Email

The Actual Pullback Happening Right Now

| From | Ross Givens <[email protected]> |

| Subject | The Actual Pullback Happening Right Now |

| Date | November 10, 2025 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Monday’s Stock Surge Daily

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back to a new trading week.

We saw a big dip in tech stocks last week, with the Magnificent 7 – as

measured by the Magnificent 7 ETF – pulling back by 3.4%.

The SPDR Tech Sector ETF (XLK), did even worse – falling by 4.2%.

And market leader Nvidia itself is down 7% for the week.

The tech pullback has understandably been dominating the financial headlines.

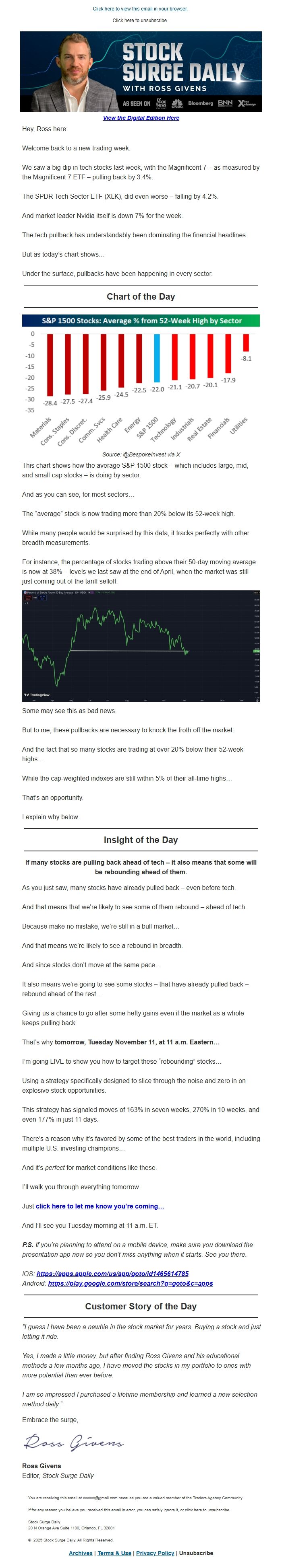

But as today’s chart shows…

Under the surface, pullbacks have been happening in every sector.

Chart of the Day

Source: @BespokeInvest via X

This chart shows how the average S&P 1500 stock – which includes large, mid,

and small-cap stocks – is doing by sector.

And as you can see, for most sectors…

The “average” stock is now trading more than 20% below its 52-week high.

While many people would be surprised by this data, it tracks perfectly with

other breadth measurements.

For instance, the percentage of stocks trading above their 50-day moving

average is now at 38% – levels we last saw at the end of April, when the market

was still just coming out of the tariff selloff.

Some may see this as bad news.

But to me, these pullbacks are necessary to knock the froth off the market.

And the fact that so many stocks are trading at over 20% below their 52-week

highs…

While the cap-weighted indexes are still within 5% of their all-time highs…

That’s an opportunity.

I explain why below.

Insight of the Day

If many stocks are pulling back ahead of tech – it also means that some will

be rebounding ahead of them.

As you just saw, many stocks have already pulled back – even before tech.

And that means that we’re likely to see some of them rebound – ahead of tech.

Because make no mistake, we’re still in a bull market…

And that means we’re likely to see a rebound in breadth.

And since stocks don’t move at the same pace…

It also means we’re going to see some stocks – that have already pulled back –

rebound ahead of the rest…

Giving us a chance to go after some hefty gains even if the market as a whole

keeps pulling back.

That’s why tomorrow, Tuesday November 11, at 11 a.m. Eastern…

I’m going LIVE to show you how to target these “rebounding” stocks…

Using a strategy specifically designed to slice through the noise and zero in

on explosive stock opportunities.

This strategy has signaled moves of 163% in seven weeks, 270% in 10 weeks, and

even 177% in just 11 days.

There’s a reason why it’s favored by some of the best traders in the world,

including multiple U.S. investing champions…

And it’s perfect for market conditions like these.

I’ll walk you through everything tomorrow.

Just click here to let me know you’re coming…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I guess I have been a newbie in the stock market for years. Buying a stock

and just letting it ride.

Yes, I made a little money, but after finding Ross Givens and his educational

methods a few months ago, I have moved the stocks in my portfolio to ones with

more potential than ever before.

I am so impressed I purchased a lifetime membership and learned a new

selection method daily.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Click here to view this email in your browser.

<[link removed]>

Click here to unsubscribe.

<[link removed]>

View the Digital Edition Here

<[link removed]>

Hey, Ross here:

Welcome back to a new trading week.

We saw a big dip in tech stocks last week, with the Magnificent 7 – as

measured by the Magnificent 7 ETF – pulling back by 3.4%.

The SPDR Tech Sector ETF (XLK), did even worse – falling by 4.2%.

And market leader Nvidia itself is down 7% for the week.

The tech pullback has understandably been dominating the financial headlines.

But as today’s chart shows…

Under the surface, pullbacks have been happening in every sector.

Chart of the Day

Source: @BespokeInvest via X

This chart shows how the average S&P 1500 stock – which includes large, mid,

and small-cap stocks – is doing by sector.

And as you can see, for most sectors…

The “average” stock is now trading more than 20% below its 52-week high.

While many people would be surprised by this data, it tracks perfectly with

other breadth measurements.

For instance, the percentage of stocks trading above their 50-day moving

average is now at 38% – levels we last saw at the end of April, when the market

was still just coming out of the tariff selloff.

Some may see this as bad news.

But to me, these pullbacks are necessary to knock the froth off the market.

And the fact that so many stocks are trading at over 20% below their 52-week

highs…

While the cap-weighted indexes are still within 5% of their all-time highs…

That’s an opportunity.

I explain why below.

Insight of the Day

If many stocks are pulling back ahead of tech – it also means that some will

be rebounding ahead of them.

As you just saw, many stocks have already pulled back – even before tech.

And that means that we’re likely to see some of them rebound – ahead of tech.

Because make no mistake, we’re still in a bull market…

And that means we’re likely to see a rebound in breadth.

And since stocks don’t move at the same pace…

It also means we’re going to see some stocks – that have already pulled back –

rebound ahead of the rest…

Giving us a chance to go after some hefty gains even if the market as a whole

keeps pulling back.

That’s why tomorrow, Tuesday November 11, at 11 a.m. Eastern…

I’m going LIVE to show you how to target these “rebounding” stocks…

Using a strategy specifically designed to slice through the noise and zero in

on explosive stock opportunities.

This strategy has signaled moves of 163% in seven weeks, 270% in 10 weeks, and

even 177% in just 11 days.

There’s a reason why it’s favored by some of the best traders in the world,

including multiple U.S. investing champions…

And it’s perfect for market conditions like these.

I’ll walk you through everything tomorrow.

Just click here to let me know you’re coming…

<[link removed]>

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download

the presentation app now so you don’t miss anything when it starts. See you

there.

iOS: [link removed]

<[link removed]>

Android: [link removed]

<[link removed]>

Customer Story of the Day

“I guess I have been a newbie in the stock market for years. Buying a stock

and just letting it ride.

Yes, I made a little money, but after finding Ross Givens and his educational

methods a few months ago, I have moved the stocks in my portfolio to ones with

more potential than ever before.

I am so impressed I purchased a lifetime membership and learned a new

selection method daily.”

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily

You are receiving this email at [email protected] because you are a

valued member of the Traders Agency Community.

If for any reason you believe you received this email in error, you can

safely ignore it, orclick here to unsubscribe

<[link removed]>

.

Stock Surge Daily

20 N Orange Ave Suite 1100, Orlando, FL 32801

© 2025 Stock Surge Daily. All Rights Reserved.

Archives <[link removed]> | Terms & Use

<[link removed]> | Privacy Policy

<[link removed]> | Unsubscribe

<[link removed]>

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- SparkPost