Email

Special Report: How Much Does the California Budget Depend on High-Income Earners?

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | Special Report: How Much Does the California Budget Depend on High-Income Earners? |

| Date | November 19, 2025 9:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] How Much Does the California Budget Depend on High-Income Earners? Reliance on the $1 Million Club

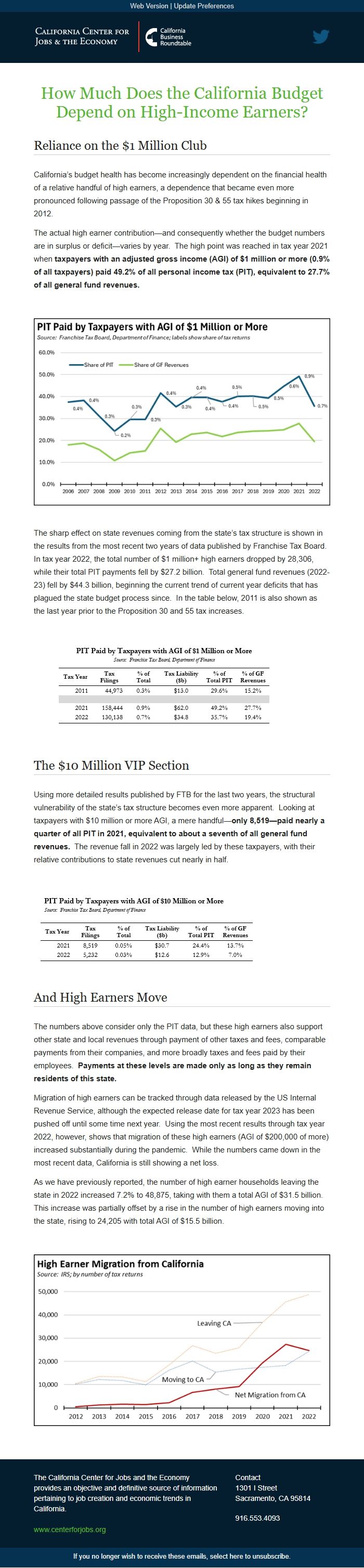

California’s budget health has become increasingly dependent on the financial health of a relative handful of high earners, a dependence that became even more pronounced following passage of the Proposition 30 & 55 tax hikes beginning in 2012.

The actual high earner contribution—and consequently whether the budget numbers are in surplus or deficit—varies by year. The high point was reached in tax year 2021 when taxpayers with an adjusted gross income (AGI) of $1 million or more (0.9% of all taxpayers) paid 49.2% of all personal income tax (PIT), equivalent to 27.7% of all general fund revenues.

The sharp effect on state revenues coming from the state’s tax structure is shown in the results from the most recent two years of data published by Franchise Tax Board. In tax year 2022, the total number of $1 million+ high earners dropped by 28,306, while their total PIT payments fell by $27.2 billion. Total general fund revenues (2022-23) fell by $44.3 billion, beginning the current trend of current year deficits that has plagued the state budget process since. In the table below, 2011 is also shown as the last year prior to the Proposition 30 and 55 tax increases.

The $10 Million VIP Section

Using more detailed results published by FTB for the last two years, the structural vulnerability of the state’s tax structure becomes even more apparent. Looking at taxpayers with $10 million or more AGI, a mere handful—only 8,519—paid nearly a quarter of all PIT in 2021, equivalent to about a seventh of all general fund revenues. The revenue fall in 2022 was largely led by these taxpayers, with their relative contributions to state revenues cut nearly in half.

And High Earners Move

The numbers above consider only the PIT data, but these high earners also support other state and local revenues through payment of other taxes and fees, comparable payments from their companies, and more broadly taxes and fees paid by their employees. Payments at these levels are made only as long as they remain residents of this state.

Migration of high earners can be tracked through data released by the US Internal Revenue Service, although the expected release date for tax year 2023 has been pushed off until some time next year. Using the most recent results through tax year 2022, however, shows that migration of these high earners (AGI of $200,000 of more) increased substantially during the pandemic. While the numbers came down in the most recent data, California is still showing a net loss.

As we have previously reported, the number of high earner households leaving the state in 2022 increased 7.2% to 48,875, taking with them a total AGI of $31.5 billion. This increase was partially offset by a rise in the number of high earners moving into the state, rising to 24,205 with total AGI of $15.5 billion.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

California’s budget health has become increasingly dependent on the financial health of a relative handful of high earners, a dependence that became even more pronounced following passage of the Proposition 30 & 55 tax hikes beginning in 2012.

The actual high earner contribution—and consequently whether the budget numbers are in surplus or deficit—varies by year. The high point was reached in tax year 2021 when taxpayers with an adjusted gross income (AGI) of $1 million or more (0.9% of all taxpayers) paid 49.2% of all personal income tax (PIT), equivalent to 27.7% of all general fund revenues.

The sharp effect on state revenues coming from the state’s tax structure is shown in the results from the most recent two years of data published by Franchise Tax Board. In tax year 2022, the total number of $1 million+ high earners dropped by 28,306, while their total PIT payments fell by $27.2 billion. Total general fund revenues (2022-23) fell by $44.3 billion, beginning the current trend of current year deficits that has plagued the state budget process since. In the table below, 2011 is also shown as the last year prior to the Proposition 30 and 55 tax increases.

The $10 Million VIP Section

Using more detailed results published by FTB for the last two years, the structural vulnerability of the state’s tax structure becomes even more apparent. Looking at taxpayers with $10 million or more AGI, a mere handful—only 8,519—paid nearly a quarter of all PIT in 2021, equivalent to about a seventh of all general fund revenues. The revenue fall in 2022 was largely led by these taxpayers, with their relative contributions to state revenues cut nearly in half.

And High Earners Move

The numbers above consider only the PIT data, but these high earners also support other state and local revenues through payment of other taxes and fees, comparable payments from their companies, and more broadly taxes and fees paid by their employees. Payments at these levels are made only as long as they remain residents of this state.

Migration of high earners can be tracked through data released by the US Internal Revenue Service, although the expected release date for tax year 2023 has been pushed off until some time next year. Using the most recent results through tax year 2022, however, shows that migration of these high earners (AGI of $200,000 of more) increased substantially during the pandemic. While the numbers came down in the most recent data, California is still showing a net loss.

As we have previously reported, the number of high earner households leaving the state in 2022 increased 7.2% to 48,875, taking with them a total AGI of $31.5 billion. This increase was partially offset by a rise in the number of high earners moving into the state, rising to 24,205 with total AGI of $15.5 billion.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor