| From | xxxxxx <[email protected]> |

| Subject | The Real Fraud, Waste, and Abuse |

| Date | November 9, 2025 1:05 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[[link removed]]

THE REAL FRAUD, WASTE, AND ABUSE

[[link removed]]

Adam Gaffney, Danny McCormick, Steffie Woolhandler, David Himmelstein

November 7, 2025

Health Affairs

[[link removed]]

*

[[link removed]]

*

[[link removed]]

*

*

[[link removed]]

_ Medicare And Medicaid Privatization _

,

President Donald Trump and Elon Musk’s Department of Government

Efficiency (DOGE) have taken a chainsaw to the US federal government,

slashing programs, personnel, research, and global aid. The recently

enacted One Big Beautiful Bill Act (OBBBA) budget reconciliation

package, meanwhile, cuts nearly $1 trillion from Medicaid and the

Affordable Care Act over the next decade—adding more than 10 million

[[link removed]] to the ranks of the uninsured.

The OBBBA also slashes nearly $290 billion

[[link removed]] from food subsidies for the

poor and could trigger $490 billion

[[link removed]] in cuts

from Medicare.

The president and his congressional allies claim these cuts are needed

remedies for waste, fraud, and abuse. Yet, they turn a blind eye to

the trillions of dollars that private insurers drain from the public

Medicare and Medicaid programs. Indeed, one of the administration’s

first health financing actions—augmenting payments to Medicare’s

private-insurance subcontractors—will add $25 billion

[[link removed]]

to that waste in the coming year alone. If the administration were

serious about curbing waste and inefficiency, it would start by

reducing the diversion of public funds to these corporate

intermediaries.

Medicare Advantage Overpayments

Medicaid and Medicare, established in 1965 as publicly administered

health insurance programs for the poor and elderly, respectively, have

since the 1980s increasingly subcontracted coverage to private health

insurance firms (ostensibly to improve efficiency); government pays

them premiums, and the firms pay the providers. For decades, the

Medicare Payment Advisory Commission (MedPAC)—Medicare’s official

monitor—has warned that such privatization raises costs. Yet, today,

more than half

[[link removed]]

of Medicare beneficiaries are covered by private Medicare Advantage

(MA) insurers, lured by ubiquitous ads promising lower out-of-pocket

costs and extra benefits (for example, dental care and eyeglasses).

Meanwhile, state governments, which run Medicaid, now consign 75

percent

[[link removed]]

of Medicaid beneficiaries to private, mostly for-profit, managed care

plans.

MA insurers use various maneuvers (some legal and some not) to extract

overpayments (that is, payments exceeding the costs that Medicare

would have incurred had MA enrollees been covered under publicly

administered Medicare). Those maneuvers fall into two categories:

“upcoding,” that is, exaggerating enrollees’ severity of illness

to collect higher premiums from Medicare (from which, according to

MedPAC

[[link removed]],

insurers in MA garnered overpayments of $38 billion in 2024); and

favorable selection, that is, avoiding (or ejecting) unprofitably ill

enrollees, which raised taxpayers’ cost by an additional $41

billion.

Combined, upcoding plus favorable selection boosted taxpayers’ costs

for MA by more than $600 billion between 2007 and 2024; during that

period, MA plans’ overhead (a category encompassing profits as well

as expenditures for marketing, executives’ salaries, and the managed

care bureaucracy that deters care) totaled $592 billion

[[link removed]],

or 97 percent of the overpayments. For 2025, MedPAC estimates that MA

overpayments will boost taxpayers’ cost for MA enrollees by 20

percent

[[link removed]].

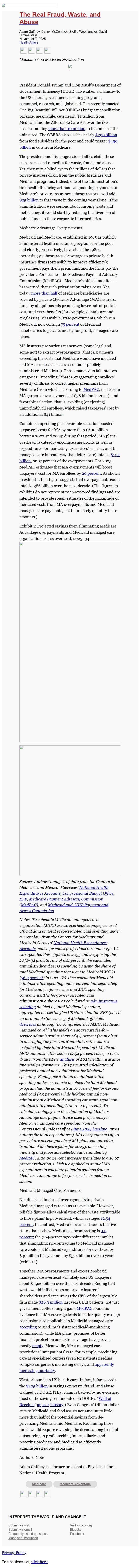

As shown in exhibit 1, that figure suggests that overpayments could

total $1,386 billion over the next decade. (The figures in exhibit 1

do not represent peer-reviewed findings and are intended to provide

rough estimates of the magnitude of increased costs from MA

overpayments and Medicaid managed care payments, not to precisely

quantify these amounts.)

Exhibit 1: Projected savings from eliminating Medicare Advantage

overpayments and Medicaid managed care organization excess overhead,

2025–34

_Source: Authors’ analysis of data from the Centers for Medicare and

Medicaid Services’ __National Health Expenditures Accounts_

[[link removed]]_,

__Congressional Budget Office_

[[link removed]]_,

__KFF_

[[link removed]]_,

__Medicare Payment Advisory Commission (MedPAC)_

[[link removed]]_,

and __Medicaid and CHIP Payment and Access Commission_

[[link removed]]_._

_Notes: To calculate Medicaid managed care organization (MCO) excess

overhead savings, we used official data on total projected Medicaid

spending under current law from the Centers for Medicare and Medicaid

Services’ __National Health Expenditures Accounts_

[[link removed]]_,

which provides projections through 2032. We extrapolated these figures

to 2033 and 2034 using the 2031–32 growth rate of 6.11 percent. We

calculated annual Medicaid MCO spending by using the share of total

Medicaid spending that went to Medicaid MCOs (__56.9 percent_

[[link removed]]_)

in 2022. We then calculated Medicaid administrative spending under

current law separately for Medicaid fee-for-service and MCO spending

components. The fee-for-service Medicaid administrative share was

calculated as __administrative spending_

[[link removed]]_

divided by total Medicaid spending, aggregated across the five US

states that the KFF (based on its annual state survey of Medicaid

officials) __describes_

[[link removed]]_

as having “no comprehensive MMC [Medicaid managed care].” This

yields an aggregate fee-for-service administrative share of 4.9

percent (equivalent to averaging the five states’ administrative

shares weighted by their total Medicaid spending). Medicaid MCO

administrative share (12.54 percent) was, in turn, drawn from the

KFF’s __analysis_

[[link removed]]_

of 2023 health insurance financial performance. This permitted

calculation of projected annual non-administrative Medicaid spending.

Finally, we estimated administrative spending under a scenario in

which the total Medicaid program had the administrative costs of

fee-for-service Medicaid (4.9 percent) while holding annual

non-administrative Medicaid spending constant, equal

non-administrative spending/(100.0–4.9 percent). To calculate

savings from the elimination of Medicare Advantage overpayments, we

used projections for Medicare managed care spending from the

Congressional Budget Office (__June 2024 baseline_

[[link removed]]_;

gross outlays for total expenditures). MA overpayments of 20 percent

are overpayments of MA plans compared to traditional Medicare plans

for 2025 from coding intensity and favorable selection as estimated by

__MedPAC_

[[link removed]]_.

A 20.00 percent increase translates to a 16.67 percent reduction,

which we applied to annual MA expenditures to calculate potential

savings from a Medicare Advantage to fee-for-service transition as

shown._

Medicaid Managed Care Payments

No official estimates of overpayments to private Medicaid managed care

plans are available. However, reliable figures allow calculation of

the waste attributable to those plans’ high overhead, which averages

12.54 percent

[[link removed]].

In contrast, Medicaid overhead across the five states that eschew

Medicaid subcontracting is 4.9 percent

[[link removed]];

the 7.64-percentage-point difference implies that eliminating

subcontracting to Medicaid managed care could cut Medicaid

expenditures for overhead by $40 billion this year and by $534 billion

over 10 years (exhibit 1).

Together, MA overpayments and excess Medicaid managed care overhead

will likely cost US taxpayers about $1,920 billion over the next

decade. Ending that waste would inflict losses on private insurers’

shareholders and executives (the CEO of the largest MA firm made $26.3

million

[[link removed]]

last year). But patients, not just government coffers, might gain.

MedPAC

[[link removed]]

found no evidence that MA coverage leads to better quality care, (a

conclusion also applicable to Medicaid managed care according

[[link removed]] to

MedPAC’s sister Medicaid-monitoring commission), while MA plans’

promises of better financial protection and extra coverage have proven

mostly empty [[link removed]].

Meanwhile, MA’s managed care restrictions limit patients’ care,

for example, precluding care at specialized centers (even for patients

needing complex surgeries), increasing delays, and apparently

increasing mortality

[[link removed]].

Waste abounds in US health care. In fact, it far exceeds the $205

billion [[link removed]] in savings on waste, fraud, and

abuse claimed by DOGE. (That claim is backed by no evidence; most of

the savings enumerated on DOGE’s “Wall of Receipts

[[link removed]]” appear

[[link removed]]

illusory

[[link removed]].)

Even Congress’ trillion-dollar cuts to Medicaid and food assistance

amount to little more than half of the potential savings from

de-privatizing Medicaid and Medicare. Reclaiming those funds would

require reversing the decades-long trend of outsourcing to

profit-seeking intermediaries and restoring Medicare and Medicaid as

efficiently administered public programs.

Authors’ Note

Adam Gaffney is a former president of Physicians for a National Health

Program.

