Email

The Waiting Room | After the Shutdown: Will Congress Take Any Action on Health Care?

| From | Lincoln Square <[email protected]> |

| Subject | The Waiting Room | After the Shutdown: Will Congress Take Any Action on Health Care? |

| Date | November 20, 2025 3:05 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

Greetings, Lincoln Square readers!

When we left off two weeks ago, the federal government was in its fifth or sixth week of being shut down due to a standoff between Republicans and Democrats over several critical issues … most prominently, the enhanced ACA tax credits which are still, as of this writing, scheduled to expire at the end of December … less than six weeks from today.

As you likely know by now, while the latter is still (sadly) the case, the former no longer is: A few days later, 8 Senate Democrats joined 52 Senate Republicans in voting to go ahead and re-open the government without an extension of the upgraded subsidies. The House followed in kind a few days later, and after ~40 days or so, voila, the United States Government is back open for business, for good or for bad.

If you’re interested in my thoughts about how that all ended up playing out you can read it here. [ [link removed] ]

Now, Democrats were able to, at the very least, get Senate Majority Leader John Thune (R-S.D.) to agree to a vote on extending the enhanced tax credits sometime in December (House Speaker Mike Johnson (R-La.) has agreed to no such thing in his chamber, however)…and while this may sound like pretty weak tea, one important consequence is that the whole ordeal has casued both Senate and House Republicans to start scrambling to come up with some sort of alternative — any alternative — to doing the one thing they despise most of all: Agreeing to keep the Affordable Care Act strong and successful.

They can’t have that happen under any circumstances, and so they’ve started slapping together several half-baked, half-assed, poorly-thought-out “plans” for what to do instead … with the clock ticking.

I did a write-up of the one which seems to be the least awful so far [ [link removed] ] (from Louisiana GOP Sen. Bill Cassidy) … but my main takeaway from even that one is, in a nutshell:

“…it would be cumbersome, confusing and pointless at best, and a complete disaster at worst.”

The very short, simple version of what Cassidy has in mind seems to be taking the money which would otherwise go to ACA enrollees to bring their premiums down to affordable levels and instead give it to them in the form of Savings Accounts (either FSAs or HSAs) which they could then use to … bring their deductibles and co-pays down to affordable levels instead.

Again, it’s not necessarily a completely awful idea, but there’s been zero details on a hundred different key points which would have to be worked out first, and in the meantime, the enhanced subsidies expire on December 31.

More to the point, however: Even if such a proposal resulted in a ZERO dollar deductible, it still wouldn’t be much use if you can’t afford the premiums to enroll in the policy in the first place.

So, where does that leave things for, y’know, all ~24 million or so actual ACA enrollees?

Well, my general advice is this:

HOPE for some sort of last-minute, 11th-hour tax credit extension deal, but don’t count on it.

In other words, when you visit HealthCare.Gov, your states ACA exchange website or your authorized ACA enrollment broker or assister & shop around for 2026 healthcare coverage, do so under the assumption that the enhanced tax credits will NOT be in place in 2026.

Remember that while the initial deadline to get covered in most states is December 15th, you’d still have time to switch to a different plan between then and the final deadline of January 15 (again, in most states) for coverage starting February 1 if you have to. This would be impractical for many and could be confusing for others, but…it’s something.

See my annual ACA Enrollment Guide [ [link removed] ] for all of the initial & final deadlines, and remember that unlike other states, IDAHO residents only have until December 15 to enroll, period.

Another important thing to keep in mind is that, due to some very wonky behind-the-scenes stuff which I won’t bore you with here, there are fourteen states where GOLD plans cost LESS on average than SILVER plans … and where, alternately, average BRONZE plans should be dirt cheap.

If you live in any of the following states and are enrolled in a Silver plan right now, I strongly urge you to take a close look at Gold plans instead, as you may be pleasantly surprised. See here for details. [ [link removed] ]

Alaska, Arkansas, Colorado, Illinois, Maryland, Missouri, New Mexico, Pennsylvania, Texas, Vermont, Virginia, Washington, West Virginia and Wyoming.

IN ADDITION, there are nine states (some of which are included in the “cheap gold” list above as well) which have established, retooled or expanded their own supplemental, state-based subsidies [ [link removed] ] to help partly or fully mitigate the lost federal tax credits …

California, Colorado, Connecticut, Maryland, Massachusetts, New Jersey, New Mexico, Vermont and Washington.

… while D.C., Minnesota, New York and Oregon all have their Basic Health Plan (BHP) programs for enrollees who earn less than twice the Federal Poverty Level. Again, you can read details about each of these in my enrollment guide. [ [link removed] ]

Finally, if you earn more than four times the Federal Poverty Level (FPL) and will therefore not be eligible for federal tax credits in 2026, I mentioned last time that I’d provide more details about ways you can legally get your Modified Adjusted Gross Income (MAGI) below that critical 400% FPL threshold.

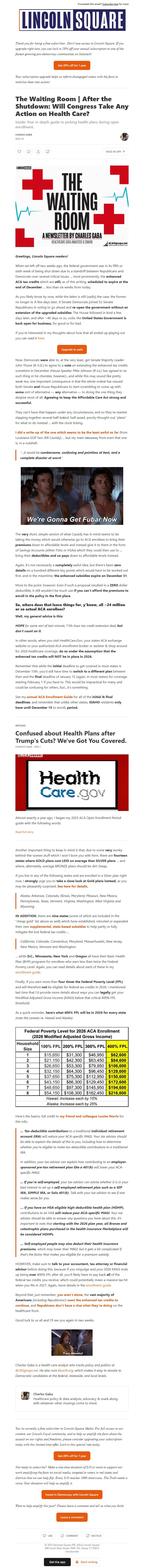

As a quick reminder, here’s what 400% FPL will be in 2026 for every state (note the caveats re. Hawaii and Alaska):

Here’s the basics; full credit to my friend and colleague Louise Norris [ [link removed] ] for this info:

… Tax-deductible contributions to a traditional individual retirement account (IRA) will reduce your ACA-specific MAGI. Your tax advisor should be able to explain the details of this to you, including how to determine whether you’re eligible to make tax-deductible contributions to a traditional IRA.

In addition, your tax advisor can explain how contributing to an employer-sponsored pre-tax retirement plan like a 401(k) will lower your ACA-specific MAGI.

... If you’re self-employed, your tax advisor can advise whether it is in your best interest to set up a self-employed retirement plan such as a SEP IRA, SIMPLE IRA, or Solo 401(k). Talk with your tax advisor to see if one makes sense for you.

… If you have an HSA-eligible high-deductible health plan (HDHP), contributions to an HSA will reduce your ACA-specific MAGI. Your tax advisor should be able to answer any questions you have about this. It’s important to note that starting with the 2026 plan year, all Bronze and catastrophic plans purchased in the health insurance Marketplace will be considered HDHPs.

… Self-employed people may also deduct their health insurance premiums, which may lower their MAGI, but it gets a bit complicated if that’s the factor that makes you eligible for a premium subsidy.

HOWEVER, make sure to talk to your accountant, tax attorney or financial advisor before doing this, because if you misjudge and your 2026 MAGI ends up being over 400% FPL after all, you’ll likely have to pay back all of the federal tax credits you receive, which could potentially mean a massive tax hit when you file in 2027. Again, more details in the enrollment guide. [ [link removed] ]

Beyond that, just remember, you aren’t alone [ [link removed] ], the vast majority of Americans (including Republicans!) want the enhanced tax credits to continue [ [link removed] ], and Repubicans don’t have a clue what they’re doing [ [link removed] ] on the healthcare front.

Good luck to us all and I’ll see you again in two weeks.

Charles Gaba is a health care analyst who tracks policy and politics at ACASignups.net [ [link removed] ]. He also runs Blue26.org [ [link removed] ], which makes it easy to donate to Democratic candidates at the federal, statewide, and local levels.

Unsubscribe [link removed]?

Greetings, Lincoln Square readers!

When we left off two weeks ago, the federal government was in its fifth or sixth week of being shut down due to a standoff between Republicans and Democrats over several critical issues … most prominently, the enhanced ACA tax credits which are still, as of this writing, scheduled to expire at the end of December … less than six weeks from today.

As you likely know by now, while the latter is still (sadly) the case, the former no longer is: A few days later, 8 Senate Democrats joined 52 Senate Republicans in voting to go ahead and re-open the government without an extension of the upgraded subsidies. The House followed in kind a few days later, and after ~40 days or so, voila, the United States Government is back open for business, for good or for bad.

If you’re interested in my thoughts about how that all ended up playing out you can read it here. [ [link removed] ]

Now, Democrats were able to, at the very least, get Senate Majority Leader John Thune (R-S.D.) to agree to a vote on extending the enhanced tax credits sometime in December (House Speaker Mike Johnson (R-La.) has agreed to no such thing in his chamber, however)…and while this may sound like pretty weak tea, one important consequence is that the whole ordeal has casued both Senate and House Republicans to start scrambling to come up with some sort of alternative — any alternative — to doing the one thing they despise most of all: Agreeing to keep the Affordable Care Act strong and successful.

They can’t have that happen under any circumstances, and so they’ve started slapping together several half-baked, half-assed, poorly-thought-out “plans” for what to do instead … with the clock ticking.

I did a write-up of the one which seems to be the least awful so far [ [link removed] ] (from Louisiana GOP Sen. Bill Cassidy) … but my main takeaway from even that one is, in a nutshell:

“…it would be cumbersome, confusing and pointless at best, and a complete disaster at worst.”

The very short, simple version of what Cassidy has in mind seems to be taking the money which would otherwise go to ACA enrollees to bring their premiums down to affordable levels and instead give it to them in the form of Savings Accounts (either FSAs or HSAs) which they could then use to … bring their deductibles and co-pays down to affordable levels instead.

