|

|

Bessent takes an ax to Obama era financial bureaucracy

15 year old agency faces scrutiny for overreach and stifling economic growth.

Hello Capitalists,

Here is everything you should be following today:

Bessent continues his charge through the US regulatory system

Seeks to proactively assess emerging economic threats

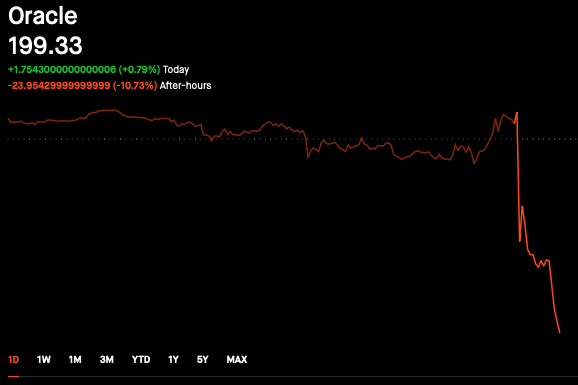

Trader’s jitters over Oracle proved correct as the stock tanks

Fed cuts rates by .25%, Powell warns of only one more in 2026

Pepsi to slash product lines in cost cutting venture after investor pressure

Cracker Barrel’s Woke Hangover continues

Today’s markets + assets:

✅ DOW: 48679.64 (⬆️ 1.29%)

✅ S&P: 6888.42 (⬆️ 0.03%)

🔴 NASDAQ: 23518.77 (⬇️ 0.57%)

⚠️🔴CBOE VIX Volatility Index: 15.30 (⬆️ 2.98%)

✅ Gold: $4307.60 (⬆️ 1.96%)

✅ Silver: $64.38 (⬆️ 5.52%)

🔴 Bitcoin: $90,209 (⬇️ 0.29%)

The Capitalist is a reader-supported publication Reject Corporate Left-Wing Journalism

Bessent leads the charge to reform Obama era financial oversight council

Treasury Secretary Scott Bessent is poised to upend the Financial Stability Oversight Council, proposing a dramatic pivot from 2008 crisis-era crackdowns to deregulation that could unleash economic growth in a letter unveiled Thursday.

Bessent Chairs Deregulation Drive: As FSOC head, Bessent’s letter urges members to probe if U.S. rules stifle growth and erode stability, flipping the council’s traditional enforcement role.

Post-Crisis Body Targeted: Established in 2010 amid 2008 meltdown fallout, FSOC monitored Wall Street risks to avert repeats; now, it faces scrutiny for overreach and stifling economic growth.

AI Resilience Task Force: The proposal launches a working group to harness AI for bolstering financial durability while also scanning emerging tech for unforeseen hazards.

Trump Agenda Alignment: The initiative echoes the Trump administration’s pro-business rollback, diverging sharply from prior emphasis on intensified oversight of big banks under Presidents Obama and Biden.

Ifrah Law heightens the success of iGaming clients through every phase of their business cycle

Led by a managing partner who has been at the center of every significant court case affecting online gaming, Ifrah Law operates at the cutting edge of technology, innovation, and regulation.

Its lawyers represent industry players throughout the entire business cycle, from the formation of a corporation or licensing relationship, through marketing, partnering, growth, and disputes, to profitable exits.

We’re proud to share that all partners at Ifrah Law have been ranked by Chambers and Partners, the gold standard for evaluating legal excellence worldwide.

Oracle’s debt load crushes earnings, shares tank as AI panic spreads

Oracle shares cratered 15% Thursday after earnings revealed a $16.06 billion revenue shortfall and $10 billion negative free cash flow, igniting fears over massive AI infrastructure debt and rippling panic through Nvidia, AMD, and CoreWeave stocks amid a volatile Silicon Valley sell-off.

Concerning Trend Continues: Including the 15% crash yesterday Oracle’s share price has now fallen by more than 41% in the last three months. From a high of $330 on September 11th to as low as $186 today.

Earnings Miss Sparks Turmoil: Oracle’s Q2 revenue hit $16.06 billion, undercutting $16.21 billion forecasts, as aggressive AI data center expansions fueled investor doubts on sustainability.

Debt Avalanche Alarms Wall Street: The company plans $20-30 billion in annual borrowing through 2028, including a record $18 billion September bond sale, alongside a $50 billion fiscal 2025 capex surge.

Sector-Wide Sell-Off Ensues: Nvidia dropped over 2%, AMD 3%, CoreWeave 5%, and Micron 1%, amplifying scrutiny on AI bubble debt risks despite robust demand signals.

Analysts Spot Buying Chance: Wedbush calls the dip a “clear opportunity,” citing healthy AI backlog; as Oracle eyes chip leasing and customer-supplied hardware to ease debt pressures.

Fed cuts again but warns that the pace of cuts may slow down

In a divided 10-3 vote, the Federal Reserve cut its benchmark interest rate by a quarter-point Wednesday marking the third reduction this year amid cooling inflation, but signaled a cautious slowdown with just one more cut eyed for 2026.

Third Consecutive Cut Approved: The Federal Open Market Committee lowers federal funds rate to 3.5%-3.75% on December 10, 2025, in a split decision with three dissents for deeper or no action.

Internal Divisions Exposed: Dissenters include Governor Stephen Miran pushing for half-point slash and regional presidents favoring pause, highlighting policy rifts amid funding market pressures.

Projections Signal Restraint: The Fed’s “Dot Plot” forecasts a single 2026 rate cut and one in 2027, with GDP growth upgraded to 2.3% but inflation lingering above 2% target until 2028.

Markets Rally Cautiously: Stocks surged with Dow gaining 500 points post-announcement, while Treasury yields dip. The Fed will also resume $40 billion Treasury bill buys to ease liquidity strains.

Pepsi to axe hundreds of snacks and slashes prices after investor pressure

In a bold capitulation to activist investor Elliott Management’s pressure - after they took a $4 billion stake, PepsiCo announced Tuesday it will slash nearly 20% of its U.S. product lineup—hundreds of snack and beverage SKUs—by early 2026 while closing plants and cutting prices to revive lagging sales against rival Coca-Cola.

Activist Stake Ignites Overhaul: Elliott’s September $4 billion investment prompted a scathing letter demanding cost cuts, outsourcing of bottling, and divestitures to counter PepsiCo’s decade-low valuations and sales slump.

Factories Shuttered for Savings: Three U.S. plants face closure and select production lines face cancellation in 2025, targeting productivity gains and at least a 1% annual profit margin boosts over three years.

Healthier Launches Prioritized: New products emphasizing no artificial colors, higher protein, fiber, and whole grains aim to align with consumer trends, boosting mainstream brand frequency amid affordability drives.

Growth Rebound Forecasted: Executives project 2-4% core sales acceleration in late 2026, fueled by streamlined operations and reinvested capital, with Elliott praising the “urgent” collaborative pivot.

Cracker Barrel’s Woke hangover is going to take a long time to recover from

Cracker Barrel’s reckless rebrand, meant to modernize its folksy image which instead sparked a nationwide backlash and forced a hasty reversal, is still haunting the company, with CEO Julie Masino warning Tuesday that the chain’s recovery from plunging sales and traffic will demand patience amid lingering consumer distrust.

Sales Plunge Drastically: First-quarter revenue dropped 5.7% year-over-year, with traffic declining 1% early August and 9% later from the botched overhaul, is exacerbating financial strain

EBITDA Takes Major Hit: Adjusted earnings before interest, taxes, depreciation, and amortization fell to $7.2 million from $45.8 million last year, partly due to $14 million in unexpected marketing and conference costs.

CEO Voices Deep Remorse: Masino admitted the rebrand “missed the mark” on guest comfort goals, and to feeling “fired by America” over the uproar, while vowing to rebuild trust through targeted apologies.

Strategic Shifts Accelerate: The company now prioritizes menu tweaks, back-of-house efficiencies, and leadership changes to cut costs and stabilize operations, aiming for fiscal 2025 trajectory despite macro challenges.

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.