Email

It’s Finally Over

| From | Ross Givens <[email protected]> |

| Subject | It’s Finally Over |

| Date | November 19, 2025 2:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Wednesday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

After 200 days trading above its 50-day moving average – one of the longest

streaks in history – the S&P 500 has closed below it two days in a row.

So let’s look at what the data tells us about what tends to happen when such

historical streaks end.

Chart of the Day

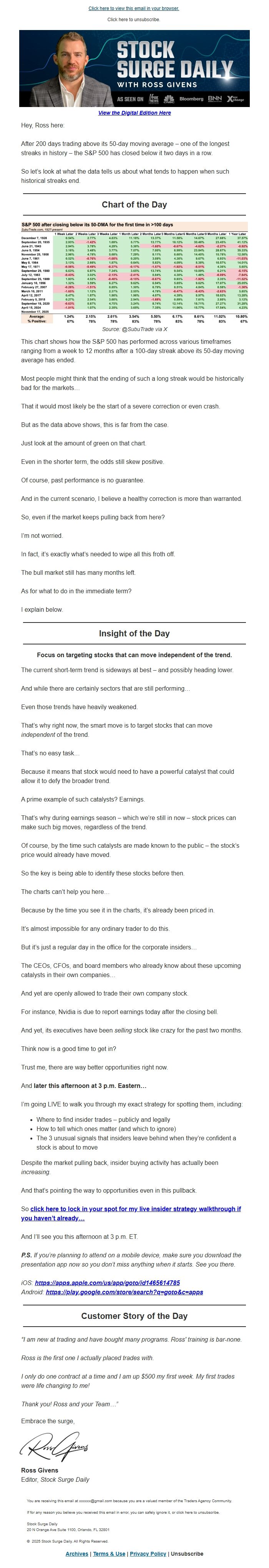

Source: @SubuTrade via X

This chart shows how the S&P 500 has performed across various timeframes

ranging from a week to 12 months after a 100-day streak above its 50-day moving

average has ended.

Most people might think that the ending of such a long streak would be

historically bad for the markets…

That it would most likely be the start of a severe correction or even crash.

But as the data above shows, this is far from the case.

Just look at the amount of green on that chart.

Even in the shorter term, the odds still skew positive.

Of course, past performance is no guarantee.

And in the current scenario, I believe a healthy correction is more than

warranted.

So, even if the market keeps pulling back from here?

I’m not worried.

In fact, it’s exactly what’s needed to wipe all this froth off.

The bull market still has many months left.

As for what to do in the immediate term?

I explain below.

Insight of the Day

Focus on targeting stocks that can move independent of the trend.

The current short-term trend is sideways at best – and possibly heading lower.

And while there are certainly sectors that are still performing…

Even those trends have heavily weakened.

That’s why right now, the smart move is to target stocks that can move

independent of the trend.

That’s no easy task…

Because it means that stock would need to have a powerful catalyst that could

allow it to defy the broader trend.

A prime example of such catalysts? Earnings.

That’s why during earnings season – which we’re still in now – stock prices

can make such big moves, regardless of the trend.

Of course, by the time such catalysts are made known to the public – the

stock’s price would already have moved.

So the key is being able to identify these stocks before then.

The charts can’t help you here…

Because by the time you see it in the charts, it’s already been priced in.

It’s almost impossible for any ordinary trader to do this.

But it’s just a regular day in the office for the corporate insiders…

The CEOs, CFOs, and board members who already know about these upcoming

catalysts in their own companies…

And yet are openly allowed to trade their own company stock.

For instance, Nvidia is due to report earnings today after the closing bell.

And yet, its executives have been selling stock like crazy for the past two

months.

Think now is a good time to get in?

Trust me, there are way better opportunities right now.

And later this afternoon at 3 p.m. Eastern…

I’m going LIVE to walk you through my exact strategy for spotting them,

including:

* Where to find insider trades – publicly and legally

* How to tell which ones matter (and which to ignore)

* The 3 unusual signals that insiders leave behind when they’re confident a

stock is about to move

Despite the market pulling back, insider buying activity has actually been

increasing.

And that’s pointing the way to opportunities even in this pullback.

So click here to lock in your spot for my live insider strategy walkthrough if

you haven’t already…

<[link removed]>

And I’ll see you this afternoon at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I am new at trading and have bought many programs. Ross' training is bar-none.

Ross is the first one I actually placed trades with.

I only do one contract at a time and I am up $500 my first week. My first

trades were life changing to me!

Thank you! Ross and your Team…”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here <[link removed]>

Hey, Ross here:

After 200 days trading above its 50-day moving average – one of the longest

streaks in history – the S&P 500 has closed below it two days in a row.

So let’s look at what the data tells us about what tends to happen when such

historical streaks end.

Chart of the Day

Source: @SubuTrade via X

This chart shows how the S&P 500 has performed across various timeframes

ranging from a week to 12 months after a 100-day streak above its 50-day moving

average has ended.

Most people might think that the ending of such a long streak would be

historically bad for the markets…

That it would most likely be the start of a severe correction or even crash.

But as the data above shows, this is far from the case.

Just look at the amount of green on that chart.

Even in the shorter term, the odds still skew positive.

Of course, past performance is no guarantee.

And in the current scenario, I believe a healthy correction is more than

warranted.

So, even if the market keeps pulling back from here?

I’m not worried.

In fact, it’s exactly what’s needed to wipe all this froth off.

The bull market still has many months left.

As for what to do in the immediate term?

I explain below.

Insight of the Day

Focus on targeting stocks that can move independent of the trend.

The current short-term trend is sideways at best – and possibly heading lower.

And while there are certainly sectors that are still performing…

Even those trends have heavily weakened.

That’s why right now, the smart move is to target stocks that can move

independent of the trend.

That’s no easy task…

Because it means that stock would need to have a powerful catalyst that could

allow it to defy the broader trend.

A prime example of such catalysts? Earnings.

That’s why during earnings season – which we’re still in now – stock prices

can make such big moves, regardless of the trend.

Of course, by the time such catalysts are made known to the public – the

stock’s price would already have moved.

So the key is being able to identify these stocks before then.

The charts can’t help you here…

Because by the time you see it in the charts, it’s already been priced in.

It’s almost impossible for any ordinary trader to do this.

But it’s just a regular day in the office for the corporate insiders…

The CEOs, CFOs, and board members who already know about these upcoming

catalysts in their own companies…

And yet are openly allowed to trade their own company stock.

For instance, Nvidia is due to report earnings today after the closing bell.

And yet, its executives have been selling stock like crazy for the past two

months.

Think now is a good time to get in?

Trust me, there are way better opportunities right now.

And later this afternoon at 3 p.m. Eastern…

I’m going LIVE to walk you through my exact strategy for spotting them,

including:

* Where to find insider trades – publicly and legally

* How to tell which ones matter (and which to ignore)

* The 3 unusual signals that insiders leave behind when they’re confident a

stock is about to move

Despite the market pulling back, insider buying activity has actually been

increasing.

And that’s pointing the way to opportunities even in this pullback.

So click here to lock in your spot for my live insider strategy walkthrough if

you haven’t already…

<[link removed]>

And I’ll see you this afternoon at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I am new at trading and have bought many programs. Ross' training is bar-none.

Ross is the first one I actually placed trades with.

I only do one contract at a time and I am up $500 my first week. My first

trades were life changing to me!

Thank you! Ross and your Team…”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost