|

|

Bitcoin hoarders face exclusion from major market indexes in billion dollar shake up

Bitcoin holding firms like Michael Saylor's Microstrategy face an uncertain future

Hello Capitalists,

Here is everything you should be following today:

Bitcoin holding firms face an uncertain future in 2026

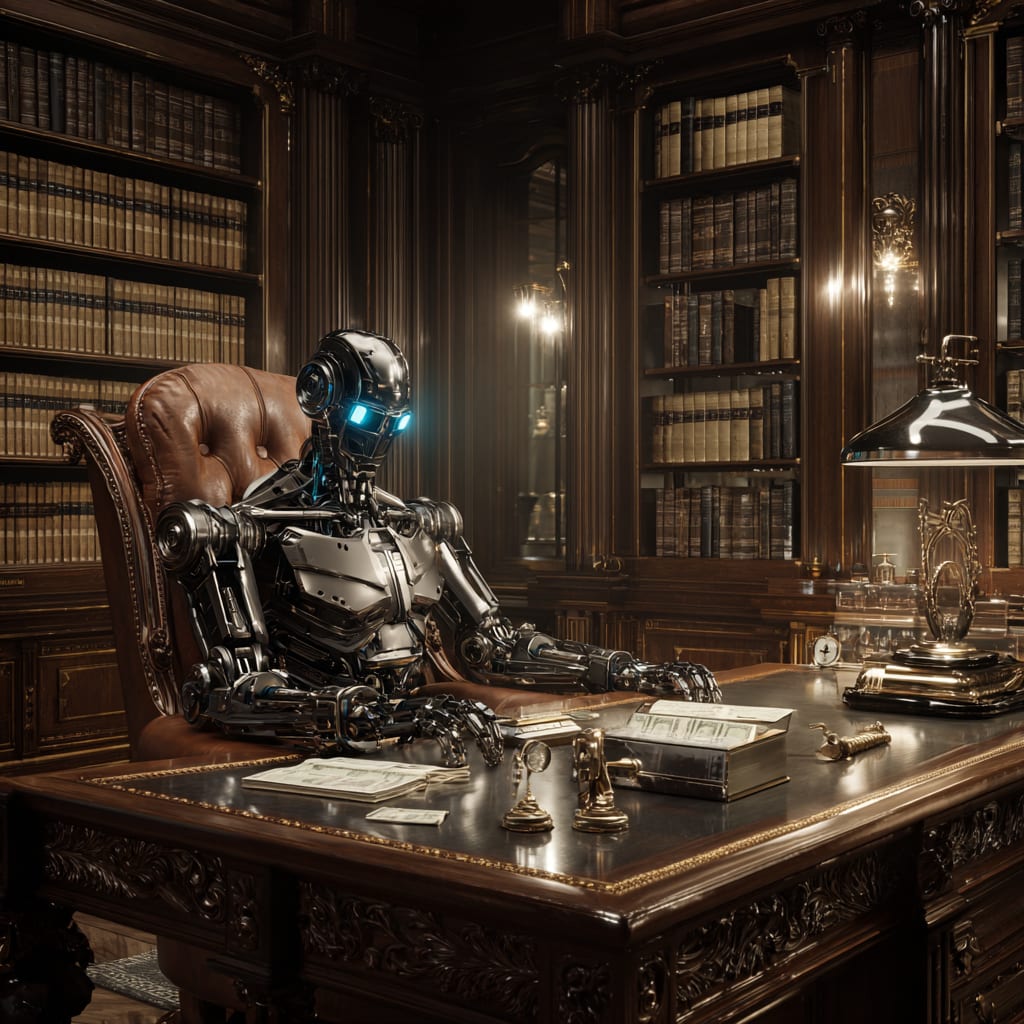

AI is about to wade in to the wealth management industry

Google inks billion dollar AI security deal

Gold and Silver eye future rate cuts to fuel their rise

Data Center investment deals in 2025 broke $61 Billion dollars

Today’s markets + assets:

✅ DOW: 48273.94 (⬆️ 0.67%)

✅ S&P: 6838.57 (⬆️ 0.94%)

✅ NASDAQ: 23283.41 (⬆️ 1.20%)

⚠️🔴CBOE VIX Volatility Index: 15.26 (⬇️ 9.54%)

✅ Gold: $4,387.00 (⬆️ 0.33%)

✅ Silver: $67.65 (⬆️ 2.60%)

✅ Bitcoin: $87,273 (⬆️ 0.25%)

The Capitalist is a reader-supported publication Reject Corporate Left-Wing Journalism

Bitcoin hoarders face index exile shock

MicroStrategy and other bitcoin-buying firms risk exclusion from major stock indexes like MSCI over their reclassification as Digital Asset Treasury DAT companies, potentially triggering up to $9 billion in share outflows and chilling the crypto treasury sector amid ongoing consultations.

Shares Skyrocketed Then Crashed: MicroStrategy’s stock surged 3,000% after starting bitcoin purchases in 2020 but has fallen 43% this year amid cryptocurrency’s decline.

Outflows Could Hit Billions: Analysts estimate $2.8 billion in forced sales from MSCI exclusion alone, rising to $8.8 billion if other indexes like Nasdaq 100 were to follow suit.

Leaders Decry Discrimination: MicroStrategy’s Saylor argue the proposal unfairly targets crypto firms, shutting them out of the $15 trillion passive-investment market.

Broader Indexes May Align: Experts predict most equity indexes will adopt similar exclusions, amplifying challenges for firms funding token buys through stock and debt.

Ifrah Law heightens the success of iGaming clients through every phase of their business cycle

Led by a managing partner who has been at the center of every significant court case affecting online gaming, Ifrah Law operates at the cutting edge of technology, innovation, and regulation.

Its lawyers represent industry players throughout the entire business cycle, from the formation of a corporation or licensing relationship, through marketing, partnering, growth, and disputes, to profitable exits.

We’re proud to share that all partners at Ifrah Law have been ranked by Chambers and Partners, the gold standard for evaluating legal excellence worldwide.

AI set to outperform human advisors in the realm or wealth management

Artificial intelligence is poised to revolutionize wealth management, outperforming most human financial advisors by delivering emotion-free, data-driven guidance and 24/7 real-time monitoring that could democratize high-quality advice for everyday investors.

Discipline Beats Emotional Pitfalls: AI sidesteps greed and fear, sticking to probabilities and rules for consistent decisions that human advisors often compromise under client or media pressure.

Continuous Oversight Enhances Outcomes: Unlike sporadic human meetings, AI tracks spending patterns, debt, investments, risks, and taxes instantly, providing immediate feedback to optimize financial health.

Low-Cost Subscriptions Transform Access: For Netflix-like fees, AI offers commission-free coaching, stress-testing decisions, and calendar-integrated plans, exposing mediocre advisory services.

Top Advisors Embrace Hybrid Model: Elite humans will use AI for calculations and execution, focusing on intuition, family dynamics, and preventing life-altering mistakes in a modernized industry.

Google cloud seals epic $10B security deal with long time partner

In a major boost for Alphabet’s cloud arm, Google Cloud announced its largest security services partnership with cybersecurity leader Palo Alto Networks, committing nearly $10 billion over years to migrate platforms and pioneer AI-driven defenses against evolving cyber threats.

AI Sparks Security Surge: Executives note artificial intelligence has massively increased demand for advanced cybersecurity, akin to early cloud-era threats.

Attackers Exploit Generative Tools: Cybercriminals increasingly use AI for attacks, mirroring defenses’ adoption of the technology.

Heavy Investments in Sector: Google eyes $32 billion Wiz acquisition; Palo Alto launches AI offerings and plans $3.35 billion Chronosphere buy.

Deep-Rooted Partnership History: Google and PAlo Alto have been collaborating since 2018, bolstered by Palo Alto CEO’s prior long tenure at Google.

Hard assets smash records on future rate cut bets

As US inflation slows to its slowest pace since early 2021, gold and silver prices are surging near all-time highs, driven by bets on further Federal Reserve rate cuts amid rising geopolitical tensions.

Gold Tops $4,330 Ounce: Spot gold hits $4,330 per ounce, marking a two-thirds rise this year, as falling interest rates boost non-yielding assets.

Metals Surge in Value: Silver has more than doubled in 2025, with platinum surging above $1,980 per ounce—its highest since 2008.

Central Banks Drive Demand: Elevated central-bank purchases and ETF inflows underpin the rally, delivering the best annual performances since 1979.

Goldman Forecasts Price Climb: Analysts predict structurally high demand and Fed support will push gold higher, despite ambiguous central bank signals.

Data center deals shatter records amid AI jitters

Global data center deals hit a record $61 billion in 2025, driven by AI infrastructure demands, even as investors fret over soaring valuations and hyperscalers’ reliance on massive debt financing.

Debt Issuance Surges: Hyperscalers doubled debt to $182 billion this year, with Meta raising nearly half its $62 billion since 2022 in 2025 alone.

U.S. Dominates Market: Most transactions occurred in America, far outpacing Europe’s slower growth, while the Middle East emerges as a new AI powerhouse.

Transactions Exceed Last Year: Over 100 deals in the first 11 months surpassed all of 2024, fueled by a global construction frenzy for energy-intensive workloads.

Future Valuations Rise: Analysts foresee strong AI demand in 2026, potentially inflating valuations further amid energy shortages and robust M&A activity.

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.