Email

The Market Just Contracted (Why That’s a Good Thing)

| From | Ross Givens <[email protected]> |

| Subject | The Market Just Contracted (Why That’s a Good Thing) |

| Date | December 9, 2025 1:15 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tuesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Yesterday I talked about the possible resumption of a calm uptrend in the

markets…

A rising tide that will help lift all boats.

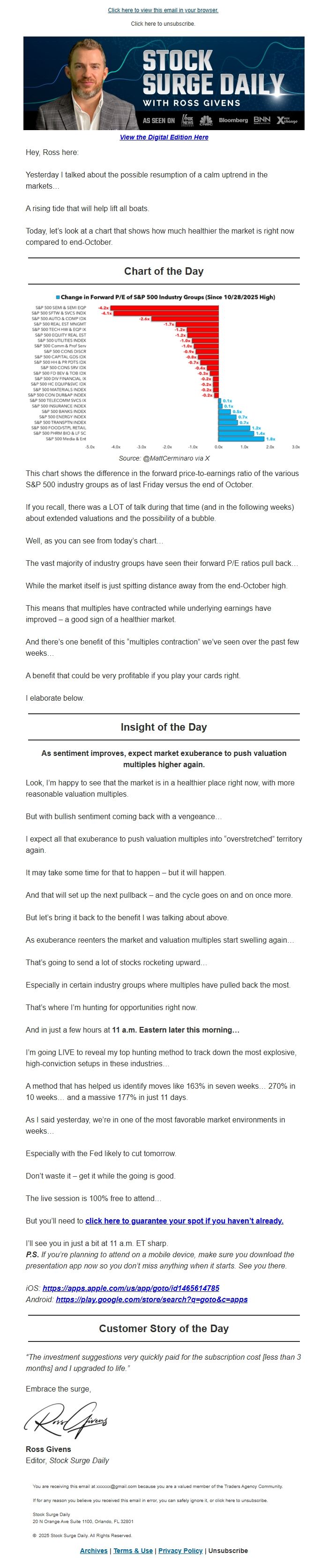

Today, let’s look at a chart that shows how much healthier the market is

right now compared to end-October.

Chart of the Day

Source: @MattCerminaro via X

This chart shows the difference in the forward price-to-earnings ratio of the

various S&P 500 industry groups as of last Friday versus the end of October.

If you recall, there was a LOT of talk during that time (and in the following

weeks) about extended valuations and the possibility of a bubble.

Well, as you can see from today’s chart…

The vast majority of industry groups have seen their forward P/E ratios pull

back…

While the market itself is just spitting distance away from the end-October

high.

This means that multiples have contracted while underlying earnings have

improved – a good sign of a healthier market.

And there’s one benefit of this “multiples contraction” we’ve seen over the

past few weeks…

A benefit that could be very profitable if you play your cards right.

I elaborate below.

Insight of the Day

As sentiment improves, expect market exuberance to push valuation multiples

higher again.

Look, I’m happy to see that the market is in a healthier place right now, with

more reasonable valuation multiples.

But with bullish sentiment coming back with a vengeance…

I expect all that exuberance to push valuation multiples into “overstretched”

territory again.

It may take some time for that to happen – but it will happen.

And that will set up the next pullback – and the cycle goes on and on once

more.

But let’s bring it back to the benefit I was talking about above.

As exuberance reenters the market and valuation multiples start swelling again…

That’s going to send a lot of stocks rocketing upward…

Especially in certain industry groups where multiples have pulled back the

most.

That’s where I’m hunting for opportunities right now.

And in just a few hours at 11 a.m. Eastern later this morning…

I’m going LIVE to reveal my top hunting method to track down the most

explosive, high-conviction setups in these industries…

A method that has helped us identify moves like 163% in seven weeks… 270% in

10 weeks… and a massive 177% in just 11 days.

As I said yesterday, we’re in one of the most favorable market environments in

weeks…

Especially with the Fed likely to cut tomorrow.

Don’t waste it – get it while the going is good.

The live session is 100% free to attend…

But you’ll need to click here to guarantee your spot if you haven’t already.

<[link removed]>

I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“The investment suggestions very quickly paid for the subscription cost [less

than 3 months] and I upgraded to life.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Yesterday I talked about the possible resumption of a calm uptrend in the

markets…

A rising tide that will help lift all boats.

Today, let’s look at a chart that shows how much healthier the market is

right now compared to end-October.

Chart of the Day

Source: @MattCerminaro via X

This chart shows the difference in the forward price-to-earnings ratio of the

various S&P 500 industry groups as of last Friday versus the end of October.

If you recall, there was a LOT of talk during that time (and in the following

weeks) about extended valuations and the possibility of a bubble.

Well, as you can see from today’s chart…

The vast majority of industry groups have seen their forward P/E ratios pull

back…

While the market itself is just spitting distance away from the end-October

high.

This means that multiples have contracted while underlying earnings have

improved – a good sign of a healthier market.

And there’s one benefit of this “multiples contraction” we’ve seen over the

past few weeks…

A benefit that could be very profitable if you play your cards right.

I elaborate below.

Insight of the Day

As sentiment improves, expect market exuberance to push valuation multiples

higher again.

Look, I’m happy to see that the market is in a healthier place right now, with

more reasonable valuation multiples.

But with bullish sentiment coming back with a vengeance…

I expect all that exuberance to push valuation multiples into “overstretched”

territory again.

It may take some time for that to happen – but it will happen.

And that will set up the next pullback – and the cycle goes on and on once

more.

But let’s bring it back to the benefit I was talking about above.

As exuberance reenters the market and valuation multiples start swelling again…

That’s going to send a lot of stocks rocketing upward…

Especially in certain industry groups where multiples have pulled back the

most.

That’s where I’m hunting for opportunities right now.

And in just a few hours at 11 a.m. Eastern later this morning…

I’m going LIVE to reveal my top hunting method to track down the most

explosive, high-conviction setups in these industries…

A method that has helped us identify moves like 163% in seven weeks… 270% in

10 weeks… and a massive 177% in just 11 days.

As I said yesterday, we’re in one of the most favorable market environments in

weeks…

Especially with the Fed likely to cut tomorrow.

Don’t waste it – get it while the going is good.

The live session is 100% free to attend…

But you’ll need to click here to guarantee your spot if you haven’t already.

<[link removed]>

I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“The investment suggestions very quickly paid for the subscription cost [less

than 3 months] and I upgraded to life.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost