|

|

Trump issues a stark warning and his list of demands to China ahead of trade talks

“I don’t want them to play the rare earth game with us...”

Hello Capitalists,

Here is everything you should be following today:

Trump lays down his demands on Xi ahead of trade talks

US Mining stocks soar as China plays chicken with Trump’s demands

Amazon’s “Cloud” crashed and broke the internet for real

Ripple announces $1Billion dollar merger for an XRP treasury

China’s Economy starts to show signs of cracking

Today’s markets + assets:

✅ DOW: 46669.60 (⬆️ 1.04%)

✅ S&P: 6738.19 (⬆️ 1.11%)

✅ NASDAQ: 23013.08 (⬆️ 1.47%)

⚠️🔴CBOE VIX Volatility Index: 18.72 (⬇️ 9.91%)

✅ Gold: $4,366 (⬆️ 3.64%)

✅ Silver: $51.455 (⬆️ 2.70%)

✅ Bitcoin: $110,629 (⬆️ 1.77%)

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

Trump delivers a stark rare earth warning to China ahead of trade talks

President Donald Trump reminded China of his threat 100% tariffs on Chinese goods set to start on November 1st, 2025, as retaliation for Beijing’s rare earth export controls, while also listing curbs on fentanyl curbs and soybean purchases as top demands ahead of resumed U.S.-China trade talks later this week.

Rare Earths Controls Sparked: China’s new export restrictions on critical rare earth minerals prompted Trump’s aggressive tariff response, aiming to prevent Beijing from using them as leverage in ongoing trade disputes warning “I don’t want them to play the rare earth game with us.”

Fentanyl Flows Fuel Demands: Trump also accused China of failing to stem fentanyl exports tied to America’s opioid epidemic, stating that China needs “to stop with the fentanyl“ making it a non-negotiable priority in negotiations to protect U.S. public health.

Soybean Halt Hits Farmers: Beijing’s sudden pause on purchasing U.S. soybean imports has escalated agricultural tensions, with Trump vowing further curtailments unless resolved before the fragile trade truce expires.

Xi Meeting Looms Large: A high-stakes Trump-Xi Jinping summit planned for late October could reshape global supply chains.

AI’s NEXT Magnificent Seven

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says “AI’s Next Magnificent Seven Could Do It Even Faster.”

See His Breakdown of the Seven Stocks You Should Own Here.

US mining stocks surge as China tries to tighten its grip on Rare Earth metals

Shares of U.S. rare earth companies surged in Monday premarket trading, fueled by Beijing’s fresh export curbs requiring approval for foreign shipments, as Washington ramps up subsidies for US miners to shatter China’s 70% stranglehold on vital minerals powering EVs and semiconductors.

China’s Export Controls Tighten: New Beijing rules demand foreign firms secure approval and detail end-uses for rare earth shipments, escalating trade frictions and spotlighting vulnerabilities in global tech supply chains.

U.S. Mine Development Prioritized: American Elements CEO Michael Silver urges treating domestic rare earth mining as a national security imperative, predicting swift government subsidies to operationalize untapped reserves.

Stock Surge Highlights Momentum: MP Materials climbed 1.8%, USA Rare Earth leaped 2.9%, and Perpetua Resources rose 3.4% premarket, mirroring gains in Canadian peers amid investor bets on diversified production.

Military Readiness, Civilian Risks: While U.S. holds ample heavy rare earths for defense needs, commercial sectors like electric vehicles and lasers face squeezes, hastening pushes for independent global sourcing.

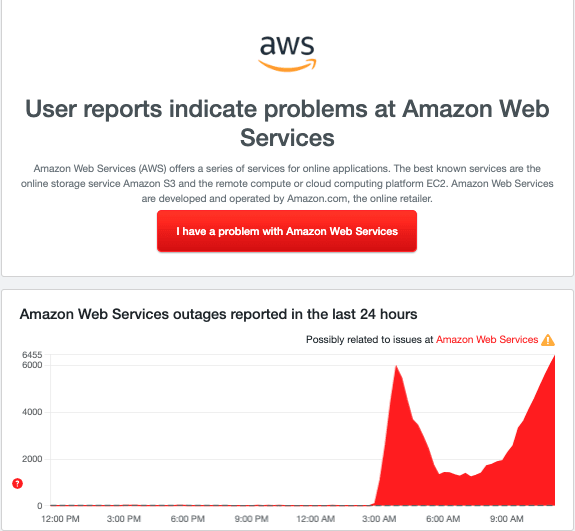

Amazon’s Cloud crash causes chaos across the web

Early Monday morning, Amazon Web Services suffered a major outage in its US-EAST-1 region, sparking connectivity chaos for millions as popular sites and Apps like Snapchat and Fortnite went dark, with recovery efforts underway amid widespread user frustration.

Affected Services Identified: Snapchat and Fortnite faced severe disruptions, while AI firm Perplexity, crypto platform Coinbase, and trading app Robinhood directly blamed AWS for their downtime.

Regional Scope Pinpointed: Issues struck the US-EAST-1 region, triggering elevated error rates and latencies across multiple AWS services, confirmed via the company’s status page.

Timeline Established Early: Outage hit just before dawn ET, with AWS alerting at 3:51 a.m. and immediately launching fixes to restore normal operations.

Business Ripples Emerge: Connectivity woes rippled through gaming, social media, finance, and crypto sectors, highlighting AWS’s critical role in powering global digital infrastructure.

Airline Chaos: The outage also crippled airline websites nationwide, stranding passengers unable to check in or access reservations via apps.

Delta, United Hit Hard: Major carriers like Delta Air Lines and United Airlines saw full website failures, blocking online bookings and app-based bag drops amid peak travel demands.

Echoes of Past Disruptions: The outage was reminiscent of July 2024’s CrowdStrike meltdown, and the incident again exposes vulnerabilities in cloud reliance, potentially costing airlines millions in lost revenue and refunds.

Ripple’s $1Billion dollar merger to create the largest public XRP treasury

In a bold play to dominate digital assets, Ripple-backed Evernorth announced plans Tuesday to raise over $1 billion through a Nasdaq merger, aiming to amass the largest public treasury of XRP tokens amid a surging crypto market under the Trump administration.

Merger Targets Nasdaq Debut: Evernorth will go public via an SPAC merger with Armada Acquisition Corp II, closing in Q1 2026 to unlock institutional XRP strategies.

SBI Injects Major Capital: Japanese investor SBI has committed $200 million for an equity stake, joining Ripple co-founder Chris Larsen, Pantera Capital, and crypto exchange Kraken in fueling the XRP-focused venture.

Birla Leads Treasury Push: Ripple exec Asheesh Birla will step down from Ripple’s board to helm the Evernorth venture, building an investment team for XRP acquisitions and holdings.

Boosts XRP Market Presence: The deal positions Evernorth as top public XRP holder, capitalizing on the post-lawsuit regulatory thaw despite equity-crypto volatility risks.

Cracks start to appear in China’s great economic wall

China’s economy braked sharply in the third quarter, with GDP growth expected to slide to 4.8% year-on-year from 5.2% in Q2, analysts forecast ahead of Monday’s official release, as U.S. trade tensions and deflationary pressures hobble exports and demand.

Fixed Assets Stagnate: Fixed-asset investment, including real estate, is projected to inch up just 0.1% in the first nine months, signaling deep stagnation in Chinese infrastructure and property sectors amid broader economic headwinds.

Retail Sales Falter: September retail sales are anticipated to decelerate to 3% year-on-year growth, underscoring weakening consumer spending and subdued domestic demand despite the Chinese government’s stimulus efforts.

Industrial Output Eases: Factory production expected to moderate to 5% annual growth in September, reflecting manufacturing slowdowns tied to global trade uncertainties and softening export pipelines.

Inflation Dips Deeper: Headline inflation tumbled 0.3% in September—below forecasts highlighting persistent deflation risks that could stifle investment and recovery momentum.

The Capitalist is a reader-supported publication Reject Corporate Left Wing Journalism

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.