|

|

These "Hard Asset Superheroes" reign in the age of debt and uncertainty

The "Debasement Trade" out of fiat shows no sign of stopping

The world is drowning in debt and investors are seeking refuge in assets that promise stability amid economic turmoil. The so-called “debasement trade”—a strategic pivot toward hard assets like precious metals - and more recently Bitcoin - as hedges against fiat currency erosion—has gained unprecedented momentum.

Escalating fiscal burdens in the U.S., Japan, and France, coupled with political uncertainty, have sparked a flight to safety, propelling gold, silver, and Bitcoin to remarkable heights. Over the past five years, and especially in the last five weeks, these assets have charted distinct yet interconnected paths, reflecting investor anxiety about global debt and currency devaluation.

The Debt Crisis Catalyst

Global debt levels are sounding alarms. The U.S., Japan, and France face mounting fiscal pressures, with deficits echoing the precarious conditions of the 2008 financial crisis and the subsequent quantitative easing eras that followed. Japan’s new Prime Minister Sanae Takaichi’s push for stimulus has weakened the yen against the dollar, while France’s political gridlock, marked by Prime Minister Sébastien Lecornu’s resignation, has eroded the Euro. These currency slippages, alongside a U.S. government shutdown on October 1, 2025, that disrupted payroll data, have amplified fears of currency debasement. Investors are responding by pouring capital into assets perceived as immune to fiat erosion: gold, silver, and now Bitcoin.

Together with Next Thing Technology

The Hidden Tech Keeping AI From Collapse

AI is booming.

But there’s a growing problem no one wants to admit: our infrastructure isn’t ready for it.¹

The U.S. grid is already stretched thin. In many states, it’s decades overdue for upgrades. Now layer on thousands of energy-hungry AI data centers — and it’s a recipe for blackouts, water shortages, and failure.¹

In fact, just this month, Bloomberg reported that AI data centers are draining millions of gallons of water from drought-prone areas in the U.S.⁹

Meanwhile, Saudi Arabia is going the opposite direction — investing $100 billion to build ultra-modern AI power hubs running on next-gen energy tech.

The U.S. needs a breakthrough. That’s where Next Thing Technologies comes in.

They’re the first American company⁹ to develop a commercially-viable¹ sodium-ion battery pack that can power AI infrastructure.¹

Why it matters:

Sodium is 1,400× more abundant than lithium⁹

Batteries are projected to be up to 60% cheaper⁶

They’re safer and scalable¹

Over 7,800 investors have already backed them with $7M+.³

You can still invest in their current round at just $6/share⁴ — with up to 20% bonus shares⁴

The company’s share offering price has increased 209% since its first funding round, which sold out completely.²

This opportunity won’t stay under the radar much longer…⁴

And the next time you hear about it, it may be too late to get it for just $6/share.⁴

👉 Click here to invest before it’s too late.⁴

Gold, Silver, and Bitcoin: Five-Year Trends vs. Five-Week Surge

Over the past five years, gold, silver, and Bitcoin have each carved unique trajectories, reflecting their distinct roles as safe-haven assets. Gold, a timeless store of value, has risen steadily. Silver, often overshadowed by its shinier sibling, has seen more volatile but still substantial gains driven by industrial demand and speculative interest. Then there is Bitcoin, the self-proclaimed “digital gold,” has been the standout, fueled by rapid institutional adoption and its fixed supply of coins.

In the last five weeks, however, the pace has accelerated dramatically with all three assets hitting All Time High’s. Gold has jumped to $4,077.90 per ounce, driven by safe-haven demand amid the U.S. shutdown and global currency weakness. Silver, more sensitive to market momentum, surged to $50.03 per ounce, reflecting speculative fervor. Bitcoin, however, has stolen the spotlight, rocketing to $126,160. That explosive rally, concentrated over a single weekend in London, underscores Bitcoin’s growing appeal as a hedge against fiat debasement. With its decentralized nature and capped supply it has resonated with investors who are suddenly wary of central bank policies in relation to both personal financial freedom and inflation.

Bitcoin ETFs and the “Digital Gold” Narrative

The surge in Bitcoin’s price has been supercharged by unprecedented inflows into U.S. Bitcoin exchange-traded funds (ETFs). In early October 2025, investors poured $3.2 billion into these funds, marking the second-highest inflow since their 2024 debut. BlackRock’s iShares Bitcoin Trust alone saw open interest hit $49.8 billion, while the combined open interest on Deribit and BlackRock’s ETF reached $80 billion—a tenfold increase from early 2024. Bullish call options, accounting for over 60% of activity in the past six months, reflect a speculative frenzy amplifying Bitcoin’s ascent.

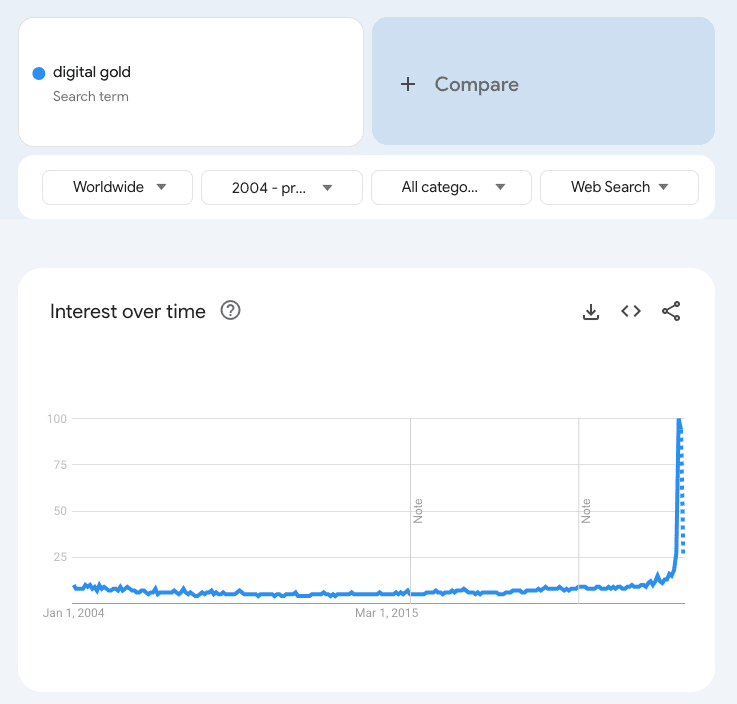

This rally has for some cemented Bitcoin’s moniker as “digital gold,” a term that has surged in prominence since May 2025. Google Trends data shows a sharp uptick in searches for “digital gold,” with interest nearly tripling from May to October 2025, as investors both retail and institutional increasingly view Bitcoin as a modern counterpart to gold’s store-of-value properties.

Unlike gold, which relies on physical scarcity, Bitcoin’s appeal lies in its algorithmic scarcity and decentralized architecture, making it a compelling hedge in an era of digital finance and eroding trust in fiat systems.

Physical vs. Digital: A Complementary Flight to Safety

While gold and silver remain stalwarts of the debasement trade, Bitcoin’s meteoric rise highlights a growing divide between physical and digital safe havens. Yet, the two asset classes are not rivals but complements. Gold and silver offer tangible stability, while Bitcoin provides (near) instant liquidity and huge future growth potential.

Together, they form a robust defense against currency devaluation and to see them move in relative lockstep and the movement upwards being fueled by broadly the same underlying impetus means that Gold may finally have something akin to a rival in the hard asset space.

Risks and the Road Ahead

The debasement trade is not without risks. Bitcoin’s rally, while spectacular, is fueled by leverage, with analysts at FalconX warning of potential liquidation cascades if the bullish momentum were to falter. The next resistance level (the point where the selling pressure from those wishing to exit a position outweighs the buying pressure of those who want to take on a position) at $135,000 looms, if it can surpass that then $150,000 as a potential target is viable, but volatility remains a concern. Gold and silver, while less volatile, face pressures of their own.

A perfect case study of the differences between these assets would be the announcement by President Trump about upcoming tariffs in retaliation to China’s tightening of export restrictions on rare earth minerals. Gold and Silver prices moved up slightly, where as at its lowest Bitcoin lost 4.01%. However, crypto is notoriously volatile, outsize swings are not uncommon and in the grand scheme of things the Bitcoin drop could be seen as negligible when compared to its growth this year.

Experts at both Pepperstone and JPMorgan have noted that self-reinforcing sentiment in both precious metals and crypto could sustain the rally long term.

BREAKING UPDATE: The Great Crypto Armageddon of 2025.

At 5:15 PM on October 10th the Crypto market suffered the biggest liquidation in its history. As of this morning (October 11th.) the costs are still being calculated. The numbers are simply staggering. As much as $19 Billion in assets may have been wiped out. Posts on X show traders personally losing millions of dollars in altcoins and leveraged bets on crypto. It turns out that the analysts at FalconX were way more correct than they knew. Right now nobody knows how bad it will be when the markets reopen.

However, amongst the wreckage, in the smoking crater of what was a burgeoning crypto market on Thursday morning, some very important takeaways exist.

Bitcoin itself is down a little over 8% ($14,000) from its highs, but when compared to its meteoric rise of 85% this year and its 950% rise over 5 years is not an End of Days situation yet. Also more interesting is that BlackRock’s Bitcoin ETF (IBIT,) down as much as 10% during the eye of the crypto crash hurricane, has rebounded making back 4% of its losses by the time trading ceased on the 10th. This certainly lends some credibility to those who argue that Bitcoin is resilient enough to be considered a safe haven (especially for strong nerved traders willing to hold through the rough seas Crypto is known for and a willingness to “buy the dip”)

Also with $770 Billion being wiped off of tech stocks on Friday and questions starting to be raised about the future sustainability of the AI Boom of the last two years, (which are only likely to increase now.) Investors around the world both retail and institutional may choose to rotate their investments in to less risky bets, and these Hard Asset Superheroes would be the likely beneficiaries.

Gold, silver, and Bitcoin, each in its own way, embody the flight to safety in an era of currency weakness and political uncertainty. Over the past five years, Bitcoin’s surge has outpaced gold and silver’s gains, but in the last five weeks, all three have seen sharp upticks, (albeit with Bitcoin still leading the pack.) The $3.2 billion flood into Bitcoin ETFs and the rising prominence of the “digital gold” narrative underscore its growing legitimacy.

The fact that the debasement trade is taking place at the scale and pace that it is reflects a profound shift in investor psychology as global debt concerns and long held fears about fiat currency intensify. These systemic worries have not gone away just because Crypto crashed spectacularly on Friday.

As fiat currencies wobble, the debasement trade is not just a trend—it’s a warning. Investors are betting on hard assets, both physical and digital, to weather the coming storm.

DISCLAIMER

Please refer to our full Disclosures page [http://www.nextthing.tech/email-disclosure] to see important information regarding the statements made herein, sometimes identified by superscript numbers (¹, ², etc.).

Forward-looking statements, performance and progress claims (cost, safety, longevity), and market data are speculative estimates based on current assumptions, involve risks, and are not guaranteed. Past performance does not predict future results, specific data requires verification, third-party mentions are informational only, and offer terms may change without notice.

Investing involves risks, including loss of principal. Please read the Offering Circular [http://edgar.secdatabase.com/61/121390024095418/filing-main.htm] before investing.

Rainmaker Ad Ventures is paid by Next Thing Technologies for promoting their securities offering. Payment is in cash and billed monthly. As of the end of May, Rainmaker has received $90,775. Additional fees may have accrued since then.

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.