Again, it’s not necessarily a completely awful idea, but there’s been zero details on a hundred different key points which would have to be worked out first, and in the meantime, the enhanced subsidies expire on December 31.

More to the point, however: Even if such a proposal resulted in a ZERO dollar deductible, it still wouldn’t be much use if you can’t afford the premiums to enroll in the policy in the first place.

So, where does that leave things for, y’know, all ~24 million or so actual ACA enrollees?

Well, my general advice is this:

HOPE for some sort of last-minute, 11th-hour tax credit extension deal, but don’t count on it.

In other words, when you visit HealthCare.Gov, your states ACA exchange website or your authorized ACA enrollment broker or assister & shop around for 2026 healthcare coverage, do so under the assumption that the enhanced tax credits will NOT be in place in 2026.

Remember that while the initial deadline to get covered in most states is December 15th, you’d still have time to switch to a different plan between then and the final deadline of January 15 (again, in most states) for coverage starting February 1 if you have to. This would be impractical for many and could be confusing for others, but…it’s something.

See my annual ACA Enrollment Guide [ [link removed] ] for all of the initial & final deadlines, and remember that unlike other states, IDAHO residents only have until December 15 to enroll, period.

Another important thing to keep in mind is that, due to some very wonky behind-the-scenes stuff which I won’t bore you with here, there are fourteen states where GOLD plans cost LESS on average than SILVER plans … and where, alternately, average BRONZE plans should be dirt cheap.

If you live in any of the following states and are enrolled in a Silver plan right now, I strongly urge you to take a close look at Gold plans instead, as you may be pleasantly surprised. See here for details. [ [link removed] ]

Alaska, Arkansas, Colorado, Illinois, Maryland, Missouri, New Mexico, Pennsylvania, Texas, Vermont, Virginia, Washington, West Virginia and Wyoming.

IN ADDITION, there are nine states (some of which are included in the “cheap gold” list above as well) which have established, retooled or expanded their own supplemental, state-based subsidies [ [link removed] ] to help partly or fully mitigate the lost federal tax credits …

California, Colorado, Connecticut, Maryland, Massachusetts, New Jersey, New Mexico, Vermont and Washington.

… while D.C., Minnesota, New York and Oregon all have their Basic Health Plan (BHP) programs for enrollees who earn less than twice the Federal Poverty Level. Again, you can read details about each of these in my enrollment guide. [ [link removed] ]

Finally, if you earn more than four times the Federal Poverty Level (FPL) and will therefore not be eligible for federal tax credits in 2026, I mentioned last time that I’d provide more details about ways you can legally get your Modified Adjusted Gross Income (MAGI) below that critical 400% FPL threshold.

As a quick reminder, here’s what 400% FPL will be in 2026 for every state (note the caveats re. Hawaii and Alaska):

Here’s the basics; full credit to my friend and colleague Louise Norris [ [link removed] ] for this info:

… Tax-deductible contributions to a traditional individual retirement account (IRA) will reduce your ACA-specific MAGI. Your tax advisor should be able to explain the details of this to you, including how to determine whether you’re eligible to make tax-deductible contributions to a traditional IRA.

In addition, your tax advisor can explain how contributing to an employer-sponsored pre-tax retirement plan like a 401(k) will lower your ACA-specific MAGI.

... If you’re self-employed, your tax advisor can advise whether it is in your best interest to set up a self-employed retirement plan such as a SEP IRA, SIMPLE IRA, or Solo 401(k). Talk with your tax advisor to see if one makes sense for you.

… If you have an HSA-eligible high-deductible health plan (HDHP), contributions to an HSA will reduce your ACA-specific MAGI. Your tax advisor should be able to answer any questions you have about this. It’s important to note that starting with the 2026 plan year, all Bronze and catastrophic plans purchased in the health insurance Marketplace will be considered HDHPs.

… Self-employed people may also deduct their health insurance premiums, which may lower their MAGI, but it gets a bit complicated if that’s the factor that makes you eligible for a premium subsidy.

HOWEVER, make sure to talk to your accountant, tax attorney or financial advisor before doing this, because if you misjudge and your 2026 MAGI ends up being over 400% FPL after all, you’ll likely have to pay back all of the federal tax credits you receive, which could potentially mean a massive tax hit when you file in 2027. Again, more details in the enrollment guide. [ [link removed] ]

Beyond that, just remember, you aren’t alone [ [link removed] ], the vast majority of Americans (including Republicans!) want the enhanced tax credits to continue [ [link removed] ], and Repubicans don’t have a clue what they’re doing [ [link removed] ] on the healthcare front.

Good luck to us all and I’ll see you again in two weeks.

Charles Gaba is a health care analyst who tracks policy and politics at ACASignups.net [ [link removed] ]. He also runs Blue26.org [ [link removed] ], which makes it easy to donate to Democratic candidates at the federal, statewide, and local levels.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a