* Medicare

[[link removed]]

* Medicare Advantage

[[link removed]]

*

[[link removed]]

*

[[link removed]]

*

*

[[link removed]]

INTERPRET THE WORLD AND CHANGE IT

Submit via web

[[link removed]]

Submit via email

Frequently asked questions

[[link removed]]

Manage subscription

[[link removed]]

Visit xxxxxx.org

[[link removed]]

Bluesky [[link removed]]

Facebook [[link removed]]

[link removed]

To unsubscribe, click the following link:

[link removed]

THE REAL FRAUD, WASTE, AND ABUSE

[[link removed]]

Adam Gaffney, Danny McCormick, Steffie Woolhandler, David Himmelstein

November 7, 2025

Health Affairs

[[link removed]]

*

[[link removed]]

*

[[link removed]]

*

*

[[link removed]]

_ Medicare And Medicaid Privatization _

,

President Donald Trump and Elon Musk’s Department of Government

Efficiency (DOGE) have taken a chainsaw to the US federal government,

slashing programs, personnel, research, and global aid. The recently

enacted One Big Beautiful Bill Act (OBBBA) budget reconciliation

package, meanwhile, cuts nearly $1 trillion from Medicaid and the

Affordable Care Act over the next decade—adding more than 10 million

[[link removed]] to the ranks of the uninsured.

The OBBBA also slashes nearly $290 billion

[[link removed]] from food subsidies for the

poor and could trigger $490 billion

[[link removed]] in cuts

from Medicare.

The president and his congressional allies claim these cuts are needed

remedies for waste, fraud, and abuse. Yet, they turn a blind eye to

the trillions of dollars that private insurers drain from the public

Medicare and Medicaid programs. Indeed, one of the administration’s

first health financing actions—augmenting payments to Medicare’s

private-insurance subcontractors—will add $25 billion

[[link removed]]

to that waste in the coming year alone. If the administration were

serious about curbing waste and inefficiency, it would start by

reducing the diversion of public funds to these corporate

intermediaries.

Medicare Advantage Overpayments

Medicaid and Medicare, established in 1965 as publicly administered

health insurance programs for the poor and elderly, respectively, have

since the 1980s increasingly subcontracted coverage to private health

insurance firms (ostensibly to improve efficiency); government pays

them premiums, and the firms pay the providers. For decades, the

Medicare Payment Advisory Commission (MedPAC)—Medicare’s official

monitor—has warned that such privatization raises costs. Yet, today,

more than half

[[link removed]]

of Medicare beneficiaries are covered by private Medicare Advantage

(MA) insurers, lured by ubiquitous ads promising lower out-of-pocket

costs and extra benefits (for example, dental care and eyeglasses).

Meanwhile, state governments, which run Medicaid, now consign 75

percent

[[link removed]]

of Medicaid beneficiaries to private, mostly for-profit, managed care

plans.

MA insurers use various maneuvers (some legal and some not) to extract

overpayments (that is, payments exceeding the costs that Medicare

would have incurred had MA enrollees been covered under publicly

administered Medicare). Those maneuvers fall into two categories:

“upcoding,” that is, exaggerating enrollees’ severity of illness

to collect higher premiums from Medicare (from which, according to

MedPAC

[[link removed]],

insurers in MA garnered overpayments of $38 billion in 2024); and

favorable selection, that is, avoiding (or ejecting) unprofitably ill

enrollees, which raised taxpayers’ cost by an additional $41

billion.

Combined, upcoding plus favorable selection boosted taxpayers’ costs

for MA by more than $600 billion between 2007 and 2024; during that

period, MA plans’ overhead (a category encompassing profits as well

as expenditures for marketing, executives’ salaries, and the managed

care bureaucracy that deters care) totaled $592 billion

[[link removed]],

or 97 percent of the overpayments. For 2025, MedPAC estimates that MA

overpayments will boost taxpayers’ cost for MA enrollees by 20

percent

[[link removed]].

As shown in exhibit 1, that figure suggests that overpayments could

total $1,386 billion over the next decade. (The figures in exhibit 1

do not represent peer-reviewed findings and are intended to provide

rough estimates of the magnitude of increased costs from MA

overpayments and Medicaid managed care payments, not to precisely

quantify these amounts.)

Exhibit 1: Projected savings from eliminating Medicare Advantage

overpayments and Medicaid managed care organization excess overhead,

2025–34

_Source: Authors’ analysis of data from the Centers for Medicare and

Medicaid Services’ __National Health Expenditures Accounts_

[[link removed]]_,

__Congressional Budget Office_

[[link removed]]_,

__KFF_

[[link removed]]_,

__Medicare Payment Advisory Commission (MedPAC)_

[[link removed]]_,

and __Medicaid and CHIP Payment and Access Commission_

[[link removed]]_._

_Notes: To calculate Medicaid managed care organization (MCO) excess

overhead savings, we used official data on total projected Medicaid

spending under current law from the Centers for Medicare and Medicaid

Services’ __National Health Expenditures Accounts_

[[link removed]]_,

which provides projections through 2032. We extrapolated these figures

to 2033 and 2034 using the 2031–32 growth rate of 6.11 percent. We

calculated annual Medicaid MCO spending by using the share of total

Medicaid spending that went to Medicaid MCOs (__56.9 percent_

[[link removed]]_)

in 2022. We then calculated Medicaid administrative spending under

current law separately for Medicaid fee-for-service and MCO spending

components. The fee-for-service Medicaid administrative share was

calculated as __administrative spending_

[[link removed]]_

divided by total Medicaid spending, aggregated across the five US

states that the KFF (based on its annual state survey of Medicaid

officials) __describes_

[[link removed]]_

as having “no comprehensive MMC [Medicaid managed care].” This

yields an aggregate fee-for-service administrative share of 4.9

percent (equivalent to averaging the five states’ administrative

shares weighted by their total Medicaid spending). Medicaid MCO

administrative share (12.54 percent) was, in turn, drawn from the

KFF’s __analysis_

[[link removed]]_

of 2023 health insurance financial performance. This permitted

calculation of projected annual non-administrative Medicaid spending.

Finally, we estimated administrative spending under a scenario in

which the total Medicaid program had the administrative costs of

fee-for-service Medicaid (4.9 percent) while holding annual

non-administrative Medicaid spending constant, equal

non-administrative spending/(100.0–4.9 percent). To calculate

savings from the elimination of Medicare Advantage overpayments, we

used projections for Medicare managed care spending from the

Congressional Budget Office (__June 2024 baseline_

[[link removed]]_;

gross outlays for total expenditures). MA overpayments of 20 percent

are overpayments of MA plans compared to traditional Medicare plans

for 2025 from coding intensity and favorable selection as estimated by

__MedPAC_

[[link removed]]_.

A 20.00 percent increase translates to a 16.67 percent reduction,

which we applied to annual MA expenditures to calculate potential

savings from a Medicare Advantage to fee-for-service transition as

shown._

Medicaid Managed Care Payments

No official estimates of overpayments to private Medicaid managed care

plans are available. However, reliable figures allow calculation of

the waste attributable to those plans’ high overhead, which averages

12.54 percent

[[link removed]].

In contrast, Medicaid overhead across the five states that eschew

Medicaid subcontracting is 4.9 percent

[[link removed]];

the 7.64-percentage-point difference implies that eliminating

subcontracting to Medicaid managed care could cut Medicaid

expenditures for overhead by $40 billion this year and by $534 billion

over 10 years (exhibit 1).

Together, MA overpayments and excess Medicaid managed care overhead

will likely cost US taxpayers about $1,920 billion over the next

decade. Ending that waste would inflict losses on private insurers’

shareholders and executives (the CEO of the largest MA firm made $26.3

million

[[link removed]]

last year). But patients, not just government coffers, might gain.

MedPAC

[[link removed]]

found no evidence that MA coverage leads to better quality care, (a

conclusion also applicable to Medicaid managed care according

[[link removed]] to

MedPAC’s sister Medicaid-monitoring commission), while MA plans’

promises of better financial protection and extra coverage have proven

mostly empty [[link removed]].

Meanwhile, MA’s managed care restrictions limit patients’ care,

for example, precluding care at specialized centers (even for patients

needing complex surgeries), increasing delays, and apparently

increasing mortality

[[link removed]].

Waste abounds in US health care. In fact, it far exceeds the $205

billion [[link removed]] in savings on waste, fraud, and

abuse claimed by DOGE. (That claim is backed by no evidence; most of

the savings enumerated on DOGE’s “Wall of Receipts

[[link removed]]” appear

[[link removed]]

illusory

[[link removed]].)

Even Congress’ trillion-dollar cuts to Medicaid and food assistance

amount to little more than half of the potential savings from

de-privatizing Medicaid and Medicare. Reclaiming those funds would

require reversing the decades-long trend of outsourcing to

profit-seeking intermediaries and restoring Medicare and Medicaid as

efficiently administered public programs.

Authors’ Note

Adam Gaffney is a former president of Physicians for a National Health

Program.

* Medicare

[[link removed]]

* Medicare Advantage

[[link removed]]

*

[[link removed]]

*

[[link removed]]

*

*

[[link removed]]

INTERPRET THE WORLD AND CHANGE IT

Submit via web

[[link removed]]

Submit via email

Frequently asked questions

[[link removed]]

Manage subscription

[[link removed]]

Visit xxxxxx.org

[[link removed]]

Bluesky [[link removed]]

Facebook [[link removed]]

[link removed]

To unsubscribe, click the following link:

[link removed]

Message Analysis

- Sender: Portside

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a