Email

The Weekly Roundup from the Office of Rick Barnes

| From | Tarrant County Tax Office <[email protected]> |

| Subject | The Weekly Roundup from the Office of Rick Barnes |

| Date | October 9, 2025 12:02 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

News and Updates from the Office of Rick Barnes ([link removed]) .

[link removed]

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

From Property Tax Exemptions to License Plates

Here’s a Helpful Guide for Those Who Served

[link removed]

The 2025 property tax information is now available.

View your tax amount, print a statement or receipt of past payment, sign up for paperless billing, and more from your online account ([link removed]) . Tax bills will be mailed the last week of October.

This week, we’re spotlighting resources that support military veterans and their families. Know someone who could use this info? Pass it along!

In This Issue

Property Tax Information

Reduce the Amount of Taxes You Pay (#Reduce-Tax-Amount-You-Pay)

View Tarrant County Exemption Amounts (#View-Exemption-Amounts)

Pay Property Tax Online Now (#Ready-to-Pay-Now)

Property Tax Payment Option for Veterans (#Quarter-Payment-Option)

Motor Vehicle Information

Registering Your Vehicle (#Register-Your-Vehicle)

Special Plates for the Military (#Special-License-Plate)

Texas Veterans Portal (#Texas-Veterans-Portal)

Support Texas Veterans (#Donations)

We packed a lot for Veterans into this week’s issue. Contact us (mailto:[email protected]?subject=Question%20from%20The%20Weekly%20Roundup&body=) if you have questions.

Property Tax Exemptions Reduce the Amount of Taxes You Pay ()

100% Disabled ([link removed])

Disabled Veteran or Survivor ([link removed])

Surviving Spouse ([link removed])

Donated Residence ([link removed])

Tax Deferral Affidavit ([link removed])

Contact an Exemptions Specialist in the County where the property is located ([link removed]) to apply.

Tarrant Appraisal District will gladly assist in answering your questions for Tarrant County properties - for free - and may be contacted by calling (817) 284-4063.

Learn more about property tax exemptions from the Texas State Comptroller’s website ([link removed]) .

Appraisal District Contact Info ([link removed])

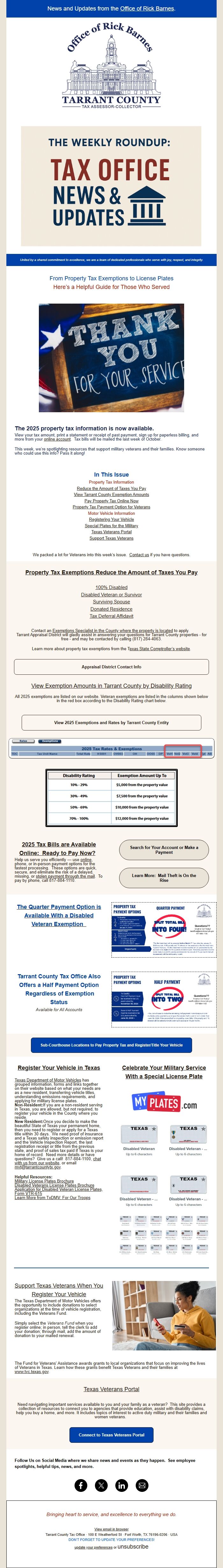

View Exemption Amounts in Tarrant County by Disability Rating ()

All 2025 exemptions are listed on our website. Veteran exemptions are listed in the columns shown below in the red box according to the Disability Rating chart below.

View 2025 Exemptions and Rates by Tarrant County Entity ([link removed])

2025 Tax Bills are Available Online: Ready to Pay Now? ()

Help us serve you efficiently — use online ([link removed]) , phone, or in-person payment options for the fastest processing. These options are quick, secure, and eliminate the risk of a delayed, missing, or stolen payment through the mail ([link removed]) . To pay by phone, call 817-884-1110.

Search for Your Account or Make a Payment ([link removed])

Learn More: Mail Theft is On the Rise ([link removed])

The Quarter Payment Option is Available With a Disabled Veteran Exemption ()

[link removed]

Tarrant County Tax Office Also Offers a Half Payment Option Regardless of Exemption Status

Available for All Accounts

[link removed]

Sub-Courthouse Locations to Pay Property Tax and Register/Title Your Vehicle ([link removed])

Register Your Vehicle in Texas ()

Texas Department of Motor Vehicles ([link removed]) has grouped information, forms and links together on their website based on what your needs are as a new resident, transferring vehicle titles, understanding emissions requirements, and applying for military license plates.

Non-Resident:If you are a non-resident serving in Texas, you are allowed, but not required, to register your vehicle in the County where you reside.

New Resident:Once you decide to make the beautiful State of Texas your permanent home, then you need to register or apply for a Texas title within 30 days. We need proof of insurance and a Texas safety inspection or emission report and the Vehicle Inspection Report, the last registration receipt or title from the previous state, and proof of sales tax paid if Texas is your home of record. Need more details or have questions? Give us a call! 817-884-1100, chat with us from our website ([link removed]) , or email [email protected] (mailto:[email protected]) .

Helpful Resources:

Military License Plates Brochure ([link removed])

Disabled Veterans License Plates Brochure ([link removed])

Application for Disabled Veteran License Plates, Form VTR-615 ([link removed])

Learn More from TxDMV: For Our Troops ([link removed])

Celebrate Your Military Service With a Special License Plate ()

[link removed]

Support Texas Veterans When You Register Your Vehicle ()

The Texas Department of Motor Vehicles offers the opportunity to include donations to select organizations at the time of vehicle registration, including the Veterans Fund.

Simply select the Veterans Fund when you register online; in person, tell the clerk to add your donation; through mail, add the amount of donation to your mailed renewal.

[link removed]

The Fund for Veterans' Assistance awards grants to local organizations that focus on improving the lives of Veterans in Texas. Learn how these grants benefit Texas Veterans and their families at www.tvc.texas.gov ([link removed]) .

Texas Veterans Portal ()

Need navigating important services available to you and your family as a veteran? This site provides a collection of resources to connect you to agencies that provide education, assist with disability claims, help you buy a home, and more. It includes topics of interest to active duty military and their families and women veterans.

Connect to Texas Veterans Portal ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

[link removed]

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

From Property Tax Exemptions to License Plates

Here’s a Helpful Guide for Those Who Served

[link removed]

The 2025 property tax information is now available.

View your tax amount, print a statement or receipt of past payment, sign up for paperless billing, and more from your online account ([link removed]) . Tax bills will be mailed the last week of October.

This week, we’re spotlighting resources that support military veterans and their families. Know someone who could use this info? Pass it along!

In This Issue

Property Tax Information

Reduce the Amount of Taxes You Pay (#Reduce-Tax-Amount-You-Pay)

View Tarrant County Exemption Amounts (#View-Exemption-Amounts)

Pay Property Tax Online Now (#Ready-to-Pay-Now)

Property Tax Payment Option for Veterans (#Quarter-Payment-Option)

Motor Vehicle Information

Registering Your Vehicle (#Register-Your-Vehicle)

Special Plates for the Military (#Special-License-Plate)

Texas Veterans Portal (#Texas-Veterans-Portal)

Support Texas Veterans (#Donations)

We packed a lot for Veterans into this week’s issue. Contact us (mailto:[email protected]?subject=Question%20from%20The%20Weekly%20Roundup&body=) if you have questions.

Property Tax Exemptions Reduce the Amount of Taxes You Pay ()

100% Disabled ([link removed])

Disabled Veteran or Survivor ([link removed])

Surviving Spouse ([link removed])

Donated Residence ([link removed])

Tax Deferral Affidavit ([link removed])

Contact an Exemptions Specialist in the County where the property is located ([link removed]) to apply.

Tarrant Appraisal District will gladly assist in answering your questions for Tarrant County properties - for free - and may be contacted by calling (817) 284-4063.

Learn more about property tax exemptions from the Texas State Comptroller’s website ([link removed]) .

Appraisal District Contact Info ([link removed])

View Exemption Amounts in Tarrant County by Disability Rating ()

All 2025 exemptions are listed on our website. Veteran exemptions are listed in the columns shown below in the red box according to the Disability Rating chart below.

View 2025 Exemptions and Rates by Tarrant County Entity ([link removed])

2025 Tax Bills are Available Online: Ready to Pay Now? ()

Help us serve you efficiently — use online ([link removed]) , phone, or in-person payment options for the fastest processing. These options are quick, secure, and eliminate the risk of a delayed, missing, or stolen payment through the mail ([link removed]) . To pay by phone, call 817-884-1110.

Search for Your Account or Make a Payment ([link removed])

Learn More: Mail Theft is On the Rise ([link removed])

The Quarter Payment Option is Available With a Disabled Veteran Exemption ()

[link removed]

Tarrant County Tax Office Also Offers a Half Payment Option Regardless of Exemption Status

Available for All Accounts

[link removed]

Sub-Courthouse Locations to Pay Property Tax and Register/Title Your Vehicle ([link removed])

Register Your Vehicle in Texas ()

Texas Department of Motor Vehicles ([link removed]) has grouped information, forms and links together on their website based on what your needs are as a new resident, transferring vehicle titles, understanding emissions requirements, and applying for military license plates.

Non-Resident:If you are a non-resident serving in Texas, you are allowed, but not required, to register your vehicle in the County where you reside.

New Resident:Once you decide to make the beautiful State of Texas your permanent home, then you need to register or apply for a Texas title within 30 days. We need proof of insurance and a Texas safety inspection or emission report and the Vehicle Inspection Report, the last registration receipt or title from the previous state, and proof of sales tax paid if Texas is your home of record. Need more details or have questions? Give us a call! 817-884-1100, chat with us from our website ([link removed]) , or email [email protected] (mailto:[email protected]) .

Helpful Resources:

Military License Plates Brochure ([link removed])

Disabled Veterans License Plates Brochure ([link removed])

Application for Disabled Veteran License Plates, Form VTR-615 ([link removed])

Learn More from TxDMV: For Our Troops ([link removed])

Celebrate Your Military Service With a Special License Plate ()

[link removed]

Support Texas Veterans When You Register Your Vehicle ()

The Texas Department of Motor Vehicles offers the opportunity to include donations to select organizations at the time of vehicle registration, including the Veterans Fund.

Simply select the Veterans Fund when you register online; in person, tell the clerk to add your donation; through mail, add the amount of donation to your mailed renewal.

[link removed]

The Fund for Veterans' Assistance awards grants to local organizations that focus on improving the lives of Veterans in Texas. Learn how these grants benefit Texas Veterans and their families at www.tvc.texas.gov ([link removed]) .

Texas Veterans Portal ()

Need navigating important services available to you and your family as a veteran? This site provides a collection of resources to connect you to agencies that provide education, assist with disability claims, help you buy a home, and more. It includes topics of interest to active duty military and their families and women veterans.

Connect to Texas Veterans Portal ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp