|

|

This content is available for free to all subscribers. But you really should consider a paid subscription. This unlocks our afternoon e-mails, our Saturday “What is Jon Reading” e-mail, and analysis on breaking news. Normally a subscription is a modest $7 a month or just $70 for the year.

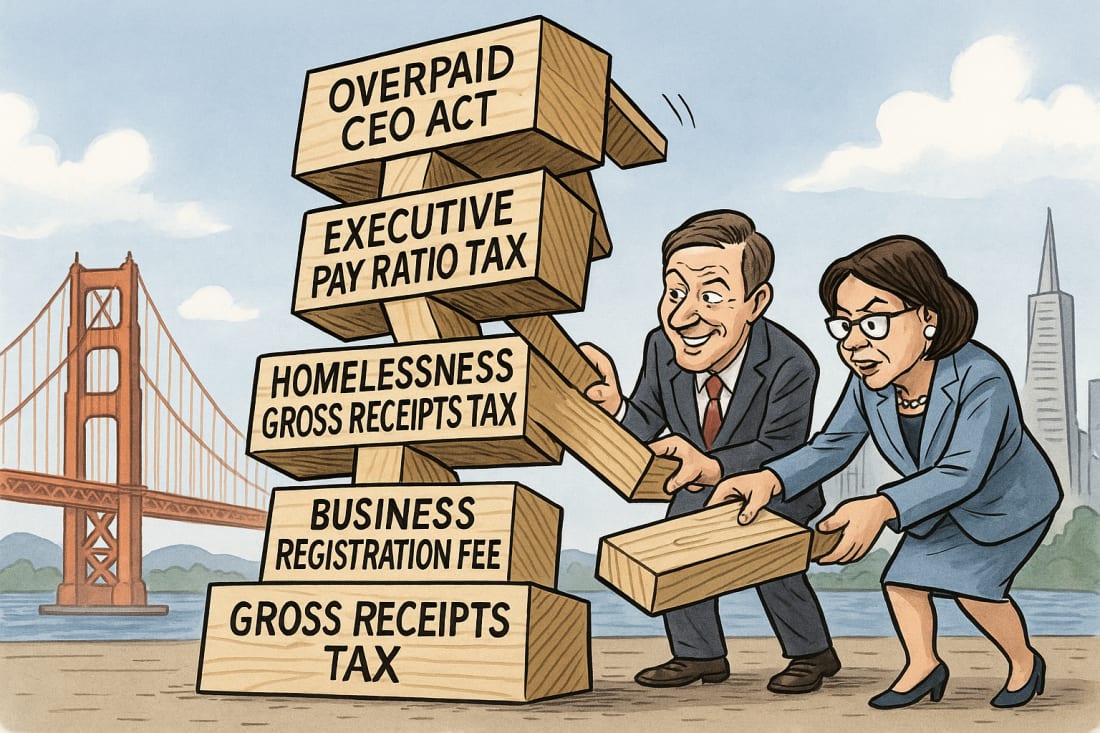

New CEO Tax Proposal Would Deepen San Francisco’s Already Punishing Business Climate

A new ballot measure targeting executive pay would layer yet another tax on top of one of the most expensive regulatory environments in America

⏱️ 6 min read

(Typically my Monday morning column is a more substantive look at some aspect of California politics or policy. San Francisco does not get enough of my attention. So this one is all about SF. This morning post is available to all readers.)

A New CEO Tax, Same Old San Francisco Instinct

I was reading in the San Francisco Chronicle last weekend about the latest tax scheme headed for the city’s 2026 ballot — the so-called “Overpaid CEO Act” — and one number immediately stood out: more than $200 million a year. That is the amount city leaders expect to extract annually from large employers through a new surcharge tied to executive compensation. It is not a tax on profit. It is a tax on gross receipts. Companies would owe it whether they are making money or not.

Only after digging into the mechanics does the broader implication become clear. That $200 million would be pulled straight out of the private sector and redirected into City Hall’s spending apparatus, adding yet another stream of politically controlled revenue to an already expansive system. Supporters frame this as a way to protect essential services. In practice, it would finance another round of government programs layered on top of a tax structure that has grown steadily heavier for decades.

San Francisco already imposed a version of this tax in 2020. After widespread concern that it discouraged investment and distorted the tax base, city officials partially trimmed it back in 2024. Now, one election cycle later, activists are seeking not only to restore it, but to expand it significantly.

A Tax On Revenue, Even When Businesses Lose Money

Under the new proposal, companies with at least 1,000 employees and $1 billion or more in revenue would face sharply higher surcharges if their CEO-to-worker pay ratio crosses the city’s preferred threshold. Because the tax is tied to gross receipts rather than earnings, it would apply through economic downturns as well as expansions.

That distinction matters. Gross-receipts taxes are indifferent to profitability. When business conditions tighten, the tax burden does not ease. It continues to draw cash out of operations, discourage hiring, and push capital toward jurisdictions with more predictable cost structures. San Francisco continues to build its revenue system around exactly this model.

