Email

Tracking Rising Tuition

| From | AEI DataPoints <[email protected]> |

| Subject | Tracking Rising Tuition |

| Date | November 6, 2025 11:58 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Also: Drivers of Divorce & Gold Market Shifts

AEIDataPoints-Banner ([link removed] )

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the Trump administration’s proposal to freeze college tuition, the influence of friends on marital status, and how US trade policy contributes to rising gold prices.

Don’t forget—subscribe ([link removed] ) and send DataPoints to a friend!

For inquiries, please email [email protected] (mailto:[email protected]) .

1. Confronting College Costs

01 Cooper ([link removed] )

Topline: Tuition charges after financial aid nearly doubled in real terms between 1990 and 2020, and there are early signs of accelerating price hikes post-pandemic. The Trump administration’s recently proposed “Compact for Academic Excellence in Higher Education” includes a commitment for signatory schools to freeze effective tuition rates for the next five years. But AEI’s Preston Cooper warns ([link removed] ) that, while tuition inflation is a pressing issue, a national tuition freeze is not the best solution.

Follow Florida’s Footsteps: Public universities in Florida have not raised their tuition since 2013. In-state students at Florida’s public universities pay the lowest tuition in the country, just $4,540 for the 2022–23 school year. This year, several Florida schools elected to raise out-of-state tuition while maintaining the in-state tuition rate, which would not be allowed under the Trump administration’s compact. The blanket tuition freeze would deny flexibility to schools with a proven history of fiscal responsibility.

Alternative Adjustments: Cooper makes the case that the Trump administration should create the conditions for downward pressure on tuition, like the student loan cap included in the One Big Beautiful Bill Act. He also suggests focusing on greater price transparency to create competition among schools and restricting federal funding for colleges where net tuition is high relative to postgraduate earnings.

"A national tuition freeze locks in current tuition prices, regardless of how those prices differ among institutions. This is unfair to institutions and states that have successfully held down costs.”

—Preston Cooper ([link removed] )

More on College Tuition

([link removed] )

2. Friendship's Influence on Marriage

02 Cox-1 ([link removed] )

Topline: Though the divorce rate is falling, one in three Americans who have ever been married end up divorced, according to the Pew Research Center. AEI’s Daniel A. Cox highlights ([link removed] ) how marital status in friendship circles influences marital success and satisfaction, finding that divorced Americans are more likely to have divorced friends.

Divorce Social Clustering: Among divorced Americans, 41 percent report that they have at least some close friends who are divorced, while only 21 percent of married Americans say the same. Most married Americans do not have divorced friends. Research has shown that if an individual’s friend gets divorced, the odds of that individual ending their own marriage increase dramatically. Even if someone in a more distant relationship, such as the friend of a friend, gets divorced, there remains a significant uptick in a person’s likelihood of divorce.

Shared Satisfaction: Marital satisfaction for men and women is lower among individuals with divorced friends. Among married Americans with no close divorced friends, 46 percent report complete satisfaction with their marital relationship. In contrast, 34 percent of Americans with at least some close divorced friends report complete satisfaction with their relationship.

"Not every marriage deserves to endure, and some relationships will carry on that probably should not, but marriage thrives more when it is not treated as an isolated commitment between two people. The success or failure of a marriage is due to more than the decisions two people make.”

—Daniel A. Cox ([link removed] )

More on Marriage

([link removed] )

3. The Global Flight to Gold

03 Lachman ([link removed] )

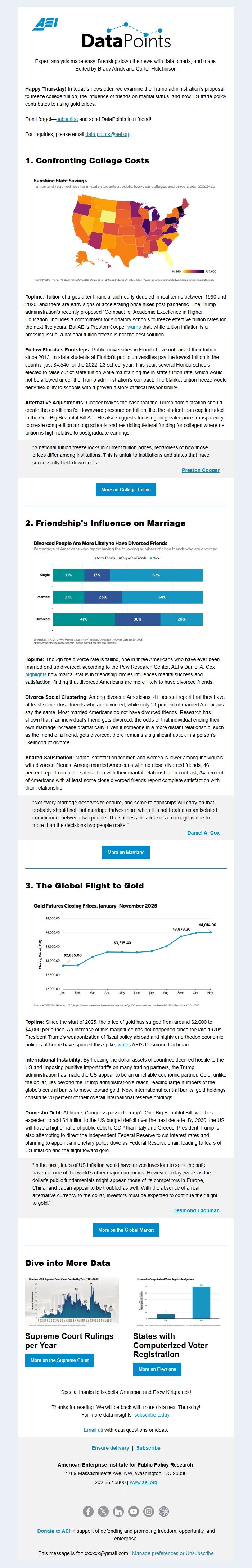

Topline: Since the start of 2025, the price of gold has surged from around $2,600 to $4,000 per ounce. An increase of this magnitude has not happened since the late 1970s. President Trump’s weaponization of fiscal policy abroad and highly unorthodox economic policies at home have spurred this spike, writes ([link removed] ) AEI’s Desmond Lachman.

International Instability: By freezing the dollar assets of countries deemed hostile to the US and imposing punitive import tariffs on many trading partners, the Trump administration has made the US appear to be an unreliable economic partner. Gold, unlike the dollar, lies beyond the Trump administration’s reach, leading large numbers of the globe’s central banks to move toward gold. Now, international central banks’ gold holdings constitute 20 percent of their overall international reserve holdings.

Domestic Debt: At home, Congress passed Trump’s One Big Beautiful Bill, which is expected to add $4 trillion to the US budget deficit over the next decade. By 2030, the US will have a higher ratio of public debt to GDP than Italy and Greece. President Trump is also attempting to direct the independent Federal Reserve to cut interest rates and planning to appoint a monetary policy dove as Federal Reserve chair, leading to fears of US inflation and the flight toward gold.

"In the past, fears of US inflation would have driven investors to seek the safe haven of one of the world’s other major currencies. However, today, weak as the dollar’s public fundamentals might appear, those of its competitors in Europe, China, and Japan appear to be troubled as well. With the absence of a real alternative currency to the dollar, investors must be expected to continue their flight to gold.”

—Desmond Lachman ([link removed] )

More on the Global Market

([link removed] )

Dive into More Data

04 White ([link removed] )

Supreme Court Rulings per Year ([link removed] )

More on the Supreme Court

([link removed] )

05 Fortier ([link removed] )

States with Computerized Voter Registration ([link removed] )

More on Elections

([link removed] )

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today ([link removed] ) .

Email us (mailto:[email protected]) with data questions or ideas.

Ensure delivery ([link removed] ) | Subscribe ([link removed] )

American Enterprise Institute for Public Policy Research

1789 Massachusetts Ave. NW, Washington, DC 20036

202.862.5800 | www.aei.org ([link removed] )

Unsubscribe from the link below ([link removed] )

Facebook ([link removed] )

X ([link removed] )

LinkedIn ([link removed] )

YouTube ([link removed] )

Instagram ([link removed] )

Podcast Logo New_Gray ([link removed] )

Donate to AEI ([link removed] ) in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] | Manage preferences or Unsubscribe ([link removed] )

AEIDataPoints-Banner ([link removed] )

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by Brady Africk and Carter Hutchinson

Happy Thursday! In today’s newsletter, we examine the Trump administration’s proposal to freeze college tuition, the influence of friends on marital status, and how US trade policy contributes to rising gold prices.

Don’t forget—subscribe ([link removed] ) and send DataPoints to a friend!

For inquiries, please email [email protected] (mailto:[email protected]) .

1. Confronting College Costs

01 Cooper ([link removed] )

Topline: Tuition charges after financial aid nearly doubled in real terms between 1990 and 2020, and there are early signs of accelerating price hikes post-pandemic. The Trump administration’s recently proposed “Compact for Academic Excellence in Higher Education” includes a commitment for signatory schools to freeze effective tuition rates for the next five years. But AEI’s Preston Cooper warns ([link removed] ) that, while tuition inflation is a pressing issue, a national tuition freeze is not the best solution.

Follow Florida’s Footsteps: Public universities in Florida have not raised their tuition since 2013. In-state students at Florida’s public universities pay the lowest tuition in the country, just $4,540 for the 2022–23 school year. This year, several Florida schools elected to raise out-of-state tuition while maintaining the in-state tuition rate, which would not be allowed under the Trump administration’s compact. The blanket tuition freeze would deny flexibility to schools with a proven history of fiscal responsibility.

Alternative Adjustments: Cooper makes the case that the Trump administration should create the conditions for downward pressure on tuition, like the student loan cap included in the One Big Beautiful Bill Act. He also suggests focusing on greater price transparency to create competition among schools and restricting federal funding for colleges where net tuition is high relative to postgraduate earnings.

"A national tuition freeze locks in current tuition prices, regardless of how those prices differ among institutions. This is unfair to institutions and states that have successfully held down costs.”

—Preston Cooper ([link removed] )

More on College Tuition

([link removed] )

2. Friendship's Influence on Marriage

02 Cox-1 ([link removed] )

Topline: Though the divorce rate is falling, one in three Americans who have ever been married end up divorced, according to the Pew Research Center. AEI’s Daniel A. Cox highlights ([link removed] ) how marital status in friendship circles influences marital success and satisfaction, finding that divorced Americans are more likely to have divorced friends.

Divorce Social Clustering: Among divorced Americans, 41 percent report that they have at least some close friends who are divorced, while only 21 percent of married Americans say the same. Most married Americans do not have divorced friends. Research has shown that if an individual’s friend gets divorced, the odds of that individual ending their own marriage increase dramatically. Even if someone in a more distant relationship, such as the friend of a friend, gets divorced, there remains a significant uptick in a person’s likelihood of divorce.

Shared Satisfaction: Marital satisfaction for men and women is lower among individuals with divorced friends. Among married Americans with no close divorced friends, 46 percent report complete satisfaction with their marital relationship. In contrast, 34 percent of Americans with at least some close divorced friends report complete satisfaction with their relationship.

"Not every marriage deserves to endure, and some relationships will carry on that probably should not, but marriage thrives more when it is not treated as an isolated commitment between two people. The success or failure of a marriage is due to more than the decisions two people make.”

—Daniel A. Cox ([link removed] )

More on Marriage

([link removed] )

3. The Global Flight to Gold

03 Lachman ([link removed] )

Topline: Since the start of 2025, the price of gold has surged from around $2,600 to $4,000 per ounce. An increase of this magnitude has not happened since the late 1970s. President Trump’s weaponization of fiscal policy abroad and highly unorthodox economic policies at home have spurred this spike, writes ([link removed] ) AEI’s Desmond Lachman.

International Instability: By freezing the dollar assets of countries deemed hostile to the US and imposing punitive import tariffs on many trading partners, the Trump administration has made the US appear to be an unreliable economic partner. Gold, unlike the dollar, lies beyond the Trump administration’s reach, leading large numbers of the globe’s central banks to move toward gold. Now, international central banks’ gold holdings constitute 20 percent of their overall international reserve holdings.

Domestic Debt: At home, Congress passed Trump’s One Big Beautiful Bill, which is expected to add $4 trillion to the US budget deficit over the next decade. By 2030, the US will have a higher ratio of public debt to GDP than Italy and Greece. President Trump is also attempting to direct the independent Federal Reserve to cut interest rates and planning to appoint a monetary policy dove as Federal Reserve chair, leading to fears of US inflation and the flight toward gold.

"In the past, fears of US inflation would have driven investors to seek the safe haven of one of the world’s other major currencies. However, today, weak as the dollar’s public fundamentals might appear, those of its competitors in Europe, China, and Japan appear to be troubled as well. With the absence of a real alternative currency to the dollar, investors must be expected to continue their flight to gold.”

—Desmond Lachman ([link removed] )

More on the Global Market

([link removed] )

Dive into More Data

04 White ([link removed] )

Supreme Court Rulings per Year ([link removed] )

More on the Supreme Court

([link removed] )

05 Fortier ([link removed] )

States with Computerized Voter Registration ([link removed] )

More on Elections

([link removed] )

Special thanks to Isabella Grunspan and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today ([link removed] ) .

Email us (mailto:[email protected]) with data questions or ideas.

Ensure delivery ([link removed] ) | Subscribe ([link removed] )

American Enterprise Institute for Public Policy Research

1789 Massachusetts Ave. NW, Washington, DC 20036

202.862.5800 | www.aei.org ([link removed] )

Unsubscribe from the link below ([link removed] )

Facebook ([link removed] )

X ([link removed] )

LinkedIn ([link removed] )

YouTube ([link removed] )

Instagram ([link removed] )

Podcast Logo New_Gray ([link removed] )

Donate to AEI ([link removed] ) in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] | Manage preferences or Unsubscribe ([link removed] )

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- HubSpot