Email

Trump's Public Opinion Slump

| From | AEI DataPoints <[email protected]> |

| Subject | Trump's Public Opinion Slump |

| Date | December 18, 2025 12:05 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Also: Dating Challenges & Interest Rates

AEIDataPoints-Banner ([link removed] )

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by Brady Africk and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine President Trump's opinion polls, men’s challenges in the dating market, and the economic consequences of a dovish Federal Reserve.

Don’t forget—subscribe ([link removed] ) and send DataPoints to a friend!

For inquiries, please email [email protected] (mailto:[email protected]) .

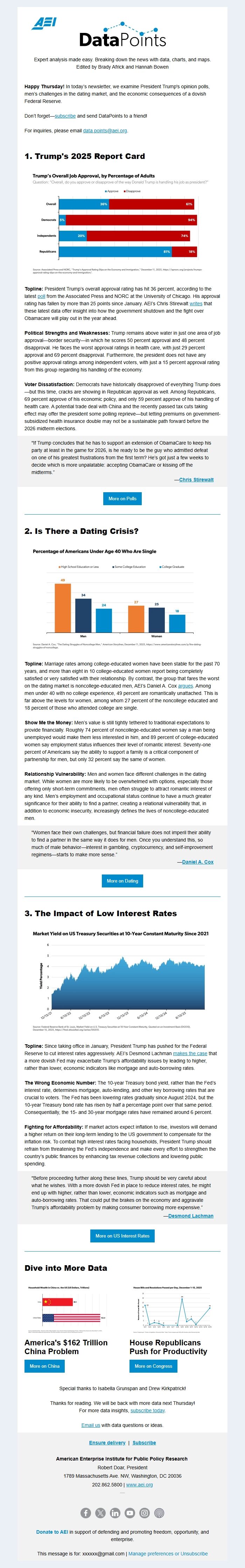

1. Trump's 2025 Report Card

01 Stirewalt ([link removed] )

Topline: President Trump’s overall approval rating has hit 36 percent, according to the latest poll ([link removed] ) from the Associated Press and NORC at the University of Chicago. His approval rating has fallen by more than 25 points since January. AEI’s Chris Stirewalt writes ([link removed] ) that these latest data offer insight into how the government shutdown and the fight over Obamacare will play out in the year ahead.

Political Strengths and Weaknesses: Trump remains above water in just one area of job approval—border security—in which he scores 50 percent approval and 48 percent disapproval. He faces the worst approval ratings in health care, with just 29 percent approval and 69 percent disapproval. Furthermore, the president does not have any positive approval ratings among independent voters, with just a 15 percent approval rating from this group regarding his handling of the economy.

Voter Dissatisfaction: Democrats have historically disapproved of everything Trump does—but this time, cracks are showing in Republican approval as well. Among Republicans, 69 percent approve of his economic policy, and only 59 percent approve of his handling of health care. A potential trade deal with China and the recently passed tax cuts taking effect may offer the president some polling reprieve—but letting premiums on government-subsidized health insurance double may not be a sustainable path forward before the 2026 midterm elections.

"If Trump concludes that he has to support an extension of ObamaCare to keep his party at least in the game for 2026, is he ready to be the guy who admitted defeat on one of his greatest frustrations from the first term? He’s got just a few weeks to decide which is more unpalatable: accepting ObamaCare or kissing off the midterms.”

—Chris Stirewalt ([link removed] )

More on Polls

([link removed] )

2. Is There a Dating Crisis?

02 Cox-2 ([link removed] )

Topline: Marriage rates among college-educated women have been stable for the past 70 years, and more than eight in 10 college-educated women report being completely satisfied or very satisfied with their relationship. By contrast, the group that fares the worst on the dating market is noncollege-educated men, AEI’s Daniel A. Cox argues ([link removed] ) . Among men under 40 with no college experience, 49 percent are romantically unattached. This is far above the levels for women, among whom 27 percent of the noncollege educated and 18 percent of those who attended college are single.

Show Me the Money: Men’s value is still tightly tethered to traditional expectations to provide financially. Roughly 74 percent of noncollege-educated women say a man being unemployed would make them less interested in him, and 89 percent of college-educated women say employment status influences their level of romantic interest. Seventy-one percent of Americans say the ability to support a family is a critical component of partnership for men, but only 32 percent say the same of women.

Relationship Vulnerability: Men and women face different challenges in the dating market. While women are more likely to be overwhelmed with options, especially those offering only short-term commitments, men often struggle to attract romantic interest of any kind. Men’s employment and occupational status continue to have a much greater significance for their ability to find a partner, creating a relational vulnerability that, in addition to economic insecurity, increasingly defines the lives of noncollege-educated men.

"Women face their own challenges, but financial failure does not imperil their ability to find a partner in the same way it does for men. Once you understand this, so much of male behavior—interest in gambling, cryptocurrency, and self-improvement regimens—starts to make more sense.”

—Daniel A. Cox ([link removed] )

More on Dating

([link removed] )

3. The Impact of Low Interest Rates

03 Lachman-2 ([link removed] )

Topline: Since taking office in January, President Trump has pushed for the Federal Reserve to cut interest rates aggressively. AEI’s Desmond Lachman makes the case ([link removed] ) that a more dovish Fed may exacerbate Trump’s affordability issues by leading to higher, rather than lower, economic indicators like mortgage and auto-borrowing rates.

The Wrong Economic Number: The 10-year Treasury bond yield, rather than the Fed’s interest rate, determines mortgage, auto-lending, and other key borrowing rates that are crucial to voters. The Fed has been lowering rates gradually since August 2024, but the 10-year Treasury bond rate has risen by half a percentage point over that same period. Consequentially, the 15- and 30-year mortgage rates have remained around 6 percent.

Fighting for Affordability: If market actors expect inflation to rise, investors will demand a higher return on their long-term lending to the US government to compensate for the inflation risk. To combat high interest rates facing households, President Trump should refrain from threatening the Fed’s independence and make every effort to strengthen the country’s public finances by enhancing tax revenue collections and lowering public spending.

"Before proceeding further along these lines, Trump should be very careful about what he wishes. With a more dovish Fed in place to reduce interest rates, he might end up with higher, rather than lower, economic indicators such as mortgage and auto-borrowing rates. That could put the brakes on the economy and aggravate Trump’s affordability problem by making consumer borrowing more expensive.”

—Desmond Lachman ([link removed] )

More on US Interest Rates

([link removed] )

Dive into More Data

04 Blumenthal ([link removed] )

America's $162 Trillion China Problem ([link removed] )

More on China

([link removed] )

05 Kosar ([link removed] )

House Republicans Push for Productivity ([link removed] )

More on Congress

([link removed] )

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today ([link removed] ) .

Email us (mailto:[email protected]) with data questions or ideas.

Ensure delivery ([link removed] ) | Subscribe ([link removed] )

American Enterprise Institute for Public Policy Research

Robert Doar, President

1789 Massachusetts Ave. NW, Washington, DC 20036

202.862.5800 | www.aei.org ([link removed] )

Unsubscribe from the link below ([link removed] )

Facebook ([link removed] )

X ([link removed] )

LinkedIn ([link removed] )

YouTube ([link removed] )

Instagram ([link removed] )

Podcast Logo New_Gray ([link removed] )

Donate to AEI ([link removed] ) in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] | Manage preferences or Unsubscribe ([link removed] )

AEIDataPoints-Banner ([link removed] )

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by Brady Africk and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine President Trump's opinion polls, men’s challenges in the dating market, and the economic consequences of a dovish Federal Reserve.

Don’t forget—subscribe ([link removed] ) and send DataPoints to a friend!

For inquiries, please email [email protected] (mailto:[email protected]) .

1. Trump's 2025 Report Card

01 Stirewalt ([link removed] )

Topline: President Trump’s overall approval rating has hit 36 percent, according to the latest poll ([link removed] ) from the Associated Press and NORC at the University of Chicago. His approval rating has fallen by more than 25 points since January. AEI’s Chris Stirewalt writes ([link removed] ) that these latest data offer insight into how the government shutdown and the fight over Obamacare will play out in the year ahead.

Political Strengths and Weaknesses: Trump remains above water in just one area of job approval—border security—in which he scores 50 percent approval and 48 percent disapproval. He faces the worst approval ratings in health care, with just 29 percent approval and 69 percent disapproval. Furthermore, the president does not have any positive approval ratings among independent voters, with just a 15 percent approval rating from this group regarding his handling of the economy.

Voter Dissatisfaction: Democrats have historically disapproved of everything Trump does—but this time, cracks are showing in Republican approval as well. Among Republicans, 69 percent approve of his economic policy, and only 59 percent approve of his handling of health care. A potential trade deal with China and the recently passed tax cuts taking effect may offer the president some polling reprieve—but letting premiums on government-subsidized health insurance double may not be a sustainable path forward before the 2026 midterm elections.

"If Trump concludes that he has to support an extension of ObamaCare to keep his party at least in the game for 2026, is he ready to be the guy who admitted defeat on one of his greatest frustrations from the first term? He’s got just a few weeks to decide which is more unpalatable: accepting ObamaCare or kissing off the midterms.”

—Chris Stirewalt ([link removed] )

More on Polls

([link removed] )

2. Is There a Dating Crisis?

02 Cox-2 ([link removed] )

Topline: Marriage rates among college-educated women have been stable for the past 70 years, and more than eight in 10 college-educated women report being completely satisfied or very satisfied with their relationship. By contrast, the group that fares the worst on the dating market is noncollege-educated men, AEI’s Daniel A. Cox argues ([link removed] ) . Among men under 40 with no college experience, 49 percent are romantically unattached. This is far above the levels for women, among whom 27 percent of the noncollege educated and 18 percent of those who attended college are single.

Show Me the Money: Men’s value is still tightly tethered to traditional expectations to provide financially. Roughly 74 percent of noncollege-educated women say a man being unemployed would make them less interested in him, and 89 percent of college-educated women say employment status influences their level of romantic interest. Seventy-one percent of Americans say the ability to support a family is a critical component of partnership for men, but only 32 percent say the same of women.

Relationship Vulnerability: Men and women face different challenges in the dating market. While women are more likely to be overwhelmed with options, especially those offering only short-term commitments, men often struggle to attract romantic interest of any kind. Men’s employment and occupational status continue to have a much greater significance for their ability to find a partner, creating a relational vulnerability that, in addition to economic insecurity, increasingly defines the lives of noncollege-educated men.

"Women face their own challenges, but financial failure does not imperil their ability to find a partner in the same way it does for men. Once you understand this, so much of male behavior—interest in gambling, cryptocurrency, and self-improvement regimens—starts to make more sense.”

—Daniel A. Cox ([link removed] )

More on Dating

([link removed] )

3. The Impact of Low Interest Rates

03 Lachman-2 ([link removed] )

Topline: Since taking office in January, President Trump has pushed for the Federal Reserve to cut interest rates aggressively. AEI’s Desmond Lachman makes the case ([link removed] ) that a more dovish Fed may exacerbate Trump’s affordability issues by leading to higher, rather than lower, economic indicators like mortgage and auto-borrowing rates.

The Wrong Economic Number: The 10-year Treasury bond yield, rather than the Fed’s interest rate, determines mortgage, auto-lending, and other key borrowing rates that are crucial to voters. The Fed has been lowering rates gradually since August 2024, but the 10-year Treasury bond rate has risen by half a percentage point over that same period. Consequentially, the 15- and 30-year mortgage rates have remained around 6 percent.

Fighting for Affordability: If market actors expect inflation to rise, investors will demand a higher return on their long-term lending to the US government to compensate for the inflation risk. To combat high interest rates facing households, President Trump should refrain from threatening the Fed’s independence and make every effort to strengthen the country’s public finances by enhancing tax revenue collections and lowering public spending.

"Before proceeding further along these lines, Trump should be very careful about what he wishes. With a more dovish Fed in place to reduce interest rates, he might end up with higher, rather than lower, economic indicators such as mortgage and auto-borrowing rates. That could put the brakes on the economy and aggravate Trump’s affordability problem by making consumer borrowing more expensive.”

—Desmond Lachman ([link removed] )

More on US Interest Rates

([link removed] )

Dive into More Data

04 Blumenthal ([link removed] )

America's $162 Trillion China Problem ([link removed] )

More on China

([link removed] )

05 Kosar ([link removed] )

House Republicans Push for Productivity ([link removed] )

More on Congress

([link removed] )

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today ([link removed] ) .

Email us (mailto:[email protected]) with data questions or ideas.

Ensure delivery ([link removed] ) | Subscribe ([link removed] )

American Enterprise Institute for Public Policy Research

Robert Doar, President

1789 Massachusetts Ave. NW, Washington, DC 20036

202.862.5800 | www.aei.org ([link removed] )

Unsubscribe from the link below ([link removed] )

Facebook ([link removed] )

X ([link removed] )

LinkedIn ([link removed] )

YouTube ([link removed] )

Instagram ([link removed] )

Podcast Logo New_Gray ([link removed] )

Donate to AEI ([link removed] ) in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] | Manage preferences or Unsubscribe ([link removed] )

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- HubSpot