Email

How Cuts In Taxes On Capital Income Neglected Wealth Building For Much Of The Population

| From | Eugene Steuerle & The Government We Deserve <[email protected]> |

| Subject | How Cuts In Taxes On Capital Income Neglected Wealth Building For Much Of The Population |

| Date | December 1, 2025 2:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

As I detail more thoroughly in Abandoned: How Republicans And Democrats Have Deserted The Working Class, The Young, And The American Dream [ [link removed] ], two Santas of easy money—a tax Santa and a spending Santa focused primarily on retirement and healthcare—have dominated federal budget policy to such an extent that they have overshadowed and effectively displaced almost all other government priorities for nearly 50 years. Here, I’ll focus on the tax Santa and deal only briefly with the spending Santa.

The quick summary: In their seesaw battles with Democrats over control of Congress and the Presidency, Republicans have mainly succeeded in enacting quite dramatic cuts on capital income earned by the wealthiest Americans. But they, as well as the Democrats, have neglected wealth building, including in human capital and know-how, for much of the population.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Federal taxes mainly rose to their current levels as a share of the economy through legislation passed during two world wars. Each time, the average economy-wide tax rate never returned to its pre-war levels. Since World War II, these taxes have stayed around 18 percent of GDP, with a low of 14.6 percent during the Great Recession years of 2009 and 2010 and a high of 20.0 percent in 2000— a rate that, under current law and without new legislation, the country will likely reach again in the future due to gradual bracket creep [average individual tax rates rising as real incomes increase].

Throughout 3 1/2 cycles involving the last seven presidents and eight presidencies, the tax cuts implemented in 1981, the first year of Ronald Reagan’s presidency, were partially offset by increases later in his administration and during those of two successors, George H.W. Bush and Bill Clinton. The substantial tax cuts in the first years of George W. Bush’s administration, in turn, were partially offset during the Obama administration. Similarly, the tax cuts enacted in the first year of the Trump administration were partially reversed at the start of the Biden administration. A fourth round of tax cuts was enacted once Donald Trump took control of the White House in 2025. In contrast to many temporary provisions enacted during his first presidency, many of these giveaways were made permanent.

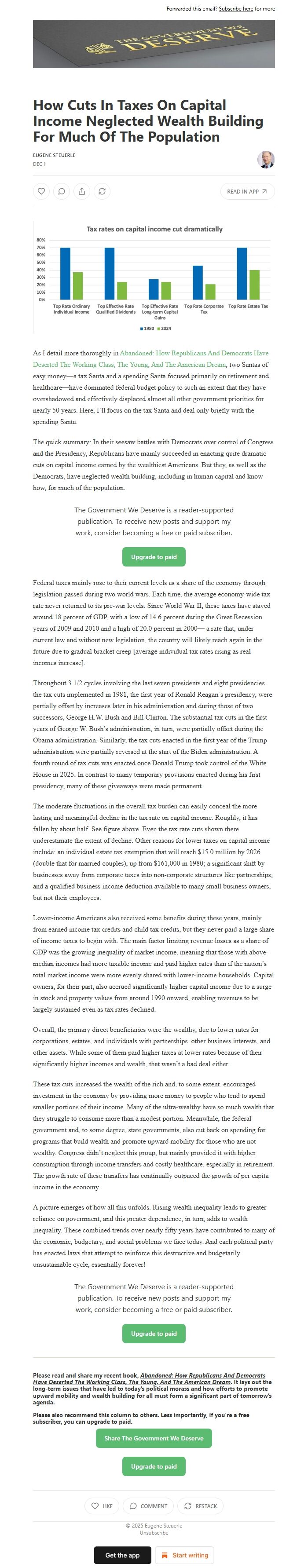

The moderate fluctuations in the overall tax burden can easily conceal the more lasting and meaningful decline in the tax rate on capital income. Roughly, it has fallen by about half. See figure above. Even the tax rate cuts shown there underestimate the extent of decline. Other reasons for lower taxes on capital income include: an individual estate tax exemption that will reach $15.0 million by 2026 (double that for married couples), up from $161,000 in 1980; a significant shift by businesses away from corporate taxes into non-corporate structures like partnerships; and a qualified business income deduction available to many small business owners, but not their employees.

Lower-income Americans also received some benefits during these years, mainly from earned income tax credits and child tax credits, but they never paid a large share of income taxes to begin with. The main factor limiting revenue losses as a share of GDP was the growing inequality of market income, meaning that those with above-median incomes had more taxable income and paid higher rates than if the nation’s total market income were more evenly shared with lower-income households. Capital owners, for their part, also accrued significantly higher capital income due to a surge in stock and property values from around 1990 onward, enabling revenues to be largely sustained even as tax rates declined.

Overall, the primary direct beneficiaries were the wealthy, due to lower rates for corporations, estates, and individuals with partnerships, other business interests, and other assets. While some of them paid higher taxes at lower rates because of their significantly higher incomes and wealth, that wasn’t a bad deal either.

