|

|

|

|

Welcome to The Disclosure Digest, our weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

Federal judge strikes down rule exempting some 501(c) nonprofits from disclosure requirements

On July 30, a U.S. district court judge struck down a federal revenue procedure that had exempted select 501(c) nonprofit entities from disclosing the names and addresses of their donors to the Internal Revenue Service. Judge Brian Morris, appointed to the bench by President Barack Obama (D), found that the IRS failed to follow proper procedures when it made the rule change.

What was at issue?

On July 16, 2018, the IRS issued Revenue Procedure 2018-38, which exempted 501(c) nonprofit entities from reporting the names and addresses of their contributors to the agency. The rule change did not apply to 501(c)(3) organizations.

Who were the parties to the suit?

The plaintiffs were Montana Gov. Stephen Bullock (D), a 2020 presidential candidate, and the Montana Department of Revenue. The state of New Jersey later joined the suit. The defendants were the Internal Revenue Service, Acting IRS Commissioner David Kautter, and the Treasury Department.

How did the court rule?

In striking down Revenue Procedure 2018-38, Judge Morris said he was not ruling on the procedure’s merits. Instead, he was assessing the validity of the process used to enact it:

|

“

|

Plaintiffs ask simply for the opportunity to submit written data and opposing views or arguments, as required by the APA’s public notice-and-comment process, before it changes the long-established reporting requirements. A proper notice-and-comment procedure will provide the IRS with the opportunity to review and consider information submitted by the public and interested parties. Then, and only then, may the IRS act on a fully-informed basis when making potentially significant changes to federal

tax law.

|

”

|

What were the arguments?

- In a court filing, attorneys for the plaintiffs said,

|

“

|

Reduced transparency for 501(c) organizations at the federal level has significant downstream effects. In the context of elections and election spending, reduced transparency at the IRS upends settled expectations that federal tax-exempt organizations are what they purport to be: domestically-funded social welfare groups validly participating in elections, for example.

|

”

|

- Before oral arguments, Justice Department attorneys for the defendants said,

|

“

|

Neither state has ever before sought or received from the IRS the information they are now trying to force the IRS to continue collecting, and both states lack the ability to obtain this information from the IRS even if it was collected. In issuing Revenue Procedure 2018-38, the IRS exercised its longstanding statutory discretion to determine what information it collects from exempt organizations to meet its tax administration needs.

|

”

|

What comes next?

The federal government has not indicated whether it intends to appeal the decision. The case name and number are Bullock v. Internal Revenue Service, 4:18-cv-00103-BMM.

|

What we're reading

- CNN, "Uproar over Trump donations sparks fresh debate about disclosure," August 10, 2019

- Governing, "Coming to Oregon Elections: Free Mail Ballots and More Donor Disclosure," August 6, 2019

- Associations Now, "Court ruling on donor disclosure rule creates confusion for nonprofits," August 5, 2019

- Bloomberg Tax, "IRS Could Face More Court Battles After Nonprofit Donor Ruling," July 31, 2019

|

The big picture

Number of relevant bills by state

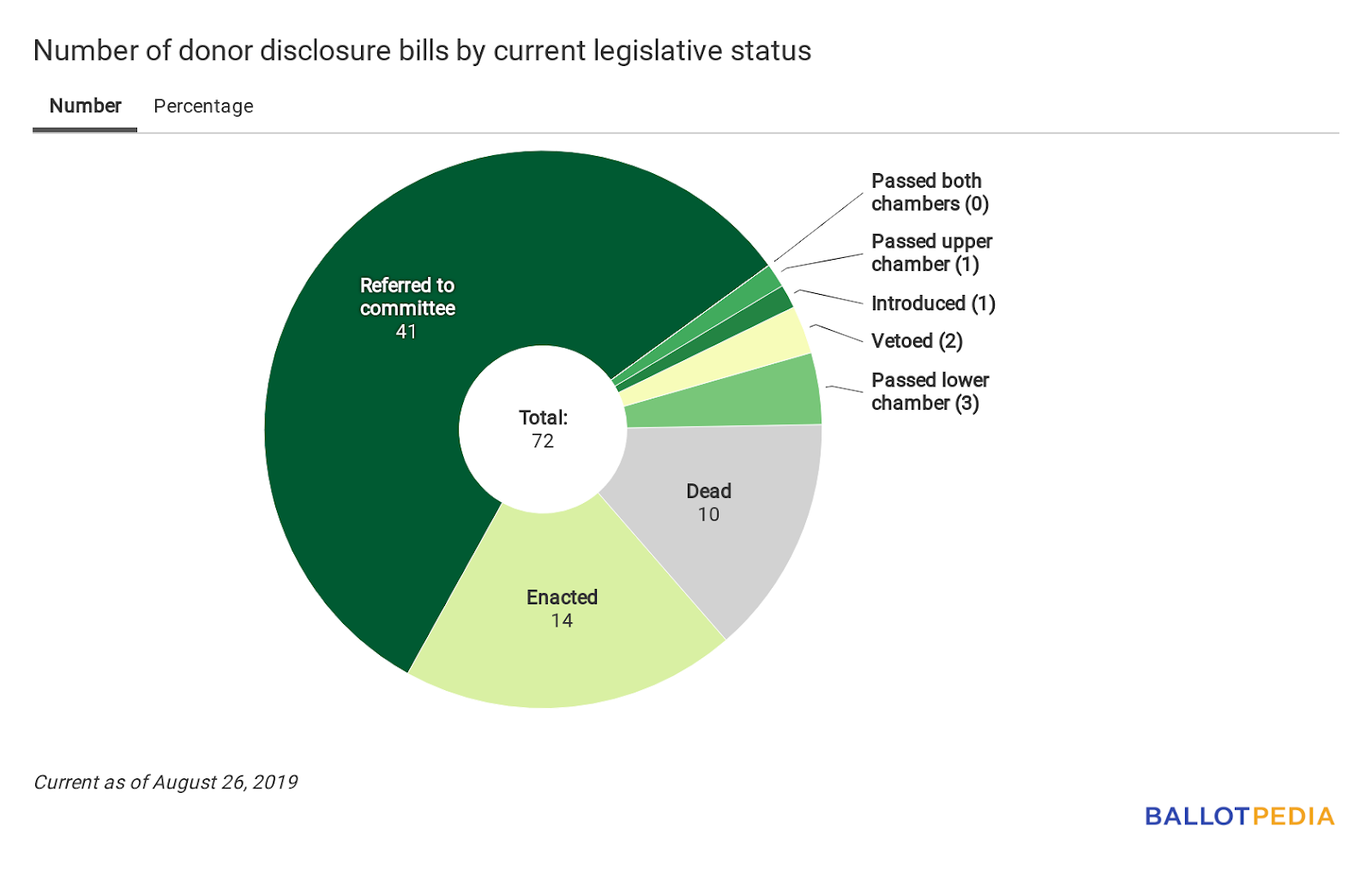

We're currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we're tracking.

Number of relevant bills by current legislative status

Number of relevant bills by partisan status of sponsor(s)

|

Recent legislative actions

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we're missing? Please email us so we can include it on our tracking list.

- California AB1217: This bill would expand the definition of "advertisement" under the state's campaign finance laws, thereby extending existing disclosure requirements.

- Senate Elections and Constitutional Amendments Committee hearing August 20.

- California AB864: This bill would expand disclosure requirements for certain kinds of political advertisements made by independent expenditure groups and other entities.

- Ordered to third reading in the Senate August 13.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations. |

|

|

|

|