| From | Fraser Institute <[email protected]> |

| Subject | Distribution of CERB and Rescinding Ontario's tax rate hike |

| Date | July 18, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------------

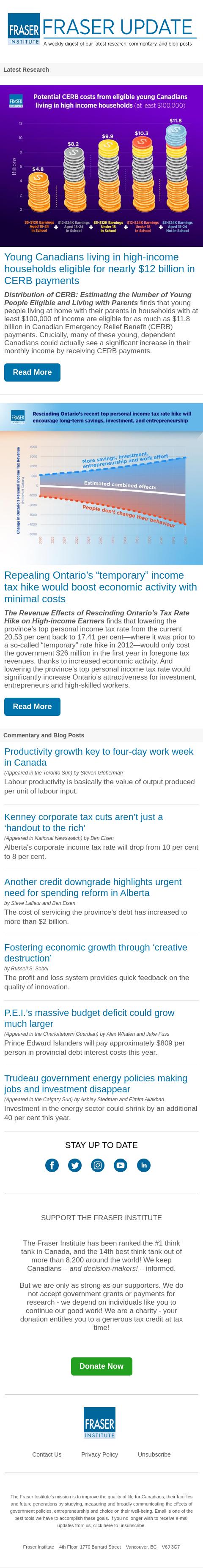

Young Canadians living in high-income households eligible for nearly $12 billion in CERB payments

Distribution of CERB: Estimating the Number of Young People Eligible and Living with Parents finds that young people living at home with their parents in households with at least $100,000 of income are eligible for as much as $11.8 billion in Canadian Emergency Relief Benefit (CERB) payments. Crucially, many of these young, dependent Canadians could actually see a significant increase in their monthly income by receiving CERB payments.

Read More [[link removed]]

Repealing Ontario’s “temporary” income tax hike would boost economic activity with minimal costs

The Revenue Effects of Rescinding Ontario’s Tax Rate Hike on High-income Earners finds that lowering the province’s top personal income tax rate from the current 20.53 per cent back to 17.41 per cent—where it was prior to a so-called “temporary” rate hike in 2012—would only cost the government $26 million in the first year in foregone tax revenues, thanks to increased economic activity. And lowering the province’s top personal income tax rate would significantly increase Ontario’s attractiveness for investment, entrepreneurs and high-skilled workers.

Read More [[link removed]]

Commentary and Blog Posts

--------------------

Productivity growth key to four-day work week in Canada [[link removed]]

(Appeared in the Toronto Sun) by Steven Globerman

Labour productivity is basically the value of output produced per unit of labour input.

Kenney corporate tax cuts aren’t just a ‘handout to the rich’ [[link removed]]

(Appeared in National Newswatch) by Ben Eisen

Alberta's corporate income tax rate will drop from 10 per cent to 8 per cent.

Another credit downgrade highlights urgent need for spending reform in Alberta [[link removed]]

by Steve Lafleur and Ben Eisen

The cost of servicing the province’s debt has increased to more than $2 billion.

Fostering economic growth through ‘creative destruction’ [[link removed]]

by Russell S. Sobel

The profit and loss system provides quick feedback on the quality of innovation.

P.E.I.’s massive budget deficit could grow much larger [[link removed]]

(Appeared in the Charlottetown Guardian) by Alex Whalen and Jake Fuss

Prince Edward Islanders will pay approximately $809 per person in provincial debt interest costs this year.

Trudeau government energy policies making jobs and investment disappear [[link removed]]

(Appeared in the Calgary Sun) by Ashley Stedman and Elmira Aliakbari

Investment in the energy sector could shrink by an additional 40 per cent this year.

SUPPORT THE FRASER INSTITUTE

----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------------

Young Canadians living in high-income households eligible for nearly $12 billion in CERB payments

Distribution of CERB: Estimating the Number of Young People Eligible and Living with Parents finds that young people living at home with their parents in households with at least $100,000 of income are eligible for as much as $11.8 billion in Canadian Emergency Relief Benefit (CERB) payments. Crucially, many of these young, dependent Canadians could actually see a significant increase in their monthly income by receiving CERB payments.

Read More [[link removed]]

Repealing Ontario’s “temporary” income tax hike would boost economic activity with minimal costs

The Revenue Effects of Rescinding Ontario’s Tax Rate Hike on High-income Earners finds that lowering the province’s top personal income tax rate from the current 20.53 per cent back to 17.41 per cent—where it was prior to a so-called “temporary” rate hike in 2012—would only cost the government $26 million in the first year in foregone tax revenues, thanks to increased economic activity. And lowering the province’s top personal income tax rate would significantly increase Ontario’s attractiveness for investment, entrepreneurs and high-skilled workers.

Read More [[link removed]]

Commentary and Blog Posts

--------------------

Productivity growth key to four-day work week in Canada [[link removed]]

(Appeared in the Toronto Sun) by Steven Globerman

Labour productivity is basically the value of output produced per unit of labour input.

Kenney corporate tax cuts aren’t just a ‘handout to the rich’ [[link removed]]

(Appeared in National Newswatch) by Ben Eisen

Alberta's corporate income tax rate will drop from 10 per cent to 8 per cent.

Another credit downgrade highlights urgent need for spending reform in Alberta [[link removed]]

by Steve Lafleur and Ben Eisen

The cost of servicing the province’s debt has increased to more than $2 billion.

Fostering economic growth through ‘creative destruction’ [[link removed]]

by Russell S. Sobel

The profit and loss system provides quick feedback on the quality of innovation.

P.E.I.’s massive budget deficit could grow much larger [[link removed]]

(Appeared in the Charlottetown Guardian) by Alex Whalen and Jake Fuss

Prince Edward Islanders will pay approximately $809 per person in provincial debt interest costs this year.

Trudeau government energy policies making jobs and investment disappear [[link removed]]

(Appeared in the Calgary Sun) by Ashley Stedman and Elmira Aliakbari

Investment in the energy sector could shrink by an additional 40 per cent this year.

SUPPORT THE FRASER INSTITUTE

----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor