|

📌 View

Online | 🚀 Share

on Facebook

Hi Friend,

The silly

season is well underway. It's the time for Christmas shopping, summer

planning, last minute errands, and when Governments tend to 'take out

the trash' – hoping bad news stories are buried in the Christmas rush.

So while Christmas is right around the corner Santa's naughty list is

growing.

This week,

we learned of some sneaky (unannounced) tax changes from Wellington,

that rates capping has been delayed until 2029, the bureaucrat golden

goodbye bonanza continues, and a record high rates hike in the

pipeline for Aucklanders.

Oh, and you

might have noticed a bit of media attention the last few days on a new

campaign we've not even launched yet! Some comments about that

below...

So grab a

cuppa. This end of week wrap up is stacked.

Rates Cap

Now ✅ or Rates Cap Later ❌

On Monday

we learned the good news is that the capping of crippling council

rates is coming. The bad news is that the Government has pushed back

implementation until 2029.

That means

that councils now have three full years to make massive rate hikes

before the cap kicks in. And does anyone have faith that they

won't?

Most

councils are currently working on their Long Term Plans – which are

required to be done every three years to set out rates and spending

parameters for the following 10 years (yes, I know how that

reads).

That means the window of opportunity to force

councils to live within their means (and what ratepayers can afford)

is narrow. The Government’s delay is an invitation for local

councils to hike everything now, bake it into the baseline, and shrug

later.

Obviously,

we

had a lot to say on this issue, with Tory

on Three News making the case for ratepayers and why we need to Cap

Rates *Now*.

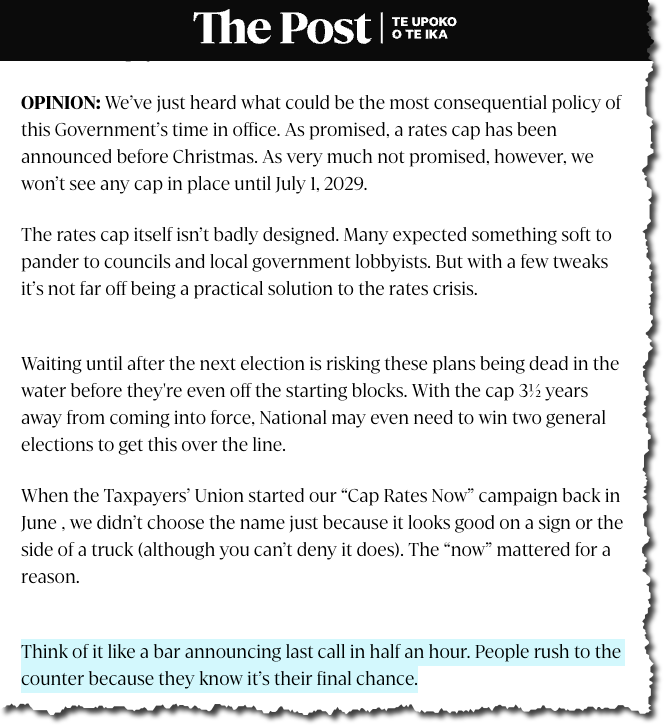

James was

also busy. His

excellent op-ed for The Post also points out that councils

will rush to push rates up while they still can, because once the cap

arrives, they’re locked in. I just love the last line of

this:

Continue

reading over on The Post's website.

Yours truly

had

a longer discussion with current Otago Regional Councillor (and host

on The Platform) Michael Laws.

I also

spoke with Duncan

Garner for his Editor in Chief podcast.

TVNZ bias:

even AI is noticing 📺

Strangely,

we didn't hear a whisper from TVNZ's One News, despite your

humble Taxpayers' Union both proposing the rates capping

policy, and driving the campaign to get the Government to adopt

it!

Just like

One News strived to ignore ratepayers during the whole two

years of coverage of the last Government's Three Waters effort, they'd

rather stick to "insiders" like Local Government NZ and others who are

using ratepayer money to oppose our Cap Rates Now

campaign.

And we are

not alone.

New

AI analysis of the framing of political stories by One News suggests

that something is going seriously awry at the taxpayer-owned

broadcaster...

NEW Rates

Cap Dashboard: how much have you already been fleeced? 💳🐑

As you

know, we track council rates across the country closely. Earlier in

the year we exposed that cumulatively, over the last three years, the

average rates hike by councils was an incredible 35

percent.

So

on Friday we launched the Rates

Cap Dashboard – a new tool revealing what the average household in

every council district would

have saved if the Government's rates cap had been in place over

the past three years.

James and

his team found:

- Across the

country, the average household would be between $670 and $864 better

off right now had the proposed 2-4 percent cap been in place over the

last three years.

- The

average household in 21 council areas would have saved more than

$1,000 each

- Queenstown-Lakes District ratepayers would have saved the

most: an incredible $1,706 lost per household.

- Even in

councils with the smallest numbers, a rates cap would still have left

hundreds of dollars in the pockets of every local

ratepayer.

The

campaign isn't over: we've got Cabinet over the line on the Cap Rates

bit, now we just need them to do it NOW.

To

back the Cap Rates

Now campaign and chip-in to the fighting fund, click

here.

Mayor

Brown’s Rates Cap Backflip 💥🛑

Wayne Brown

campaigned as the guy who’d rein in Auckland Council waste. But fast

forward to today, and Auckland Council’s operating spending continues

to balloon right under Mr Brown's nose.

Despite the rhetoric, Wayne Brown has hiked

Council spending by more than 20.5% in just three years. Cumulative

inflation over the same timeframe has been seven

percent.

During the

election campaign just been, Brown committed to keep rates no more

than 1.5 percent above inflation – which is bang on the midpoint for

where the Government has set its cap! But now, just three months

later, Wayne Brown has changed his tune.

Now

the Mayor says a rates cap “won’t work” – announcing a 7.9 percent

rates hike within an hour of the Government announcing its

policy.

If

Wayne Brown gets his way, next year's rates hike will be the highest

ever for the Super City!

Brown is

blaming the City Rail Link which he claimed will add $1 million a day

to ratepayers’ costs. But our friends at the Auckland

Ratepayers' Alliance checked the numbers: the actual cost is $26

million a year, or roughly equivalent to 1 percent on rates.

Not

nothing, but nowhere near the eight percent figure Wayne Brown is

pushing.

Brown isn’t

levelling with Aucklanders — and that’s exactly why we need a legally

enforceable cap.

With

my Ratepayers' Alliance hat on I joined Newstalk ZB to call out Mayor

Brown's 'absolute nonsense' 👇

IRD's

sneaky pre-Christmas surprise 🎄⚠️

While no one was paying attention, the IRD

quietly dropped one of the most destructive tax changes we’ve seen in

decades.

Here’s the

gist:

- Many small

businesses pay owners through a running loan account during the

year.

- At

year-end, they clear it with dividends or salary — standard

practice.

- Under the

new rule, if the loan isn’t cleared within 12 months, IRD will now

treat the whole loan

as taxable income…

- …and the owner still has to repay the loan later

using more taxable income.

Yes, taxed

twice. Yes, retrospective, covering the current tax year (in fact, IRD

say the law will be backdated to come into effect as of Thursday). And

no, there was no press conference, no speech, no debate. Just a quiet

upload to the IRD website.

Our tax

experts say that these changes will have a far greater impact on New

Zealand's SMEs and farmers than Labour's proposed Capital Gains

Tax. No wonder the Government is mum!

And nothing says “Merry Christmas” like a

backdated tax bill.

Sneaking a

policy of this magnitude through without fanfare over summer is bad

form. You

can read our full comments here.

Submissions close on 5 February (more

info here) – rest assured that the Taxpayers' Union will be back

to work well before then!

Golden

Handshakes: More than $837,000 in a single week (and that's just those

we know about!) 🤦♀️💰

If you

thought we’d hit peak golden handshake insanity with Adrian Orr's

$416,120 "golden goodbye", think again. This week alone, we already

know taxpayers are on the hook for:

- Andrew

Coster (disgraced former head of the Social Investment Agency who was

allowed to resign and therefore collect a garden leave/three-month's

pay windfall) – $130,000

- Diana

Sarfati (former head of the Ministry of Health)– $350,000

- Sarah Fitt

(former Pharmac boss) – $357,000

Tory spoke to

Newstalk ZB on Andrew Coster's golden handshake and the scale of his

payout, which you can listen to here.

We’ve also

seen another resignation as the Coster fallout continues to

reverberate through Wellington.

This time a former Deputy Police Commissioner now

at the Civil Aviation Authority, was rewarded with a payout – and one

that the CAA chief refused to even declare when asked by MPs during

Parliament's scrutiny week.

That’s a) a

middle finger to transparency and b) likely to push the total north of

$1 million this week

alone.

This is why we’re pushing for a hard cap on exit

payouts, zero payouts for anyone paid more than an MP, and full

transparency in public servants receiving such

payouts.

Until

then, the golden handshake conveyor belt rolls on.

Labour

using taxpayer funded staff to make Party propaganda 📹🚫

At Labour’s

conference, their social media adviser — funded by Parliamentary

Service — was producing

political content on the taxpayer dollar.

The

rules are clear: Parliamentary staff support MPs’ official

duties, not partisan content creation for the party

machine.

I don’t

think it’s complicated, Friend. If parties want political videos, they

should use party funds, not raid the taxpayer wallet.

And

yes, this all happened during Scrutiny Week. You couldn’t write it

better.

Health NZ

spending $3.5 million this year on “non-jobs” 🧘♂️🌀

The year

might be nearly over, but everyone’s favourite Investigations

Coordinator Rhys is still hard at work digging into waste across local

and national government.

On

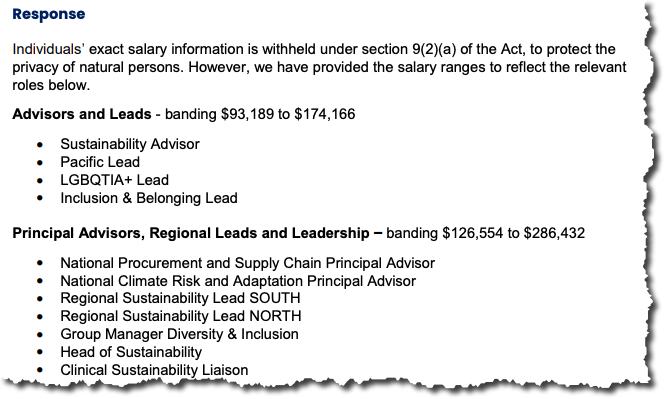

Friday, Rhys

revealed Health NZ employs 13.7 FTE staff dedicated exclusively to

DEI, sustainability, climate, and non-clinical “culture”

work.

The total

salary bill is a jaw-dropping $3,475,054.

Back of the envelope, that's an average salary of

$253,654!

As is

usual, Rhys has linked to all the source material on the website,

so you can judge for yourself whether these Health NZ salaries

are justified...

As you can

see, while Health NZ only give us the salary information in bands, we

can work out from the total that most of the roles are paid at the

very upper end!

Meanwhile:

- Emergency

departments are overflowing

- Waitlists

are blowing out

- Surgical

backlogs are growing

This is the problem in a nutshell: We’re

funding everything except actual

healthcare.

One more

thing...

Finally,

we’ve had a lot of good

publicity for our campaign launching very soon, and now it is our

turn to say what it is all about.

The

campaign is about Nicola Willis becoming our best ever finance

minister. No one wants her to succeed more than than Taxpayers’ Union

to cut wasteful spending, balance the books, and keep out a

Labour-TPM-Green high tax, high deficit, 'addicted to spending'

disaster.

Our

pressure campaign is about pointing out the fiscal elephants in the

room and her having the incentives from voters to become our best ever

finance minister and get New Zealand off the

disastrous fiscal track it has been on for so long.

Watch this

space...

|

Jordan

Williams

Executive Director

New Zealand

Taxpayers’ Union.

|

Ps. As

well as the last Taxpayers' Union-Curia Poll of 2025, it's looking

likely the Government's replacement to the Resource Management Act is

going to be released early next week. This is likely to be the biggest

(regulatory) tax relief any government has delivered under MMP. As

soon as we have worked through the details, we'll get them to you. A

big week ahead!

|