|

|

|

|

|

|

|

Money Metals News Alert

|

December 15, 2025

– The Fed's latest rate cut last Wednesday has fueled renewed strength

across the entire precious metals complex.

Silver continues to show incredible

upward momentum – pulling back briefly on Friday only to hit $64 once again

this morning. having obliterated its prior $54 high two weeks ago.

|

|

|

Technical analysts have

pointed to the potential for $72 silver in the near to medium term as this price

rerate continues.

Silver was held below $50

for decades and seems intent on catching up after its long-time underperformance

against gold and other commodities.

Gold, meanwhile, could be

making a run for its all-time high of $4,400 reached back in October.

|

|

|

|

At Money Metals, profit-taking by

longtime holders of both metals continues, but first-timers are coming in to

buy all that inventory – and then some.

If the headlines in precious metals

draw in the general public, the overwhelming majority of which don't have a single

ounce of any precious metal, things could get interesting.

Remember that Money Metals is still

giving away free silver for one more week on any silver order of $750+. Also,

don't forget to check out our HOLIDAY

GIFT SHOP and our SPECIALS

PAGE which includes a below spot silver offer!

|

|

|

Gold : Silver Ratio (as of

Friday's closing prices) – 69.4 to

1

|

|

|

|

China Reaffirms Tight Grip on Gold Market,

Ushering in a New Monetary Era

|

|

|

|

|

|

Without a doubt, the Chinese central

bank (PBoC) is still the leading single entity that is driving up the gold price

to record highs, year-to-date by more than 55 percent.

In the third quarter of 2025, the

PBoC???s gold purchases (reported and unreported) accounted for 118 tonnes, up 39%

MoM and 55% YoY, according to my long-time methodology1 (now copied by Goldman

Sachs, Bloomberg,

MarketWatch,

The

Washington Post, TIME

magazine, Financial

Times, Financiele

Dagblad, and El

Pa??s, to name a few).

|

|

|

|

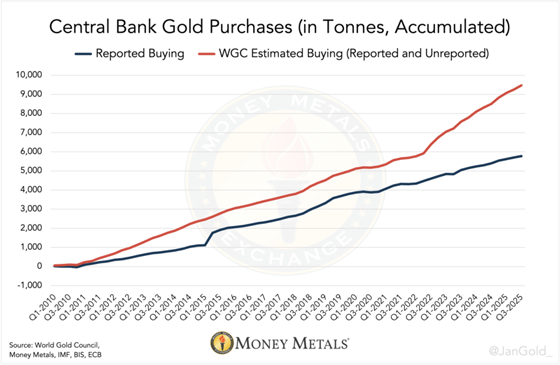

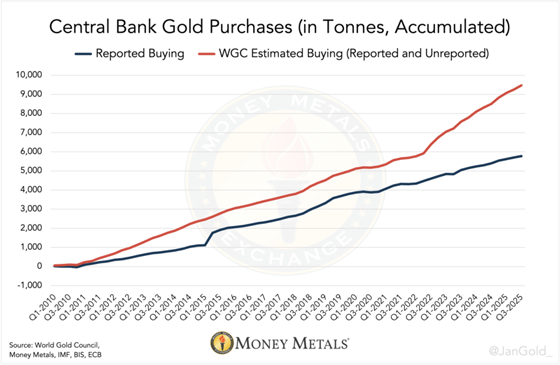

Chart 1. Reported central

bank gold buying versus estimates by the World Gold Council on central bank gold

buying based on field research (reported and unreported buying). The majority of

unreported buying must be ascribed to China.

|

|

|

My estimated total for Chinese

monetary gold reserves stands at 5,411 tonnes in Q3, versus 2,304 tonnes reported

by the central bank of China to the IMF.

Why is China buying so much gold?

It???s because China is the

second-largest economy globally, and due to the weaponization of the dollar since

the Ukraine war in 2022, the vast, covert buying spree by China and countries like

Saudi

Arabia should not be viewed as a hedge against the dollar but as a replacement

for the dollar.

|

|

|

|

The mBridge Gold

Standard

|

|

|

|

For the better part of the past 80

years, the U.S. dollar has functioned as the world???s trade and reserve currency.

This setup gave the United States the exorbitant privilege of being able to print

money to pay for imports, even though America???s manufacturing base has been eroded

as a consequence.

|

|

|

China aims to establish an

alternative to the U.S. dollar while seeking to avoid the risks associated with

issuing its own reserve currency.

On November

19, 2025, the chairman of the Central Bank of the United Arab Emirates

completed a landmark digital currency transaction during a meeting with the

governor of the People???s Bank of China, formally inaugurating project

mBridge.

|

|

|

|

The platform allows participating

countries with established digital currencies to conduct bilateral trade in their

own currencies, bypassing the U.S. dollar.

For the ???mBridge gold standard??? to be

fulfilled, any surplus of local currency accumulated through trade must be

directly exchangeable in a liquid gold market. Furthermore, it requires a new

international gold vaulting and clearinghouse network.

|

|

|

|

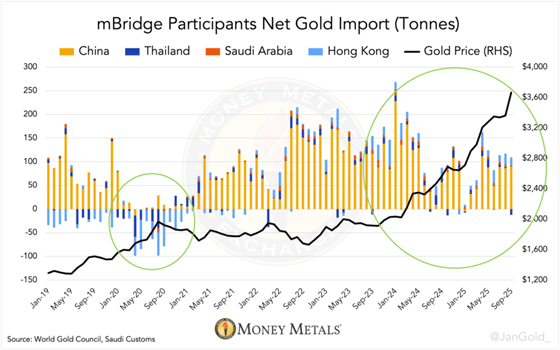

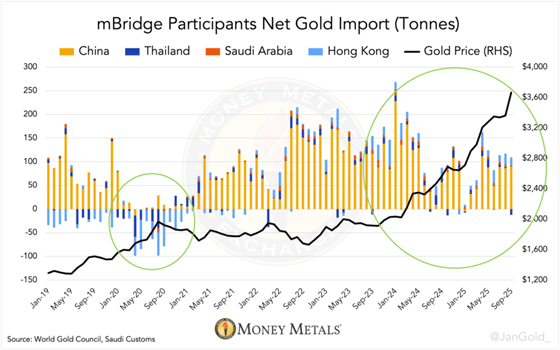

Chart 2. In a historical

shift, Eastern countries that before 2022 were price sensitive are now driving

gold higher.

|

|

|

|

China will be the largest, or one of

the largest, trading partners of countries participating in mBridge, and so the

renminbi will be a dominant trade currency in the arrangement. This is why the

Chinese are developing the Shanghai International Gold Exchange (SGEI).

|

|

|

|

|

|

|

|

|

|

This week's Market Update was

authored by Money Metals Contibuting Writer Jan

Nieuwenhuijs.

|

|

|

|

|

|

|

|

|

|

This copyrighted material may not

be republished without express permission. Offer only available through email

promotion. Offer does not apply to previous orders and may not be combined with

any other offer or program. Special shipping rates or other restrictions may apply

to international orders. The information presented here is for general educational

purposes only. Money Metals Exchange and its staff do not act as personal

investment advisors. Nor do we advocate the purchase or sale of any regulated

security listed on any exchange for any specific individual. While our track

record is excellent, investment markets have inherent risks and there can be no

assurance of future profits. You are responsible for your investment decisions,

and they should be made in consultation with your own advisors. By purchasing from

Money Metals, you understand our company is not responsible for any losses caused

by your investment decisions, nor do we have any claim to any market gains you may

enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by

the CFTC and the SEC.

|

|

|