Email

So . . . is AI a Bubble?

| From | Andrew Yang <[email protected]> |

| Subject | So . . . is AI a Bubble? |

| Date | October 22, 2025 12:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

Is AI a bubble? I’ve been seeing that question a lot lately. From Andrew Ross Sorkin to Derek Thompson to Hank Green, everyone seems to be engaging on this topic. Sorkin is likening this period to that before the crash of 1929, which is the subject of his well-researched new book.

I’m a distinct figure to be evaluating this given that I literally wrote a book, “The War on Normal People [ [link removed] ],” about how AI was/is going to replace millions of workers and ran for President on this very case. So you’d think that if anyone thought AI was indeed going to fundamentally change the nature of work, it would be me.

And yet.

The numbers are staggering. $300 billion is being spent on data centers every 10 months. AI companies have accounted for 70% of the stock market’s gains this year. Without data centers, GDP growth was only .1% in the first half of 2025. Every time a company says it’s investing billions in AI, investors cheer and bid up its stock.

Total AI revenue this year will be about $60 billion – if I told you I’d pay you $60 this year would you spend $300 - $400 a year trying to improve your product with no end in sight? Yes if you expected the revenue to go up 10 - 20x VERY quickly. In many ways, the question is how much revenue will show up and when.

Are you a user of AI tools? And how much would you pay? The scale of investment might not make sense given that a Chinese model – think DeepSeek – could undercut the pricing of what a lot of individuals or companies pay even if it’s somewhat less reliable or advanced. You also have multiple major U.S. companies that will have to compete somewhat on price.

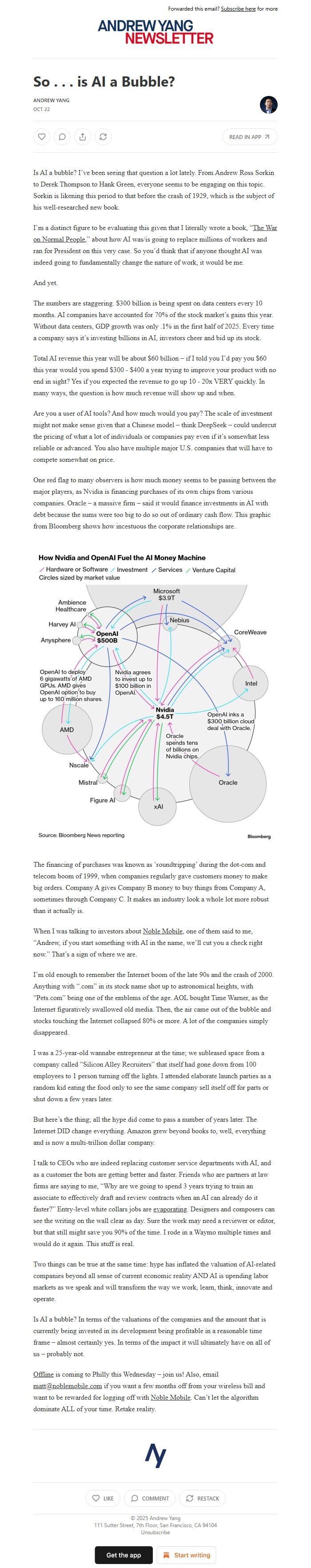

One red flag to many observers is how much money seems to be passing between the major players, as Nvidia is financing purchases of its own chips from various companies. Oracle – a massive firm – said it would finance investments in AI with debt because the sums were too big to do so out of ordinary cash flow. This graphic from Bloomberg shows how incestuous the corporate relationships are.

The financing of purchases was known as ‘roundtripping’ during the dot-com and telecom boom of 1999, when companies regularly gave customers money to make big orders. Company A gives Company B money to buy things from Company A, sometimes through Company C. It makes an industry look a whole lot more robust than it actually is.

When I was talking to investors about Noble Mobile [ [link removed] ], one of them said to me, “Andrew, if you start something with AI in the name, we’ll cut you a check right now.” That’s a sign of where we are.

I’m old enough to remember the Internet boom of the late 90s and the crash of 2000. Anything with “.com” in its stock name shot up to astronomical heights, with “Pets.com” being one of the emblems of the age. AOL bought Time Warner, as the Internet figuratively swallowed old media. Then, the air came out of the bubble and stocks touching the Internet collapsed 80% or more. A lot of the companies simply disappeared.

I was a 25-year-old wannabe entrepreneur at the time; we subleased space from a company called “Silicon Alley Recruiters” that itself had gone down from 100 employees to 1 person turning off the lights. I attended elaborate launch parties as a random kid eating the food only to see the same company sell itself off for parts or shut down a few years later.

But here’s the thing; all the hype did come to pass a number of years later. The Internet DID change everything. Amazon grew beyond books to, well, everything and is now a multi-trillion dollar company.

I talk to CEOs who are indeed replacing customer service departments with AI, and as a customer the bots are getting better and faster. Friends who are partners at law firms are saying to me, “Why are we going to spend 3 years trying to train an associate to effectively draft and review contracts when an AI can already do it faster?” Entry-level white collars jobs are evaporating [ [link removed] ]. Designers and composers can see the writing on the wall clear as day. Sure the work may need a reviewer or editor, but that still might save you 90% of the time. I rode in a Waymo multiple times and would do it again. This stuff is real.

Two things can be true at the same time: hype has inflated the valuation of AI-related companies beyond all sense of current economic reality AND AI is upending labor markets as we speak and will transform the way we work, learn, think, innovate and operate.

Is AI a bubble? In terms of the valuations of the companies and the amount that is currently being invested in its development being profitable in a reasonable time frame – almost certainly yes. In terms of the impact it will ultimately have on all of us – probably not.

Offline [ [link removed] ] is coming to Philly this Wednesday – join us! Also, email [email protected] [ mailto:[email protected] ] if you want a few months off from your wireless bill and want to be rewarded for logging off with Noble Mobile [ [link removed] ]. Can’t let the algorithm dominate ALL of your time. Retake reality.

Unsubscribe [link removed]?

Is AI a bubble? I’ve been seeing that question a lot lately. From Andrew Ross Sorkin to Derek Thompson to Hank Green, everyone seems to be engaging on this topic. Sorkin is likening this period to that before the crash of 1929, which is the subject of his well-researched new book.

I’m a distinct figure to be evaluating this given that I literally wrote a book, “The War on Normal People [ [link removed] ],” about how AI was/is going to replace millions of workers and ran for President on this very case. So you’d think that if anyone thought AI was indeed going to fundamentally change the nature of work, it would be me.

And yet.

The numbers are staggering. $300 billion is being spent on data centers every 10 months. AI companies have accounted for 70% of the stock market’s gains this year. Without data centers, GDP growth was only .1% in the first half of 2025. Every time a company says it’s investing billions in AI, investors cheer and bid up its stock.

Total AI revenue this year will be about $60 billion – if I told you I’d pay you $60 this year would you spend $300 - $400 a year trying to improve your product with no end in sight? Yes if you expected the revenue to go up 10 - 20x VERY quickly. In many ways, the question is how much revenue will show up and when.

Are you a user of AI tools? And how much would you pay? The scale of investment might not make sense given that a Chinese model – think DeepSeek – could undercut the pricing of what a lot of individuals or companies pay even if it’s somewhat less reliable or advanced. You also have multiple major U.S. companies that will have to compete somewhat on price.

One red flag to many observers is how much money seems to be passing between the major players, as Nvidia is financing purchases of its own chips from various companies. Oracle – a massive firm – said it would finance investments in AI with debt because the sums were too big to do so out of ordinary cash flow. This graphic from Bloomberg shows how incestuous the corporate relationships are.

The financing of purchases was known as ‘roundtripping’ during the dot-com and telecom boom of 1999, when companies regularly gave customers money to make big orders. Company A gives Company B money to buy things from Company A, sometimes through Company C. It makes an industry look a whole lot more robust than it actually is.

When I was talking to investors about Noble Mobile [ [link removed] ], one of them said to me, “Andrew, if you start something with AI in the name, we’ll cut you a check right now.” That’s a sign of where we are.

I’m old enough to remember the Internet boom of the late 90s and the crash of 2000. Anything with “.com” in its stock name shot up to astronomical heights, with “Pets.com” being one of the emblems of the age. AOL bought Time Warner, as the Internet figuratively swallowed old media. Then, the air came out of the bubble and stocks touching the Internet collapsed 80% or more. A lot of the companies simply disappeared.

I was a 25-year-old wannabe entrepreneur at the time; we subleased space from a company called “Silicon Alley Recruiters” that itself had gone down from 100 employees to 1 person turning off the lights. I attended elaborate launch parties as a random kid eating the food only to see the same company sell itself off for parts or shut down a few years later.

But here’s the thing; all the hype did come to pass a number of years later. The Internet DID change everything. Amazon grew beyond books to, well, everything and is now a multi-trillion dollar company.

I talk to CEOs who are indeed replacing customer service departments with AI, and as a customer the bots are getting better and faster. Friends who are partners at law firms are saying to me, “Why are we going to spend 3 years trying to train an associate to effectively draft and review contracts when an AI can already do it faster?” Entry-level white collars jobs are evaporating [ [link removed] ]. Designers and composers can see the writing on the wall clear as day. Sure the work may need a reviewer or editor, but that still might save you 90% of the time. I rode in a Waymo multiple times and would do it again. This stuff is real.

Two things can be true at the same time: hype has inflated the valuation of AI-related companies beyond all sense of current economic reality AND AI is upending labor markets as we speak and will transform the way we work, learn, think, innovate and operate.

Is AI a bubble? In terms of the valuations of the companies and the amount that is currently being invested in its development being profitable in a reasonable time frame – almost certainly yes. In terms of the impact it will ultimately have on all of us – probably not.

Offline [ [link removed] ] is coming to Philly this Wednesday – join us! Also, email [email protected] [ mailto:[email protected] ] if you want a few months off from your wireless bill and want to be rewarded for logging off with Noble Mobile [ [link removed] ]. Can’t let the algorithm dominate ALL of your time. Retake reality.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a