And this proposal would be added to everything that is already in place.

A Tax Stack That Never Stops Growing

If the new CEO tax passes, it will not land on a clean slate. It will be added to one of the most complex and costly local business-tax systems in the country.

Every business in San Francisco pays an annual Business Registration Fee based on gross receipts. For large companies, that bill can run well into the tens of thousands of dollars every year simply to remain registered with the city.

The city’s cornerstone levy is the Gross Receipts Tax, applied to San-Francisco-sourced revenue rather than profit. Depending on the industry and size of the firm, rates now climb as high as nearly 3.7 percent under the most recent restructuring. This tax applies regardless of whether a business is profitable.

Homelessness And Child Care — Paid For By Business

Layered on top of that is the Homelessness Gross Receipts Tax adopted in 2018. What began as a surcharge on firms with more than $50 million in city revenue now applies at $25 million, with top rates exceeding 1.6 percent. The same dollar of revenue can be taxed multiple times before a business ever nets a return.

Commercial landlords face an additional burden under the Early Care and Education Commercial Rents Tax, often called “Baby Prop C.” It adds a 3.5 percent tax on most commercial rents. The city projected roughly $146 million a year from that measure alone.

All of this exists before returning again to executive-pay taxes, which San Francisco first adopted in 2020, revised in 2024, and now seeks to escalate through the Overpaid CEO Act.

When city officials speak of adjustments at the margins, this is the underlying structure they are adjusting.

Taxes Aimed At Behavior, Not Just Revenue

San Francisco does not simply raise revenue. It uses the tax code as a policy instrument to steer economic behavior.

The city imposes a Sugary Drinks Tax of one cent per ounce at the distribution level. It is promoted as a public-health measure, but its cost falls heavily on small retailers and price-sensitive consumers.

Then there is the accumulation of other sector-specific taxes: utility taxes, hotel taxes, parking taxes, communications taxes, and the cannabis business tax scheduled to take effect in 2026. Each one appears manageable when viewed alone. Together they form a dense web of targeted levies layered on top of an already heavy gross-receipts framework.

In total, San Francisco now administers more than 180 separate taxes and fees under its municipal code, a level of fiscal complexity rarely matched by any major American city.

When Labor Rules Become Payroll Taxes

Many of San Francisco’s most expensive mandates are not labeled as taxes at all. They are embedded in local labor rules that function as direct cost obligations for employers.

The city’s minimum wage now stands at $19.18 per hour and rises automatically with inflation. On top of that is the Health Care Security Ordinance, which requires qualifying employers to spend nearly $4 an hour — $3.85 per hour in 2025 — on health-care costs for each covered employee, even when insurance is already provided.

Mandates That Drive Up The Cost Of Every Hire

San Francisco also mandates paid sick leave beyond state minimums, enforces a Paid Parental Leave Ordinance requiring employers to supplement state benefits to near-full wages for weeks at a time, and maintains a permanent Public Health Emergency Leave that can trigger up to 80 additional paid hours for large employers during declared emergencies.

Add to that rigid scheduling rules under the Family Friendly Workplace Ordinance, strict hiring restrictions under the Fair Chance Ordinance, and detailed facility mandates under the Lactation in the Workplace Ordinance, and the city begins to resemble less a marketplace and more a regulatory proving ground.

Each rule is defended on compassionate grounds. Together they create one of the most expensive employment environments in the nation.

So, Does It Matter?

This matters not merely because of a single tax proposal, but because of what the broader pattern reveals. San Francisco is one of the most naturally beautiful and historically significant cities in the world. It helped shape American commerce, culture, technology, and innovation. It should be a center of opportunity. Instead, it has become a national and international laboratory for aggressive tax and regulatory policy.

What began as a city that rewarded enterprise now treats it primarily as a funding source. Each new tax is framed as necessity. Each new mandate is presented as protection. Taken together, they form a governing model that no longer views the private sector as a partner in growth, but as a reservoir to be tapped for an ever-expanding public agenda.

The consequences are no longer theoretical. San Francisco now struggles with record-high office vacancy rates, persistent retail vacancies, reduced foot traffic in once-thriving commercial corridors, and a shrinking tax base as employers and residents continue to leave the city. Major companies have consolidated, downsized, or relocated operations. Public transit ridership remains depressed. Sales-tax and business-tax collections have become increasingly volatile. These trends are measurable outcomes of a governing model that steadily raises the cost of operating while weakening confidence in the city’s economic direction.

Thanks again for your support of this site.

You’re currently a free subscriber to So, Does It Matter? California Politics! For the full experience, upgrade your subscription. See how much more you get with an inexpensive, paid subscription, but clicking the button below! Support me in providing hard-hitting, clear-eyed analysis of California politics. I am beholding to no one, and sugar-coat nothing!