These tax cuts increased the wealth of the rich and, to some extent, encouraged investment in the economy by providing more money to people who tend to spend smaller portions of their income. Many of the ultra-wealthy have so much wealth that they struggle to consume more than a modest portion. Meanwhile, the federal government and, to some degree, state governments, also cut back on spending for programs that build wealth and promote upward mobility for those who are not wealthy. Congress didn’t neglect this group, but mainly provided it with higher consumption through income transfers and costly healthcare, especially in retirement. The growth rate of these transfers has continually outpaced the growth of per capita income in the economy.

A picture emerges of how all this unfolds. Rising wealth inequality leads to greater reliance on government, and this greater dependence, in turn, adds to wealth inequality. These combined trends over nearly fifty years have contributed to many of the economic, budgetary, and social problems we face today. And each political party has enacted laws that attempt to reinforce this destructive and budgetarily unsustainable cycle, essentially forever!

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

As I detail more thoroughly in Abandoned: How Republicans And Democrats Have Deserted The Working Class, The Young, And The American Dream [ [link removed] ], two Santas of easy money—a tax Santa and a spending Santa focused primarily on retirement and healthcare—have dominated federal budget policy to such an extent that they have overshadowed and effectively displaced almost all other government priorities for nearly 50 years. Here, I’ll focus on the tax Santa and deal only briefly with the spending Santa.

The quick summary: In their seesaw battles with Democrats over control of Congress and the Presidency, Republicans have mainly succeeded in enacting quite dramatic cuts on capital income earned by the wealthiest Americans. But they, as well as the Democrats, have neglected wealth building, including in human capital and know-how, for much of the population.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Federal taxes mainly rose to their current levels as a share of the economy through legislation passed during two world wars. Each time, the average economy-wide tax rate never returned to its pre-war levels. Since World War II, these taxes have stayed around 18 percent of GDP, with a low of 14.6 percent during the Great Recession years of 2009 and 2010 and a high of 20.0 percent in 2000— a rate that, under current law and without new legislation, the country will likely reach again in the future due to gradual bracket creep [average individual tax rates rising as real incomes increase].

Throughout 3 1/2 cycles involving the last seven presidents and eight presidencies, the tax cuts implemented in 1981, the first year of Ronald Reagan’s presidency, were partially offset by increases later in his administration and during those of two successors, George H.W. Bush and Bill Clinton. The substantial tax cuts in the first years of George W. Bush’s administration, in turn, were partially offset during the Obama administration. Similarly, the tax cuts enacted in the first year of the Trump administration were partially reversed at the start of the Biden administration. A fourth round of tax cuts was enacted once Donald Trump took control of the White House in 2025. In contrast to many temporary provisions enacted during his first presidency, many of these giveaways were made permanent.

The moderate fluctuations in the overall tax burden can easily conceal the more lasting and meaningful decline in the tax rate on capital income. Roughly, it has fallen by about half. See figure above. Even the tax rate cuts shown there underestimate the extent of decline. Other reasons for lower taxes on capital income include: an individual estate tax exemption that will reach $15.0 million by 2026 (double that for married couples), up from $161,000 in 1980; a significant shift by businesses away from corporate taxes into non-corporate structures like partnerships; and a qualified business income deduction available to many small business owners, but not their employees.

Lower-income Americans also received some benefits during these years, mainly from earned income tax credits and child tax credits, but they never paid a large share of income taxes to begin with. The main factor limiting revenue losses as a share of GDP was the growing inequality of market income, meaning that those with above-median incomes had more taxable income and paid higher rates than if the nation’s total market income were more evenly shared with lower-income households. Capital owners, for their part, also accrued significantly higher capital income due to a surge in stock and property values from around 1990 onward, enabling revenues to be largely sustained even as tax rates declined.

Overall, the primary direct beneficiaries were the wealthy, due to lower rates for corporations, estates, and individuals with partnerships, other business interests, and other assets. While some of them paid higher taxes at lower rates because of their significantly higher incomes and wealth, that wasn’t a bad deal either.

These tax cuts increased the wealth of the rich and, to some extent, encouraged investment in the economy by providing more money to people who tend to spend smaller portions of their income. Many of the ultra-wealthy have so much wealth that they struggle to consume more than a modest portion. Meanwhile, the federal government and, to some degree, state governments, also cut back on spending for programs that build wealth and promote upward mobility for those who are not wealthy. Congress didn’t neglect this group, but mainly provided it with higher consumption through income transfers and costly healthcare, especially in retirement. The growth rate of these transfers has continually outpaced the growth of per capita income in the economy.

A picture emerges of how all this unfolds. Rising wealth inequality leads to greater reliance on government, and this greater dependence, in turn, adds to wealth inequality. These combined trends over nearly fifty years have contributed to many of the economic, budgetary, and social problems we face today. And each political party has enacted laws that attempt to reinforce this destructive and budgetarily unsustainable cycle, essentially forever!

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a