| From | American Energy Alliance <[email protected]> |

| Subject | Heating up |

| Date | December 16, 2025 4:35 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 12/16/2025

Subscribe Now ([link removed])

** American smelting for American minerals powered by American energy.

------------------------------------------------------------

Wall Street Journal ([link removed]) (12/15/25) reports: "Korea Zinc the world’s largest zinc smelter, plans to build a $7.43 billion U.S. plant to produce key metals and minerals, under a joint venture aimed at strengthening supply-chain ties between Seoul and Washington. The move comes as the U.S. and South Korea have been seeking a stable and independent supply of rare earths amid concerns that China, which dominates the critical minerals market, could restrict or cut off their supplies. The South Korean company said in a regulatory filing Monday that construction of the smelter will begin in 2027, with completion scheduled for the end of 2029...The U.S. facilities could develop into a complex smelter also producing antimony, germanium, gallium and other strategic minerals, the company said. 'As the global trend toward weaponizing resources intensifies…this project is

expected to strengthen South Korea-U.S. economic and security cooperation while making a significant contribution to diversifying global supply chains,' Korea Zinc said in a statement."

[link removed]

** "Many [Blue states] don’t just have clean energy and renewable energy mandates, but electrification and greenhouse gas (GHG) emissions reduction mandates across entire sectors of their economy, as well—and many of the utilities we noted last week cited investments for these initiatives, too."

------------------------------------------------------------

– Mitch Rolling and Isaac Orr, Energy Bad Boys Substack ([link removed])

============================================================

Phew.

** Wall Street Journal ([link removed])

(5/1/25) reports: "Ford Motor said Monday it expected to take about $19.5 billion in charges, mainly tied to its electric-vehicle business, a massive hit as the automaker retrenches in the face of sinking EV demand. The sum is among the largest impairments taken by a company and marks the U.S. auto industry’s biggest reckoning to date that it can’t realize its electric-vehicle ambitions anytime soon. Ford, which has lost $13 billion on its EV business since 2023, said it would bolster its lineup of gas-powered vehicles while shifting to hybrid and so-called extended-range electric vehicles that include onboard gasoline engines. The goal is to pull back from loss-making assets and redeploy capital designated for EVs to models with higher profitability...The company’s pivot from all-electric vehicles is a fresh sign that America’s roadways— after a push to remake them—will continue to look in the near future much like they do today with a large number of gas-powered cars and trucks and

growing use of hybrids. The Biden administration, in particular, sought to prod the auto industry into a full and rapid embrace of EVs, but they faced resistance from many Republicans. This year, the Trump administration did away with some of the strictest clean-air and fuel economy mandates. Many consumers, meantime, stayed away from EVs because of high sticker prices, worries over battery range and access to charging stations."

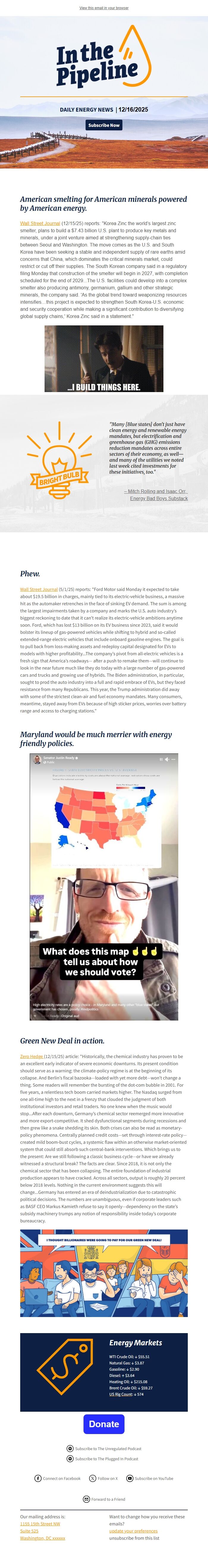

Maryland would be much merrier with energy friendly policies.

** ([link removed])

Green New Deal in action.

** Zero Hedge ([link removed])

(12/15/25) article: "Historically, the chemical industry has proven to be an excellent early indicator of severe economic downturns. Its present condition should serve as a warning: the climate-policy regime is at the beginning of its collapse. And Berlin’s fiscal bazooka—loaded with yet more debt—won’t change a thing. Some readers will remember the bursting of the dot-com bubble in 2001. For five years, a relentless tech boom carried markets higher. The Nasdaq surged from one all-time high to the next in a frenzy that clouded the judgment of both institutional investors and retail traders. No one knew when the music would stop...After each downturn, Germany’s chemical sector reemerged more innovative and more export-competitive. It shed dysfunctional segments during recessions and then grew like a snake shedding its skin. Both crises can also be read as monetary-policy phenomena. Centrally planned credit costs—set through interest-rate policy—created mild boom-bust cycles, a systemic flaw

within an otherwise market-oriented system that could still absorb such central-bank interventions. Which brings us to the present: Are we still following a classic business cycle—or have we already witnessed a structural break? The facts are clear. Since 2018, it is not only the chemical sector that has been collapsing. The entire foundation of industrial production appears to have cracked. Across all sectors, output is roughly 20 percent below 2018 levels. Nothing in the current environment suggests this will change...Germany has entered an era of deindustrialization due to catastrophic political decisions. The numbers are unambiguous, even if corporate leaders such as BASF CEO Markus Kamieth refuse to say it openly—dependency on the state’s subsidy machinery trumps any notion of responsibility inside today’s corporate bureaucracy.

Energy Markets

WTI Crude Oil: ↓ $55.51

Natural Gas: ↓ $3.87

Gasoline: ↓ $2.90

Diesel: ↑ $3.64

Heating Oil: ↓ $215.08

Brent Crude Oil: ↓ $59.27

** US Rig Count ([link removed])

: ↓ 574

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect on Facebook ([link removed])

** Connect on Facebook ([link removed])

** Follow on X ([link removed])

** Follow on X ([link removed])

** Subscribe on YouTube ([link removed])

** Subscribe on YouTube ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

DAILY ENERGY NEWS | 12/16/2025

Subscribe Now ([link removed])

** American smelting for American minerals powered by American energy.

------------------------------------------------------------

Wall Street Journal ([link removed]) (12/15/25) reports: "Korea Zinc the world’s largest zinc smelter, plans to build a $7.43 billion U.S. plant to produce key metals and minerals, under a joint venture aimed at strengthening supply-chain ties between Seoul and Washington. The move comes as the U.S. and South Korea have been seeking a stable and independent supply of rare earths amid concerns that China, which dominates the critical minerals market, could restrict or cut off their supplies. The South Korean company said in a regulatory filing Monday that construction of the smelter will begin in 2027, with completion scheduled for the end of 2029...The U.S. facilities could develop into a complex smelter also producing antimony, germanium, gallium and other strategic minerals, the company said. 'As the global trend toward weaponizing resources intensifies…this project is

expected to strengthen South Korea-U.S. economic and security cooperation while making a significant contribution to diversifying global supply chains,' Korea Zinc said in a statement."

[link removed]

** "Many [Blue states] don’t just have clean energy and renewable energy mandates, but electrification and greenhouse gas (GHG) emissions reduction mandates across entire sectors of their economy, as well—and many of the utilities we noted last week cited investments for these initiatives, too."

------------------------------------------------------------

– Mitch Rolling and Isaac Orr, Energy Bad Boys Substack ([link removed])

============================================================

Phew.

** Wall Street Journal ([link removed])

(5/1/25) reports: "Ford Motor said Monday it expected to take about $19.5 billion in charges, mainly tied to its electric-vehicle business, a massive hit as the automaker retrenches in the face of sinking EV demand. The sum is among the largest impairments taken by a company and marks the U.S. auto industry’s biggest reckoning to date that it can’t realize its electric-vehicle ambitions anytime soon. Ford, which has lost $13 billion on its EV business since 2023, said it would bolster its lineup of gas-powered vehicles while shifting to hybrid and so-called extended-range electric vehicles that include onboard gasoline engines. The goal is to pull back from loss-making assets and redeploy capital designated for EVs to models with higher profitability...The company’s pivot from all-electric vehicles is a fresh sign that America’s roadways— after a push to remake them—will continue to look in the near future much like they do today with a large number of gas-powered cars and trucks and

growing use of hybrids. The Biden administration, in particular, sought to prod the auto industry into a full and rapid embrace of EVs, but they faced resistance from many Republicans. This year, the Trump administration did away with some of the strictest clean-air and fuel economy mandates. Many consumers, meantime, stayed away from EVs because of high sticker prices, worries over battery range and access to charging stations."

Maryland would be much merrier with energy friendly policies.

** ([link removed])

Green New Deal in action.

** Zero Hedge ([link removed])

(12/15/25) article: "Historically, the chemical industry has proven to be an excellent early indicator of severe economic downturns. Its present condition should serve as a warning: the climate-policy regime is at the beginning of its collapse. And Berlin’s fiscal bazooka—loaded with yet more debt—won’t change a thing. Some readers will remember the bursting of the dot-com bubble in 2001. For five years, a relentless tech boom carried markets higher. The Nasdaq surged from one all-time high to the next in a frenzy that clouded the judgment of both institutional investors and retail traders. No one knew when the music would stop...After each downturn, Germany’s chemical sector reemerged more innovative and more export-competitive. It shed dysfunctional segments during recessions and then grew like a snake shedding its skin. Both crises can also be read as monetary-policy phenomena. Centrally planned credit costs—set through interest-rate policy—created mild boom-bust cycles, a systemic flaw

within an otherwise market-oriented system that could still absorb such central-bank interventions. Which brings us to the present: Are we still following a classic business cycle—or have we already witnessed a structural break? The facts are clear. Since 2018, it is not only the chemical sector that has been collapsing. The entire foundation of industrial production appears to have cracked. Across all sectors, output is roughly 20 percent below 2018 levels. Nothing in the current environment suggests this will change...Germany has entered an era of deindustrialization due to catastrophic political decisions. The numbers are unambiguous, even if corporate leaders such as BASF CEO Markus Kamieth refuse to say it openly—dependency on the state’s subsidy machinery trumps any notion of responsibility inside today’s corporate bureaucracy.

Energy Markets

WTI Crude Oil: ↓ $55.51

Natural Gas: ↓ $3.87

Gasoline: ↓ $2.90

Diesel: ↑ $3.64

Heating Oil: ↓ $215.08

Brent Crude Oil: ↓ $59.27

** US Rig Count ([link removed])

: ↓ 574

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect on Facebook ([link removed])

** Connect on Facebook ([link removed])

** Follow on X ([link removed])

** Follow on X ([link removed])

** Subscribe on YouTube ([link removed])

** Subscribe on YouTube ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp