| From | Fraser Institute <[email protected]> |

| Subject | Personal tax rates and biologic medicines |

| Date | July 11, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

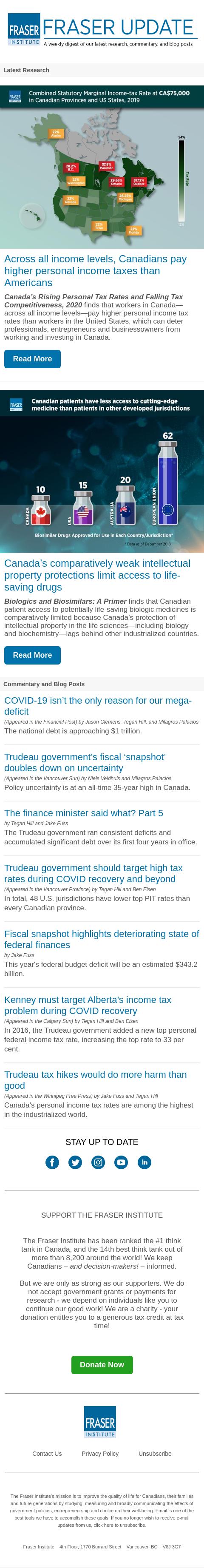

Across all income levels, Canadians pay higher personal income taxes than Americans

Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness, 2020 finds that workers in Canada—across all income levels—pay higher personal income tax rates than workers in the United States, which can deter professionals, entrepreneurs and businessowners from working and investing in Canada.

Read More [[link removed]]

Canada’s comparatively weak intellectual property protections limit access to life-saving drugs

Biologics and Biosimilars: A Primer finds that Canadian patient access to potentially life-saving biologic medicines is comparatively limited because Canada’s protection of intellectual property in the life sciences—including biology and biochemistry—lags behind other industrialized countries.

Read More [[link removed]]

Commentary and Blog Posts

------------------

COVID-19 isn’t the only reason for our mega-deficit [[link removed]]

(Appeared in the Financial Post) by Jason Clemens, Tegan Hill, and Milagros Palacios

The national debt is approaching $1 trillion.

Trudeau government’s fiscal ‘snapshot’ doubles down on uncertainty [[link removed]]

(Appeared in the Vancouver Sun) by Niels Veldhuis and Milagros Palacios

Policy uncertainty is at an all-time 35-year high in Canada.

The finance minister said what? Part 5 [[link removed]]

by Tegan Hill, Jake Fuss

The Trudeau government ran consistent deficits and accumulated significant debt over its first four years in office.

Trudeau government should target high tax rates during COVID recovery and beyond [[link removed]]

(Appeared in the Vancouver Province) by Tegan Hill and Ben Eisen

In total, 48 U.S. jurisdictions have lower top PIT rates than every Canadian province.

Fiscal snapshot highlights deteriorating state of federal finances [[link removed]]

by Jake Fuss

This year's federal budget deficit will be an estimated $343.2 billion.

Kenney must target Alberta’s income tax problem during COVID recovery [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill and Ben Eisen

In 2016, the Trudeau government added a new top personal federal income tax rate, increasing the top rate to 33 per cent.

Trudeau tax hikes would do more harm than good [[link removed]]

(Appeared in the Winnipeg Free Press)

by Jake Fuss and Tegan Hill

Canada’s personal income tax rates are among the highest in the industrialized world.

SUPPORT THE FRASER INSTITUTE

-----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

Across all income levels, Canadians pay higher personal income taxes than Americans

Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness, 2020 finds that workers in Canada—across all income levels—pay higher personal income tax rates than workers in the United States, which can deter professionals, entrepreneurs and businessowners from working and investing in Canada.

Read More [[link removed]]

Canada’s comparatively weak intellectual property protections limit access to life-saving drugs

Biologics and Biosimilars: A Primer finds that Canadian patient access to potentially life-saving biologic medicines is comparatively limited because Canada’s protection of intellectual property in the life sciences—including biology and biochemistry—lags behind other industrialized countries.

Read More [[link removed]]

Commentary and Blog Posts

------------------

COVID-19 isn’t the only reason for our mega-deficit [[link removed]]

(Appeared in the Financial Post) by Jason Clemens, Tegan Hill, and Milagros Palacios

The national debt is approaching $1 trillion.

Trudeau government’s fiscal ‘snapshot’ doubles down on uncertainty [[link removed]]

(Appeared in the Vancouver Sun) by Niels Veldhuis and Milagros Palacios

Policy uncertainty is at an all-time 35-year high in Canada.

The finance minister said what? Part 5 [[link removed]]

by Tegan Hill, Jake Fuss

The Trudeau government ran consistent deficits and accumulated significant debt over its first four years in office.

Trudeau government should target high tax rates during COVID recovery and beyond [[link removed]]

(Appeared in the Vancouver Province) by Tegan Hill and Ben Eisen

In total, 48 U.S. jurisdictions have lower top PIT rates than every Canadian province.

Fiscal snapshot highlights deteriorating state of federal finances [[link removed]]

by Jake Fuss

This year's federal budget deficit will be an estimated $343.2 billion.

Kenney must target Alberta’s income tax problem during COVID recovery [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill and Ben Eisen

In 2016, the Trudeau government added a new top personal federal income tax rate, increasing the top rate to 33 per cent.

Trudeau tax hikes would do more harm than good [[link removed]]

(Appeared in the Winnipeg Free Press)

by Jake Fuss and Tegan Hill

Canada’s personal income tax rates are among the highest in the industrialized world.

SUPPORT THE FRASER INSTITUTE

-----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor