Email

New Study: California Ranks #1 in Debt — Because Sacramento Can’t Stop Spending

| From | Jon Fleischman - So, Does It Matter? <[email protected]> |

| Subject | New Study: California Ranks #1 in Debt — Because Sacramento Can’t Stop Spending |

| Date | October 23, 2025 8:11 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

⏱️ 4.5 min read

(Our afternoon content is usually for our paid subscribers — but this study should be spread far and wide, so sticking it outside of the firewall. But around 40% of our content is reserved for premium subscribers. You can get more information here [ [link removed] ].)

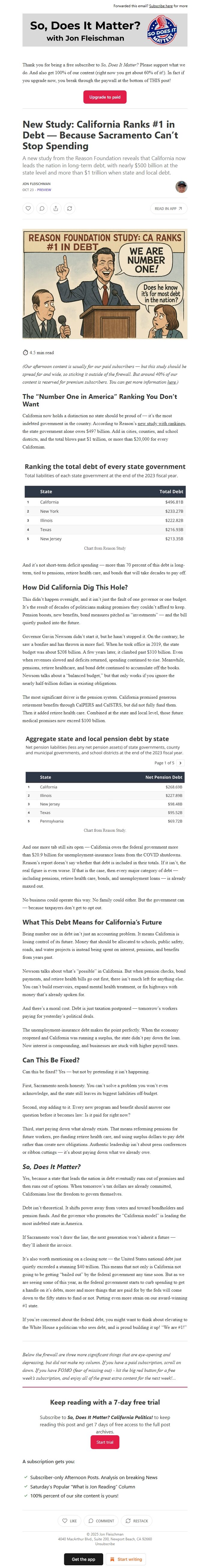

The “Number One in America” Ranking You Don’t Want

California now holds a distinction no state should be proud of — it’s the most indebted government in the country. According to Reason’s new study with rankings [ [link removed] ], the state government alone owes $497 billion. Add in cities, counties, and school districts, and the total blows past $1 trillion, or more than $20,000 for every Californian.

And it’s not short-term deficit spending — more than 70 percent of this debt is long-term, tied to pensions, retiree health care, and bonds that will take decades to pay off.

How Did California Dig This Hole?

This didn’t happen overnight, and it isn’t just the fault of one governor or one budget. It’s the result of decades of politicians making promises they couldn’t afford to keep. Pension boosts, new benefits, bond measures pitched as “investments” — and the bill quietly pushed into the future.

Governor Gavin Newsom didn’t start it, but he hasn’t stopped it. On the contrary, he saw a bonfire and has thrown in more fuel. When he took office in 2019, the state budget was about $208 billion. A few years later, it climbed past $310 billion. Even when revenues slowed and deficits returned, spending continued to rise. Meanwhile, pensions, retiree healthcare, and bond debt continued to accumulate off the books. Newsom talks about a “balanced budget,” but that only works if you ignore the nearly half-trillion dollars in existing obligations.

The most significant driver is the pension system. California promised generous retirement benefits through CalPERS and CalSTRS, but did not fully fund them. Then it added retiree health care. Combined at the state and local level, those future medical promises now exceed $100 billion.

And one more tab still sits open — California owes the federal government more than $20.9 billion for unemployment-insurance loans from the COVID shutdowns. Reason’s report doesn’t say whether that debt is included in their totals. If it isn’t, the real figure is even worse. If that is the case, then every major category of debt — including pensions, retiree health care, bonds, and unemployment loans — is already maxed out.

No business could operate this way. No family could either. But the government can — because taxpayers don’t get to opt out.

What This Debt Means for California’s Future

Being number one in debt isn’t just an accounting problem. It means California is losing control of its future. Money that should be allocated to schools, public safety, roads, and water projects is instead being spent on interest, pensions, and benefits from years past.

Newsom talks about what’s “possible” in California. But when pension checks, bond payments, and retiree health bills go out first, there isn’t much left for anything else. You can’t build reservoirs, expand mental health treatment, or fix highways with money that’s already spoken for.

And there’s a moral cost. Debt is just taxation postponed — tomorrow’s workers paying for yesterday’s political deals.

The unemployment-insurance debt makes the point perfectly. When the economy reopened and California was running a surplus, the state didn’t pay down the loan. Now interest is compounding, and businesses are stuck with higher payroll taxes.

Can This Be Fixed?

Can this be fixed? Yes — but not by pretending it isn’t happening.

First, Sacramento needs honesty. You can’t solve a problem you won’t even acknowledge, and the state still leaves its biggest liabilities off-budget.

Second, stop adding to it. Every new program and benefit should answer one question before it becomes law: Is it paid for right now?

Third, start paying down what already exists. That means reforming pensions for future workers, pre-funding retiree health care, and using surplus dollars to pay debt rather than create new obligations. Authentic leadership isn’t about press conferences or ribbon cuttings — it’s about paying down what we already owe.

So, Does It Matter?

Yes, because a state that leads the nation in debt eventually runs out of promises and then runs out of options. When tomorrow’s tax dollars are already committed, Californians lose the freedom to govern themselves.

Debt isn’t theoretical. It shifts power away from voters and toward bondholders and pension funds. And the governor who promotes the “California model” is leading the most indebted state in America.

If Sacramento won’t draw the line, the next generation won’t inherit a future — they’ll inherit the invoice.

It’s also worth mentioning on a closing note — the United States national debt just quietly exceeded a stunning $40 trillion. This means that not only is California not going to be getting “bailed out” by the federal government any time soon. But as we are seeing some of this year, as the federal government starts to curb spending to get a handle on it’s debts, more and more things that are paid for by the feds will come down to the fifty states to fund or not. Putting even more strain on our award-winning #1 state.

If you’re concerned about the federal debt, you might want to think about elevating to the White House a politician who sees debt, and is proud building it up! “We are #1!”

Below the firewall are three more significant things that are eye-opening and depressing, but did not make my column. If you have a paid subscription, scroll on down. If you have FOMO (fear of missing out) - hit the big red button for a free week’s subscription, and enjoy all of the great extra content for the next week!...

Unsubscribe [link removed]?

⏱️ 4.5 min read

(Our afternoon content is usually for our paid subscribers — but this study should be spread far and wide, so sticking it outside of the firewall. But around 40% of our content is reserved for premium subscribers. You can get more information here [ [link removed] ].)

The “Number One in America” Ranking You Don’t Want

California now holds a distinction no state should be proud of — it’s the most indebted government in the country. According to Reason’s new study with rankings [ [link removed] ], the state government alone owes $497 billion. Add in cities, counties, and school districts, and the total blows past $1 trillion, or more than $20,000 for every Californian.

And it’s not short-term deficit spending — more than 70 percent of this debt is long-term, tied to pensions, retiree health care, and bonds that will take decades to pay off.

How Did California Dig This Hole?

This didn’t happen overnight, and it isn’t just the fault of one governor or one budget. It’s the result of decades of politicians making promises they couldn’t afford to keep. Pension boosts, new benefits, bond measures pitched as “investments” — and the bill quietly pushed into the future.

Governor Gavin Newsom didn’t start it, but he hasn’t stopped it. On the contrary, he saw a bonfire and has thrown in more fuel. When he took office in 2019, the state budget was about $208 billion. A few years later, it climbed past $310 billion. Even when revenues slowed and deficits returned, spending continued to rise. Meanwhile, pensions, retiree healthcare, and bond debt continued to accumulate off the books. Newsom talks about a “balanced budget,” but that only works if you ignore the nearly half-trillion dollars in existing obligations.

The most significant driver is the pension system. California promised generous retirement benefits through CalPERS and CalSTRS, but did not fully fund them. Then it added retiree health care. Combined at the state and local level, those future medical promises now exceed $100 billion.

And one more tab still sits open — California owes the federal government more than $20.9 billion for unemployment-insurance loans from the COVID shutdowns. Reason’s report doesn’t say whether that debt is included in their totals. If it isn’t, the real figure is even worse. If that is the case, then every major category of debt — including pensions, retiree health care, bonds, and unemployment loans — is already maxed out.

No business could operate this way. No family could either. But the government can — because taxpayers don’t get to opt out.

What This Debt Means for California’s Future

Being number one in debt isn’t just an accounting problem. It means California is losing control of its future. Money that should be allocated to schools, public safety, roads, and water projects is instead being spent on interest, pensions, and benefits from years past.

Newsom talks about what’s “possible” in California. But when pension checks, bond payments, and retiree health bills go out first, there isn’t much left for anything else. You can’t build reservoirs, expand mental health treatment, or fix highways with money that’s already spoken for.

And there’s a moral cost. Debt is just taxation postponed — tomorrow’s workers paying for yesterday’s political deals.

The unemployment-insurance debt makes the point perfectly. When the economy reopened and California was running a surplus, the state didn’t pay down the loan. Now interest is compounding, and businesses are stuck with higher payroll taxes.

Can This Be Fixed?

Can this be fixed? Yes — but not by pretending it isn’t happening.

First, Sacramento needs honesty. You can’t solve a problem you won’t even acknowledge, and the state still leaves its biggest liabilities off-budget.

Second, stop adding to it. Every new program and benefit should answer one question before it becomes law: Is it paid for right now?

Third, start paying down what already exists. That means reforming pensions for future workers, pre-funding retiree health care, and using surplus dollars to pay debt rather than create new obligations. Authentic leadership isn’t about press conferences or ribbon cuttings — it’s about paying down what we already owe.

So, Does It Matter?

Yes, because a state that leads the nation in debt eventually runs out of promises and then runs out of options. When tomorrow’s tax dollars are already committed, Californians lose the freedom to govern themselves.

Debt isn’t theoretical. It shifts power away from voters and toward bondholders and pension funds. And the governor who promotes the “California model” is leading the most indebted state in America.

If Sacramento won’t draw the line, the next generation won’t inherit a future — they’ll inherit the invoice.

It’s also worth mentioning on a closing note — the United States national debt just quietly exceeded a stunning $40 trillion. This means that not only is California not going to be getting “bailed out” by the federal government any time soon. But as we are seeing some of this year, as the federal government starts to curb spending to get a handle on it’s debts, more and more things that are paid for by the feds will come down to the fifty states to fund or not. Putting even more strain on our award-winning #1 state.

If you’re concerned about the federal debt, you might want to think about elevating to the White House a politician who sees debt, and is proud building it up! “We are #1!”

Below the firewall are three more significant things that are eye-opening and depressing, but did not make my column. If you have a paid subscription, scroll on down. If you have FOMO (fear of missing out) - hit the big red button for a free week’s subscription, and enjoy all of the great extra content for the next week!...

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a