Prefer to view this content on our website? Click here.

Dear Fellow Investor,

Three Hot Stock Splits To Buy Right Now

Stock splits may not change the intrinsic value of a company, but they almost always change something just as important: investor behavior.

At the start of June 2025, we highlighted why these corporate actions are worth watching. Even though a split simply adjusts the share count and price proportionally, it often acts as a bullish signal about management confidence, business strength, and future expectations. And historically, liquidity improves, retail participation jumps, and momentum accelerates in the months that follow.

Think about it this way: If a high-quality name has climbed to $500 or $1,000 a share, a stock split can reset the price to a more psychologically appealing level—inviting a new wave of buyers who previously felt priced out. That increase in demand can become a powerful catalyst.

That’s exactly what we’re seeing today with three widely followed names that recently split and continue to look compelling on the post-split pullback.

Below are three stock splits you may want to keep on your radar, each offering a fundamentally strong setup, renewed analyst optimism, and attractive upside potential.

Company: O’Reilly Automotive (SYM: ORLY)

One of our early June highlights was O’Reilly Automotive, a long-time outperformer in the auto parts retail space. At the time, the stock traded around $1,365 before executing its 15:1 stock split, reducing the share price to the $90–$100 range.

Fast forward to today, and ORLY trades near $100—but despite the lower share price, its outlook is stronger than ever.

Major analysts have been raising their targets across the board:

-

Goldman Sachs increased its price target by $13 to $121.

-

Barclays nudged its target higher to $91.

-

Raymond James upgraded the stock to “outperform,” calling the recent pullback an attractive entry point.

-

Morgan Stanley reiterated its bullish stance with a $115 target.

What’s driving this optimism? Analysts continue to stress the company’s powerful competitive position, recession-resistant business model, and relentless market share gains. According to commentary cited by Seeking Alpha, analysts highlighted:

“Our thesis remains intact; we continue to view ORLY as a best-in-class retailer with the ability to continue gaining market share in the structurally advantaged auto parts sector.”

That confidence is rooted in O’Reilly’s impressive Q3’25 comparable sales growth of +5.6%, beating the Street’s expectations of +4.7%. Add in consistent cash flow, a strong balance sheet, and decades-long operational excellence, and ORLY remains one of the most reliable performers in consumer retail.

Even after the split, ORLY’s fundamentals haven’t changed at all—and with a more accessible share price, it has room to attract fresh demand and resume its long-term outperformance trend.

Trader Marketing Group

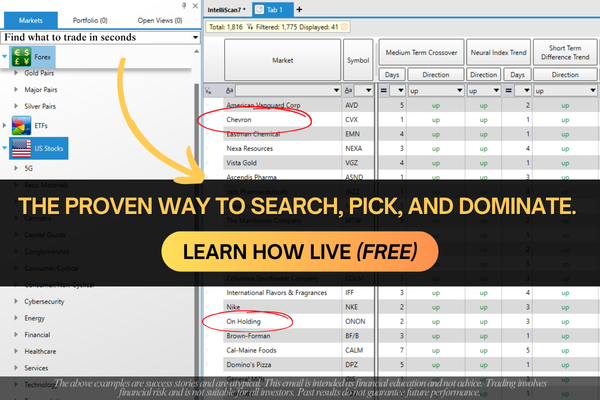

NEW METHOD: search, pick, and dominate

Looking for a new trading method?

Between Fed decisions, earnings surprises, and geopolitical headlines, knowing what and when to trade feels impossible.

But the rollercoaster doesn't have to be so wild.

What if you could identify high-probability trades in seconds using artificial intelligence, and plan your entire trading day in as little as 15 minutes?

(By clicking the links and image above, you will automatically register and opt-in to receive emails from Vantagepoint A.I.)

No more emotional decisions. No more stress. Just clear direction on what to trade, with day or swing trading confidence in just a couple clicks.

When you know what's likely to happen 1-3 days in advance, you remove the anxiety and start trading with conviction.

The markets may be unpredictable, but your strategy doesn't have to be.

Discover this A.I. strategy at no cost and see how traders are achieving consistent wins daily.

(By clicking the links and image above, you will automatically register and opt-in to receive emails from Vantagepoint A.I.)

Don't trade blind when Tesla's about to unveil something that "defies physics."

Company: Interactive Brokers (SYM: IBKR)

Another June split worth paying attention to is Interactive Brokers (SYM: IBKR), which executed a 4:1 split and now trades near $61.52—still comfortably valued given its growth trajectory and rising analyst targets.

As one of the most technologically advanced brokerage platforms in the world, IBKR has spent the last decade evolving from a niche platform for active traders into a full-scale global brokerage for both retail and institutional clients. Its transformation into an automated, highly scalable financial services provider is gaining recognition on Wall Street.

Most recently:

-

BMO Capital raised its price target by $2 and reiterated an outperform rating following the company’s strong earnings report.

-

Goldman Sachs bumped its target up to $93 with a buy rating.

-

Analysts at CICC initiated coverage with an outperform and a $91 target.

According to commentary summarized by Investing.com:

“CICC highlighted the company’s transformation from an electronic market maker into an automated broker that serves both retail and institutional clients.”

This shift is important—IBKR is no longer simply a platform for high-frequency traders. It’s becoming a global brokerage powerhouse with diverse revenue streams, exceptional cost efficiency, and one of the most sophisticated tech infrastructures in the industry.

The recent split brought shares down to a more attractive level, and with recurring revenue rising, interest income stabilizing, and global customer growth accelerating, IBKR looks well-positioned to continue climbing.

If markets remain active—and 2025 is shaping up to be exactly that—Interactive Brokers could be one of the biggest software-driven winners in financial services.

Small Caps Daily

Why SGD Could Be Wall Street’s Next Sustainability Sleeper Hit

Safe & Green Development Corp. (NASDAQ: SGD) is a sub-$10 million sustainability company that has evolved from modular construction into an environmental powerhouse. Through its Resource Group acquisition, SGD operates composting facilities and produces SURGRO™ engineered soil using proprietary technology—targeting a market projected at $69.4 billion by 2033. The company eliminated all convertible debt, secured $9 million in growth capital, and focuses on waste-to-value solutions. CEO David Villarreal emphasizes operational excellence and shareholder value. SGD positions itself at the intersection of sustainability, infrastructure, and clean tech, offering investors early exposure to scalable green innovation with real assets and operations.

See how SGD is positioning itself at the center of the next trillion-dollar sustainability trend.

Company: Fastenal (SYM: FAST)

Finally, Fastenal, a major industrial and construction supply distributor, completed a 2:1 stock split in May. After the split, shares settled around $39.55, creating an oversold setup that looks increasingly attractive.

Several recent catalysts add to the bullish case:

-

Director Sam Hseng-Hung Hsu purchased 1,000 shares for $42,450, a notable insider buy that signals confidence in the company’s long-term prospects.

-

The stock has already priced in a wave of pessimism tied to previous downgrades and earnings concerns—setting the stage for a potential rebound.

-

A key technical factor: from its recent levels around $39.50, the stock has a clear path to refill its bearish gap at $46, representing meaningful near-term upside.

Fastenal benefits from strong customer relationships, reliable cash flow, and a diversified product portfolio covering fasteners, construction materials, industrial supplies, and logistics services. Its model thrives during periods of economic expansion, but it also holds up surprisingly well during slowdowns thanks to its essential role in manufacturing and construction supply chains.

With the split behind it, an insider buy on the books, and sentiment poised to swing back in its favor, FAST offers one of the more compelling industrial setups heading into 2026.

Trade Algo

Is this your new #1 enemy in trading?

Imagine this scenario…You are a super-intelligent investor who can scan through millions of data, detect patterns, and execute savvy trades… in just minutes.

It would be an unfair advantage, right?

Welcome to the AI Age, where AI can make trading decisions in milliseconds.

Take Minotaur Capital as an example.

The hedge fund replaced human analysts with AI… and… ended up beating the benchmark index by more than two times.

Here's the good news...

You can get a taste of using A.I. technology to find the top momentum trades.

As a Behind the Markets reader, we’d like to offer you a SPECIAL gift where you can sign up for our SMS “dark pool alerts” for FREE.

Click here to claim FREE SMS dark pool alerts now.

Are there any other stocks with recent buyback programs that you've got your eye on? What other sectors of the market are you currently interested in? Hit "reply" to this email and let us know your thoughts!