| From | Gov. DeWine Comms <[email protected]> |

| Subject | Governor DeWine Announces Historic Preservation Projects |

| Date | December 17, 2025 6:40 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Governor, Lt. Governor, Development Logos

*FOR IMMEDIATE RELEASE:*

December 17, 2025

*MEDIA CONTACTS:

*Dan Tierney: 614-644-0957

Jill Del Greco: 614-644-0957

Governor DeWine Announces

Historic Preservation Projects

(COLUMBUS, Ohio)— Ohio Governor Mike DeWine, Lt. Governor Jim Tressel, and Ohio Department of Development Director Lydia Mihalik today announced state support for dozens of historic restoration projects that will encourage continued economic growth in Ohio.

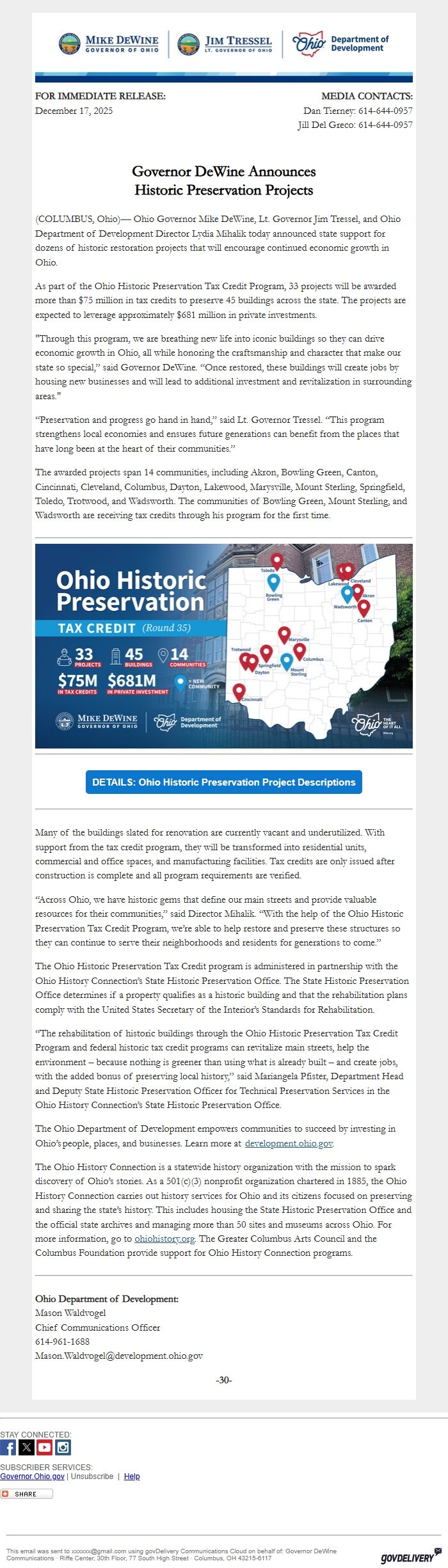

As part of the Ohio Historic Preservation Tax Credit Program, 33 projects will be awarded more than $75 million in tax credits to preserve 45 buildings across the state. The projects are expected to leverage approximately $681 million in private investments.

"Through this program, we are breathing new life into iconic buildings so they can drive economic growth in Ohio, all while honoring the craftsmanship and character that make our state so special,” said Governor DeWine. “Once restored, these buildings will create jobs by housing new businesses and will lead to additional investment and revitalization in surrounding areas."

“Preservation and progress go hand in hand,” said Lt. Governor Tressel. “This program strengthens local economies and ensures future generations can benefit from the places that have long been at the heart of their communities.”

The awarded projects span 14 communities, including Akron, Bowling Green, Canton, Cincinnati, Cleveland, Columbus, Dayton, Lakewood, Marysville, Mount Sterling, Springfield, Toledo, Trotwood, and Wadsworth. The communities of Bowling Green, Mount Sterling, and Wadsworth are receiving tax credits through his program for the first time.

________________________________________________________________________

Map of communities receiving awards [ [link removed] ]

________________________________________________________________________

*DETAILS: Ohio Historic Preservation Project Descriptions* [ [link removed] ]

________________________________________________________________________

Many of the buildings slated for renovation are currently vacant and underutilized. With support from the tax credit program, they will be transformed into residential units, commercial and office spaces, and manufacturing facilities. Tax credits are only issued after construction is complete and all program requirements are verified.

“Across Ohio, we have historic gems that define our main streets and provide valuable resources for their communities,” said Director Mihalik. “With the help of the Ohio Historic Preservation Tax Credit Program, we’re able to help restore and preserve these structures so they can continue to serve their neighborhoods and residents for generations to come.”

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection’s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior’s Standards for Rehabilitation.

“The rehabilitation of historic buildings through the Ohio Historic Preservation Tax Credit Program and federal historic tax credit programs can revitalize main streets, help the environment – because nothing is greener than using what is already built – and create jobs, with the added bonus of preserving local history,” said Mariangela Pfister, Department Head and Deputy State Historic Preservation Officer for Technical Preservation Services in the Ohio History Connection’s State Historic Preservation Office.

The Ohio Department of Development empowers communities to succeed by investing in Ohio’s people, places, and businesses. Learn more at development.ohio.gov [ [link removed] ].

The Ohio History Connection is a statewide history organization with the mission to spark discovery of Ohio’s stories. As a 501(c)(3) nonprofit organization chartered in 1885, the Ohio History Connection carries out history services for Ohio and its citizens focused on preserving and sharing the state’s history. This includes housing the State Historic Preservation Office and the official state archives and managing more than 50 sites and museums across Ohio. For more information, go to ohiohistory.org [ [link removed] ]. The Greater Columbus Arts Council and the Columbus Foundation provide support for Ohio History Connection programs.

________________________________________________________________________

*Ohio Department of Development:

*Mason Waldvogel

Chief Communications Officer

614-961-1688

[email protected]

*-30-*

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Visit us on YouTube [ [link removed] ] Visit us on Instagram [ [link removed] ]

SUBSCRIBER SERVICES:

Governor.Ohio.gov [ [link removed] ] | Unsubscribe [ [link removed] ] | Help [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using govDelivery Communications Cloud on behalf of: Governor DeWine Communications · Riffe Center, 30th Floor, 77 South High Street · Columbus, OH 43215-6117 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;} table.govd_hr {min-width: 100%;} p, li, h1, h2, h3 { overflow-wrap: normal; word-wrap: normal; word-break: keep-all; -moz-hyphens: none; -ms-hyphens: none; -webkit-hyphens: none; hyphens: none; mso-hyphenate: none; }

*FOR IMMEDIATE RELEASE:*

December 17, 2025

*MEDIA CONTACTS:

*Dan Tierney: 614-644-0957

Jill Del Greco: 614-644-0957

Governor DeWine Announces

Historic Preservation Projects

(COLUMBUS, Ohio)— Ohio Governor Mike DeWine, Lt. Governor Jim Tressel, and Ohio Department of Development Director Lydia Mihalik today announced state support for dozens of historic restoration projects that will encourage continued economic growth in Ohio.

As part of the Ohio Historic Preservation Tax Credit Program, 33 projects will be awarded more than $75 million in tax credits to preserve 45 buildings across the state. The projects are expected to leverage approximately $681 million in private investments.

"Through this program, we are breathing new life into iconic buildings so they can drive economic growth in Ohio, all while honoring the craftsmanship and character that make our state so special,” said Governor DeWine. “Once restored, these buildings will create jobs by housing new businesses and will lead to additional investment and revitalization in surrounding areas."

“Preservation and progress go hand in hand,” said Lt. Governor Tressel. “This program strengthens local economies and ensures future generations can benefit from the places that have long been at the heart of their communities.”

The awarded projects span 14 communities, including Akron, Bowling Green, Canton, Cincinnati, Cleveland, Columbus, Dayton, Lakewood, Marysville, Mount Sterling, Springfield, Toledo, Trotwood, and Wadsworth. The communities of Bowling Green, Mount Sterling, and Wadsworth are receiving tax credits through his program for the first time.

________________________________________________________________________

Map of communities receiving awards [ [link removed] ]

________________________________________________________________________

*DETAILS: Ohio Historic Preservation Project Descriptions* [ [link removed] ]

________________________________________________________________________

Many of the buildings slated for renovation are currently vacant and underutilized. With support from the tax credit program, they will be transformed into residential units, commercial and office spaces, and manufacturing facilities. Tax credits are only issued after construction is complete and all program requirements are verified.

“Across Ohio, we have historic gems that define our main streets and provide valuable resources for their communities,” said Director Mihalik. “With the help of the Ohio Historic Preservation Tax Credit Program, we’re able to help restore and preserve these structures so they can continue to serve their neighborhoods and residents for generations to come.”

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection’s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior’s Standards for Rehabilitation.

“The rehabilitation of historic buildings through the Ohio Historic Preservation Tax Credit Program and federal historic tax credit programs can revitalize main streets, help the environment – because nothing is greener than using what is already built – and create jobs, with the added bonus of preserving local history,” said Mariangela Pfister, Department Head and Deputy State Historic Preservation Officer for Technical Preservation Services in the Ohio History Connection’s State Historic Preservation Office.

The Ohio Department of Development empowers communities to succeed by investing in Ohio’s people, places, and businesses. Learn more at development.ohio.gov [ [link removed] ].

The Ohio History Connection is a statewide history organization with the mission to spark discovery of Ohio’s stories. As a 501(c)(3) nonprofit organization chartered in 1885, the Ohio History Connection carries out history services for Ohio and its citizens focused on preserving and sharing the state’s history. This includes housing the State Historic Preservation Office and the official state archives and managing more than 50 sites and museums across Ohio. For more information, go to ohiohistory.org [ [link removed] ]. The Greater Columbus Arts Council and the Columbus Foundation provide support for Ohio History Connection programs.

________________________________________________________________________

*Ohio Department of Development:

*Mason Waldvogel

Chief Communications Officer

614-961-1688

[email protected]

*-30-*

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] Visit us on YouTube [ [link removed] ] Visit us on Instagram [ [link removed] ]

SUBSCRIBER SERVICES:

Governor.Ohio.gov [ [link removed] ] | Unsubscribe [ [link removed] ] | Help [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using govDelivery Communications Cloud on behalf of: Governor DeWine Communications · Riffe Center, 30th Floor, 77 South High Street · Columbus, OH 43215-6117 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;} table.govd_hr {min-width: 100%;} p, li, h1, h2, h3 { overflow-wrap: normal; word-wrap: normal; word-break: keep-all; -moz-hyphens: none; -ms-hyphens: none; -webkit-hyphens: none; hyphens: none; mso-hyphenate: none; }

Message Analysis

- Sender: Office of the Ohio Governor

- Political Party: n/a

- Country: United States

- State/Locality: Ohio

- Office: n/a

-

Email Providers:

- govDelivery