Email

Rotational Breakout

| From | Ross Givens <[email protected]> |

| Subject | Rotational Breakout |

| Date | November 13, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Thursday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Neither the S&P 500 or the Nasdaq – the two most-watched indexes – are at all

time highs.

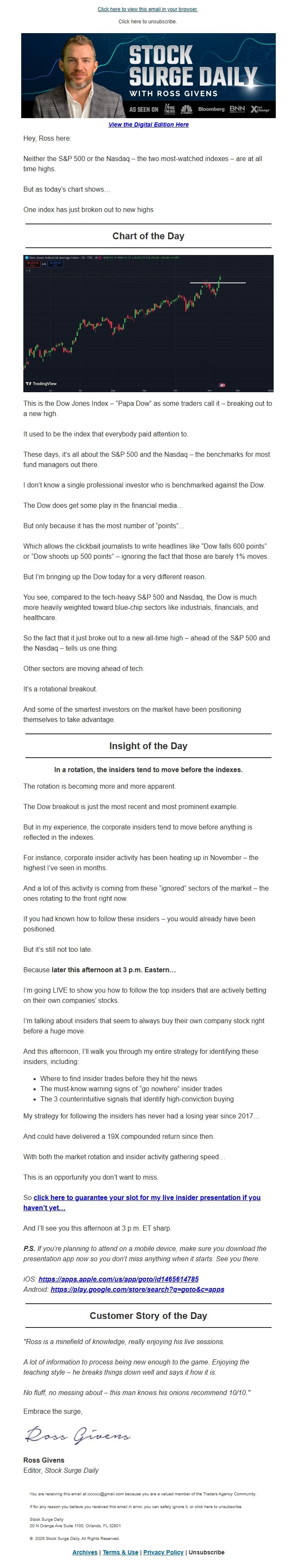

But as today’s chart shows…

One index has just broken out to new highs

Chart of the Day

This is the Dow Jones Index – “Papa Dow” as some traders call it – breaking

out to a new high.

It used to be the index that everybody paid attention to.

These days, it’s all about the S&P 500 and the Nasdaq – the benchmarks for

most fund managers out there.

I don’t know a single professional investor who is benchmarked against the Dow.

The Dow does get some play in the financial media…

But only because it has the most number of “points”...

Which allows the clickbait journalists to write headlines like “Dow falls 600

points” or “Dow shoots up 500 points” – ignoring the fact that those are barely

1% moves.

But I’m bringing up the Dow today for a very different reason.

You see, compared to the tech-heavy S&P 500 and Nasdaq, the Dow is much more

heavily weighted toward blue-chip sectors like industrials, financials, and

healthcare.

So the fact that it just broke out to a new all-time high – ahead of the S&P

500 and the Nasdaq – tells us one thing:

Other sectors are moving ahead of tech.

It’s a rotational breakout.

And some of the smartest investors on the market have been positioning

themselves to take advantage.

Insight of the Day

In a rotation, the insiders tend to move before the indexes.

The rotation is becoming more and more apparent.

The Dow breakout is just the most recent and most prominent example.

But in my experience, the corporate insiders tend to move before anything is

reflected in the indexes.

For instance, corporate insider activity has been heating up in November –

the highest I’ve seen in months.

And a lot of this activity is coming from these “ignored” sectors of the

market – the ones rotating to the front right now.

If you had known how to follow these insiders – you would already have been

positioned.

But it’s still not too late.

Because later this afternoon at 3 p.m. Eastern…

I’m going LIVE to show you how to follow the top insiders that are actively

betting on their own companies’ stocks.

I’m talking about insiders that seem to always buy their own company stock

right before a huge move.

And this afternoon, I’ll walk you through my entire strategy for identifying

these insiders, including:

* Where to find insider trades before they hit the news

* The must-know warning signs of “go nowhere” insider trades

* The 3 counterintuitive signals that identify high-conviction buying

My strategy for following the insiders has never had a losing year since 2017…

And could have delivered a 19X compounded return since then.

With both the market rotation and insider activity gathering speed…

This is an opportunity you don’t want to miss.

So click here to guarantee your slot for my live insider presentation if you

haven’t yet… <[link removed]>

And I’ll see you this afternoon at 3 p.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Ross is a minefield of knowledge, really enjoying his live sessions.

A lot of information to process being new enough to the game. Enjoying the

teaching style – he breaks things down well and says it how it is.

No fluff, no messing about – this man knows his onions recommend 10/10."

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Neither the S&P 500 or the Nasdaq – the two most-watched indexes – are at all

time highs.

But as today’s chart shows…

One index has just broken out to new highs

Chart of the Day

This is the Dow Jones Index – “Papa Dow” as some traders call it – breaking

out to a new high.

It used to be the index that everybody paid attention to.

These days, it’s all about the S&P 500 and the Nasdaq – the benchmarks for

most fund managers out there.

I don’t know a single professional investor who is benchmarked against the Dow.

The Dow does get some play in the financial media…

But only because it has the most number of “points”...

Which allows the clickbait journalists to write headlines like “Dow falls 600

points” or “Dow shoots up 500 points” – ignoring the fact that those are barely

1% moves.

But I’m bringing up the Dow today for a very different reason.

You see, compared to the tech-heavy S&P 500 and Nasdaq, the Dow is much more

heavily weighted toward blue-chip sectors like industrials, financials, and

healthcare.

So the fact that it just broke out to a new all-time high – ahead of the S&P

500 and the Nasdaq – tells us one thing:

Other sectors are moving ahead of tech.

It’s a rotational breakout.

And some of the smartest investors on the market have been positioning

themselves to take advantage.

Insight of the Day

In a rotation, the insiders tend to move before the indexes.

The rotation is becoming more and more apparent.

The Dow breakout is just the most recent and most prominent example.

But in my experience, the corporate insiders tend to move before anything is

reflected in the indexes.

For instance, corporate insider activity has been heating up in November –

the highest I’ve seen in months.

And a lot of this activity is coming from these “ignored” sectors of the

market – the ones rotating to the front right now.

If you had known how to follow these insiders – you would already have been

positioned.

But it’s still not too late.

Because later this afternoon at 3 p.m. Eastern…

I’m going LIVE to show you how to follow the top insiders that are actively

betting on their own companies’ stocks.

I’m talking about insiders that seem to always buy their own company stock

right before a huge move.

And this afternoon, I’ll walk you through my entire strategy for identifying

these insiders, including:

* Where to find insider trades before they hit the news

* The must-know warning signs of “go nowhere” insider trades

* The 3 counterintuitive signals that identify high-conviction buying

My strategy for following the insiders has never had a losing year since 2017…

And could have delivered a 19X compounded return since then.

With both the market rotation and insider activity gathering speed…

This is an opportunity you don’t want to miss.

So click here to guarantee your slot for my live insider presentation if you

haven’t yet… <[link removed]>

And I’ll see you this afternoon at 3 p.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

"Ross is a minefield of knowledge, really enjoying his live sessions.

A lot of information to process being new enough to the game. Enjoying the

teaching style – he breaks things down well and says it how it is.

No fluff, no messing about – this man knows his onions recommend 10/10."

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost