders are paying particularly close attention to gold -- with the yellow metal now poking above its all-time high reached back in October. Gold has traded sideways for two months while silver and the platinum group metals took the lead.

A new breakout in gold would make major headlines and lead to a new surge in retail interest in all precious metals as well as mining stocks. Interestingly, the stocks have barely outperformed the metals themselves this year.

At Money Metals, we're seeing rising levels of first-time purchaser inflows -- and only modest selling from long-time holders despite the significant capital gains they now enjoy.

[link removed]

In reality, though, very few Americans own a single ounce of gold or silver bullion -- having been failed by their financial advisors who were taught to belittle gold and those who own it. Other parts of the world, particularly Asia, are having most of the fun.

A quick reminder -- Money Metals' free silver bonus is still valid through Wednesday. Purchase $750 or more in silver and we'll throw in a quarter ounce buffalo silver round with our thanks.

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$4,351 (+0.9%) [link removed]

$4,437 (+1.9%) [link removed]

Silver [link removed]

$67.38 (+8.4%) [link removed]

$69.17 (+2.5%) [link removed]

Platinum [link removed]

$1,985 (+13%) [link removed]

$2,098 (+5.2%) [link removed]

Palladium [link removed]

$1,747 (+15.3%) [link removed]

$1,799 (+2.9%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 64.6 to 1

What Drove the Strong Performance of Platinum Group Metals in 2025?

Share this Article: [link removed] [link removed] [link removed]

Gold and silver have hogged the spotlight; however, the platinum group metals (PGMs) have had a breakout year as well.

Platinum has surged by 92 percent in 2025, and palladium has gained 65 percent. Meanwhile, the price of rhodium (A rarer PGM used in catalytic converters and in anticorrosion applications) surged by 79 percent.

Six rare metals make up the platinum group [link removed] : platinum, palladium, rhodium, ruthenium, iridium, and osmium. The metals share similar chemical properties, including high melting points, strong corrosion resistance, and catalytic power.

PGM demand primarily flows from industrial applications. Platinum and palladium are integral inputs in the production of catalytic converters for both gasoline and diesel-powered engines. They are also used in chemical and petroleum processing, electronics, and specialized medical and industrial equipment. Platinum is popular in jewelry, and both platinum and palladium garner physical investment demand.

What is behind the meteoric rise in the price of PGMs in 2025?

Many of the supply and demand dynamics that have driven silver higher are also at play in the PGM markets. They are in structural deficits with very tight supplies.

For instance, the global platinum market charted its third straight significant structural deficit [link removed] last year, and we should expect these supply shortfalls to continue into the foreseeable future, according to the World Platinum Investment Council (WPIC).

1 Oz Platinum Bars (Generic) [link removed] [link removed]

Shop Now >> [link removed]

Platinum demand outpaced supply by 995,000 ounces last year. That was 46 percent higher than forecast.

The WPIC expects a market deficit of around 848,000 ounces in 2025.

Like silver and gold, the PGM markets also experienced a displacement of metal due to tariff worries. They are also getting a boost from looser monetary policy [link removed] and dollar devaluation [link removed] .

The 2025 PGM market played out in two distinct phases.

PGMs began the year with range-bound trading, continuing a multi-year trend. As Metals Focus described it, platinum, palladium, and their cousins traded in ???narrow, orderly ranges.???

The 2025 PGM market played out in two distinct phases.

PGMs began the year with range-bound trading, continuing a multi-year trend. As Metals Focus described it, platinum, palladium, and their cousins traded in ???narrow, orderly ranges.???

???Persistent deficits, thinning liquidity and muted secondary supply shaped conditions.???

During the first quarter, platinum???s 30-day annualized volatility hit the lowest level since 2018, reflecting the sense of stability in the PGM market.

However, underlying market tightness already existed, and pressure was building.

Flooding in South Africa disrupted mining operations and added to the supply pressure.

The country supplies more than 70 percent of global primary platinum and over 80 percent of rhodium, ruthenium, and iridium.

1 Oz Silver Britannia (Queen Elizabeth) [link removed] [link removed]

Shop Now >> [link removed]

Russia is another significant supplier of PGMs. Its economy has been crippled by sanctions.

Supply disruptions were combined with persistent weakness in secondary supply, driven by subdued recycling activity.

This supply pressure began to manifest first in rising prices for two PGMs. Rhodium rose by 25 percent through Q1.25 to $5,700. Ruthenium gained roughly 35 percent to $630, aided by improving chemical and electronics demand and strong speculative interest in China.

However, despite tightening fundamentals, the platinum and palladium markets remained relatively subdued, with both gaining about 8 percent by the end of March.

Tariff worries set off the breakout for the other PGMs.

As was the case with silver, large amounts of metal moved from overseas into CME vaults in New York in an effort to get ahead of potential tariffs. Both platinum and palladium stocks in CME warehouses surged.

As Metals Focus explained, ???Once it became clear that the tariffs would not apply to platinum and palladium, and as the outlook for the auto sector weakened, metal began to leave CME warehouses and inventories declined through April and May. While these shifts did not initially drive price action, they framed the volatility that followed.???

Gold???s spring rally created further tailwinds for the PGMs. A series of all-time highs incentivized some investment rotation into platinum and palladium, particularly in China. Rising gold jewelry prices also sparked renewed interest in platinum jewelry.

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Contributing Writer Mike Maharrey.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a