|

|

Does the AI Emperor have no clothes on?

“If your company investment tree does not fork, you might be an AI hyperscaler.”

The Capitalist is a reader-supported publication

Reject Corporate Left Wing Journalism

If there is one thing that AI does. It is do things AT SPEED. It can write at speed, it can code at speed, it can make beautiful art at speed, it can put people out of work at speed and it also appears that it can hurtle towards a financial disaster at speed.

In the future when we look back this will likely be the moment that people will say that the writing was on the wall. We didn’t realize it in that moment, but this was when AI crossed the rubicon.

In the last few months at the Capitalist, we have started to flag some of the very thorny issues that were on the horizon for AI, but events have moved forward at such a rapid pace that they are no longer on the horizon.

In June we wrote about the power issues facing AI. In early October we flagged the staggering debt and financing issues facing AI. In late October we called attention to the revenue generation of AI (or rather the lack of it) Now, barely five months since we started, in the second week of November, these issues have exploded into the mainstream.

The AI Utopia envisioned in 2024 is now dealing with the cold reality of late 2025. Whispered mutterings consigned to the dark corners of the internet have transformed into serious questions, asked by serious people with serious projections and none of them look great.

What is coming in to focus with AI is three distinct issues:

There isn’t the power to fuel the AI Utopia.

There isn’t enough money to invest in building the AI Utopia.

The revenue being generated by AI is far from Utopia-esque.

The Body’s Most Abundant Protein (That Most People Are Losing Fast)

Your body loses 1–2% of its collagen every year after 30—and it’s the most abundant protein you’ve got. Translation? Less support for joints, skin, nails, and overall resilience.

NativePath Collagen helps you restore what time chips away—clean, grass-fed, no fillers, no junk. One study found that women taking just 5g a day saw meaningful improvements in bone support over a year. That’s the power of consistent collagen intake.

Just mix two flavorless scoops into coffee or any drink for 18g of easy, high-quality protein that supports joints, mobility, digestion, and more.

Power to the people! (And not for data centers.)

The power needed to run AI is on a scale that we can barely comprehend. America’s grid was strained before AI was even a functional reality. A Texas winter storm or a California heatwave could easily put it on its back. AI is only in its infancy now - we are not even close to AI Utopia yet - and its appetite is already becoming a major headache both in terms of feeding it but also politically. At town halls across the nation, questions are beginning to bubble up about why vast percentages of states electricity reserves are being gobbled up by data centers, driving prices higher than they already are for cash strapped residents.

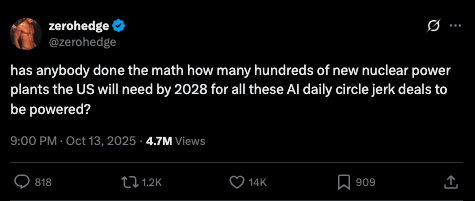

The ever more fantastical AI deals being announced almost daily promise a glittering future but do nothing to address the bottom line which is that the resources needed to power the “glittering future” just do not exist yet.

It’s also not just power. The ever ascending climb of AI Chips in the power stakes means that very soon “cooling” and “thermal management” of data centers will be the next goldmine industry. Air cooling will just not cut it anymore. It won’t be long before the drain of data centers will not just be power but water as well, as AI titans seek to quench the white hot fires that they have built. For anyone wanting a preview of what that will look like you only need to look at the bitter fight that has raged over who gets to use the waters of the Colorado River for the last century. It will be coming to a town hall near you ….. shortly.

Money Money Money (but from who?)

It is no secret to anyone that there has been an AI boom. The news is filled near daily with stories of billion dollar deals being inked, investments being made, and shortly after news breaks of a deal or an investment there is another story about how much XYZ company’s stock has soared off the back of the deal.

A lot of these are multi year deals to either build data centers, or supply chips to data centers, or to invest in the companies supplying the chips or data centers or both. However as we have noted previously, a lot of these deals are opaque and near circular in nature. You have AI companies investing in chip manufacturers and then buying chips from those manufacturers which causes stocks in one or both parties to rise. To paraphrase from Jeff Foxworthy “If your company investment tree does not fork, you might be an AI hyperscaler.”

This investment carousel makes it hard to pin down exactly how much is being invested, to who, and by who. There are questions starting to be raised by some that behind the fanfare, there maybe an investment shortfall between what actually exists and what it will take to fulfill these deals (dreams?). Quite how large that is, nobody really knows but some have estimated it to be as much as $1.4 trillion dollars. Were this to be the case, the question would be who fills that gap?

The obvious answer would be the Federal government, because AI has moved on from just a business proposition. There is now a national security dimension to winning the “AI War.” It is already being speculated by some that the US and China are in a Cold War over AI specifically, and tech in general.

President Trump has already made it clear with his investments in rare earth mineral mines, the federal acquisition of TikTok and the export restrictions on Nvidia relating to exporting its most advanced chips going to China, that the US is intent on fortifying and expanding on its AI, data, and rare earth security. However, restricting sales of cutting edge computer chips and prospecting for rare earth minerals is a long way from footing the bill to fund a hyperscaler CEO’s AI Utopian dreams. So it looks like any shortfall in funds will have to come from somewhere else.

Which leads us to…

Build AI ✅ - Upgrade AI ✅ - ????? - Profit….(maybe?)

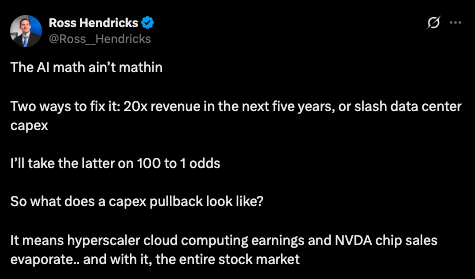

The power issues described above are a bottleneck to AI advancement, but they “could” be solved eventually even if there was some time lag. The investment holes “could” be plugged even if it was through unpopular means.

Those issues on a macroeconomic level (in a no-holds-barred-fantasyland,) “could” be resolved. But the AI revenue question makes these issues look like child’s play.

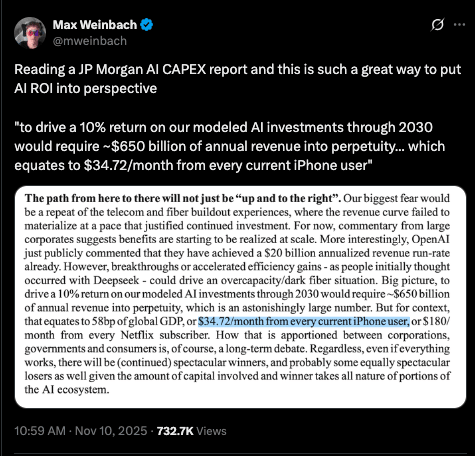

JP Morgan has highlighted this 800 pound gorilla issue in one of its latest reports perfectly.

“Big Picture, to drive a 10% return on our modeled AI investments through 2030 would require $650 billion of annual revenue into perpetuity which is an astonishingly large number. But for context that equates to 58bp of Global GDP, or $34.72 per month from every single iPhone user, or $180 per month from every NFLX subscriber” - JPM

The scale of this issue cannot be understated.

There are more than 8 billion people in the world. 1.56 billion of them have an iPhone. For the Hyperscaler’s AI gamble to work, according to JP Morgan, every, single, last one of them would need to pony up $40 a month for at least the next 5 years and probably longer.

Logic alone says that is an almost impossibly tall order, but when combined with the other issues we’ve noted above this gets in to the realm of near impossible.

Because, quite simply put, there is no compelling reason that exists today for why 1.56 billion people need to spend $40 a month, every month, on AI as it exists at the moment. Maybe that changes in the future, it could well do.

But ask yourself this: How many of your friends do you know who pay for AI? If they have an iPhone, ask them. If they don’t, that’s a problem for the AI industry.

Prospective AI subscription buyers are facing credit card delinquencies and auto loan defaults that are at their highest in history. Post-Covid Inflation in its broadest definition has touched nearly every facet of peoples lives from housing, to food and energy costs. The failures of the past be it the 2008 bailouts and the ensuing money printing, or the disaster of Obamacare that will likely see healthcare premiums skyrocket, are all weighing on the very people who the AI industry needs to go out and pay an extra $40 a month.

The people don’t have it, and even if they did have $40 a month to spare, why would you buy an AI subscription? (To fulfill Sam Altman’s AI Utopian dreams is likely not near the top of their list.)

And so it begins

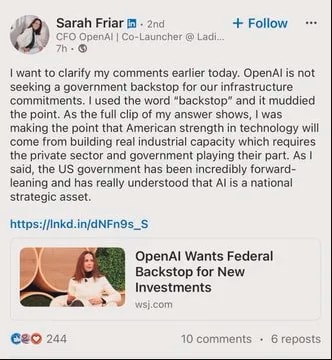

If there was a moment where, in the future, you will be able to look back to and pinpoint the moment when the wheels came off the AI bandwagon (or at least started to wobble) it will likely be OpenAI’s CFO Sarah Friar’s fumbled statement about a government providing federal guarantees to OpenAI’s investments.

Coming so soon after the announcement of OpenAI’s multi billion dollar deal with Oracle, the statement landed like a lead balloon.

Backlash was swift with even President Trump’s AI Czar David Sacks making a statement that there was “no federal bailout for AI.” His statement went further and for OpenAI it was a real problem. Posting on X, Sacks said “The U.S. has at least 5 major frontier model companies. If one fails, others will take its place,”

In so many words what Sacks said was basically that “There are a bunch of big players in the AI game and if some of them go bankrupt along the way, thats fine, the market will pick a winner and we’re not in the business of picking winners and losers.”

For the AI industry in general and OpenAI in particular, this was the starting pistol for unleashing two years worth of pent up skepticism about AI, and it came thick and fast.

In a frantic backpedal of a statement Sarah Friar tried to explain that she wasn’t asking for a “pre-bailout” but it didn’t work.

Sam Altman followed up with a Bill Ackman style essay on X later but the damage was done.

Suddenly all those massive deals were cast under a different light because, even if it wasn’t the case, it looked to many like OpenAI was making deals with the idea in the back of their mind that if they grew fast enough and became big enough they would be backstopped by the government because they would be “too big to fail.”

As we noted above, it is certainly true that AI now has a national security dimension, and that the AI “Cold War” with China means that the government has a vested interest to seeing America lead and ultimately win the AI race. However, in light of OpenAI’s botched handling of the “backstop” comments, it does appear that in the minds of some Hyperscalers, they have conflated Uncle Sam’s need for a robust AI industry with their personal zealotry to achieve AI Utopia at any price.

The boundless optimism is gone and now come the questions.

In the heady days of late 2024 no one asked how AI was going to make money, people were just amazed to see it work, but now they are asking and it is not going well. The initial awe surrounding AI has dissipated, people now want to know, “When is there going to be comparable revenue to cost, where is this financing coming from, how (who) is going to fund these mind boggling investments if 1.56 billion people don’t put their hand in their pocket and pay $40 a month?”

Sam Altman was pushed on this very subject in an interview with Brad Gerstner on the Bg2Pod and he became visibly defensive, snapping.

“If you want to sell your shares, I’ll find you a buyer,”

Altman’s defensive attitude did not play well amongst industry watchers.

It was not just OpenAI that is getting the tough questions. The AI industry in general has also been subject to a lot more scrutiny than it has been in the last 12 months. Instead of a non-stop stream of good news about “everything AI” there are now more than a few pieces of bad news.

Meta having spent billions on its own AI projects was put under the microscope after its Q3 results were announced. Mark Zuckerberg put up a vigorous defense of why Meta was spending as much as they were on AI but had to admit that they will likely have to spend even more in 2026. Investors were not happy and Meta’s shares tanked as a result.

Coreweave, yet another AI company that launched its IPO in 2025, took a beating when CNBC’s Jim Cramer pushed its CEO Mike Intrator to break down details of his company’s investment strategy and the CEO sidestepped the questions. The market punished Coreweave with a 20% drop in its share price.

Oracle, fresh off its blockbuster deal with Open AI and several surges in its share price, is now being scrutinized over the debt load that it is taking on.

Even Nvidia, once the golden child of the AI revolution, woke up to the announcement by SoftBank out of Japan (one of their earliest investors) that they would be liquidating their entire Nvidia holdings for $5.38 billion dollars. SoftBank was quick to point out that this had nothing to do with concerns over the AI industry and announced that they would be investing instead in OpenAI, increasing their stake from 4% to 11%. Granted, OpenAI has and will likely continue to buy a great many chips from Nvidia but this is yet more turbulence in the AI space.

The latest thing rocking the AI industry is that Michael Burry of “Big Short” fame recently posted that he has taken up a massive short position against both Nvidia and Palantir, accusing them of artificially extending the lifespan of the chips in their accounting, thus giving the impression of lower depreciation costs and therefore able to book higher profits. Burry has yet to provide all of his evidence but the sheer fact that it has been voiced runs contrary to the fairytale narrative that AI has benefited from up until now.

This accusation, if it were to be true, would do more than take the sheen off of AI, because it harkens back to what was going on inside the company that Nvidia replaced on the S&P500 in 2000.

Enron.

It is never a good thing when people start equating your company with Enron and suggesting that you are the modern Jeff Skilling.

As it stands right now there is no concrete proof yet if what Burry is claiming is true, but what is certainly true is that the AI Utopia being touted by Hyperscalers:

Needs more power than the grid can supply.

Will shortly require vast amounts of water to cool their data centers.

Produce a product that they have yet to figure out how to sell to 1.56 billion people for $40 a month.

Is made up of unfulfilled deals that total more than the GDP of developed nations based on the idea that 1.56 billion people WILL pay $40 per month.

This piece is not meant to denigrate AI or the path of progress we are on. AI, like the internet before it, will most likely take over the world one day and be as ubiquitous as the cellphone, of that we are almost certain.

But, given the state of play in the AI industry right now, with all that we have covered here, short of an earth shattering, transcendental, biblical, epoch level shift in “something” the question no one wants to ask hangs ominously in the air: Is the writing on the wall for the AI boom?

Or to put it more crudely, Does the AI Emperor have no clothes on?

The Capitalist is a reader-supported publication

Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.