Email

What to Expect After the Fed Cut

| From | Ross Givens <[email protected]> |

| Subject | What to Expect After the Fed Cut |

| Date | December 11, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Thursday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

As expected, the Fed just cut rates again yesterday.

Before the cut, indexes were within spitting distance of all-time highs.

So today, let’s see how that has tended to play out in the past.

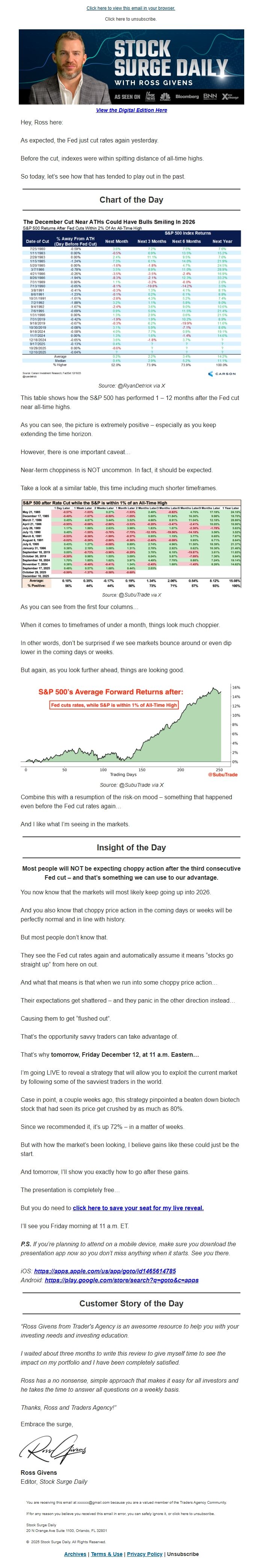

Chart of the Day

Source: @RyanDetrick via X

This table shows how the S&P 500 has performed 1 – 12 months after the Fed cut

near all-time highs.

As you can see, the picture is extremely positive – especially as you keep

extending the time horizon.

However, there is one important caveat…

Near-term choppiness is NOT uncommon. In fact, it should be expected.

Take a look at a similar table, this time including much shorter timeframes.

Source: @SubuTrade via X

As you can see from the first four columns…

When it comes to timeframes of under a month, things look much choppier.

In other words, don’t be surprised if we see markets bounce around or even dip

lower in the coming days or weeks.

But again, as you look further ahead, things are looking good.

Source: @SubuTrade via X

Combine this with a resumption of the risk-on mood – something that happened

even before the Fed cut rates again…

And I like what I’m seeing in the markets.

Insight of the Day

Most people will NOT be expecting choppy action after the third consecutive

Fed cut – and that’s something we can use to our advantage.

You now know that the markets will most likely keep going up into 2026.

And you also know that choppy price action in the coming days or weeks will be

perfectly normal and in line with history.

But most people don’t know that.

They see the Fed cut rates again and automatically assume it means “stocks go

straight up” from here on out.

And what that means is that when we run into some choppy price action…

Their expectations get shattered – and they panic in the other direction

instead…

Causing them to get “flushed out”.

That’s the opportunity savvy traders can take advantage of.

That’s why tomorrow, Friday December 12, at 11 a.m. Eastern…

I’m going LIVE to reveal a strategy that will allow you to exploit the current

market by following some of the savviest traders in the world.

Case in point, a couple weeks ago, this strategy pinpointed a beaten down

biotech stock that had seen its price get crushed by as much as 80%.

Since we recommended it, it’s up 72% – in a matter of weeks.

But with how the market’s been looking, I believe gains like these could just

be the start.

And tomorrow, I’ll show you exactly how to go after these gains.

The presentation is completely free…

But you do need to click here to save your seat for my live reveal.

<[link removed]>

I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross Givens from Trader's Agency is an awesome resource to help you with your

investing needs and investing education.

I waited about three months to write this review to give myself time to see

the impact on my portfolio and I have been completely satisfied.

Ross has a no nonsense, simple approach that makes it easy for all investors

and he takes the time to answer all questions on a weekly basis.

Thanks, Ross and Traders Agency!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

As expected, the Fed just cut rates again yesterday.

Before the cut, indexes were within spitting distance of all-time highs.

So today, let’s see how that has tended to play out in the past.

Chart of the Day

Source: @RyanDetrick via X

This table shows how the S&P 500 has performed 1 – 12 months after the Fed cut

near all-time highs.

As you can see, the picture is extremely positive – especially as you keep

extending the time horizon.

However, there is one important caveat…

Near-term choppiness is NOT uncommon. In fact, it should be expected.

Take a look at a similar table, this time including much shorter timeframes.

Source: @SubuTrade via X

As you can see from the first four columns…

When it comes to timeframes of under a month, things look much choppier.

In other words, don’t be surprised if we see markets bounce around or even dip

lower in the coming days or weeks.

But again, as you look further ahead, things are looking good.

Source: @SubuTrade via X

Combine this with a resumption of the risk-on mood – something that happened

even before the Fed cut rates again…

And I like what I’m seeing in the markets.

Insight of the Day

Most people will NOT be expecting choppy action after the third consecutive

Fed cut – and that’s something we can use to our advantage.

You now know that the markets will most likely keep going up into 2026.

And you also know that choppy price action in the coming days or weeks will be

perfectly normal and in line with history.

But most people don’t know that.

They see the Fed cut rates again and automatically assume it means “stocks go

straight up” from here on out.

And what that means is that when we run into some choppy price action…

Their expectations get shattered – and they panic in the other direction

instead…

Causing them to get “flushed out”.

That’s the opportunity savvy traders can take advantage of.

That’s why tomorrow, Friday December 12, at 11 a.m. Eastern…

I’m going LIVE to reveal a strategy that will allow you to exploit the current

market by following some of the savviest traders in the world.

Case in point, a couple weeks ago, this strategy pinpointed a beaten down

biotech stock that had seen its price get crushed by as much as 80%.

Since we recommended it, it’s up 72% – in a matter of weeks.

But with how the market’s been looking, I believe gains like these could just

be the start.

And tomorrow, I’ll show you exactly how to go after these gains.

The presentation is completely free…

But you do need to click here to save your seat for my live reveal.

<[link removed]>

I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross Givens from Trader's Agency is an awesome resource to help you with your

investing needs and investing education.

I waited about three months to write this review to give myself time to see

the impact on my portfolio and I have been completely satisfied.

Ross has a no nonsense, simple approach that makes it easy for all investors

and he takes the time to answer all questions on a weekly basis.

Thanks, Ross and Traders Agency!”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost