|

|

Air travel safety crisis approaches - JD Vance and airline CEOs demand government reopen NOW

"You do not get to take the American people's government hostage and then demand that we give you everything you want in order to pay our air traffic controllers.”

Hello Capitalists,

Here is everything you should be following today:

Safety fears escalate as Air Traffic Controllers don’t get paid

“All we need is five reasonable Democrats” - Vance

Goldman CEO blasts a quarter century of US-China policy as a '“mistake”

Another company just took an “off the balance sheet” loan this was $750M

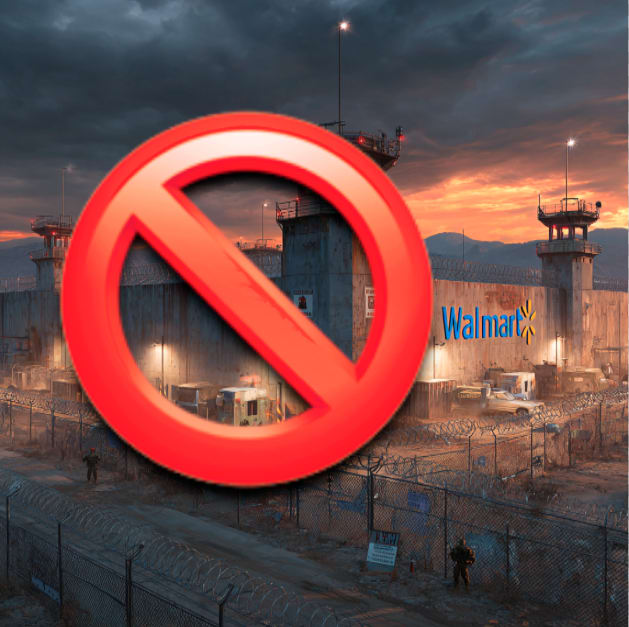

Walmart pushes back on fake TikTok looting story

Samsung goes all in with Nvidia for their new “AI Megafactory”

Netflix has really good news for investors

Today’s markets + assets:

✅ DOW: 47532.60 (⬆️ 0.02%)

✅ S&P: 6841.70 (⬆️ 0.28%)

✅ NASDAQ: 23734.69 (⬇️ 0.65%)

⚠️✅CBOE VIX Volatility Index: 17.96 (⬆️ 6.33%)

🔴 Gold: $4009.00 (⬇️ 0.13%)

🔴 Silver: $48.34 (⬇️ 0.54%)

✅ Bitcoin: $109,389 (⬆️ 0.16%)

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

Vance and Airline CEOs hammer Democrats over shutdown fueled safety concerns

Major U.S. airlines including Delta, American Airlines and United in a meeting with Vice President JD Vance implored Congress to end the four-week Democrat initiated shutdown after air traffic controllers missed their first full paychecks, warning of mounting safety risks and holiday travel chaos amid chronic staffing shortages.

Missed Paychecks Spark Urgency: Controllers and TSA officers, deemed essential, worked without October 28ths pay amid the shutdown starting on October 1, fueling a bipartisan White House roundtable with airline CEOs.

Staffing Crisis Compounds Risks: FAA faces a 3,800-controller shortfall, forcing mandatory overtime; union warns financial stress distracts from safety, eroding airspace reliability daily.

Holiday Havoc Looms Large: The upcoming record travel season is threatened by potential delays and cancellations. Unlike 2018 shutdown’s severe disruptions, current airport bottlenecks signal an escalation.

CEOs Highlight Fuel Crisis: Executives warned Vance that escalating jet fuel prices, up 25% year-over-year, could force route cuts and layoffs without federal intervention.

Vance Pledges Policy Support: The vice president committed to prioritizing aviation subsidies in upcoming budget talks, citing airlines’ role in economic connectivity.

Future Collaboration Teased: Leaders discussed joint lobbying efforts with Congress, aiming for tax credits on sustainable fuels to green operations by 2030.

Your Complimentary 90-Day AMAC Membership

America is at a crossroads — and your voice matters. That’s why we’re inviting you to try AMAC — The Association of Mature American Citizens — free for 90 days.

When you activate your complimentary membership, you’ll receive immediate access to:

Exclusive Savings on travel, insurance, healthcare, and more

Trusted Resources on Medicare, retirement, and Social Security

A Voice in Washington through AMAC Action, our powerful grassroots advocacy arm

Community & Fun with the AMAC Magazine, book club, sweepstakes, and more

No cost. No credit card needed. No obligation. Just 90 days of everything AMAC has to offer — so you can experience the difference for yourself.

[Activate Your Free 90-Day Membership]

Join today and stand with millions of like-minded Americans fighting to protect faith, family, and freedom.

P.S. You’ll also start receiving AMAC Magazine, the trusted publication conservatives rely on for news and insight you won’t find anywhere else.

Goldman CEO trashes the last 25 years of US-China policy as a “mistake”

In a fiery FOX Business interview, Goldman Sachs CEO David Solomon branded five decades of U.S.-China trade policy a colossal blunder, while hailing the Trump-Xi summit in South Korea as a pivotal step toward fairer deals amid soaring tariff threats and export curbs.

Past Policy Flawed Engagement: Solomon decries U.S. strategy of open participation without safeguards, fostering unfair trade imbalances over 50 years.

Summit Yields Trade Truce: The Trump-Xi talks secure China’s soybean buys, fentanyl crackdown pledges, and U.S. tariff reductions on Chinese imports.

No Decoupling Foreseen: Despite tensions, Solomon anticipates ongoing economic ties, urging reciprocal rules for balanced superpower interactions.

Buy-now-pay-later firm Affirm just got a $750m off “balance sheet loan”

In a bold expansion of their alliance, buy-now-pay-later giant Affirm on Thursday secured a $750 million loan purchase deal from New York Life Insurance, unlocking funding for $1.75 billion in annual consumer installment loans through 2026 and signaling insurers’ rush into high-yield fintech assets.

Partnership Roots Deepen Ties: Building on its 2023 origins, New York Life has invested nearly $2 billion in Affirm’s collateral pools, marking sustained confidence in its lending model.

Off-Balance Boosts Capacity: The off-balance-sheet financing empowers Affirm to scale lending without straining its core finances, mirroring deals with partners like Liberty Mutual and PGIM.

Insurer Appetite Fuels Trend: Traditional giants like New York Life chase stable, higher yields in consumer finance as interest rates fall, echoing Klarna’s pacts with Nelnet and PayPal’s $7 billion Blue Owl venture.

Economic Tailwinds Aid Growth: With solid spending and declining delinquencies—bolstered by 90% repeat borrowers—Affirm eyes robust expansion despite lingering subprime credit cautions.

Walmart pushes back on TikTok rumor about EBT looting

Walmart on Thursday debunked viral TikTok rumors claiming it would shutter all stores on Nov. 1 amid threats of mass looting if federal SNAP benefits lapse due to the prolonged Democrat shutdown of the government, assuring customers it will remain fully open for in-store shopping.

Rumors Sparked TikTok Frenzy: Viral videos amassed millions of views, falsely alleged that Walmart would restrict access to online-only amid “brokie” threats of raiding stores for food if SNAP expires Saturday.

TikTok Cracks Down Swiftly: Platform removed misleading clips for violating guidelines on harmful misinformation and curbed search visibility to prevent further spread of panic-inducing falsehoods.

Shutdown Hits SNAP Hard: Ongoing fifth-week federal impasse risks halting aid for 40 million Americans, fueling billions in grocery spending and prompting law enforcement alerts on potential unrest at big-box retailers.

Economy Faces Foggy Outlook: Federal Reserve Chair Jerome Powell warns prolonged shutdown clouds economic visibility, exacerbating fears of disrupted consumer patterns and broader instability from benefit disruptions.

Samsung goes all in on Nvidia for next gen mobile chip production

Samsung Electronics announced Thursday it will deploy Nvidia GPUs in a groundbreaking “AI Megafactory” to automate chip production for mobile devices and robots, partnering with Nvidia to slash manufacturing times and supercharge South Korea’s AI ambitions amid a global tech surge.

GPU Cluster Deployment: Samsung is procuring 50,000 Nvidia GPUs to automate semiconductor lithography, targeting efficiency gains for device and robotics chips.

Performance Leap Achieved: The partnership intends to optimize Samsung’s platform for a 20-fold speed boost, integrating Nvidia’s Omniverse software for AI model simulations.

Memory Tech Adaptation: Samsung is tweaking their fourth-generation High Bandwidth Memory (HBM) for Nvidia AI chips, enhancing the HBM used in advanced computing applications.

Korea AI Momentum: Initiative follows Nvidia CEO’s Seoul meetings, mirroring 50,000-GPU deployments by SK Group and Hyundai to fuel national AI leadership.

Netflix drops a 10-1 stock split as shares break $1100

Netflix announced Wednesday a 10-for-1 stock split, set to distribute additional shares Nov. 14 to holders as of Nov. 10, with trading on the adjusted price beginning Nov. 17—aiming to slash its $1,089 share price and broaden access for everyday investors and employees amid 42% year-to-date gains.

Boosting Employee Stock Access: The split targets affordability for staff in Netflix’s option program, countering the stock’s elite $1,000-plus S&P 500 status without altering company value.

Third Historic Company Split: The split marks Netflix’s latest move after 2004 and 2015 stock actions, reflecting sustained growth as streaming pioneer over two decades.

After-Hours Surge Reaction: Shares jumped over 2% post-announcement, building on five-year rally that further cements Netflix’s market dominance.

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.