| From | Fraser Institute <[email protected]> |

| Subject | Home affordability, Measuring tax progressivity, and Canadian banking |

| Date | November 22, 2025 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Mortgage payments for typical home now exceeds 50% of after-tax family income in every Ontario urban centre; 110% in Toronto [[link removed]]

Home Ownership and Rent Affordability in Canadian CMAs, 2014-2023 finds that while house prices have increased, BC, Ontario, and Atlantic Canadian worker salaries have largely stagnated from 2014-2023, which has also contributed to the increase in after-tax earnings spent on mortgage payments.

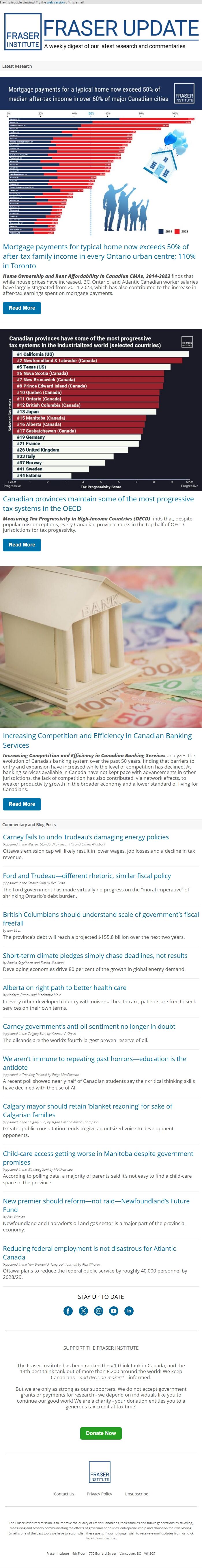

Read More [[link removed]] Canadian provinces maintain some of the most progressive tax systems in the OECD [[link removed]]

Measuring Tax Progressivity in High-Income Countries (OECD) finds that, despite popular misconceptions, every Canadian province ranks in the top half of OECD jurisdictions for tax progessivity.

Read More [[link removed]] [[link removed]] Increasing Competition and Efficiency in Canadian Banking Services [[link removed]]

Increasing Competition and Efficiency in Canadian Banking Services analyzes the evolution of Canada’s banking system over the past 50 years, finding that barriers to entry and expansion have increased while the level of competition has declined. As banking services available in Canada have not kept pace with advancements in other jurisdictions, the lack of competition has also contributed, via network effects, to weaker productivity growth in the broader economy and a lower standard of living for Canadians.

Read More [[link removed]] Commentary and Blog Posts Carney fails to undo Trudeau’s damaging energy policies [[link removed]] (Appeared in the Western Standard) by Tegan Hill and Elmira Aliakbari

Ottawa's emission cap will likely result in lower wages, job losses and a decline in tax revenue.

Ford and Trudeau—different rhetoric, similar fiscal policy [[link removed]] (Appeared in the Ottawa Sun) by Ben Eisen

The Ford government has made virtually no progress on the “moral imperative” of shrinking Ontario's debt burden.

British Columbians should understand scale of government’s fiscal freefall [[link removed]] by Ben Eisen

The province's debt will reach a projected $155.8 billion over the next two years.

Short-term climate pledges simply chase deadlines, not results [[link removed]] by Annika Segelhorst and Elmira Aliakbari

Developing economies drive 80 per cent of the growth in global energy demand.

Alberta on right path to better health care [[link removed]] by Nadeem Esmail and Mackenzie Moir

In every other developed country with universal health care, patients are free to seek services on their own terms.

Carney government’s anti-oil sentiment no longer in doubt [[link removed]] (Appeared in the Calgary Sun) by Kenneth P. Green

The oilsands are the world’s fourth-largest proven reserve of oil.

We aren’t immune to repeating past horrors—education is the antidote [[link removed]] (Appeared in Trending Politics) by Paige MacPherson

A recent poll showed nearly half of Canadian students say their critical thinking skills have declined with the use of AI.

Calgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families [[link removed]] (Appeared in the Calgary Sun) by Tegan Hill and Austin Thompson

Greater public consultation tends to give an outsized voice to development opponents.

Child-care access getting worse in Manitoba despite government promises [[link removed]] (Appeared in the Winnipeg Sun) by Matthew Lau

According to polling data, a majority of parents said it’s not easy to find a child-care space in the province.

New premier should reform—not raid—Newfoundland’s Future Fund [[link removed]] by Alex Whalen

Newfoundland and Labrador’s oil and gas sector is a major part of the provincial economy.

Reducing federal employment is not disastrous for Atlantic Canada [[link removed]] (Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen

Ottawa plans to reduce the federal public service by roughly 40,000 personnel by 2028/29.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Home Ownership and Rent Affordability in Canadian CMAs, 2014-2023 finds that while house prices have increased, BC, Ontario, and Atlantic Canadian worker salaries have largely stagnated from 2014-2023, which has also contributed to the increase in after-tax earnings spent on mortgage payments.

Read More [[link removed]] Canadian provinces maintain some of the most progressive tax systems in the OECD [[link removed]]

Measuring Tax Progressivity in High-Income Countries (OECD) finds that, despite popular misconceptions, every Canadian province ranks in the top half of OECD jurisdictions for tax progessivity.

Read More [[link removed]] [[link removed]] Increasing Competition and Efficiency in Canadian Banking Services [[link removed]]

Increasing Competition and Efficiency in Canadian Banking Services analyzes the evolution of Canada’s banking system over the past 50 years, finding that barriers to entry and expansion have increased while the level of competition has declined. As banking services available in Canada have not kept pace with advancements in other jurisdictions, the lack of competition has also contributed, via network effects, to weaker productivity growth in the broader economy and a lower standard of living for Canadians.

Read More [[link removed]] Commentary and Blog Posts Carney fails to undo Trudeau’s damaging energy policies [[link removed]] (Appeared in the Western Standard) by Tegan Hill and Elmira Aliakbari

Ottawa's emission cap will likely result in lower wages, job losses and a decline in tax revenue.

Ford and Trudeau—different rhetoric, similar fiscal policy [[link removed]] (Appeared in the Ottawa Sun) by Ben Eisen

The Ford government has made virtually no progress on the “moral imperative” of shrinking Ontario's debt burden.

British Columbians should understand scale of government’s fiscal freefall [[link removed]] by Ben Eisen

The province's debt will reach a projected $155.8 billion over the next two years.

Short-term climate pledges simply chase deadlines, not results [[link removed]] by Annika Segelhorst and Elmira Aliakbari

Developing economies drive 80 per cent of the growth in global energy demand.

Alberta on right path to better health care [[link removed]] by Nadeem Esmail and Mackenzie Moir

In every other developed country with universal health care, patients are free to seek services on their own terms.

Carney government’s anti-oil sentiment no longer in doubt [[link removed]] (Appeared in the Calgary Sun) by Kenneth P. Green

The oilsands are the world’s fourth-largest proven reserve of oil.

We aren’t immune to repeating past horrors—education is the antidote [[link removed]] (Appeared in Trending Politics) by Paige MacPherson

A recent poll showed nearly half of Canadian students say their critical thinking skills have declined with the use of AI.

Calgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families [[link removed]] (Appeared in the Calgary Sun) by Tegan Hill and Austin Thompson

Greater public consultation tends to give an outsized voice to development opponents.

Child-care access getting worse in Manitoba despite government promises [[link removed]] (Appeared in the Winnipeg Sun) by Matthew Lau

According to polling data, a majority of parents said it’s not easy to find a child-care space in the province.

New premier should reform—not raid—Newfoundland’s Future Fund [[link removed]] by Alex Whalen

Newfoundland and Labrador’s oil and gas sector is a major part of the provincial economy.

Reducing federal employment is not disastrous for Atlantic Canada [[link removed]] (Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen

Ottawa plans to reduce the federal public service by roughly 40,000 personnel by 2028/29.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor