Email

What Really Happened in the Markets Last Week

| From | Ross Givens <[email protected]> |

| Subject | What Really Happened in the Markets Last Week |

| Date | November 17, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Monday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Last week was a choppy one, with the market closing higher one day and lower

the next – ultimately ending the week lower.

With fears of a bubble mounting, this is only adding to the negative sentiment

around the market.

That’s why in times like these, it’s worth zooming out to get a clearer

picture.

Chart of the Day

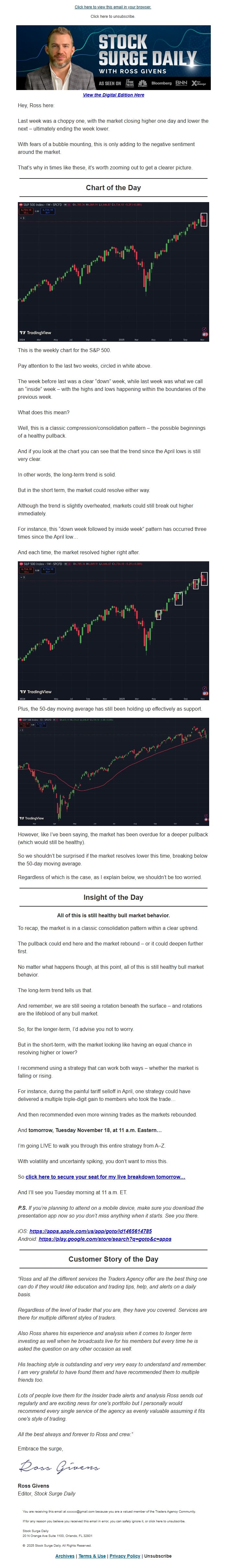

This is the weekly chart for the S&P 500.

Pay attention to the last two weeks, circled in white above.

The week before last was a clear “down” week, while last week was what we call

an “inside” week – with the highs and lows happening within the boundaries of

the previous week.

What does this mean?

Well, this is a classic compression/consolidation pattern – the possible

beginnings of a healthy pullback.

And if you look at the chart you can see that the trend since the April lows

is still very clear.

In other words, the long-term trend is solid.

But in the short term, the market could resolve either way.

Although the trend is slightly overheated, markets could still break out

higher immediately.

For instance, this “down week followed by inside week” pattern has occurred

three times since the April low…

And each time, the market resolved higher right after.

Plus, the 50-day moving average has still been holding up effectively as

support.

However, like I’ve been saying, the market has been overdue for a deeper

pullback (which would still be healthy).

So we shouldn’t be surprised if the market resolves lower this time, breaking

below the 50-day moving average.

Regardless of which is the case, as I explain below, we shouldn’t be too

worried.

Insight of the Day

All of this is still healthy bull market behavior.

To recap, the market is in a classic consolidation pattern within a clear

uptrend.

The pullback could end here and the market rebound – or it could deepen

further first.

No matter what happens though, at this point, all of this is still healthy

bull market behavior.

The long-term trend tells us that.

And remember, we are still seeing a rotation beneath the surface – and

rotations are the lifeblood of any bull market.

So, for the longer-term, I’d advise you not to worry.

But in the short-term, with the market looking like having an equal chance in

resolving higher or lower?

I recommend using a strategy that can work both ways – whether the market is

falling or rising.

For instance, during the painful tariff selloff in April, one strategy could

have delivered a multiple triple-digit gain to members who took the trade…

And then recommended even more winning trades as the markets rebounded.

And tomorrow, Tuesday November 18, at 11 a.m. Eastern…

I’m going LIVE to walk you through this entire strategy from A–Z.

With volatility and uncertainty spiking, you don’t want to miss this.

So click here to secure your seat for my live breakdown tomorrow…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross and all the different services the Traders Agency offer are the best

thing one can do if they would like education and trading tips, help, and

alerts on a daily basis.

Regardless of the level of trader that you are, they have you covered.

Services are there for multiple different styles of traders.

Also Ross shares his experience and analysis when it comes to longer term

investing as well when he broadcasts live for his members but every time he is

asked the question on any other occasion as well.

His teaching style is outstanding and very very easy to understand and

remember. I am very grateful to have found them and have recommended them to

multiple friends too.

Lots of people love them for the Insider trade alerts and analysis Ross sends

out regularly and are exciting news for one's portfolio but I personally would

recommend every single service of the agency as evenly valuable assuming it

fits one's style of trading.

All the best always and forever to Ross and crew.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Last week was a choppy one, with the market closing higher one day and lower

the next – ultimately ending the week lower.

With fears of a bubble mounting, this is only adding to the negative sentiment

around the market.

That’s why in times like these, it’s worth zooming out to get a clearer

picture.

Chart of the Day

This is the weekly chart for the S&P 500.

Pay attention to the last two weeks, circled in white above.

The week before last was a clear “down” week, while last week was what we call

an “inside” week – with the highs and lows happening within the boundaries of

the previous week.

What does this mean?

Well, this is a classic compression/consolidation pattern – the possible

beginnings of a healthy pullback.

And if you look at the chart you can see that the trend since the April lows

is still very clear.

In other words, the long-term trend is solid.

But in the short term, the market could resolve either way.

Although the trend is slightly overheated, markets could still break out

higher immediately.

For instance, this “down week followed by inside week” pattern has occurred

three times since the April low…

And each time, the market resolved higher right after.

Plus, the 50-day moving average has still been holding up effectively as

support.

However, like I’ve been saying, the market has been overdue for a deeper

pullback (which would still be healthy).

So we shouldn’t be surprised if the market resolves lower this time, breaking

below the 50-day moving average.

Regardless of which is the case, as I explain below, we shouldn’t be too

worried.

Insight of the Day

All of this is still healthy bull market behavior.

To recap, the market is in a classic consolidation pattern within a clear

uptrend.

The pullback could end here and the market rebound – or it could deepen

further first.

No matter what happens though, at this point, all of this is still healthy

bull market behavior.

The long-term trend tells us that.

And remember, we are still seeing a rotation beneath the surface – and

rotations are the lifeblood of any bull market.

So, for the longer-term, I’d advise you not to worry.

But in the short-term, with the market looking like having an equal chance in

resolving higher or lower?

I recommend using a strategy that can work both ways – whether the market is

falling or rising.

For instance, during the painful tariff selloff in April, one strategy could

have delivered a multiple triple-digit gain to members who took the trade…

And then recommended even more winning trades as the markets rebounded.

And tomorrow, Tuesday November 18, at 11 a.m. Eastern…

I’m going LIVE to walk you through this entire strategy from A–Z.

With volatility and uncertainty spiking, you don’t want to miss this.

So click here to secure your seat for my live breakdown tomorrow…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“Ross and all the different services the Traders Agency offer are the best

thing one can do if they would like education and trading tips, help, and

alerts on a daily basis.

Regardless of the level of trader that you are, they have you covered.

Services are there for multiple different styles of traders.

Also Ross shares his experience and analysis when it comes to longer term

investing as well when he broadcasts live for his members but every time he is

asked the question on any other occasion as well.

His teaching style is outstanding and very very easy to understand and

remember. I am very grateful to have found them and have recommended them to

multiple friends too.

Lots of people love them for the Insider trade alerts and analysis Ross sends

out regularly and are exciting news for one's portfolio but I personally would

recommend every single service of the agency as evenly valuable assuming it

fits one's style of trading.

All the best always and forever to Ross and crew.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost