Email

The Weekly Roundup from the Office of Rick Barnes

| From | Tarrant County Tax Office <[email protected]> |

| Subject | The Weekly Roundup from the Office of Rick Barnes |

| Date | November 6, 2025 1:09 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

News and Updates from the Office of Rick Barnes ([link removed]) .

[link removed]

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

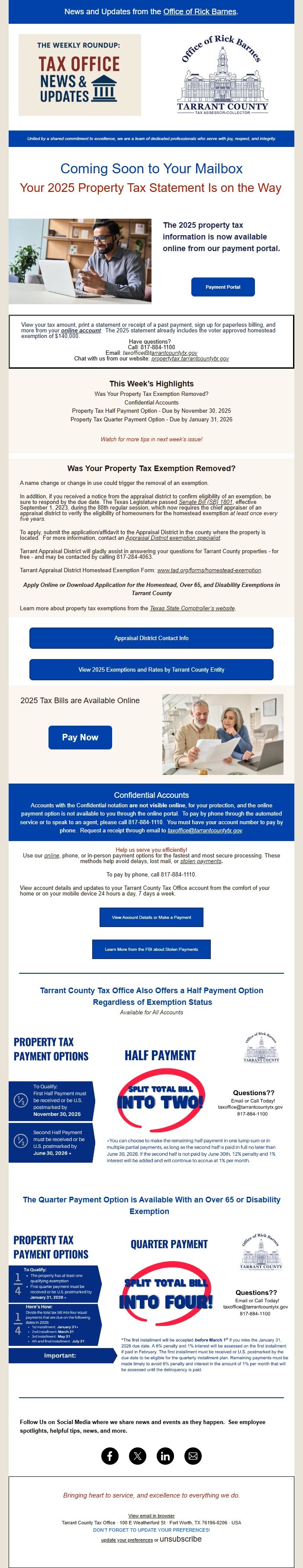

Coming Soon to Your Mailbox

Your 2025 Property Tax Statement Is on the Way

[link removed]

The 2025 property tax information is now available online from our payment portal.

Payment Portal ([link removed])

View your tax amount, print a statement or receipt of a past payment, sign up for paperless billing, and more from your online account ([link removed]) . The 2025 statement already includes the voter approved homestead exemption of $140,000.

Have questions?

Call: 817-884-1100

Email: [email protected] (mailto:[email protected]?subject=Question%20from%20Weekly%20Roundup&body=)

Chat with us from our website: propertytax.tarrantcountytx.gov

This Week’s Highlights

Was Your Property Tax Exemption Removed?

Confidential Accounts

Property Tax Half Payment Option - Due by November 30, 2025

Property Tax Quarter Payment Option - Due by January 31, 2026

Watch for more tips in next week’s issue!

Was Your Property Tax Exemption Removed?

A name change or change in use could trigger the removal of an exemption.

In addition, if you received a notice from the appraisal district to confirm eligibility of an exemption, be sure to respond by the due date. The Texas Legislature passed Senate Bill (SB) 1801 ([link removed]) , effective September 1, 2023, during the 88th regular session, which now requires the chief appraiser of an appraisal district to verify the eligibility of homeowners for the homestead exemption at least once every five years.

To apply, submit the application/affidavit to the Appraisal District in the county where the property is located. For more information, contact an Appraisal District exemption specialist ([link removed]) .

Tarrant Appraisal District will gladly assist in answering your questions for Tarrant County properties - for free - and may be contacted by calling 817-284-4063.

Tarrant Appraisal District Homestead Exemption Form: www.tad.org/forms/homestead-exemption.

Apply Online or Download Application for the Homestead, Over 65, and Disability Exemptions ([link removed]) in Tarrant County

Learn more about property tax exemptions from the Texas State Comptroller’s website ([link removed]) .

Appraisal District Contact Info ([link removed])

View 2025 Exemptions and Rates by Tarrant County Entity ([link removed])

2025 Tax Bills are Available Online

Pay Now ([link removed])

[link removed]

Confidential Accounts

Accounts with the Confidential notation are not visible online, for your protection, and the online payment option is not available to you through the online portal. To pay by phone through the automated service or to speak to an agent, please call 817-884-1110. You must have your account number to pay by phone. Request a receipt through email to [email protected] (mailto:[email protected]?subject=Confidential%20Account%20Receipt%20Request&body=Account%20Number(s)%3A) .

Help us serve you efficiently!

Use our online ([link removed]) , phone, or in-person payment options for the fastest and most secure processing. These methods help avoid delays, lost mail, or stolen payments ([link removed]) .

To pay by phone, call 817-884-1110.

View account details and updates to your Tarrant County Tax Office account from the comfort of your home or on your mobile device 24 hours a day, 7 days a week.

View Account Details or Make a Payment ([link removed])

Learn More from the FBI about Stolen Payments ([link removed])

Tarrant County Tax Office Also Offers a Half Payment Option Regardless of Exemption Status

Available for All Accounts

[link removed]

The Quarter Payment Option is Available With an Over 65 or Disability Exemption

[link removed]

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

[link removed]

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

Coming Soon to Your Mailbox

Your 2025 Property Tax Statement Is on the Way

[link removed]

The 2025 property tax information is now available online from our payment portal.

Payment Portal ([link removed])

View your tax amount, print a statement or receipt of a past payment, sign up for paperless billing, and more from your online account ([link removed]) . The 2025 statement already includes the voter approved homestead exemption of $140,000.

Have questions?

Call: 817-884-1100

Email: [email protected] (mailto:[email protected]?subject=Question%20from%20Weekly%20Roundup&body=)

Chat with us from our website: propertytax.tarrantcountytx.gov

This Week’s Highlights

Was Your Property Tax Exemption Removed?

Confidential Accounts

Property Tax Half Payment Option - Due by November 30, 2025

Property Tax Quarter Payment Option - Due by January 31, 2026

Watch for more tips in next week’s issue!

Was Your Property Tax Exemption Removed?

A name change or change in use could trigger the removal of an exemption.

In addition, if you received a notice from the appraisal district to confirm eligibility of an exemption, be sure to respond by the due date. The Texas Legislature passed Senate Bill (SB) 1801 ([link removed]) , effective September 1, 2023, during the 88th regular session, which now requires the chief appraiser of an appraisal district to verify the eligibility of homeowners for the homestead exemption at least once every five years.

To apply, submit the application/affidavit to the Appraisal District in the county where the property is located. For more information, contact an Appraisal District exemption specialist ([link removed]) .

Tarrant Appraisal District will gladly assist in answering your questions for Tarrant County properties - for free - and may be contacted by calling 817-284-4063.

Tarrant Appraisal District Homestead Exemption Form: www.tad.org/forms/homestead-exemption.

Apply Online or Download Application for the Homestead, Over 65, and Disability Exemptions ([link removed]) in Tarrant County

Learn more about property tax exemptions from the Texas State Comptroller’s website ([link removed]) .

Appraisal District Contact Info ([link removed])

View 2025 Exemptions and Rates by Tarrant County Entity ([link removed])

2025 Tax Bills are Available Online

Pay Now ([link removed])

[link removed]

Confidential Accounts

Accounts with the Confidential notation are not visible online, for your protection, and the online payment option is not available to you through the online portal. To pay by phone through the automated service or to speak to an agent, please call 817-884-1110. You must have your account number to pay by phone. Request a receipt through email to [email protected] (mailto:[email protected]?subject=Confidential%20Account%20Receipt%20Request&body=Account%20Number(s)%3A) .

Help us serve you efficiently!

Use our online ([link removed]) , phone, or in-person payment options for the fastest and most secure processing. These methods help avoid delays, lost mail, or stolen payments ([link removed]) .

To pay by phone, call 817-884-1110.

View account details and updates to your Tarrant County Tax Office account from the comfort of your home or on your mobile device 24 hours a day, 7 days a week.

View Account Details or Make a Payment ([link removed])

Learn More from the FBI about Stolen Payments ([link removed])

Tarrant County Tax Office Also Offers a Half Payment Option Regardless of Exemption Status

Available for All Accounts

[link removed]

The Quarter Payment Option is Available With an Over 65 or Disability Exemption

[link removed]

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp