Email

5 Reasons I’m Not Worried About the Markets

| From | Ross Givens <[email protected]> |

| Subject | 5 Reasons I’m Not Worried About the Markets |

| Date | December 15, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Monday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back.

Although the Fed cut on Friday, we saw a relatively sharp dip in the indexes

on Friday.

Here are 5 reasons why I’m not worried yet.

Chart of the Day

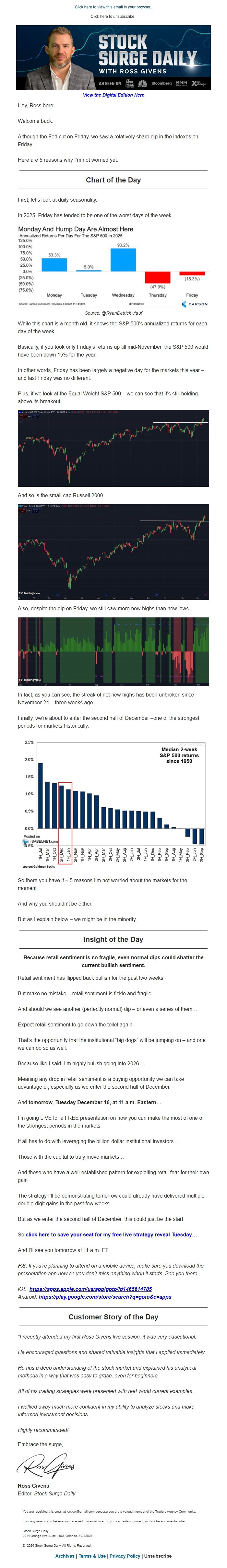

First, let’s look at daily seasonality.

In 2025, Friday has tended to be one of the worst days of the week.

Source: @RyanDetrick via X

While this chart is a month old, it shows the S&P 500’s annualized returns for

each day of the week.

Basically, if you took only Friday’s returns up till mid-November, the S&P 500

would have been down 15% for the year.

In other words, Friday has been largely a negative day for the markets this

year – and last Friday was no different.

Plus, if we look at the Equal Weight S&P 500 – we can see that it’s still

holding above its breakout.

And so is the small-cap Russell 2000.

Also, despite the dip on Friday, we still saw more new highs than new lows.

In fact, as you can see, the streak of net new highs has been unbroken since

November 24 – three weeks ago.

Finally, we’re about to enter the second half of December –one of the

strongest periods for markets historically.

So there you have it – 5 reasons I’m not worried about the markets for the

moment…

And why you shouldn’t be either.

But as I explain below – we might be in the minority.

Insight of the Day

Because retail sentiment is so fragile, even normal dips could shatter the

current bullish sentiment.

Retail sentiment has flipped back bullish for the past two weeks.

But make no mistake – retail sentiment is fickle and fragile.

And should we see another (perfectly normal) dip – or even a series of them…

Expect retail sentiment to go down the toilet again.

That’s the opportunity that the institutional “big dogs” will be jumping on –

and one we can do so as well.

Because like I said, I’m highly bullish going into 2026…

Meaning any drop in retail sentiment is a buying opportunity we can take

advantage of, especially as we enter the second half of December.

And tomorrow, Tuesday December 16, at 11 a.m. Eastern…

I’m going LIVE for a FREE presentation on how you can make the most of one of

the strongest periods in the markets.

It all has to do with leveraging the billion-dollar institutional investors…

Those with the capital to truly move markets…

And those who have a well-established pattern for exploiting retail fear for

their own gain.

The strategy I’ll be demonstrating tomorrow could already have delivered

multiple double-digit gains in the past few weeks…

But as we enter the second half of December, this could just be the start.

So click here to save your seat for my free live strategy reveal Tuesday…

<[link removed]>

And I’ll see you tomorrow at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I recently attended my first Ross Givens live session, it was very

educational.

He encouraged questions and shared valuable insights that I applied

immediately.

He has a deep understanding of the stock market and explained his analytical

methods in a way that was easy to grasp, even for beginners.

All of his trading strategies were presented with real-world current examples.

I walked away much more confident in my ability to analyze stocks and make

informed investment decisions.

Highly recommended!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back.

Although the Fed cut on Friday, we saw a relatively sharp dip in the indexes

on Friday.

Here are 5 reasons why I’m not worried yet.

Chart of the Day

First, let’s look at daily seasonality.

In 2025, Friday has tended to be one of the worst days of the week.

Source: @RyanDetrick via X

While this chart is a month old, it shows the S&P 500’s annualized returns for

each day of the week.

Basically, if you took only Friday’s returns up till mid-November, the S&P 500

would have been down 15% for the year.

In other words, Friday has been largely a negative day for the markets this

year – and last Friday was no different.

Plus, if we look at the Equal Weight S&P 500 – we can see that it’s still

holding above its breakout.

And so is the small-cap Russell 2000.

Also, despite the dip on Friday, we still saw more new highs than new lows.

In fact, as you can see, the streak of net new highs has been unbroken since

November 24 – three weeks ago.

Finally, we’re about to enter the second half of December –one of the

strongest periods for markets historically.

So there you have it – 5 reasons I’m not worried about the markets for the

moment…

And why you shouldn’t be either.

But as I explain below – we might be in the minority.

Insight of the Day

Because retail sentiment is so fragile, even normal dips could shatter the

current bullish sentiment.

Retail sentiment has flipped back bullish for the past two weeks.

But make no mistake – retail sentiment is fickle and fragile.

And should we see another (perfectly normal) dip – or even a series of them…

Expect retail sentiment to go down the toilet again.

That’s the opportunity that the institutional “big dogs” will be jumping on –

and one we can do so as well.

Because like I said, I’m highly bullish going into 2026…

Meaning any drop in retail sentiment is a buying opportunity we can take

advantage of, especially as we enter the second half of December.

And tomorrow, Tuesday December 16, at 11 a.m. Eastern…

I’m going LIVE for a FREE presentation on how you can make the most of one of

the strongest periods in the markets.

It all has to do with leveraging the billion-dollar institutional investors…

Those with the capital to truly move markets…

And those who have a well-established pattern for exploiting retail fear for

their own gain.

The strategy I’ll be demonstrating tomorrow could already have delivered

multiple double-digit gains in the past few weeks…

But as we enter the second half of December, this could just be the start.

So click here to save your seat for my free live strategy reveal Tuesday…

<[link removed]>

And I’ll see you tomorrow at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I recently attended my first Ross Givens live session, it was very

educational.

He encouraged questions and shared valuable insights that I applied

immediately.

He has a deep understanding of the stock market and explained his analytical

methods in a way that was easy to grasp, even for beginners.

All of his trading strategies were presented with real-world current examples.

I walked away much more confident in my ability to analyze stocks and make

informed investment decisions.

Highly recommended!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost