|

|

People are FLEEING blue states for Texas and Florida - Leftistism has consequences...

New York and New Jersey hemorrhaged nearly $690 billion in resident income over the past decade as 2.1 million high-earners fled soaring taxes and urban decay...

Hello Capitalists,

Here is everything you should be following today:

Texas and Florida are where everyone wants to be

Democrat states are losing BILLIONS in revenue

Coinbase abandons Delaware for Texas

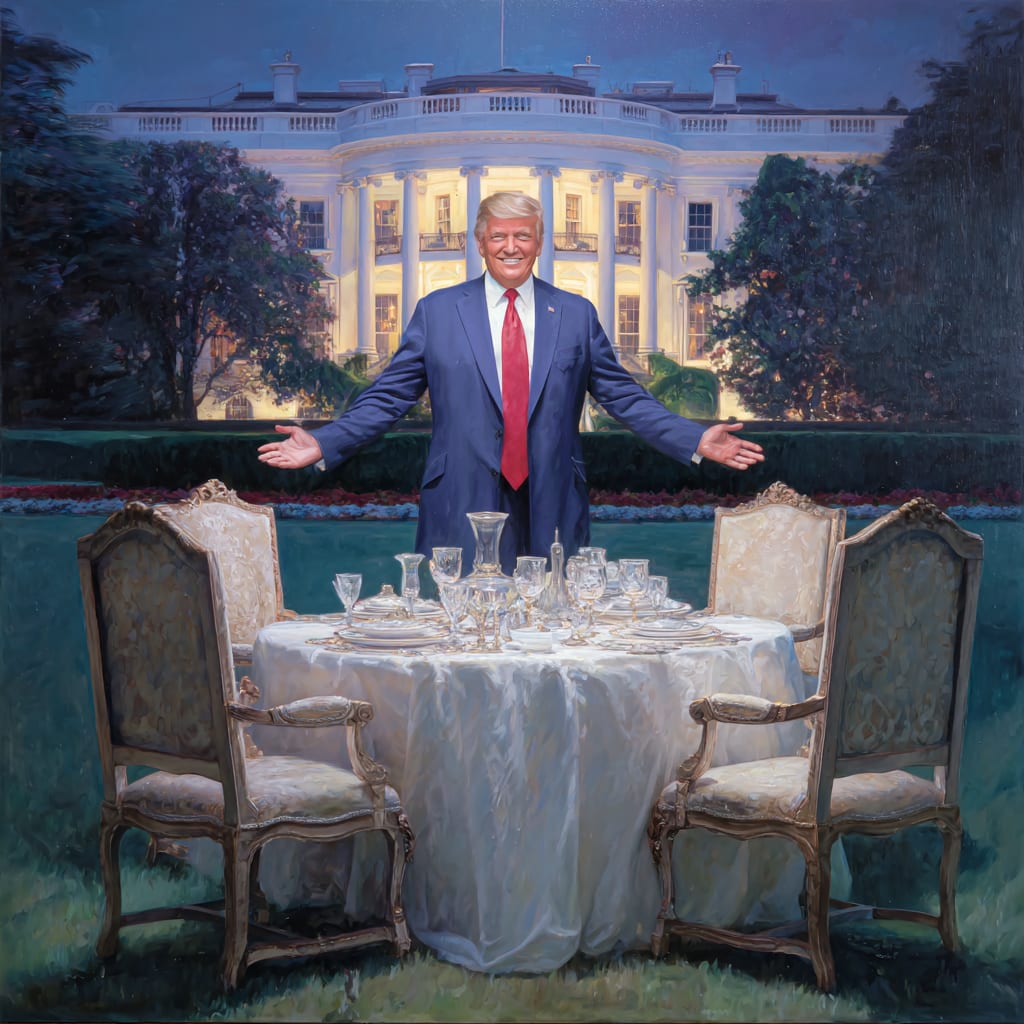

Trump’s high stakes dinner with Wall Street Titans is tonight

AMD surges on huge profit projection “gamble”

Coreweave CEO dodges the hard questions as stock tumbles

Today’s markets + assets:

✅ DOW: 48321.00 (⬆️ 0.82%)

✅ S&P: 6856.88 (⬆️ 0.15%)

🔴 NASDAQ: 23407.73 (⬇️ 0.26%)

⚠️✅CBOE VIX Volatility Index: 17.65 (⬆️ 2.14%)

✅ Gold: $4205.3 (⬇️ 2.16%)

✅ Silver: $53.325 (⬆️ 5.08%)

🔴 Bitcoin: $101,628 (⬇️ 1.56%)

The Capitalist is a reader-supported publication Reject Corporate Left-Wing Journalism

Blue States are hemorrhaging BILLIONS as residents flee

New York and New Jersey hemorrhaged nearly $690 billion in resident income over the past decade as 2.1 million high-earners fled soaring taxes and urban decay for sun-soaked havens like Florida and Texas, according to a stark new Census Bureau analysis.

Cumulative Losses Mount: From 2013 to 2022, New York shed $517.5 billion in incomes while New Jersey dropped $170.1 billion, ranking them among America’s top four net losers alongside California and Illinois.

Population Surge Southward: Florida scooped up $1 trillion in gains and 1.59 million new residents, with Texas close behind at $290 billion and 1.27 million, dwarfing other states’ inflows.

Domestic Migration Drains: Over 2011-2022, New York lost 1.76 million residents net, and New Jersey 350,000, fueling a historic wealth transfer that economist Steve Moore calls a “regional bloodletting.”

Economic Power Shifts: The exodus has turbocharged Southern economies while hollowing out Northeast powerhouses, highlighting how low-tax policies lure affluent workers and reshape national prosperity maps.

Coinbase DITCHES Delaware for business friendly Texas

In another black eye for blue states Crypto giant Coinbase announced Wednesday it has reincorporated in Texas, abandoning Delaware amid frustration with its unpredictable courts, following Elon Musk’s lead with Tesla and SpaceX. The shift aims to shield executives from shareholder lawsuits in a more business-friendly legal landscape.

Delaware Courts Unpredictable Rulings: Coinbase cites recent Chancery Court decisions, including Tesla’s $56 billion Musk pay package rescission, as eroding the state’s once-reliable consistency for corporate governance.

Texas Shields Corporate Insiders: A new Texas law empowers firms to restrict shareholder suits against executives for fiduciary breaches, providing stronger protections than Delaware’s framework.

Echoing Musk’s Anti-Delaware Campaign: Elon Musk urged companies to flee Delaware in a 2024 X post. Coinbase’s exit now joins Dropbox, TripAdvisor, and investor Andreessen Horowitz in the exodus from the blue state.

Together with American Hartford Gold

They’ve Pushed America To The Brink of Financial Ruin

The American Dream is being threatened by the policies of reckless politicians who’ve unleashed a wave of inflation not seen since the 1970s.

Citadel CEO Ken Griffin confirms a brutal truth: “We’re definitely on a sugar high in the US economy right now,” warning that we are in a “very pro-inflationary environment.”

In 2008, the S&P 500 plummeted more than 38%, wiping out trillions in retirement savings overnight. For those nearing retirement, the losses were catastrophic but they pale in comparison to what’s on the horizon.

This isn’t speculation. This view is shared by some of the world’s most wealthy and influential.

Look at the latest news from Goldman Sachs and JP Morgan. With the US Dollar’s devaluation and “smart money” demand soaring, their 2026 gold price forecast has surged to $4,500–$4,900 per ounce. The “smart money” isn’t waiting for the inevitable collapse.

They’re protecting their wealth with a little-known IRS loophole that allows a tax-free, penalty-free transfer of savings into physical gold.

You can follow the same path to security. If you have a 401(k), IRA, TSP, or pension, you can use the same wealth-saving loophole the elites have gatekept for decades.

Download the 2025 Wealth Protection Guide now and learn how to shield your savings from disaster.

This isn’t about getting rich quick. It’s about ensuring you don’t become poor overnight.

Trump’s Wall Street Titan dinner is tonight

President Donald Trump will host a high-stakes White House dinner Wednesday night with JPMorgan Chase CEO Jamie Dimon and Nasdaq’s top executive, forging closer ties to corporate titans amid drives to bolster U.S. capital markets and secure vital supply chains for national defense.

Private Guest List Confirmed: Administration officials have verified attendance for some key finance leaders, including Dimon, though the full roster remains undisclosed despite media inquiries.

JPMorgan’s Massive Pledge: JPM has already announced a $1.5 trillion, 10-year investment push into manufacturing, defense, energy, and tech, with $10 billion earmarked for equity in security-critical firms.

Strategic Economic Focus: Discussions are expected to target reshoring industries, expanding domestic production, and channeling private funds into high-tech and energy infrastructure for growth.

Series of Elite Engagements: The vent extends Trump’s pattern of discreet business summits, emphasizing private-sector roles in rebuilding American economic resilience.

AMD surges on profit forecasts as CEO claims AI is “The right gamble”

Advanced Micro Devices shares skyrocketed 10% Wednesday after CEO Lisa Su projected a 60% surge in data center revenue over three to five years, fueled by AI expansion and deals with OpenAI and Oracle, positioning the chipmaker to challenge Nvidia’s dominance.

Data Center Dominance Projected: Su dismissed fears about AI spending saying that “It’s the right gamble” expects $16 billion in 2025 data center sales to balloon 60% amid a $1 trillion AI market opportunity, including GPUs, CPUs, and networking gear.

Overall Revenue Acceleration: Forecasts project 35% company-wide growth from $34 billion base in 2025, with data centers comprising the bulk, plus 10% uptick in client PC and gaming chips.

Margin Expansion Ahead: AMD is targeting 55-58% gross margins and over 35% operating margins in 3-5 years, bolstering profitability as AI investments pay off.

Strategic Partnerships Sealed: The deals that AMD has locked in includes a 6-gigawatt OpenAI pact and a 50,000-chip Oracle supply deal starting in 2026. AMD is eyeing gigawatt-scale wins with MI450 and MI500 processors across multiple “hyperscalers” thanks to it’s chip design.

Coreweave CEO dodges questions over data center delays tied to failed acquisition

In a CNBC interview Tuesday, CoreWeave’s CEO Mike Intrator dodged questions on whether the failed attempt to acquire Core Scientific triggered crippling delays at multiple AI data centers, sending shares of both companies plunging—CoreWeave down 16% and Core Scientific 10%—as revised 2025 revenue forecasts fell short of Wall Street hopes.

Q3 Revenue Skyrockets Dramatically: CoreWeave posted $1.36 billion in third-quarter sales, a 134% surge from last year, fueled by booming AI infrastructure demand despite isolated setbacks.

Failed Acquisition Fuels Suspicion: The earlier $9 billion bid to buy Core Scientific collapsed in a shareholder vote, leaving lingering ties that now spotlight the bitcoin miner’s role in multi-state site delays.

Mega-Deals Anchor Backlog Strength: Coreweave’s $14.2 billion Meta pact and $22.4 billion OpenAI expansion remain untouched by hiccups, bolstering a robust pipeline across 41 global data centers.

Intense Remediation Hopes To Accelerates Progress: CoreWeave dispatched on-site teams for daily collaboration with contractors, vowing swift facility activations without eroding contract values or long-term growth trajectory.