Email

The “Bright” Side of Layoffs?

| From | Ross Givens <[email protected]> |

| Subject | The “Bright” Side of Layoffs? |

| Date | December 19, 2025 2:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Friday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

There’s been a lot of discussion about the labor market lately.

The unemployment rate has jumped to a four-year high…

And it seems like every week there’s new news about mass layoffs happening at

some company or another.

I sympathize with those who are struggling. It’s tough out there.

But as traders, it’s important we understand how to use the environment –

something we have zero control over – to our advantage.

So for today’s chart, let’s look at how these layoffs could impact stock

prices.

Chart of the Day

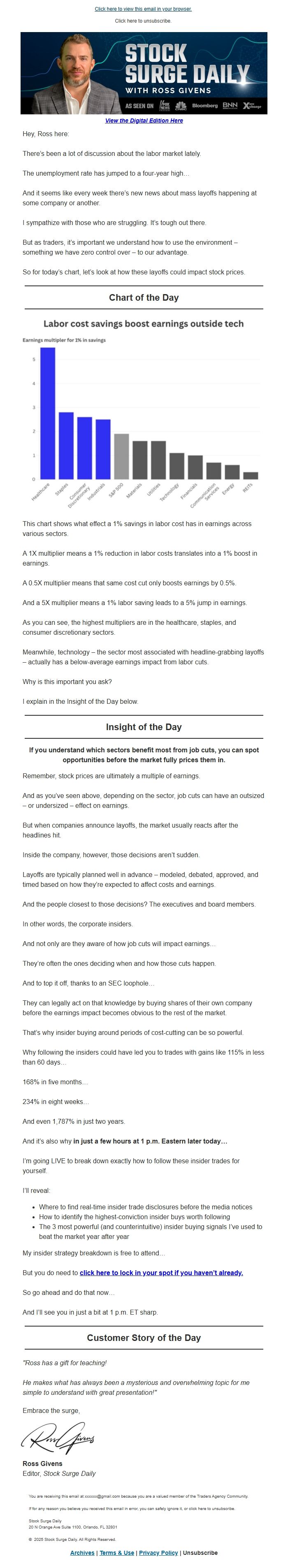

This chart shows what effect a 1% savings in labor cost has in earnings

across various sectors.

A 1X multiplier means a 1% reduction in labor costs translates into a 1% boost

in earnings.

A 0.5X multiplier means that same cost cut only boosts earnings by 0.5%.

And a 5X multiplier means a 1% labor saving leads to a 5% jump in earnings.

As you can see, the highest multipliers are in the healthcare, staples, and

consumer discretionary sectors.

Meanwhile, technology – the sector most associated with headline-grabbing

layoffs – actually has a below-average earnings impact from labor cuts.

Why is this important you ask?

I explain in the Insight of the Day below.

Insight of the Day

If you understand which sectors benefit most from job cuts, you can spot

opportunities before the market fully prices them in.

Remember, stock prices are ultimately a multiple of earnings.

And as you’ve seen above, depending on the sector, job cuts can have an

outsized – or undersized – effect on earnings.

But when companies announce layoffs, the market usually reacts after the

headlines hit.

Inside the company, however, those decisions aren’t sudden.

Layoffs are typically planned well in advance – modeled, debated, approved,

and timed based on how they’re expected to affect costs and earnings.

And the people closest to those decisions? The executives and board members.

In other words, the corporate insiders.

And not only are they aware of how job cuts will impact earnings…

They’re often the ones deciding when and how those cuts happen.

And to top it off, thanks to an SEC loophole…

They can legally act on that knowledge by buying shares of their own company

before the earnings impact becomes obvious to the rest of the market.

That’s why insider buying around periods of cost-cutting can be so powerful.

Why following the insiders could have led you to trades with gains like 115%

in less than 60 days…

168% in five months…

234% in eight weeks…

And even 1,787% in just two years.

And it’s also why in just a few hours at 1 p.m. Eastern later today…

I’m going LIVE to break down exactly how to follow these insider trades for

yourself.

I’ll reveal:

* Where to find real-time insider trade disclosures before the media notices

* How to identify the highest-conviction insider buys worth following

* The 3 most powerful (and counterintuitive) insider buying signals I’ve used

to beat the market year after year

My insider strategy breakdown is free to attend…

But you do need to click here to lock in your spot if you haven’t already.

<[link removed]>

So go ahead and do that now…

And I’ll see you in just a bit at 1 p.m. ET sharp.

Customer Story of the Day

"Ross has a gift for teaching!

He makes what has always been a mysterious and overwhelming topic for me

simple to understand with great presentation!"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

There’s been a lot of discussion about the labor market lately.

The unemployment rate has jumped to a four-year high…

And it seems like every week there’s new news about mass layoffs happening at

some company or another.

I sympathize with those who are struggling. It’s tough out there.

But as traders, it’s important we understand how to use the environment –

something we have zero control over – to our advantage.

So for today’s chart, let’s look at how these layoffs could impact stock

prices.

Chart of the Day

This chart shows what effect a 1% savings in labor cost has in earnings

across various sectors.

A 1X multiplier means a 1% reduction in labor costs translates into a 1% boost

in earnings.

A 0.5X multiplier means that same cost cut only boosts earnings by 0.5%.

And a 5X multiplier means a 1% labor saving leads to a 5% jump in earnings.

As you can see, the highest multipliers are in the healthcare, staples, and

consumer discretionary sectors.

Meanwhile, technology – the sector most associated with headline-grabbing

layoffs – actually has a below-average earnings impact from labor cuts.

Why is this important you ask?

I explain in the Insight of the Day below.

Insight of the Day

If you understand which sectors benefit most from job cuts, you can spot

opportunities before the market fully prices them in.

Remember, stock prices are ultimately a multiple of earnings.

And as you’ve seen above, depending on the sector, job cuts can have an

outsized – or undersized – effect on earnings.

But when companies announce layoffs, the market usually reacts after the

headlines hit.

Inside the company, however, those decisions aren’t sudden.

Layoffs are typically planned well in advance – modeled, debated, approved,

and timed based on how they’re expected to affect costs and earnings.

And the people closest to those decisions? The executives and board members.

In other words, the corporate insiders.

And not only are they aware of how job cuts will impact earnings…

They’re often the ones deciding when and how those cuts happen.

And to top it off, thanks to an SEC loophole…

They can legally act on that knowledge by buying shares of their own company

before the earnings impact becomes obvious to the rest of the market.

That’s why insider buying around periods of cost-cutting can be so powerful.

Why following the insiders could have led you to trades with gains like 115%

in less than 60 days…

168% in five months…

234% in eight weeks…

And even 1,787% in just two years.

And it’s also why in just a few hours at 1 p.m. Eastern later today…

I’m going LIVE to break down exactly how to follow these insider trades for

yourself.

I’ll reveal:

* Where to find real-time insider trade disclosures before the media notices

* How to identify the highest-conviction insider buys worth following

* The 3 most powerful (and counterintuitive) insider buying signals I’ve used

to beat the market year after year

My insider strategy breakdown is free to attend…

But you do need to click here to lock in your spot if you haven’t already.

<[link removed]>

So go ahead and do that now…

And I’ll see you in just a bit at 1 p.m. ET sharp.

Customer Story of the Day

"Ross has a gift for teaching!

He makes what has always been a mysterious and overwhelming topic for me

simple to understand with great presentation!"

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost