|

|

The Global Gold Rush accelerates as investors flee to safety

Gold up 55% in year Silver is up 65%, Bitcoin at $123K

Hello Capitalists,

Here is everything you should be following today:

Gold just hit a new All Time High AGAIN

Bitcoin and Silver follow Gold’s lead up

Jewelers scramble and hike prices

Bank of England sees huge correction if AI bubble pops

Goldman Sachs warns there isn’t a full scale bubble…yet

Today’s markets + assets:

✅ DOW: 46620.83 (⬆️ - 0.04%)

✅ S&P: 6754.87 (⬆️ - 0.60%)

✅ NASDAQ: 23041.51 (⬆️ - 1.11%)

⚠️⬇️CBOE VIX Volatility Index: 16.41 (⬇️4.81%)

✅ Gold: $4063.3 (⬆️ - 1.45%)

✅ Silver: $48.66 (⬆️ - 2.42%)

✅ Bitcoin: $123.410 (⬆️ - 1.65%)

Gold smashes yesterdays record, now up 55% as the “Debasement Trade” heats up

Gold futures shattered records again Wednesday, surging past $4,060 an ounce as investors fled to safe-haven assets amid Japan’s fiscal stimulus pivot and a weakening U.S. dollar, fueling parallel rallies in silver and bitcoin.

Gold Futures Shatter Records: Spot gold climbed $55 per ounce in a single day, meaning that Gold is now up 55% year-to-date, driven by ETF inflows and central bank demand amid currency debasement fears.

Gold Surges Amid Dollar Woes: Gold has climbed more than 20% since late July fueled by the U.S. dollar’s sharpest annual drop against major currencies since the 1970s post-gold standard era.

Silver Reaches Decade Peak: Silver futures climbed to $48.70 per ounce, surging 65% this year, as lower interest rates enhance appeal of non-yielding precious metals.

Bitcoin Nears All-Time High: BTC traded around $123,000, just shy of $126,160 record, benefiting from fiscal uncertainty and weakening dollar trends.

Japan’s Stimulus Sparks Rally: New PM Sanae Takaichi’s “fiscal dove” stance signals deficit-driven growth, boosting the “debasement trade” with equities also hitting highs.

Jewelry Prices Hiked: Affordable jewelry brands like Mejuri and Pandora have been forced to hike prices and scramble for alternatives to shield profit margins from the relentless surge.

Midsize Brands Adapt Tactics: Companies like Pandora face 80-basis-point cost hits while Signet grapples with 30%+ gold expense jumps, prompting supply chain tweaks and lower-karat innovations to stay viable.

Analysts Predict Prolonged Rally: Goldman Sachs eyes 6% more gains to mid-2026, with 95% of central banks planning higher holdings, signaling persistent uncertainty.

Together with the Health Sciences Institute

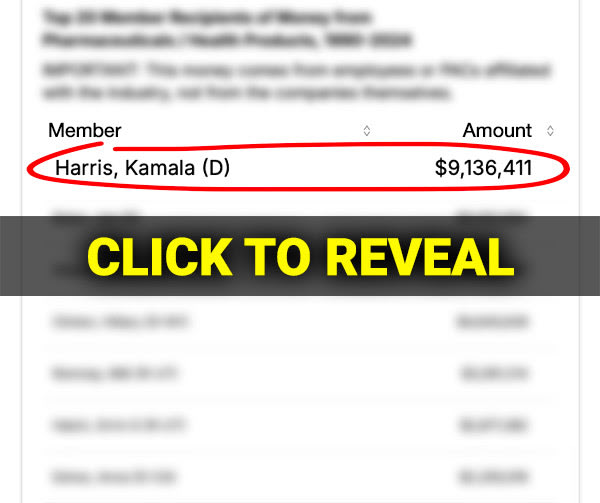

Dems fear new list more than Epstein?

Dear patriotic American,

Why are the Dems so obsessed with the Epstein list?

Is it because they’re trying to take attention away from this new list?

The top names are… See the full list here.

P.S. If you ask me, every name on the list has blood on their hands. Because they put 92 million American citizens in danger [click to see the truth].

Bank of England sees a rough future if the AI bubble pops

The Bank of England issued a stark alert Wednesday, cautioning that a bursting artificial intelligence bubble could unleash a “sharp market correction,” hammering global equities and rippling through the U.K.’s open economy amid already strained households and businesses.

Valuations Hit Record Highs: Equity markets perch at near all-time peaks, propelled by robust U.S. tech earnings, rendering them vulnerable to AI-driven downside shocks.

S&P Concentration Peaks Historically: Top five S&P 500 firms command nearly 30% market share, the highest in 50 years, amplifying risks from AI hype reversal.

AI Progress Risks Emerge: Disappointing adoption, fierce competition, or supply bottlenecks in power, data, and commodities could swiftly deflate lofty earnings expectations.

Global Tensions Amplify Threats: Geopolitical strife, trade fragmentation, and political uncertainties in France, Japan, and the U.S. heighten chances of unpriced adverse outcomes.

Loading...

Goldman Sachs: No Bubble Burst……YET!

Goldman Sachs’ top equity strategist Peter Oppenheimer warns the U.S. stock market’s AI-fueled surge echoes past bubbles with soaring tech valuations and narrowing leadership, but robust fundamentals keep it from bursting—for now.

Valuations Echo Past Bubbles: Oppenheimer notes similarities like climbing P/E ratios and AI vendor financing reminiscent of the 1990s dot-com era, yet current levels remain below historical extremes.

Tech Giants Dominate Globally: The five largest U.S. tech firms now outvalue entire markets of Europe, UK, India, Japan, and Canada combined, with top 10 stocks claiming 24.5% of worldwide equities.

Fundamentals Anchor Rally: Unlike speculative booms, today’s leaders like Nvidia and Microsoft boast strong balance sheets and aligned cash flows, supporting sustainable growth over irrational hype.

Risks Loom on Horizon: Stretched tech metrics however do signal caution; intensified competition or weakening earnings could tip the market into bubble territory, with analysts urging vigilant monitoring.

7-11 to embrace a revamp of its stores after 45% jump in sales during tests

In a bold pivot to revive its fading U.S. empire, 7-Eleven—under Japanese parent Seven & i Holdings—is slashing underperforming outlets and flooding shelves with fan-favorite egg-salad sandwiches and healthier eats, fueling 45% sales surges in revamped spots amid a rejected $47 billion takeover.

Overhaul Sparks Sales Surge: Revamped U.S. stores achieve 45% higher sales per location, proving early success in food-focused redesigns amid 17% net income drop last year.

IPO Looms on Horizon: Seven & i Holdings is eyeing a planned 2026 public spin-off of its North American arm, retaining a majority stake while trying to boost profitability in its revenue-heavy yet low-margin U.S. operations. Canadian chain Couche-Tard’s which owns the Circle K brand scrapped a $47 billion acquisition in July 2025.

Expansion Targets Diners: Plans for 1,300 new large-format stores by 2030 integrate acquired taco and chicken chains, evolving from complacency to meet shifting consumer tastes.

Homebuyers gamble on risky mortgages amid rate crunch

In a high-stakes bid for affordability, U.S. homebuyers and refinancers are surging toward adjustable-rate mortgages, with the share of mortgages using them jumping to 9.5% last week as fixed rate mortgages hover stubbornly near 6.43%, according to the Mortgage Bankers Association—despite the looming threat of future rate hikes amid economic uncertainty.

Demand Plunges Overall: Total mortgage applications fell 4.7% last week on the seasonally adjusted index, reflecting broader market chill from elevated home prices and steady high rates.

Refinance Activity Volatile: Refinancing dropped 8% weekly but remains 18% above last year’s levels, buoyed by slight rate dips, while purchase apps edged down 1% yet rose 14% year-over-year.

ARM Rates Tempt Savings: Adjustable mortgages average nearly one percentage point below 30-year fixed options, which has been fueling the shift despite the fixed term on an ARM often lasting only up to 10 years before potential adjustments.

Market Signals Caution: Experts warn of ARM risks as rates could spike post-fixed period. ARM mortgages were one of the contributing factors to the 2008 housing crash and the resulting Great Recession.

You're currently a free subscriber to The Capitalist. For the full experience, upgrade your subscription.