Email

Legislative Update - Standing With Our Immigrant Communities

| From | Rep. Mohamud Noor <[email protected]> |

| Subject | Legislative Update - Standing With Our Immigrant Communities |

| Date | December 10, 2025 9:21 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Rep. Noor

*Dear Neighbors, *

I’d like to start by condemning the hateful and bigoted language from President Trump directed toward our Somali communities [ [link removed] ]. His rhetoric is not only dead wrong, but inflammatory and dangerous. His is a moral failing that we must all call out and condemn. I also condemn the ongoing ICE terror campaign that is a direct assault on our beloved immigrant communities. To be abundantly clear; the actions of ICE are frequently illegal, harmful, and based on manufactured lies about our friends and neighbors. These hateful actions must not be tolerated and we should all fight against it.

In that vein, I’d like to share a toolkit put together by my Senate colleagues [ [link removed] ]. In it you will find numerous tips around knowing your rights, legal assistance, emergency contacts, advocacy and community support, and many extra resources. Please share with your networks.

Paid Family Medical Leave to Launch on January 1, 2026

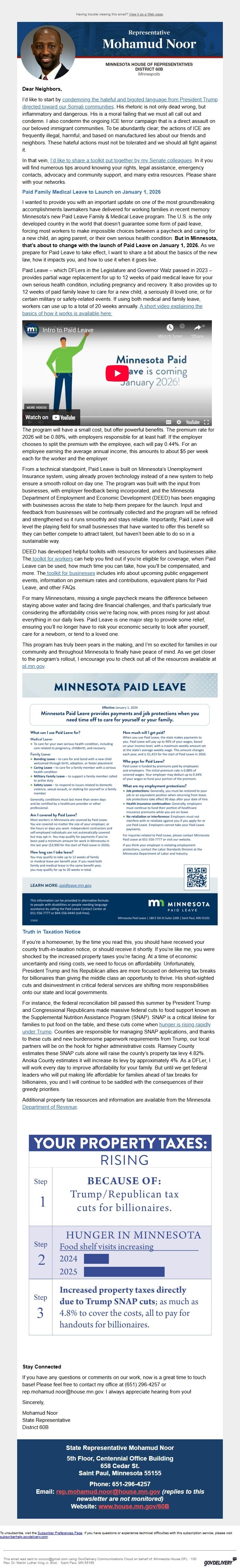

I wanted to provide you with an important update on one of the most groundbreaking accomplishments lawmakers have delivered for working families in recent memory: Minnesota’s new Paid Leave Family & Medical Leave program. The U.S. is the only developed country in the world that doesn’t guarantee some form of paid leave, forcing most workers to make impossible choices between a paycheck and caring for a new child, an aging parent, or their own serious health condition. *But in Minnesota, that’s about to change with the launch of Paid Leave on January 1, 2026. *As we prepare for Paid Leave to take effect, I want to share a bit about the basics of the new law, how it impacts you, and how to use it when it goes live.

Paid Leave – which DFLers in the Legislature and Governor Walz passed in 2023 – provides partial wage replacement for up to 12 weeks of paid medical leave for your own serious health condition, including pregnancy and recovery. It also provides up to 12 weeks of paid family leave to care for a new child, a seriously ill loved one, or for certain military or safety-related events. If using both medical and family leave, workers can use up to a total of 20 weeks annually. A short video explaining the basics of how it works is available here: [ [link removed] ]

[ [link removed] ]

The program will have a small cost, but offer powerful benefits. The premium rate for 2026 will be 0.88%, with employers responsible for at least half. If the employer chooses to split the premium with the employee, each will pay 0.44%. For an employee earning the average annual income, this amounts to about $5 per week each for the worker and the employer.

From a technical standpoint, Paid Leave is built on Minnesota’s Unemployment Insurance system, using already proven technology instead of a new system to help ensure a smooth rollout on day one. The program was built with the input from businesses, with employer feedback being incorporated, and the Minnesota Department of Employment and Economic Development (DEED) has been engaging with businesses across the state to help them prepare for the launch. Input and feedback from businesses will be continually collected and the program will be refined and strengthened so it runs smoothly and stays reliable. Importantly, Paid Leave will level the playing field for small businesses that have wanted to offer this benefit so they can better compete to attract talent, but haven’t been able to do so in a sustainable way.

DEED has developed helpful toolkits with resources for workers and businesses alike. The toolkit for workers [ [link removed] ] can help you find out if you’re eligible for coverage, when Paid Leave can be used, how much time you can take, how you’ll be compensated, and more. The toolkit for businesses [ [link removed] ] includes info about upcoming public engagement events, information on premium rates and contributions, equivalent plans for Paid Leave, and other FAQs.

For many Minnesotans, missing a single paycheck means the difference between staying above water and facing dire financial challenges, and that’s particularly true considering the affordability crisis we’re facing now, with prices rising for just about everything in our daily lives. Paid Leave is one major step to provide some relief, ensuring you’ll no longer have to risk your economic security to look after yourself, care for a newborn, or tend to a loved one.

This program has truly been years in the making, and I’m so excited for families in our community and throughout Minnesota to finally have peace of mind. As we get closer to the program’s rollout, I encourage you to check out all of the resources available at pl.mn.gov [ [link removed] ].

fgsdfsfdgdfsg

Truth in Taxation Notice

If you’re a homeowner, by the time you read this, you should have received your county truth-in-taxation notice, or should receive it shortly. If you’re like me, you were shocked by the increased property taxes you’re facing. At a time of economic uncertainty and rising costs, we need to focus on affordability. Unfortunately, President Trump and his Republican allies are more focused on delivering tax breaks for billionaires than giving the middle class an opportunity to thrive. His short-sighted cuts and disinvestment in critical federal services are shifting more responsibilities onto our state and local governments.

For instance, the federal reconciliation bill passed this summer by President Trump and Congressional Republicans made massive federal cuts to food support known as the Supplemental Nutrition Assistance Program (SNAP). SNAP is a critical lifeline for families to put food on the table, and these cuts come when hunger is rising rapidly under Trump [ [link removed] ]. Counties are responsible for managing SNAP applications, and thanks to these cuts and new burdensome paperwork requirements from Trump, our local partners will be on the hook for higher administrative costs. Ramsey County estimates these SNAP cuts alone will raise the county’s property tax levy 4.82%. Anoka County estimates it will increase its levy by approximately 4%. As a DFLer, I will work every day to improve affordability for your family. But until we get federal leaders who will put making life affordable for families ahead of tax breaks for billionaires, you and I will continue to be saddled with the consequences of their greedy priorities.

Additional property tax resources and information are available from the Minnesota Department of Revenue [ [link removed] ].

tyjymyfn

*Stay Connected*

If you have any questions or comments on our work, now is a great time to touch base! Please feel free to contact my office at (651) 296-4257 or [email protected]. I always appreciate hearing from you!

Sincerely,

Mohamud Noor

State Representative

District 60B

State Representative Mohamud Noor

5th Floor, Centennial Office Building

658 Cedar St.

Saint Paul, Minnesota 55155

Phone: 651-296-4257

Email: [email protected]" (replies to this newsletter are not monitored)"

Website: www.house.mn.gov/60B [ [link removed] ]

To unsubscribe, visit the Subscriber Preferences Page [ [link removed] ]. If you have questions or experience technical difficulties with this subscription service, please visit subscriberhelp.govdelivery.com [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota House DFL · 100 Rev. Dr. Martin Luther King Jr. Blvd. · Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

Rep. Noor

*Dear Neighbors, *

I’d like to start by condemning the hateful and bigoted language from President Trump directed toward our Somali communities [ [link removed] ]. His rhetoric is not only dead wrong, but inflammatory and dangerous. His is a moral failing that we must all call out and condemn. I also condemn the ongoing ICE terror campaign that is a direct assault on our beloved immigrant communities. To be abundantly clear; the actions of ICE are frequently illegal, harmful, and based on manufactured lies about our friends and neighbors. These hateful actions must not be tolerated and we should all fight against it.

In that vein, I’d like to share a toolkit put together by my Senate colleagues [ [link removed] ]. In it you will find numerous tips around knowing your rights, legal assistance, emergency contacts, advocacy and community support, and many extra resources. Please share with your networks.

Paid Family Medical Leave to Launch on January 1, 2026

I wanted to provide you with an important update on one of the most groundbreaking accomplishments lawmakers have delivered for working families in recent memory: Minnesota’s new Paid Leave Family & Medical Leave program. The U.S. is the only developed country in the world that doesn’t guarantee some form of paid leave, forcing most workers to make impossible choices between a paycheck and caring for a new child, an aging parent, or their own serious health condition. *But in Minnesota, that’s about to change with the launch of Paid Leave on January 1, 2026. *As we prepare for Paid Leave to take effect, I want to share a bit about the basics of the new law, how it impacts you, and how to use it when it goes live.

Paid Leave – which DFLers in the Legislature and Governor Walz passed in 2023 – provides partial wage replacement for up to 12 weeks of paid medical leave for your own serious health condition, including pregnancy and recovery. It also provides up to 12 weeks of paid family leave to care for a new child, a seriously ill loved one, or for certain military or safety-related events. If using both medical and family leave, workers can use up to a total of 20 weeks annually. A short video explaining the basics of how it works is available here: [ [link removed] ]

[ [link removed] ]

The program will have a small cost, but offer powerful benefits. The premium rate for 2026 will be 0.88%, with employers responsible for at least half. If the employer chooses to split the premium with the employee, each will pay 0.44%. For an employee earning the average annual income, this amounts to about $5 per week each for the worker and the employer.

From a technical standpoint, Paid Leave is built on Minnesota’s Unemployment Insurance system, using already proven technology instead of a new system to help ensure a smooth rollout on day one. The program was built with the input from businesses, with employer feedback being incorporated, and the Minnesota Department of Employment and Economic Development (DEED) has been engaging with businesses across the state to help them prepare for the launch. Input and feedback from businesses will be continually collected and the program will be refined and strengthened so it runs smoothly and stays reliable. Importantly, Paid Leave will level the playing field for small businesses that have wanted to offer this benefit so they can better compete to attract talent, but haven’t been able to do so in a sustainable way.

DEED has developed helpful toolkits with resources for workers and businesses alike. The toolkit for workers [ [link removed] ] can help you find out if you’re eligible for coverage, when Paid Leave can be used, how much time you can take, how you’ll be compensated, and more. The toolkit for businesses [ [link removed] ] includes info about upcoming public engagement events, information on premium rates and contributions, equivalent plans for Paid Leave, and other FAQs.

For many Minnesotans, missing a single paycheck means the difference between staying above water and facing dire financial challenges, and that’s particularly true considering the affordability crisis we’re facing now, with prices rising for just about everything in our daily lives. Paid Leave is one major step to provide some relief, ensuring you’ll no longer have to risk your economic security to look after yourself, care for a newborn, or tend to a loved one.

This program has truly been years in the making, and I’m so excited for families in our community and throughout Minnesota to finally have peace of mind. As we get closer to the program’s rollout, I encourage you to check out all of the resources available at pl.mn.gov [ [link removed] ].

fgsdfsfdgdfsg

Truth in Taxation Notice

If you’re a homeowner, by the time you read this, you should have received your county truth-in-taxation notice, or should receive it shortly. If you’re like me, you were shocked by the increased property taxes you’re facing. At a time of economic uncertainty and rising costs, we need to focus on affordability. Unfortunately, President Trump and his Republican allies are more focused on delivering tax breaks for billionaires than giving the middle class an opportunity to thrive. His short-sighted cuts and disinvestment in critical federal services are shifting more responsibilities onto our state and local governments.

For instance, the federal reconciliation bill passed this summer by President Trump and Congressional Republicans made massive federal cuts to food support known as the Supplemental Nutrition Assistance Program (SNAP). SNAP is a critical lifeline for families to put food on the table, and these cuts come when hunger is rising rapidly under Trump [ [link removed] ]. Counties are responsible for managing SNAP applications, and thanks to these cuts and new burdensome paperwork requirements from Trump, our local partners will be on the hook for higher administrative costs. Ramsey County estimates these SNAP cuts alone will raise the county’s property tax levy 4.82%. Anoka County estimates it will increase its levy by approximately 4%. As a DFLer, I will work every day to improve affordability for your family. But until we get federal leaders who will put making life affordable for families ahead of tax breaks for billionaires, you and I will continue to be saddled with the consequences of their greedy priorities.

Additional property tax resources and information are available from the Minnesota Department of Revenue [ [link removed] ].

tyjymyfn

*Stay Connected*

If you have any questions or comments on our work, now is a great time to touch base! Please feel free to contact my office at (651) 296-4257 or [email protected]. I always appreciate hearing from you!

Sincerely,

Mohamud Noor

State Representative

District 60B

State Representative Mohamud Noor

5th Floor, Centennial Office Building

658 Cedar St.

Saint Paul, Minnesota 55155

Phone: 651-296-4257

Email: [email protected]" (replies to this newsletter are not monitored)"

Website: www.house.mn.gov/60B [ [link removed] ]

To unsubscribe, visit the Subscriber Preferences Page [ [link removed] ]. If you have questions or experience technical difficulties with this subscription service, please visit subscriberhelp.govdelivery.com [ [link removed] ].

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota House DFL · 100 Rev. Dr. Martin Luther King Jr. Blvd. · Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery