Email

New Budget Numbers Again Reveal Unsustainable Debt & Abandonment Of Working Families

| From | Eugene Steuerle & The Government We Deserve <[email protected]> |

| Subject | New Budget Numbers Again Reveal Unsustainable Debt & Abandonment Of Working Families |

| Date | October 28, 2025 11:44 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

The Treasury Department recently released its estimates of government spending, revenues, and the deficit for the fiscal year 2025, which ended on September 30. For those willing to look beyond political rhetoric, the data clearly show the severity of our budget crisis. Non-wartime deficits relative to our national income at this level of low unemployment are at all-time highs, while debt as a share of national income will soon reach records, even surpassing what was needed to fight World War II.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The data also reveal why our budget choices reflect those of a declining economy. Very little in the largest spending categories is allocated to workers and their families, or to efforts that would promote upward mobility and wealth building for most individuals, as I detail more thoroughly here [ [link removed] ]. Meanwhile, recent legislation and executive actions primarily focus on vulnerable constituencies rather than on the parts of the budget that continue to increase the national debt at unsustainable rates.

The deficit for 2025 hit $1.8 trillion, roughly the same as in 2024. At 6 percent of GDP, it’s unlike anything we’ve seen during times of relative prosperity. For example, from 2013 to 2019, after the initial recovery from the Great Recession, the deficit was at 3.4 percent.

Remember, a non-recessionary deficit of 3.4 percent is already unsustainable because it doesn’t provide enough resources to handle a recession or emergency. The COVID-19 and post-COVID-19 years clearly show this failure, as the debt-to-GDP ratio surged and continued to rise afterward. Budget deficits have been a concerning trend throughout this century, and the situation has only gotten worse.

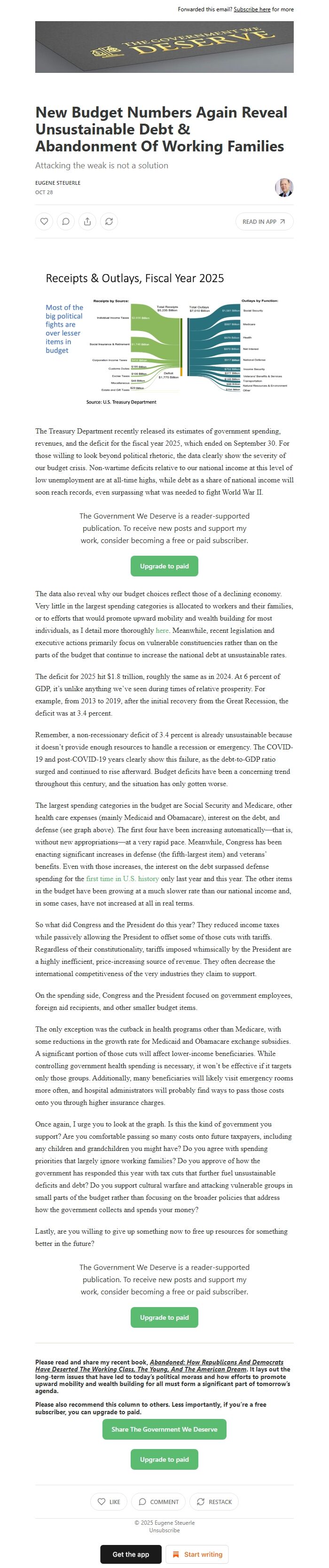

The largest spending categories in the budget are Social Security and Medicare, other health care expenses (mainly Medicaid and Obamacare), interest on the debt, and defense (see graph above). The first four have been increasing automatically—that is, without new appropriations—at a very rapid pace. Meanwhile, Congress has been enacting significant increases in defense (the fifth-largest item) and veterans’ benefits. Even with those increases, the interest on the debt surpassed defense spending for the first time in U.S. history [ [link removed] ] only last year and this year. The other items in the budget have been growing at a much slower rate than our national income and, in some cases, have not increased at all in real terms.

So what did Congress and the President do this year? They reduced income taxes while passively allowing the President to offset some of those cuts with tariffs. Regardless of their constitutionality, tariffs imposed whimsically by the President are a highly inefficient, price-increasing source of revenue. They often decrease the international competitiveness of the very industries they claim to support.

On the spending side, Congress and the President focused on government employees, foreign aid recipients, and other smaller budget items.

The only exception was the cutback in health programs other than Medicare, with some reductions in the growth rate for Medicaid and Obamacare exchange subsidies. A significant portion of those cuts will affect lower-income beneficiaries. While controlling government health spending is necessary, it won’t be effective if it targets only those groups. Additionally, many beneficiaries will likely visit emergency rooms more often, and hospital administrators will probably find ways to pass those costs onto you through higher insurance charges.

Once again, I urge you to look at the graph. Is this the kind of government you support? Are you comfortable passing so many costs onto future taxpayers, including any children and grandchildren you might have? Do you agree with spending priorities that largely ignore working families? Do you approve of how the government has responded this year with tax cuts that further fuel unsustainable deficits and debt? Do you support cultural warfare and attacking vulnerable groups in small parts of the budget rather than focusing on the broader policies that address how the government collects and spends your money?

Lastly, are you willing to give up something now to free up resources for something better in the future?

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

The Treasury Department recently released its estimates of government spending, revenues, and the deficit for the fiscal year 2025, which ended on September 30. For those willing to look beyond political rhetoric, the data clearly show the severity of our budget crisis. Non-wartime deficits relative to our national income at this level of low unemployment are at all-time highs, while debt as a share of national income will soon reach records, even surpassing what was needed to fight World War II.

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The data also reveal why our budget choices reflect those of a declining economy. Very little in the largest spending categories is allocated to workers and their families, or to efforts that would promote upward mobility and wealth building for most individuals, as I detail more thoroughly here [ [link removed] ]. Meanwhile, recent legislation and executive actions primarily focus on vulnerable constituencies rather than on the parts of the budget that continue to increase the national debt at unsustainable rates.

The deficit for 2025 hit $1.8 trillion, roughly the same as in 2024. At 6 percent of GDP, it’s unlike anything we’ve seen during times of relative prosperity. For example, from 2013 to 2019, after the initial recovery from the Great Recession, the deficit was at 3.4 percent.

Remember, a non-recessionary deficit of 3.4 percent is already unsustainable because it doesn’t provide enough resources to handle a recession or emergency. The COVID-19 and post-COVID-19 years clearly show this failure, as the debt-to-GDP ratio surged and continued to rise afterward. Budget deficits have been a concerning trend throughout this century, and the situation has only gotten worse.

The largest spending categories in the budget are Social Security and Medicare, other health care expenses (mainly Medicaid and Obamacare), interest on the debt, and defense (see graph above). The first four have been increasing automatically—that is, without new appropriations—at a very rapid pace. Meanwhile, Congress has been enacting significant increases in defense (the fifth-largest item) and veterans’ benefits. Even with those increases, the interest on the debt surpassed defense spending for the first time in U.S. history [ [link removed] ] only last year and this year. The other items in the budget have been growing at a much slower rate than our national income and, in some cases, have not increased at all in real terms.

So what did Congress and the President do this year? They reduced income taxes while passively allowing the President to offset some of those cuts with tariffs. Regardless of their constitutionality, tariffs imposed whimsically by the President are a highly inefficient, price-increasing source of revenue. They often decrease the international competitiveness of the very industries they claim to support.

On the spending side, Congress and the President focused on government employees, foreign aid recipients, and other smaller budget items.

The only exception was the cutback in health programs other than Medicare, with some reductions in the growth rate for Medicaid and Obamacare exchange subsidies. A significant portion of those cuts will affect lower-income beneficiaries. While controlling government health spending is necessary, it won’t be effective if it targets only those groups. Additionally, many beneficiaries will likely visit emergency rooms more often, and hospital administrators will probably find ways to pass those costs onto you through higher insurance charges.

Once again, I urge you to look at the graph. Is this the kind of government you support? Are you comfortable passing so many costs onto future taxpayers, including any children and grandchildren you might have? Do you agree with spending priorities that largely ignore working families? Do you approve of how the government has responded this year with tax cuts that further fuel unsustainable deficits and debt? Do you support cultural warfare and attacking vulnerable groups in small parts of the budget rather than focusing on the broader policies that address how the government collects and spends your money?

Lastly, are you willing to give up something now to free up resources for something better in the future?

The Government We Deserve is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a