Email

Fixing a Broken System Holding Back Homeownership in Southern California

| From | Supervisor Jim Desmond <[email protected]> |

| Subject | Fixing a Broken System Holding Back Homeownership in Southern California |

| Date | December 8, 2025 2:45 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

John --

It sounds strange to say it, but I want to make selling a home affordable. At our upcoming Board of Supervisors meeting, I’m bringing forward an effort that I believe is long overdue — and absolutely essential if we want to give families, seniors, veterans, and young people a real shot at homeownership again.

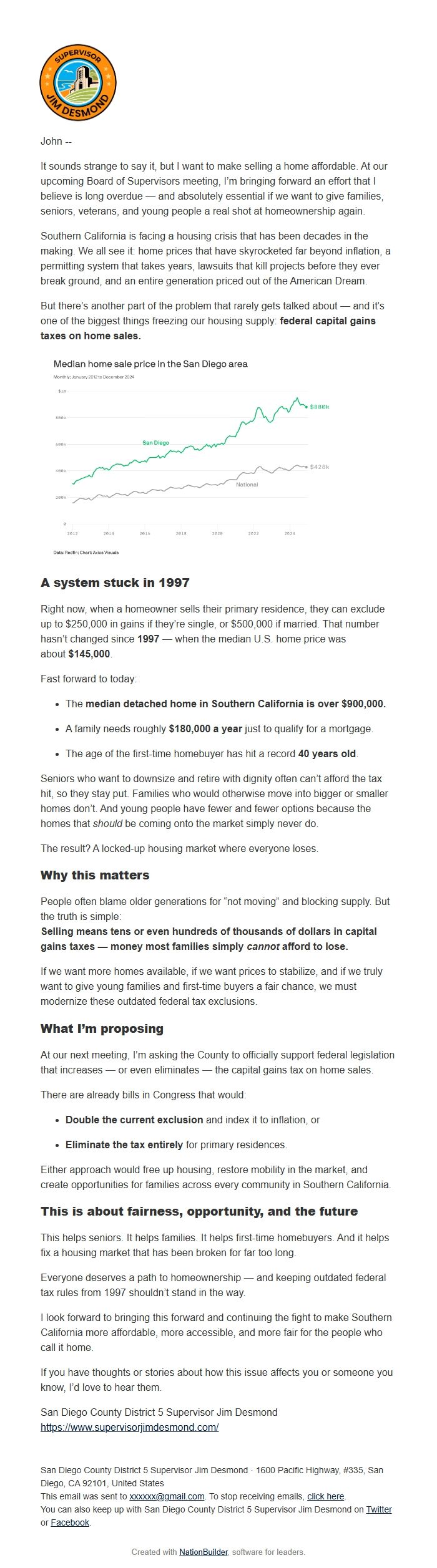

Southern California is facing a housing crisis that has been decades in the making. We all see it: home prices that have skyrocketed far beyond inflation, a permitting system that takes years, lawsuits that kill projects before they ever break ground, and an entire generation priced out of the American Dream.

But there’s another part of the problem that rarely gets talked about — and it’s one of the biggest things freezing our housing supply:federal capital gains taxes on home sales.

A system stuck in 1997

Right now, when a homeowner sells their primary residence, they can exclude up to $250,000 in gains if they’re single, or $500,000 if married. That number hasn’t changed since1997— when the median U.S. home price was about$145,000.

Fast forward to today:

- Themedian detached home in Southern California is over $900,000.

- A family needs roughly$180,000 a yearjust to qualify for a mortgage.

- The age of the first-time homebuyer has hit a record40 years old.

Seniors who want to downsize and retire with dignity often can’t afford the tax hit, so they stay put. Families who would otherwise move into bigger or smaller homes don’t. And young people have fewer and fewer options because the homes thatshouldbe coming onto the market simply never do.

The result? A locked-up housing market where everyone loses.

Why this matters

People often blame older generations for “not moving” and blocking supply. But the truth is simple:

Selling means tens or even hundreds of thousands of dollars in capital gains taxes — money most families simplycannotafford to lose.

If we want more homes available, if we want prices to stabilize, and if we truly want to give young families and first-time buyers a fair chance, we must modernize these outdated federal tax exclusions.

What I’m proposing

At our next meeting, I’m asking the County to officially support federal legislation that increases — or even eliminates — the capital gains tax on home sales.

There are already bills in Congress that would:

- Double the current exclusionand index it to inflation, or

- Eliminate the tax entirelyfor primary residences.

Either approach would free up housing, restore mobility in the market, and create opportunities for families across every community in Southern California.

This is about fairness, opportunity, and the future

This helps seniors. It helps families. It helps first-time homebuyers. And it helps fix a housing market that has been broken for far too long.

Everyone deserves a path to homeownership — and keeping outdated federal tax rules from 1997 shouldn’t stand in the way.

I look forward to bringing this forward and continuing the fight to make Southern California more affordable, more accessible, and more fair for the people who call it home.

If you have thoughts or stories about how this issue affects you or someone you know, I’d love to hear them.

San Diego County District 5 Supervisor Jim Desmond

<[link removed]>[link removed]

-=-=-

San Diego County District 5 Supervisor Jim Desmond - 1600 Pacific Highway, #335, San Diego, CA 92101, United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

It sounds strange to say it, but I want to make selling a home affordable. At our upcoming Board of Supervisors meeting, I’m bringing forward an effort that I believe is long overdue — and absolutely essential if we want to give families, seniors, veterans, and young people a real shot at homeownership again.

Southern California is facing a housing crisis that has been decades in the making. We all see it: home prices that have skyrocketed far beyond inflation, a permitting system that takes years, lawsuits that kill projects before they ever break ground, and an entire generation priced out of the American Dream.

But there’s another part of the problem that rarely gets talked about — and it’s one of the biggest things freezing our housing supply:federal capital gains taxes on home sales.

A system stuck in 1997

Right now, when a homeowner sells their primary residence, they can exclude up to $250,000 in gains if they’re single, or $500,000 if married. That number hasn’t changed since1997— when the median U.S. home price was about$145,000.

Fast forward to today:

- Themedian detached home in Southern California is over $900,000.

- A family needs roughly$180,000 a yearjust to qualify for a mortgage.

- The age of the first-time homebuyer has hit a record40 years old.

Seniors who want to downsize and retire with dignity often can’t afford the tax hit, so they stay put. Families who would otherwise move into bigger or smaller homes don’t. And young people have fewer and fewer options because the homes thatshouldbe coming onto the market simply never do.

The result? A locked-up housing market where everyone loses.

Why this matters

People often blame older generations for “not moving” and blocking supply. But the truth is simple:

Selling means tens or even hundreds of thousands of dollars in capital gains taxes — money most families simplycannotafford to lose.

If we want more homes available, if we want prices to stabilize, and if we truly want to give young families and first-time buyers a fair chance, we must modernize these outdated federal tax exclusions.

What I’m proposing

At our next meeting, I’m asking the County to officially support federal legislation that increases — or even eliminates — the capital gains tax on home sales.

There are already bills in Congress that would:

- Double the current exclusionand index it to inflation, or

- Eliminate the tax entirelyfor primary residences.

Either approach would free up housing, restore mobility in the market, and create opportunities for families across every community in Southern California.

This is about fairness, opportunity, and the future

This helps seniors. It helps families. It helps first-time homebuyers. And it helps fix a housing market that has been broken for far too long.

Everyone deserves a path to homeownership — and keeping outdated federal tax rules from 1997 shouldn’t stand in the way.

I look forward to bringing this forward and continuing the fight to make Southern California more affordable, more accessible, and more fair for the people who call it home.

If you have thoughts or stories about how this issue affects you or someone you know, I’d love to hear them.

San Diego County District 5 Supervisor Jim Desmond

<[link removed]>[link removed]

-=-=-

San Diego County District 5 Supervisor Jim Desmond - 1600 Pacific Highway, #335, San Diego, CA 92101, United States

This email was sent to [email protected]. To stop receiving emails: [link removed]

-=-=-

Created with NationBuilder - [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- NationBuilder